Credible Loan Review 2020 – READ THIS BEFORE Applying!

Online lending platforms are offering one of the best services in the financial industry.

With the increasing confidence in online platforms, this emerging market has also experienced extensive growth in the number of new online lending platforms. Therefore, choosing the right platform is essential for getting an easier and fast loan.

To help you with that, we review Credible– which is one of the most famous platforms for connecting borrowers with lenders regarding student loans, private student loan, mortgage, refinancing, credit cards, and personal loans.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Credible has developed online marketplace that helps borrowers in getting competitive, personalized loan offers from various lenders in real-time.What is Credible?

Unlike other loan providers, Credible offers various types of loans and refinancing services. Like Lendio and CashUSA, the platform helps borrowers in connecting with lenders through a simple application form. The platform is free for borrowers and getting the rate wouldn’t impact your credit score. Its lenders offer student loans, mortgage, student loan refinancing, credit cards, and personal loans. The platform has helped borrowers in getting millions of dollars in the past couple of years. The interest rate stands in the range of 4% to 35%. They help in getting loans in the range of $1000 to $100,000. The repayment schedule is fixed. Credible has also developed a strong customer support team. They are also available to respond to queries through the instant chat feature.

Fortunately, Credible works with many credible lenders such as Upgrade Loans when it comes to personal loans, student loan and refinancing. Companies they frequently partner with include Best Egg, Avant, LightStream, Prosper, and LendingClub, among many others.

What are the Pros and Cons of Credible?

Pros:

✅One form, multiple lenders

✅Quick funding

✅No-cost service

✅Income-Based Repayment Plans

Cons:

❌ Third-party lender

❌ Potential fees

❌ Limited terms

❌ Limited selection

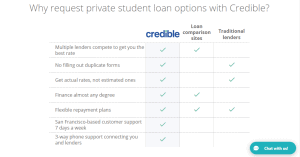

Comparing Credible loans marketplace to direct lending sites

Credible isn’t a direct lender but a shared loans platform bringing together borrowers and lenders. The platform boasts of introducing a lender to largest pool of loan providers at competitive loan terms and catering for virtually every type of loan. Most common loan products offered here include multi-use personal loans, installment loans, student loans, and even mortgage. But how friendly are its rates and services compared to those offered by Check ‘N’ Go, Rise Credit, and CashNet USA direct lenders?

Credible

- Borrow any type of loan between $1,000 and $100,000

- Minimum credit score 580+ FICO

- Loan APR is between 3.99% and 35.99% (depending on credit score)

- Loan repayment ranges from 2 to 7 years

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

CashNet USA

- Borrow limit extends from $100 to $3,000 depending on the type of loan and the borrower’s state of residence

- Requires a credit score of at least 300

- Annual interest rates starts from 89% to 1,140% on payday loans

- 2 weeks to 6 months payback period

Check n’ Go

- Borrowing limits $100 to $1,500

- Credit Score Required 300 FICO

- Fee Rate on $100 starts from $25 (state dependent)

- Term of Loan 10 to 31 days

How Credible Works?

Credible has created a simple and user-friendly platform – where they permit a borrower to get loans from various types of lenders. They do not charge any fee for checking loan options; the platform also does not charge any fee if your loan application is accepted. They take a commission from the lender for providing customers.

The lenders supported by Credible offers several types of loans in the range of $1,000 to $100,000. The interest rates stand in the range of 4% APR to 36%. They offer a lower interest rate to individuals with higher credit score and a robust income stream. If you don’t have the best credit score, you could be charged a higher interest rate. The loan repayment terms stand in the range of two to seven years.

They have developed a simple application form. The borrower is only required to submit that form to get rates. Once the borrower submits the form, the platform instantly offers loan options from various lenders. You need to select one of the offers that fit with your financial goals. The borrower can get funds on the next day after receiving approval.

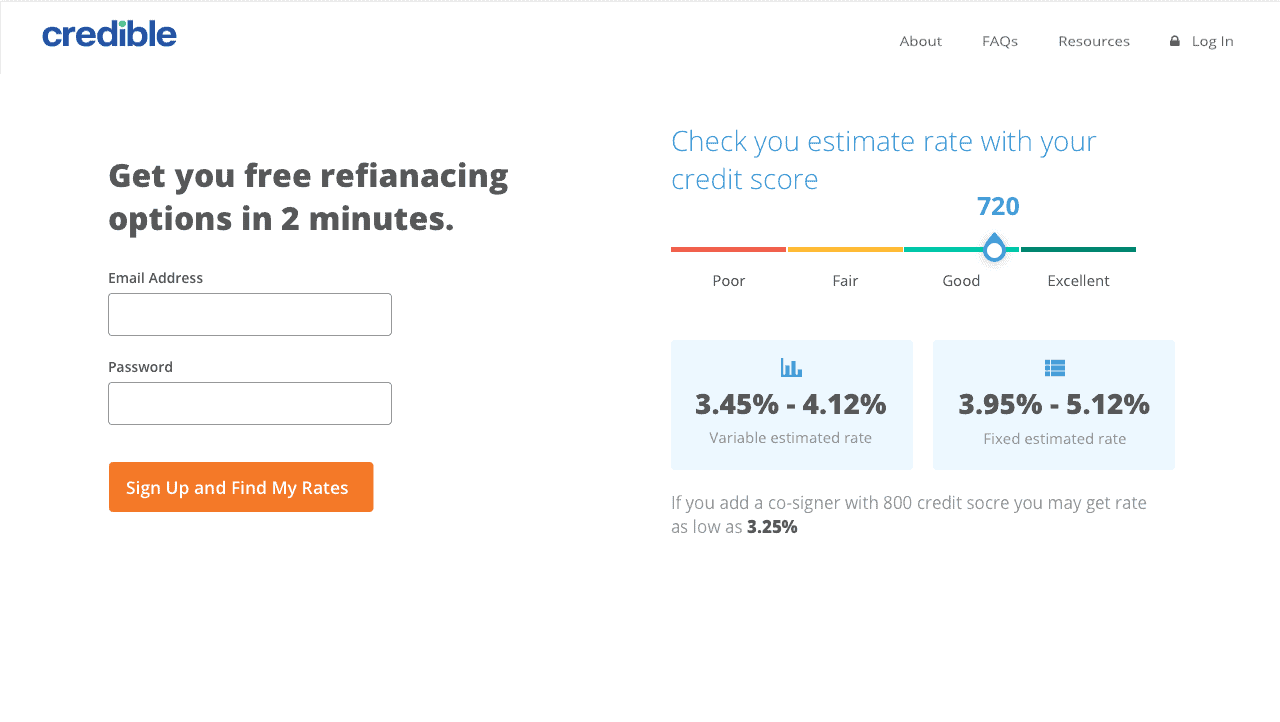

What is the Loan Application Process of Credible?

The loan application process is simple and straightforward. You need to visit the website to submit an online loan application. The loan application process is composed of three steps:

- Find Rate

Once you reached the website, you need to click on “Find My Rate”. This tab is available on the home page of its website. Once you click on this tab, the platform will show a loan application form where you have to inform about the loan purpose along with filling the basic personal information. The borrower is required to provide information related to education, income, and finances.

The loan application will not impact your credit score. This loan application only helps in knowing about the offers. The platform, on the other hand, makes a soft credit check. If you qualify for the loan after a soft credit check, the platform will show different types of offers. Be prepared to provide the following information when filling out the online form:

- How much you want to borrow.

- What you plan to use the money for.

- Your highest level of completed education.

- Current employment status.

- Date of birth.

- Annual income — before taxes.

- Estimated credit score.

- Compare Your Options

Once you submitted the form, the platform will instantly show multiple offers in your dashboard. You need to compare all the offers to select the best one that suits your requirements. The loan options include the loan amount, interest rate, repayment schedule along with other charges.

- Apply For the Loan

Once you selected the loan offer, the platform will ask you to provide more information related to your income, bank accounts, and other financial details. You also need to provide a few documents. The platform will ask you for more in-depth questions about your financial history. After providing all the information, the lender will run a real credit check –which could slightly impact your credit score.

After you complete this process, the lender will work with you directly to finalize all the details.If everything is satisfactory, the lender will immediately transfer funds into your bank account. Sometimes, it takes one business day while other times it takes up to three business days.

What are the Eligibility criteria for Credible Loans?

The eligibility criteria are simple and clear. They permit a borrower with average to above-average credit score. Below are the features that borrowers need to fulfill to qualify for a loan:

- The credit score of 680 and over

- Citizenship or permanent residency of the United States

- A checking account in your name

- You must be over 18 years old.

They do not accept clients from European and Asian countries. They only accept clients from the United States. You need to have a valid Social Security Number and permanent residency status to apply for the loan. Clients are accepted from all states of the United States. Below are a few states that are accepted on this platform:

[one_fourth]- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

What Types of Loans Credible Offers?

Credible offers multiple types of loans. On the other hand, Avant, Upgrade and Best Egg only offer personal loans. Credible seeks to cover all the financial needs of individuals. Below are the types of loans that are accepted on this platform:

- Credible Private Student Loans

Credible permits individuals to get a private student loan. These individuals must be students – who are still in school. The student loans are composed of both fixed-rate and variable rate. The borrower is required to fill the form after comparing multiple loan offers. Credible permits individuals to invite a co-signer to your application.

They provide loan offers from many reputable lenders. These lenders include Sallie Mae, Citizens Bank, College Ave, Discover, and more.

Private student loans are really helpful in paying for the school fee after you reach your federal limits. Compare private student loans, eligibility rules, rates, and terms before borrowing for college or graduate loan. Credible offers an interest rate of 3.89% variable to 4.50% fixed APR for a student loan. Below are the best features of Credible private loans:

- Origination fee: They do not charge an origination fee of private student loans

- Service fee: There is no service fee on private student loans.

- Prepayment penalty: There is no prepayment penalty in case you want to make early repayment of a loan.

Credible Personal Loans

Personal loans are one of the best ways of getting funds for various types of personal purposes. Credible also offers personal loans. The offers the following types of personal loans:

- Consolidating credit card debt

- Paying for a wedding

- Career development opportunities

- Starting a new business

- Home improvement

- Vacation

- Car.

They offer personal loans in the range of $1000 to $100,000 with the time duration of one to five years. Credible supports reputable lenders like Best Egg, Avant, LendingClub, FreedomPlus, Marcus, Payoff, Prosper, and Upstart. Loan rates start from 4.99% to 35%.

Student Loan Refinancing

Student loan refinancing is common all over the world. In the case of Credible, interest rates and loan terms through Credible vary according to the lender you qualify with. Students can refinance both federal and private loans along with Parent PLUS Loans that were used to fund approved US undergraduate and graduate programs.

Below are the restrictions that borrowers have to fulfill to qualify for student loan refinancing:

- At least $5,000 of student debt from a qualifying US educational program

- US citizen or permanent resident — or have a cosigner that meets these criteria

- At least 18 years old.

Once you qualify for the loan, below are the features that you can avail from refinancing loan through lenders supported by Credible:

- No origination and repayment fees

- Cosigners allowed.

- Multiple lenders

- No cost offers.

Mortgage Refinancing:

Credible offers mortgage refinancing. The individuals can refinance their mortgage through this platform. You need to apply for mortgage refinancing through Credible. The platform will show you the refinancing offers. Its mortgage refinancing has the following features:

- Multiple lenders

- Fixed rates

- Adjustable rates

- No spam

- Dedicated support team

- Cash-out

- Smart technology

- 256-bit data encryption.

Borrowers with stronger credit score may be approved for mortgages equal to 97% of their home’s value and with debt-to-income ratios as high as 45 or 50%. On the other hand, if your credit score isn’t so great, lender’s may only allow you to borrow up to 75% of your home’s value with a 36% debt to income ratio.Credit Card:

The platform permits users to compare various types of credit cards to select the one according to your financial goals. It provides honest and unbiased results. They will help you in finding the best credit card for your situation. It displays all the best credit card offers on its platform.

What is the Cost Structure of Credible Loans?

The platform is clear and transparent about the cost structure. They clearly highlighted all the costs related to loans. They do not charge any fee on student loans and student loan refinancing. However, the lender may charge a small fee on personal loans and mortgage refinancing.

- Closing costs and other fees related to mortgage refinancing stands in the range of 2% to 6% of the mortgage.

- Origination charges

- Third-party fees (such as title insurance, appraisal, survey, and pest inspection)

- Other costs.

Is Credible Customer Support Team Good?

Yes, Credible has developed a strong customer support service. The platform permits its clients to contact customer support through various channels. They have developed extensive frequently asked question segment. They have answered all the general question in this section. The borrowers can easily find the answers of general questions through the FAQ page.

If you still have more questions, you have various ways to reach the support team. They have developed an instant chat feature. This feature permits borrowers to instantly connect with the support team without waiting longer. The borrower can also contact the support team through email and phone call. They usually respond to emails in three business days.

Is Credible Safe?

Yes, Credible is a safe platform. It has received strong feedback score on independent websites like Trustpilot. Individuals have borrowed millions of dollars through this platform. In addition, they only support reputable lenders that have strong goodwill in the market. It also seriously takes the security of borrowers. The secure borrowers account through the following technologies.

- Encryption

- HTTPS Secure

- SSL Security.

The platform doesn’t sell or share borrower’s personal information with anyone other than listed lenders.

Credible Review 2019 – Verdict

Credible is among the best platforms that help borrowers in connecting with lenders. The platform permits borrowers to get rates from multiple lenders just by submitting a simple loan application. The borrower is free to select any loan option according to financial goals. The loan options include interest rate, duration of the loan term and other basic information. They offer lower interest rates to borrowers with a high credit score.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ:

What role Credible plays in refinancing student loans?

Credible helps borrowers in connecting with various types of lenders. It also permits you to review the student loan refinancing products from several leading companies. The loan proposals include your total repayment amount, monthly payment, APR and repayment options. It does not take more than a few minutes to get rates through Creditable.

Can the borrower refinance student loans before becoming a graduate?

Yes, the lenders supported by Credible provide options to get student loans for people who did not graduate and are no longer enrolled in school.

What types of loans can I refinance? Federal and private loans? Parent PLUS loans?

The lenders supported by Credible permits borrowers to refinance federal and private loans. The borrower is also eligible to refinance Parent PLUS loans. If you are refinancing federal loans, please be aware that your federal benefits may not transfer to private lenders when you refinance.

Does the borrower is guaranteed to receive prequalified rates from every lender?

No, the borrower is not guaranteed to receive prequalified rates. The lenders have their own criteria to decide whether you are entitled to a prequalified rate according to data you provide along with a report of a soft credit inquiry. It’s always good to add a creditworthy co-signer – which always increases the chances of being approved by a lender.

Does the borrower lose any of the benefits that federal loans provide if the borrower refinances loans?

Yes, there are few benefits of federal loans that could not transfer to private loans. These benefits include forbearance, deferment, and certain forgiveness and federal repayment programs. However, it’s good to read disclosures carefully to understand what benefits you might lose.

Does a lender disburse funds directly to the borrower?

No, generally the lenders directly transfer funds to the previous lender. If there is an overpayment to your previous lender, the lender will reconcile that amount with you, which is usually handled through a check made payable to you.

US Payday Loan Reviews – A-Z Directory

Siraj Sarwar

Based in Saudi Arabia, Siraj has a strong understanding of and passion for accounting and finance. He has worked for international clients for many years on several projects related to the stock market, equity research and other business, accounting and finance related projects. Siraj is a published financial analyst on the world's leading websites including SeekingAlpha, TheStreet, MSN, and others.View all posts by Siraj SarwarWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up