Best Trading Platforms for Beginners in 2026

Are you looking to find the best trading platforms of 2026? If so, you’ll know firsthand that there are now hundreds, if not thousands of investment brokers operating in the space. As such, knowing which platform to go with is no easy feat.

The best starting point is to consider what it is you’re looking for in a broker. For example, are you looking for a platform that offers thousands of financial instruments, or are you more concerned with fast withdrawals? Similarly, if you’re looking to trade high volumes, you’ll likely want to stick with platforms that offer low fees.

Either way, we would suggest reading our in-depth guide on the Best Trading Platforms of 2026. Within it, not only we will list the best three platforms currently in the market, but we’ll also provide you with the ins and outs of what you need to look out for prior to joining a new broker.

Best Trading Platforms Available Right Now

If you don’t have time to read our full guide, here’s a quick look at the top online trading platforms in 2026.

- Fineco Bank – Excellent CFD trading platform with 100 free trades

- E-TRADE – Great trading platform for advanced traders

- TD Ameritrade – Ideal for long term trading

-

-

What Criteria are Used to Rank the Best Trading Platforms?

- How many financial instruments does the broker list?

- How much does the broker charge in trading fees and commissions?

- What deposit and withdrawal methods does the broker support?

- How long does it take to get your account verified?

- What trading features and charting tools does the broker offer?

Top 3 Trading Platforms Online

Fully in-line with the criteria outlined above, we have listed the best 3 trading platforms currently active in the market. We have included an option for both beginners and more advanced traders, so be sure to read through the pros and cons listed beneath each broker.

1. Fineco Bank - Best CFD Trading Platform

Fineco Bank is an Italian brokerage firm launched in 1999. It now operates in Italy and the UK and boasts more than 1 million users.

Fineco Bank stands out for offering more than 10,000 shares from the US, UK, and Europe. Better yet, if you're trading CFDs, there's no commission and no added spread for trading all these shares. You also don't have to meet a minimum deposit to open a Fineco Bank trading account.

The broker also offers CFD trading for stock indices, forex, and commodities. Spreads start at just 0.4 pips for index trading and 0.8 pips for forex trading.

We especially like Fineco Bank's desktop trading platform, PowerDesk. This comprehensive technical analysis suite comes with dozens of technical indicators and drawing tools, a market news feed, and an economic calendar. Fineco Bank also offers research reports and a global stock screener to help you develop new trading ideas.

Fineco Bank is regulated by the Bank of Italy and listed on the Milan Stock Exchange. You can only fund your account via bank transfer at this time.

You can join Fineco today by clicking the button below and use the code FIN100-AD to get 100 free trades!

Key Points:

- 100 free trades

- Trade over 10,000 shares from the US, UK, and Europe

- No commission for CFD trading

- PowerDesk trading platform is easy to use and comprehensive

- Global stock screener to find new trade ideas

- Regulated by the Bank of Italy

Our Rating

Your capital is at risk.2. E*Trade – Best for Advanced Traders

It might be worth considering e-Trade. The platform allows you to trade thousands of securities without needing to pay any fees or commissions.

This covers everything from stocks, bonds, mutual funds, ETFs, options, and futures. As a seasoned investor, you’ll be pleased to know that e-Trade offers a number of advanced trading tools. This includes more than 100 technical chart indicators, drawing tools, and the option to fully customize your trading screen.

We also like the e-Trade mobile trading platform. This is great if you have a tendency to open and close trades while on the move. Although the platform is suited to experienced investors, we also like the fact that there is no account minimum. This allows you to fully test out the broker with small amounts prior to committing long term.

Key Points:

- More than 4,000 financial instruments supported

- 100+ technical indicators and drawing tools

- No fees or commissions other than the spread

- Fully optimized mobile platform for trading on the move

- Great reputation – especially with US investors

Our Rating

3. TD Ameritrade – Best for Longer-Term Trades

While the trading platforms we have discussed thus far focus on short-term trading, you might want to consider the merits of TD Ameritrade if you’re looking to hold on to your investments long-term.

The U.S. based broker is one of the most recognized trading platforms globally, with a reputation that exceeds 45 years. You will have the option of buying and selling heaps of traditional securities. This includes direct access to major stock exchanges such as the NYSE, Nasdaq, and the LSE. The broker also offers mutual funds, bonds, futures, options, and even a fully-fledged forex department.

If you’re a qualified investor, you’ll also be able to invest in IPOs through TD Ameritrade. In terms of fees, TD Ameritrade offers commission-free trading on its ETFs and mutual funds. The only caveat to this is that you’ll need to hold on to your investment for at least one month. If you don’t, you’ll pay a rather hefty $13,90 per trade, so only use the broker if you’re looking to play the long-term game.

Key Points:

- 45 years in the retail and institutional trading space

- Lists most asset classes

- Qualified traders can invest in IPOs

- No trading fees if you hold on to your ETF or mutual fund for at least 30 days

- Heavily regulated

Our Rating

What to Consider When Choosing a Trading Platform?

Although we have listed our top three trading platforms to consider in 2021, you still need to perform your own research. This is to ensure that the trading platform meets your individual needs prior to depositing funds. You should make a number of considerations such as the trading fees charged, deposit methods supported, number of financial instruments listed, eligibility requirements, and more.

To help you along the way we have listed the main factors that you need to consider when choosing a new trading platform.

- Regulatory Considerations – Does it Hold a Trading License?

Regulation in the online trading arena is awfully complex. The main reason for this is that depending where the broker is located, they will be required to hold certain licenses. For example, trading platforms typically need licenses for both their securities and CFD offerings.

Moreover, if the trading platform seeks to accept customers from the US, then it needs to ensure that it has the required regulatory standing. Key licensing bodies to look out for include the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC)

- Platform Fees and Charges

On top of the platform’s regulatory standing, you also need to spend some time assessing fees. This starts at the very offset with deposit fees for your chosen payment method. You should then explore how the platform charges you to make trades. Some platforms will charge a fee for each trade that you make, while others will charge an annual maintenance fee. A number of brokers now offer commission-free trading, although you will still pay fees indirectly via the spread.

- Financial Instruments Coverage

Once you’ve looked at regulation and fees, you then need to explore what financial instruments the platform supports. If you’ve got a specific niche that you like to trade – such as forex, commodities, or stocks, then choose a broker that specializes in your chosen asset class. If not, then you are best off choosing a trading platform with a highly extensive listing of assets.

- Payment Methods

Newbie traders often overlook the payment department. Firstly, you’ll need to see what payment methods the broker supports to deposit and withdraw funds. This should include the likes of debit/credit cards and a bank wire. A number of brokers are now supporting popular e-wallets such as PayPal and Skrill, too. You should also assess whether or not a minimum deposit or withdrawal amount is specified by the platform.

- Customer Support

Having access to top-grade customer support is crucial when trading online. We prefer platforms that offer live chat, as it’s by far the easiest way to contact customer service. We also like to see the option of telephone and email support. Most importantly, we prefer trading platforms that offer customer support around the clock. This ensures that you will always be able to speak with a support agent regardless of your location.

- User-Friendliness

If you’re a seasoned investor, then this particular metric likely won’t concern you. However, if you’re just starting out in the world of online trading, then it’s crucial that you stick with platforms that cater to newbies. This should include a simple deposit and withdrawal process.

- Technical Indicators

Experienced traders know first hand the importance of technical chart indicators. As such, if you’re a seasoned investor with the ability to read charts, you’ll want to choose a trading platform that offers heaps of technical tools. This includes the likes of Parabolic Stop and Reverse, Exponential Averages, Bollinger Bands, and Fibonacci Levels.

Am I Eligible to Join a Trading Platform?

Although the best trading platforms typically have a global presence, not all nationalities will be supported. This is usually dictated by the licenses the platform holds. In particular, investors from the US are often prohibited from joining an online broker because the platform is not regulated by the SEC. We would suggest checking whether your country of residence is supported before attempting to open an account.

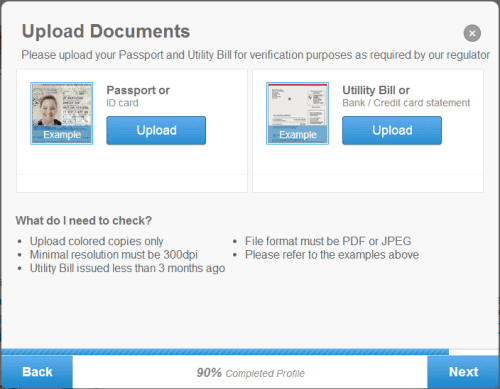

If your country is supported, you will also need to ensure that you are aged 18 years or older. Regardless of which broker you use, you will need to go through a KYC (Know Your Customer) program before you can deposit funds. This is to ensure that the trading platform remains compliant with its licensing bodies. The KYC process requires you to verify your identity and country of residence. You can do this easily by uploading a copy of your government-issued ID and proof of address.

What Financial Instruments can you Trade?

One of the most important factors that you need to assess before joining a new brokerage platform is the type of instruments that you can trade. This should include asset classes such as stocks and shares, futures, options, commodities, mutual funds, and cryptocurrencies. You also need to explore how many instruments you can trade within each asset class.

We’ve listed the most common asset classes that the best trading platforms typically list below.

- Trading platforms for stocks

Stocks and shares are still the most popular asset class traded in the online space. This covers blue-chip companies like Apple, IBM, Netflix, Facebook, Ford Motors, and British American Tobacco. Most trading platforms will cover the major stock markets such as the NYSE, Nasdaq, JSE, and the LSE. Some trading platforms will also support less liquid stock exchanges. This could include markets in Singapore, Germany, Hong Kong, or Canada.

Learn more about buying stocks and shares here.

- Commodities Trading

Commodities trading is a multi-trillion dollar industry that typically operates on a 24/7 basis. This covers precious metals such as gold and silver, and energies like oil and gas. Commodity prices are mainly affected by real-world news events, so it’s crucial that you are kept abreast of current affairs. For example, if tensions in the Middle East are on the rise, the price of oil will likely increase.

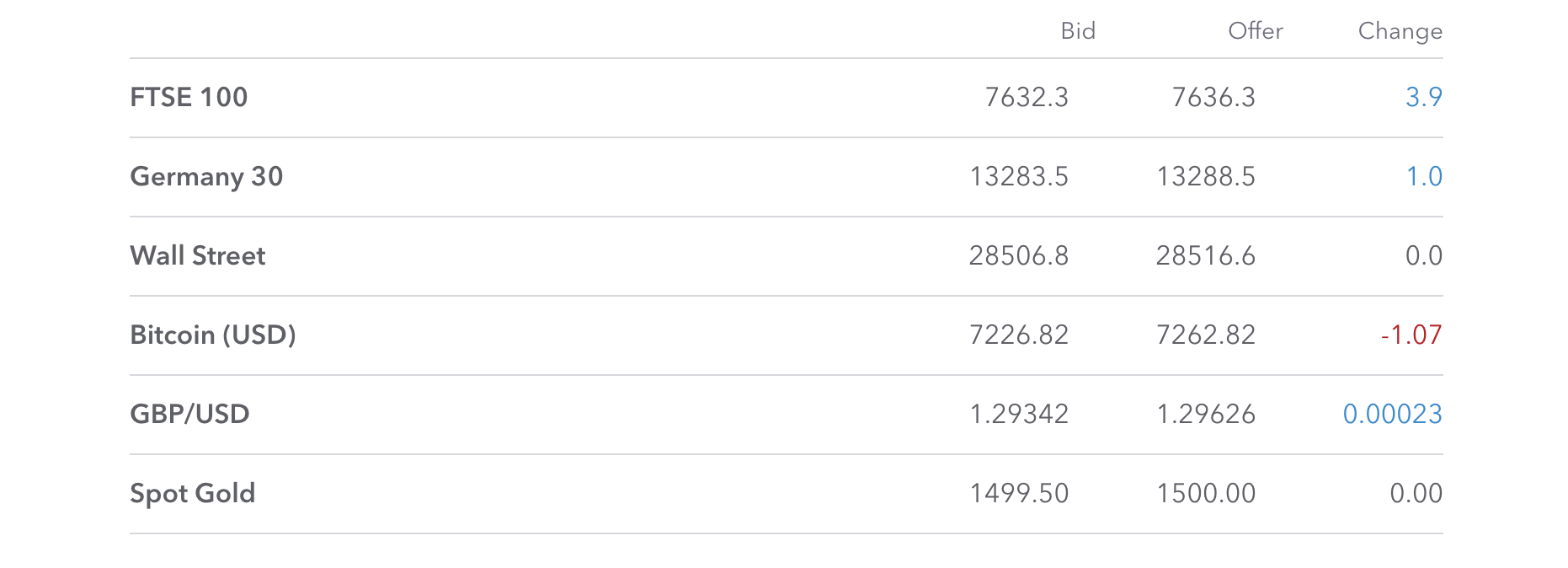

- Indexes

If you’re keen to invest in the stocks and shares space, but you can’t quite decide on which equities to back, it might be worth considering an index. These cover the wider stock markets, subsequently allowing you to invest in hundreds of companies via a single trade. For example, the FTSE 100 covers the 100 largest companies traded on the London Stock Exchange, and the S&P 500 covers the 500 largest companies listed in the US.

- Futures and Options

Futures and options allow you to place more sophisticated trades on your chosen asset class. They essentially allow you to speculate on the future price of an asset without actually owning it. For example, if you feel that the price of natural gas is due to increase within the next couple of months, you can purchase a 3-month futures contract.

- ETFs

In a similar nature to futures and options, Exchange-Traded Funds (ETFs) allow you to invest in an asset without actually owning or storing it. ETFs will track the real-world movement of a particular asset such as gold or US dollars, and you can go both long and short. As such, ETFs are perfect if you want to profit from an asset when the markets are down. One of the most anticipated ETFs is that of Bitcoin, although it could be some time before we see one.

- Trading platforms for bitcoin and cryptocurrency

Although cryptocurrencies such as Bitcoin have only been around for 11 years, the industry is now a multi-billion dollar market. As such, a number of online platforms now allow you to buy, sell, and trade cryptocurrencies at the click of a button. The easiest way to do this is via a cryptocurrency CFD. This will allow you to invest in cryptocurrencies without needing to worry about the hassle of storing it in a private wallet.

Learn more about cryptocurrency trading here.

Summary – Choosing a Trading Platform

In summary, there are now thousands of trading platforms operating in the online space. Never before has it been so easy to buy and sell assets from the comfort of your own home, and most platforms even allow you to trade while on the go via a mobile phone. However, with so many brokers offering their services, knowing which platform to open an account with can be challenging.

With that being said, we hope that you now have a firm understanding of what you need to look out for when choosing a new trading platform. Whether it’s regulation, low fees, deposit methods, the number of financial instruments, or withdrawal times, we’ve covered all bases.

Ultimately, you need to ensure that the trading platform is right for your individual needs prior to parting with your money. The most efficient way of achieving this is to start with small amounts as a means of testing the broker out. Once you’re happy with the service being offered, you can then make a larger commitment.

Glossary of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQs

How do I find a trading platform that is suitable for newbie traders?

A number of trading platforms now market their services to newbie traders.

How are trading fees calculated?

There are a number of different ways that trading platforms calculate fees. This can be a fixed fee every time you place a trade, or an annual maintenance fee. Some brokers will not charge any trading fees per-say, although you’ll pay in the form of the spread.

What is leverage?

If an online trading platform offers leverage, this means that you can trade with more than you have in your account. For example, if you apply leverage at a ratio of 10:1, you would only need to fund your trade with 10% of the total investment size.

Will I need to provide ID when I join a trading platform?

In order to remain compliant with its licensing bodies, online trading platforms must confirm your identity before allowing you to trade. You can do this by uploading a copy of your ID and proof of address.

Are commission-free brokers really free?

In reality, there is no such thing as a ‘commission-free broker’. Although you might not pay any commissions, you will pay fees indirectly via the spread. You can calculate this by working out the percentage difference between the ‘bid’ and ‘ask’ price.

How do I withdraw funds from a trading platform?

Most trading platforms require you to make a withdrawal to your bank account.

See Our Full Range Of Trading Resources – Traders A-Z

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up