Robinhood Review 2021: Platform, Fees, Pros and Cons

Stock trading used to require a phone call to a stockbroker who would charge a high fee to execute your stock trade. Nowadays, you can enter a stock trading mobile application and trade an array of financial instruments with a minimum cost.

Robinhood is a free-trading app that shook up the financial industry in 2018 and recently rolled out stocks and options trading with no commissions. Really, commission-free. Take note that Robinhood provides a great mobile trading app and recently had launched a web-based desktop trading platform. As a result, the Robinhood commission-free service is mostly suitable for beginners who wish to learn how to trade stock, options, cryptocurrencies and ETFs or experienced traders that usually take swing/long term positions.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Robinhood?

Robinhood Markets, also known as Robinhood, was founded in 2013 by Vladimir Tenev and Baiju Bhatt. The company headquartered in California, United States. Robinhood is a commission-free investment and stock-trading app that provides users to trade stocks, ETFs, options, and cryptocurrencies.

Robinhood services more than 6 million customer accounts and its valuation is estimated at around 7.6 billion USD, after another round of funding of $200 million in May 2019.

Though Robinhood is the new kid on the block, it is one of the fastest-growing brokers in the industry. Similarly to brokers like Fidelity and Charles Schwab, the broker also considered safe for investors and traders as it is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Special features

Well, it’s hard to say that Robinhood delivers high-quality features. The brokers’ motto is simplicity and as a result, Robinhood provides effective, simple, and entertaining features for its clients.

- Robinhood Snacks & Daily Podcasts

The broker offers a 3-minute daily newsletter with fresh takes on the financial news and entertaining podcasts breakdown of the top 3 daily business stories in 15-minutes.

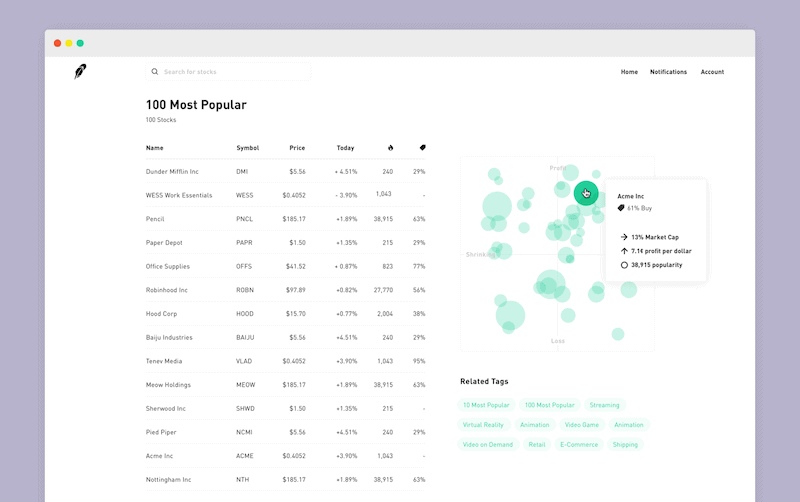

- Collections

Robinhood offers a feature called collections, which is available on their investment mobile app and web-based platforms. The collection feature helps traders to categorize stocks and options by sectors and other search terms.

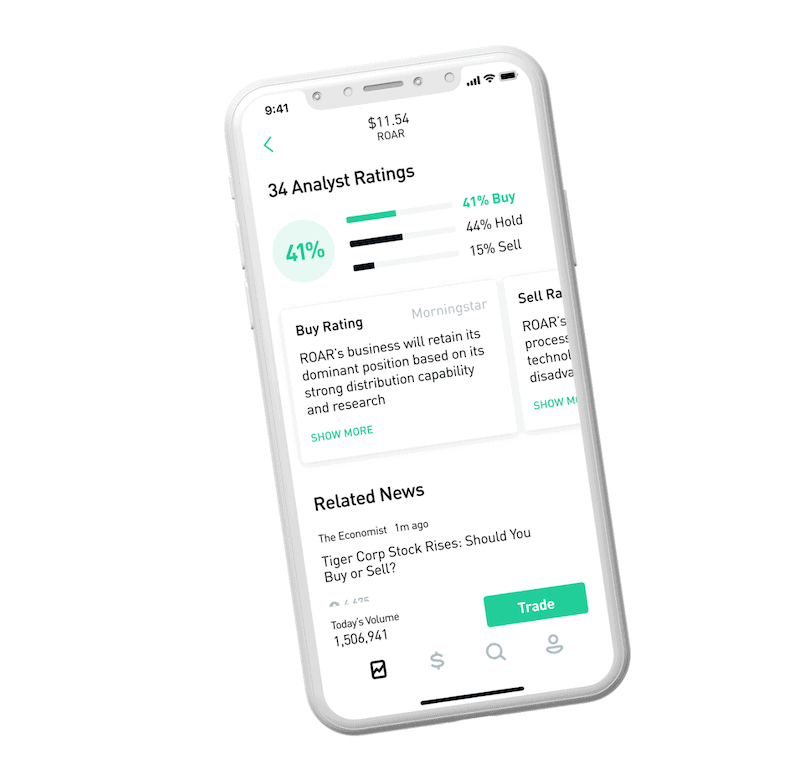

- Analyst Ratings & People Also Bought

These two features can help traders to get a general market sentiment on a specific instrument. You can view buy, sell, and hold ratings from Wall Street analysts and read commentary from Morningstar analysts.

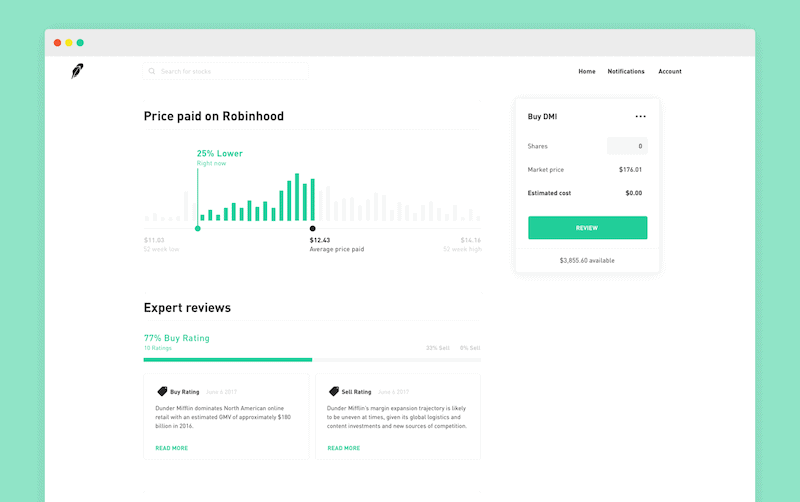

- Price Paid

With this feature, you can view the average share price Robinhood investors bought at, and conclude your next trade based on the data.

Tradable securities

Robinhood’s selection of markets and products is limited compared to other stock brokers in the industry like TD Ameritrade. The free-commission broker does provide a list of 5000 stocks and ETFs, 16 cryptocurrencies, and an extensive list of equities options, however, trading conditions fall behind the industry’s benchmark. For example, traders cannot short stocks at Robinhood.

Here are the markets covered by Robinhood:

- Stocks

- Options

- Exchanged Traded Funds (ETFs)

- Cryptocurrencies

- Cash management (coming soon)

Promotions

Robinhood offers a continuous promotion of a referral program. According to Robinhood’s website, when you invite your friends to join Robinhood, you can both earn a free stock. The referral can be done from the mobile app, and, if enough of your friends sign up, you can earn up to $500 in free stocks.

Click here to sign up for the promotion.

Account Minimum

There is no minimum deposit requirement at Robinhood for the standard account. If you wish to open/upgrade to the Robinhood Gold account, then there’s a minimum deposit requirement of $2000.

Supported Countries

At the time of writing, Robinhood accepts traders from the United States and Australia.

Languages Supported

The broker supports its website and mobile application in English only as Robinhood’s services are available only for US and Australian clients.

Trading Platforms

Robinhood was initially designed to provide traders access to financial markets through its mobile application trading platform, but with the increasing popularity of Robinhood, the company has lunched a web-based trading platform. Remember that Robinhood is a commission-free brokerage so some active traders will find that the broker falls short in its trading platforms.

Robinhood Mobile Application

Robinhood’s mobile application is a top-notch trading app when it comes to user interface and customizability. The app is beautifully designed, offering a user-friendly and easy-to-use mobile app. The Robinhood app is available on iOS and Android for American and Australian residents.

Robinhood’s mobile application does provide traders all the basic tools to operate an online trading account:

- News feeds

- Candlestick charts and basic technical analysis indicators

- customizable alerts

- Market execution

- Watch List – Stocks, options, ETFs, and cryptocurrencies

- The mobile app supports different types of orders: market orders, limit orders, stop limit orders and stop orders.

- Fundamental data

- Basic research tools

Robinhood Web Platform

Robinhood has launched a web-based trading platform in 2018. Similarly to the mobile application, the web-based platform is a solid trading platform, providing all the basic features and tools to execute market orders.

In line with Robinhood’s mobile application functionality and the company’s website, the web-based platform is well-designed and easy-to-use. On the downside, the platform lacks the basic needs and advanced features for traders and investors.

Fees and Limits

In terms of commission and fees, Robinhood’s offers a great trading experience. Robinhood is commission-free online platform – the broker does not charge fees in order to open a trading account, to maintain your account, or to transfer funds to your account. Compared to other online stockbrokers like TD Ameritrade and Charles Shwab that charge around $4.95-$6.95 per trade, Robinhood US stock trading is fully commission-free.

Robinhood also does not charge any hidden fees and discloses all fees and commission on the website. Here are some of the additional fees at Robinhood:

- SEC: $20.70* per $1,000,000 of principal. This fee is rounded up to the nearest penny.

- FINRA Trading Activity Fee (TAF): $.000119 per share. This fee is rounded up to the nearest penny and no greater than $5.95.

- $50 fee for non-US stocks

- Average margin fees of 6%

The fact that Robinhood does not charge any stock trading fees means that the broker’s platform is a great choice for beginners as it is easier to start trading with no per share fees.

Min Deposit and Max Withdrawals

Robinhood does not require a minimum deposit for the standard account but the broker requires a minimum deposit of $2000 for the Robinhood Gold account. Robinhood has a maximum withdrawal limit of $50,000 per day.

How to withdraw funds

At Robinhood, things are simple. Here are the steps to follow if you would like to withdraw funds from Robinhood:

- Log in to your account on your mobile phone or PC

- Tap the Account icon in the bottom right corner.

- Tap Transfers and then Transfer to Your Bank.

- Choose the bank account you’d like to transfer to.

- Enter the deposit and click submit

Account Types

Robinhood falls short in the selection of account types. The broker has three account types, the cash account, the standard/instant account and the gold account.

Robinhood Instant/Standard Account

The Robinhood standard account is a margin account which allows you the access to instant deposit and extended-hours trading. With the standard account, you won’t have to wait for funds to be processed when you make a deposit or sell stocks up to $1000. Note that day trading terms are limited in the standard account and the ability to leverage your position is not included.

Robinhood Cash Account

The cash account is even more basic than the standard account. This account enables you o place commission-free trades during the standard and extended-hours trading sessions and does not limit your day trading. However, with the cash account, you won’t have access to instant deposits or instant settlements.

Robinhood Gold Account

The Robinhood gold account is the most professional trading account offered by the broker. Here are some of the advantages of the gold account:

- Instant deposits of up to $50,000

- Professional research data from Morningstar

- Level II market data from Nasdaq

- Leverage up to 2:1

- Trading on margin

There are some downsides to the gold account. Those include a minimum deposit of $2000, a monthly cost of $5, and a 5% yearly interest on the amount you use above $1,000.

Note that you can try the Robinhood Gold account for free for the first 30 days.

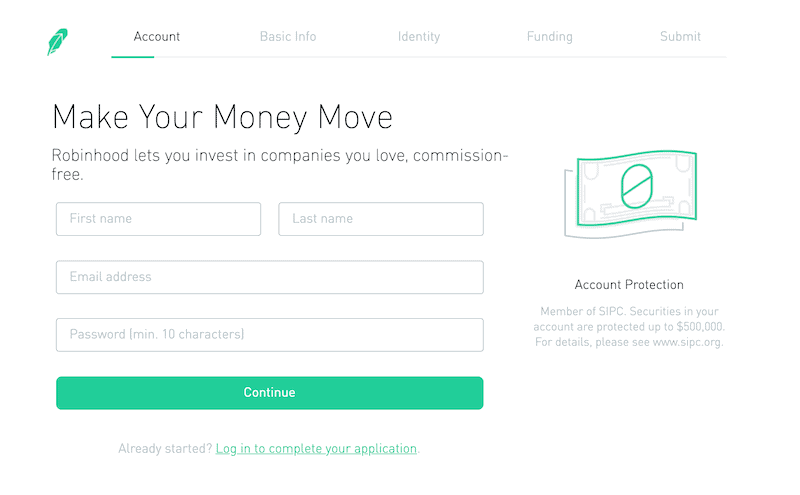

How to Sign Up on Robinhood

Sign up with Robinhood a simple and straightforward process. It can be done via the mobile application which is available on Apple Store and Google Play, or via the broker’s website. In order to open an account with Robinhood, you must be at least 18 years old, provide a valid social security number, fill in your U.S. residential address and submit the below application.

Follow the next steps to open an account with Robinhood:

First, click here to sign up for your trading account. On the top right side of the home page, click the “Sign Up” button.

In the next steps, you must provide your personal details, trading experience, and submit identity documentation (you can submit documentation through your mobile).

Now, after you finish these steps you can move on to fund your account with one of Robinhood’s payment methods.

How to Configure Your Trading Account

Robinhood’s platform is not customizable, however, the broker takes pride in its special design for newcomers and experts. Indeed, Robinhood platform’s user interface is great and there’s no need of a complex account configuration. The platform is very intuitive and all you have to do before you start trading is to find all the basic pages and know the market orders so you can execute your trades.

How to Buy and Sell Stocks on Robinhood

Trading stocks on Robinhood’s platform is a simple and quick process. Here’s what you need to do:

- Choose your preferred stock and enter the stock’s page.

- Tap Trade.

- Tap Buy/Sell

- Tap Order Types in the upper right order.

- Select your preferred order type (Market, limit, stop loss, stop limit).

- Confirm your order.

- Swipe up to submit your order.

Safety and Regulation

Though the broker is relatively new in the online trading industry, Robinhood has managed to gain the support of major regulators in order to protect its clients in the United States and Australia. Robinhood is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

Education, Research and Data

Robinhood is not a conventional online broker and therefore, the broker offers different forms of educational material and data. First, the broker offers the Robinhood Snacks, a unique 3-minute daily newsletter of financial news, and has received great user reviews.

Robinhood also operates a blog on its website with relevant news and analysis. A basic news feed is included in the cash and standard account and traders that choose the Robinhood Gold account can enjoy professional research from Morningstar which provides a global financial investment-research service.

Customer Service

Robinhood customer support team provides limited support for users. Those include email and a ‘submit request’ form through the mobile application and the website. The broker does have a useful help center that includes different sections: Get started, invest in Robinhood, tools & more, manage your account, troubleshooting questions, and tax questions.

Users can also contact Robinhood support team via Twitter, Linkedin, and Facebook.

In conclusion, though the response time is longer than that of the conventional in the industry, Robinhood’s customer support team are knowledgeable and professional.

Robinhood Pros and Cons

Pros

- A commission-free trading platform

- Robinhood’s mobile application and web-based platforms are user-friendly and easy-to-use.

- No deposit minimum requirements

- No hidden fees

- Regulated broker

Cons

- Not possible to short stocks

- Basic charts

- A limited selection of account types

- No phone or live chat

- No demo account

- Available only for residents in the United and Australia

Final Thoughts

Robinhood came out to the market with an innovative product which creates stocks trading simple and easy. The mobile app was designed for simplicity and for those who wish to be part of financial markets without the hassle of learning an advanced trading platform and trading tools. Yet, Robinhood falls short in many basic trading elements compared to other brokers like Charles Schwab. The selection of markets and products is limited as well as trading functionality. Robinhood offers a solid platform for beginners and intermediate traders who lack the knowledge of advanced day trading strategies.

In conclusion, if you are an investor that seeks a simple and innovative platform to connect with financial markets, Robinhood is the perfect choice. Otherwise, you might want to pay the extra commission in order to get a professional trading platform and unique trading features.

Glossary of Trading Platform Terms

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Can Non US/Australia residents trade with Robinhood?

No, non-US and Australia residents cannot open a trading account at Robinhood. The broker is currently offering services to residents from the United States and Australia.

Is Robinhood regulated?

Robinhood is a regulated online broker and a member of the Financial Industry Regulatory Authority (FINRA), Securities Investor Protection Corporation (SIPC) and the Federal Deposit Insurance Corporation (FDIC).

How can I contact Robinhood in order to open a trading account?

In order to open a new trading account, you can contact Robinhood via this email address – [email protected].

Can I use automated trading with Robinhood

No, Robinhood offers traders a simple trading platform that does not include automated trading.

Can I trade cryptocurrencies with Robinhood

Yes, Robinhood provides cryptocurrency trading. The broker offers a selection of 16 cryptocurrencies including bitcoin, ethereum, bitcoin cash, litecoin and other crypto coins.

See Our Full Range Of Broker Resources – Brokers A-Z

See Our Full Range Of Broker Reviews – Broker Reviews A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up