RISE Credit Loan Review 2020 – READ THIS BEFORE Applying!

If you’ve currently got a poor credit rating, then you might find that you struggle to obtain financing. Even in the event that you can obtain credit, this is likely to be with a specialist lender that charges a very high rate of interest. With that being said, installment loan lenders like RISE Credit claim to offer bad credit loans at competitive APR rates.

If you’ve got nowhere else to turn and you’re thinking about using RISE Credit for your financing needs, be sure to read our comprehensive review first. Within it, we’ve covered everything you need to know. This includes the APR rates charged by the lender, who is eligible, and how much you can borrow.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

As a bad credit lender, RISE Credit is only suitable as a last resort. The interest rates could be very high, so do make sure that you will be able to pay the loan back on time before applying

As a bad credit lender, RISE Credit is only suitable as a last resort. The interest rates could be very high, so do make sure that you will be able to pay the loan back on time before applyingWhat is RISE Credit?

RISE Credit is an online lender like Spotloan and Money Mutual that provides installment loans to those with poor to bad credit. The platform allows you to apply for a loan without needing to visit a physical branch, and in most cases, you’ll receive your funds the very next working day. With loans ranging from $500 to $5,000, RISE Credit can be used to fund virtually anything. In fact, and as is often the case with unsecured loans, you can borrow the money for any purpose at all.

As RISE Credit is a direct lender – meaning that it covers all of the loans it offers without using third party financiers, the platform is only available in certain states. The reason for this is that US lenders offering bad credit loans are required to apply for an independent state license in all of the locations it operates in.

Nevertheless, although the company is referred to as a high interest lender, the maximum APR charged by RISE Credit is 299%. Sure, while this is still somewhat high, it is lower than the average Payday Loan APR rate of 400%.

RISE Credit also offer a line of credit, albeit, this is only available to residents based in Kansas and Tennessee.

What are the Pros and Cons of RISE Credit?

RISE Credit Pros:

✅Competitively priced in comparison to other bad credit lenders

✅Most loans are transferred the next working day

✅Suitable for people with bad credit

✅Pay your loan off early without being penalized

✅Very fast application process

✅Ability to improve credit score by always paying on-time

Cons:

❌ Interest rates much higher than traditional lenders

❌Only available in a select number of US states

Comparing Rise Credit with other Bad Credit and online installment loan providers

Rise Credit is a poor to bad credit online loans facilitator specializing in payday and installment loans. Its three biggest selling points are the affordability of its loans, extended loan repayment periods, and fast application processing as well as funding. We have stacked it against other popular online installment loan providers like Opploans, Oportun and Advance America and summed their key features in the table below

Rise Credit

- Offers loan from between $500 to $5000

- Bad credit score is allowed

- Annual rates starts from as low as 36% to as high as 299%

- Depending on the state, the repayment term ranges from 7 to 26 months

Opploans

- Borrow limit $1,000 to $4,000

- Bad credit score is allowed

- Annual payment rate starts from 99% to 199%

- Payment period of 9 to 36 months

Oportun

- Loan amount starts from $300 to $9,000

- No minimum credit score required

- Annual rates fall between 20% to 67%

- Loan should be repaid in a span of 6 to 46 months

Advance America

- Loan limit starts from $100 to $5,000

- Requires a Credit Score of above 300

- For every $100 borrowed an interest of $22 is incurred

- Weekly and monthly payback installments

How Does RISE Credit Work?

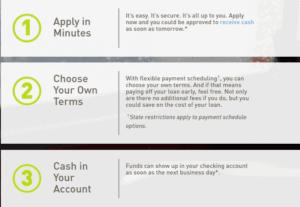

RISE Credit is a direct lender, and as such, you will be dealing directly the company at all times. The lender operates in a similar way to other online lenders, and you can complete the entire application process within 15 minutes.

If you do want to make an application, you will need to do this via the RISE Credit website. Initially, you need will go through a pre-approval application process, which means that the platform will base its decision on a soft credit check enquiry. In layman terms, this means that the application will not appear on your credit report, even if you are not approved.

A soft credit check turns in to a hard enquiry as soon as you decide to proceed with your pre-approval rates. This will then be posted to your credit report, meaning other lenders will be able to see that you applied.You will need to tell the online platform how much you want to borrow, and for how long. Next, you’ll need to provide some basic information, such as your name, address, date of birth and telephone number. To validate your ID, you’ll need to enter your driving license and social security numbers. You also need to enter information about your place of work, such as your annual income, and when you get paid.

Once you’ve provided all of the necessary information, you should receive an instant pre-approval decision. At this point, if you are approved and you are happy with the rates offered, the funds are usually transferred the next working day.

How Much Does RISE Credit Cost?

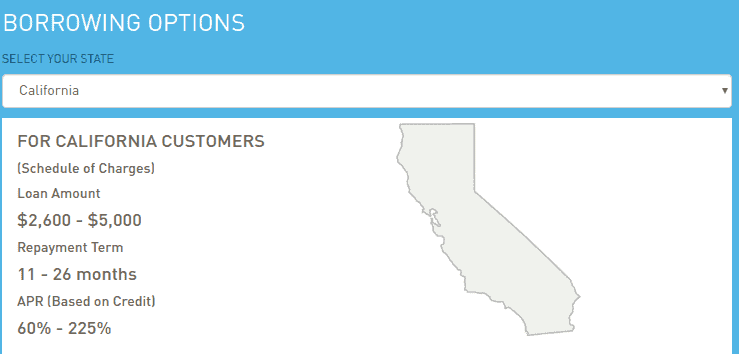

It will come as no surprise to learn that the rates charged by RISE Credit are significantly higher than what you would pay with a traditional lender. However, as bad credit lenders go, RISE Credit are actually quite competitive. The APR rates that you will be offered can vary from 36% up to a maximum of 299%.

The reason we say that these rates are quite competitive is that the average Payday Loan will come with an APR of 400%. As such, even if RISE Credit offers you the highest rate of 299%, you would still be making considerable savings.

The only way to find out how much you are going to pay on your RISE Credit loan is to go through the soft credit check application. This only takes a few months, the search won’t appear on your credit report, and you are under no obligation to proceed.With such a disparity in the APR rates it offers, RISE Credit will base your specific rate on a number of key factors. Notably, this centres around your financial background. Here are the things that the lender will look at before providing you with a rate.

✔️ Current FICO credit score

✔️ Employment status

✔️ Annual income

✔️ Loan repayment history

✔️ Debt-to-income ratio

✔️ How much debt you currently have

The amount of APR that you are charged will also be determined by the state you reside in. Each state has its own laws surrounding interest charges, so do bare this in mind.Other Fees or Charges

With the online lending space getting more and more competitive, RISE Credit have made the decision not to charge an origination fee. This is a fee typically charged by traditional lenders as a way to cover the costs of arranging the loan, and can cost anywhere from 1% up to 5%.

Additionally, RISE Credit do not charge you any fees if you decide to pay back the loan early. This is excellent news, as you can avoid a significant amount of APR interest if you are able to settle the loan well before the loan term matures.

Am I Eligible for a RISE Credit Loan?

Although RISE Credit does have a much lower eligibility threshold in comparison to traditional lenders, you still need to assess whether or not you are likely to qualify. Before looking at the fundamentals, you first need to make sure that you are based in an eligible state. As we noted earlier, RISE Credit is a direct lender, meaning it is required to hold regulatory licenses in each of the states it operates in.

Check out the full list of eligible states below before proceeding with your application.

✔️Alabama

✔️California

✔️ Delaware

✔️Georgia

✔️Idaho

✔️Illinois

✔️Kansas

✔️ Mississippi

✔️ Missouri

✔️New Mexico

✔️ North Dakota

✔️ Ohio

✔️ South Carolina

✔️Texas

✔️Utah

✔️ Wisconsin

If you’re based in a location outside of the above states, then you’ll need to find another lender.

In terms of your credit profile, it is likely that you will need to have a FICO credit score of at least 300, which sits at the very bottom of the ‘Poor Credit’ threshold. While the lender does not state a minimum income, this is likely to be based on state lending laws. This can range between $1,500 per month and $3,600 per month, depending on the state you live in.

You will also need to ensure that you have a valid social security number, checking account, be a US citizen or permanent US resident, and be aged at least 18 years old.

How Much can I Borrow and for how Long?

By applying for a loan with RISE Credit, you will have the option of borrowing between $500 and $5,000. You might be approved for a loan, but at a smaller amount than you applied for. For example, if you asked to borrow the full $5,000, RISE Credit might pre-approve you with a loan offer of $3,000.

In terms of the loan term, this will vary depending on the state that you live in. For example, those based in Ohio can take out a loan from 7-26 months, while those in California can choose from 11-26 months.

As a side note, if you repay your loan on-time and in-full, the next time you apply for a loan with RISE Credit you are likely to get a significant discount on your APR financing costs.Paying Your Loan back

The standard way of paying your RISE Credit loan back is by setting up an ACH direct debit. This means that the funds will be automatically debited from your checking account on the same day of every month, until the loan is repaid in full. We would suggest choosing this option, as it will ensure that you never miss a payment.

RISE Credit state that you can ask to use an alternative payment method by calling the customer support team. This is likely to include a debit card payment. Just remember that you will need to do this manually each month.

What if I Miss a Payment?

RISE Credit advise you to call them as soon as possible if you think you are going to miss a payment, or if you won’t have enough money in your checking account on the automatic payment date. In most cases, the lender will allow you to extend your repayment date by a few days. However, this is not guaranteed.

If you are more than 7 days late with you payment, then you will be charged a late payment fee. The platform does not publish what this is, as it will depend on the lending regulations governing the state you live in.

Finally, it is all-but certain that RISE Credit will report a late payment to the main credit agencies. This will, of course, have a negative impact on your FICO score.

Customer Service at RISE Credit?

RISE Credit offers a number of support channels, should you need assistance.

📱Phone: (866) 580-1226

📧 Email: [email protected]

✍️ In Writing: RISE, PO Box 101808, Fort Worth, TX 76185

Although you can apply for loans and check your account online 24/7, the customer service team is only available during the follow hours (Eastern Time).

⏱️ Monday-Friday: 08:00 – 23:00

⏱️ Saturday-Sunday: 09:00 – 18:00

RISE Credit Review: The Verdict

In summary, while bad credit lenders should always be the last resort, lenders like RISE Credit and Opploans are a notable option if you do require financing. The platform is very upfront with its terms, it does not charge any origination or application fees, and you can repay the loan early without being financially penalized.

In terms of its APR rates, this can vary from 36% all the way up to 299%. While the upper end of the spectrum might sound high, this is still much lower than what the average Payday Loan provider charges. Moreover, if your credit score isn’t super low, then you likely won’t pay the maximum rate anyway.

Finally, we also like the fact that you can explore your eligibility and financing costs without it having an impact on your credit report. This, at the very least, allows you to assess whether RISE Credit is right for you in a risk-free manner.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

FAQ:

Will RISE Credit check my credit score?

Although RISE Credit is a bad credit lender, they are no a ‘No Credit Check Lender’. In fact, the platform will take your FICO credit score into account when assessing whether or not you qualify for a loan, and how much you should be charged.

When will RISE Credit transfer my loan funds?

If RISE Credit is able to automatically validate the information you provide within your loan application, then you’ll likely receive the funds the next working day. In rarer cases, the platform might ask you for supporting documentation. If they do, then it might delay the process by a couple of days.

Does RISE Credit charge an origination fee?

RISE Credit does not charge any origination fees.

How much will I have to pay in late payments?

RISE Credit will charge you a late payment fee if your loan payment is overdue for 7 days or more. The amount you are charged will be based on the state you live in. You’ll be able to view this in your pre-approval loan agreement.

What APR rate does RISE Credit charge?

RISE Credit can charge anywhere from 36% APR to 299% APR. This will depend on a range of factors, such as your credit profile, annual income, debt-to-income ratio, and even the state that you live in.

US Payday Loan Reviews – A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up