Merrill Edge Review | Trading Costs, Tools, And More

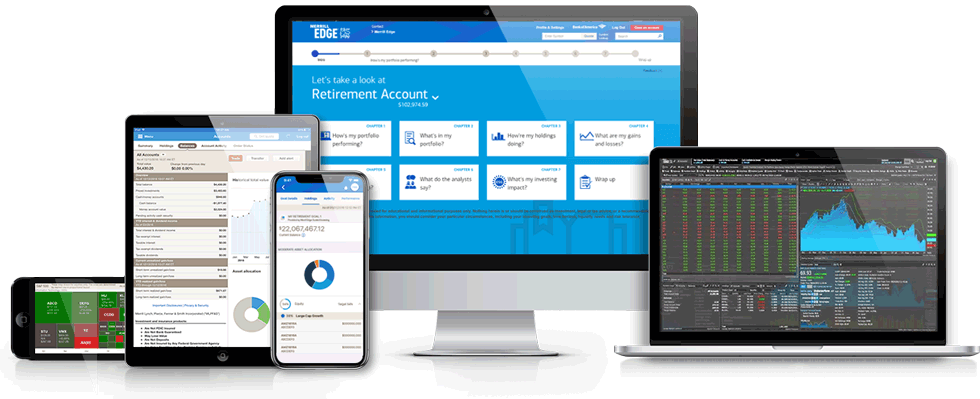

Merrill Edge is the investment and brokerage arm of the Bank of America that promises to give its investors the power to “put plans into action.” Started in 2010, Merrill edge is one of the few online firms that provide both banking and investment brokerage services under one roof. The broker promises a wide range of services to their investment clients, from educational and research materials, proprietary trading tools, free trades, and excellent customer support for their clients. They also maintain three trading platforms for the different classes of investors.

We, however, sought to verify the effectiveness of the broker and the reliability of their platform features. In this review is everything you need to know before registering with the investment cum banking services provider.

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.How does merrill edge work?

The Bank of America launched Merrill Edge soon after the acquisition of Merrill Lynch in 2010. Ideally, the online brokerage platform was supposed to combine the effectiveness of Merrill Lynch’s research and investment tools with Bank of America’s online investing platform – Quick & Reilly. It presents investors with a platform where they can research and learn of the different investment options available to them. Here you can also execute different trades individually, through a managed investment platform or with the help of investment advisors. Some of the investment options available to Merrill edge investors include stocks, ETFs, mutual funds, and bonds.

Whom does Merrill Edge appeal to most?

Merrill edge appeals to three types of investment clients; Bank of America clients, low volume traders and high balance clients. The appeal for bank of America clients is made possible by the fact that these clients can link their bank savings accounts with the investment account for the seamless flow of cash. Its relatively high transaction fees have also locked out high volume traders, ensuring that it only appeals to low volume traders. Its appeal for the high balance clients is, on the other hand, made possible by the fact that its bonuses and promotions are dedicated to clients with high operating balances. These often have the effect of pushing the trading costs to relatively affordable levels for this investment class.

Trading platforms:

Web trader:

Merrill Edge is available in a web trader that is accessible to all the investment broker’s clients. The trading platform is browser-based and easily accessed via the company website. We find it relatively presentable, highly intuitive, and equipped with several screeners that come in handy when vetting different types of investment tools. On this platform, you will have access to all the trading products availed by Merrill Edge including stocks. Mutual funds, ETFs, and bonds. The platform also features several market analysis tools and indicators that users can use to determine the best market entry point.

MarketPro:

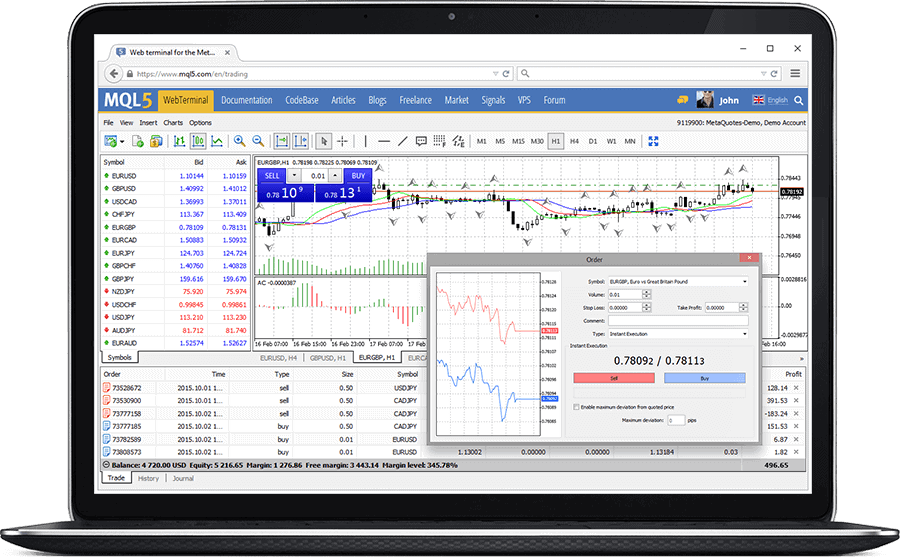

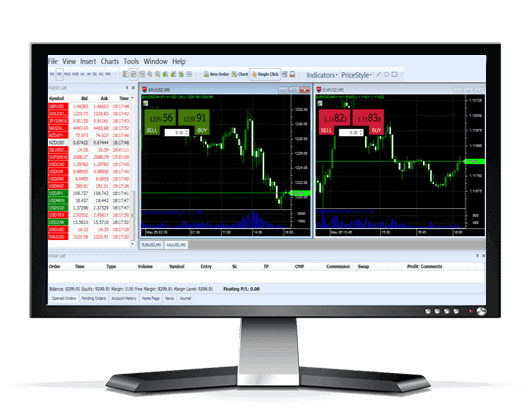

MarketPro is a proprietary trading platform for Merrill Edge. It is an improved version of the web trader that is also available on the browser version. It has all the features and tools contained in the web trader. However, unlike the web trader, the MarketPro trading platform is only available to a select class of Merrill Edge online investors.

We consider the MarketPro platform relatively robust and more intuitive as it treats its users to live market-trading data, highly interactive charts, and a customizable dashboard. It also features an expanded range of trading tools and over 36 technical analysis indicators that will come in handy when entering or exiting markets.

The downside to this flagship trading platform by Bank of America is that it is highly restrictive and biased towards high volume traders and clients with huge operating balances. For instance, you can only access the MarketPro trading platform if you execute more than 15 trades per quarter or have a combine balance on over $50,000 in your Merill edge trader and Bank of America savings accounts. Note that, this too doesn’t get you access to live market trading data on Nasdaq. For this, you will need to execute more than 30 trades per quarter or have combined assets of over $1 million in your Merrill and Bank of American accounts.

Trading fees and commissions:

Merrill Edge imposes a $6.95 dollar fee on all equity and options trades and an additional $0.75 per options contract transacted on their platform. We find this relatively expensive and uncompetitive in an industry where more and more online brokerages are bent on keeping the transaction costs low. Some have even embraced the zero-fee mode for some of the instruments traded on their platform.

Commission-free trades

Merrill Edge maintains two types of commission-free trades; one is available to clients with high operating balances and the other is availed to clients on the Preferred Rewards Program. On this program, Gold status clients with a combined Merrill and Bank of America balances of above $20,000 get free equity trades per month. Platinum status clients with balances over $50,000 and Platinum Honors clients with balances exceeding $100,000, on the other hand, get 30 and 100 free trades per month respectively.

Minimum operating balances

One of the most interesting factors about the Merrill Edge broker account is that it doesn’t require you to maintain a minimum account operating balance. There also is no minimum investment requirement nor a minimum withdrawal amount.

What did we like and didn’t about Merrill Edge?

what we like:

- Integration with the Bank of America:

Merrill Edge is one of the few banks that we have come across with an integrated and revolutionized how you interact with your bank and investment accounts. These two are linked into a seamless connection that allows for fast, easy, and free transfer of funds from one account to another. You don’t even need two login credentials to access either account. And even more interestingly, you can view your investment account balances on the Bank of America mobile apps and ATMs.

- Trading technology and mobile access:

The Bank of America and Merrill edge trading accounts are also available in the form of both iOS and Android apps. Either of these gives you total access to your investment or savings accounts where you can view balances, execute trades and market orders, and also monitor different research and trade reports. The banker has also made it possible to view and initiate a trade on your smartphone, but you will need to complete the action on either the company website or the mobile app.

- 24/7 customer support:

Bank of America stands out with its 24/7 phone customer support to their bank and investment account holders. This customer support team is also available through several other means including social media channels, live chat feature on the company website, and at the different bank branches across the country. What we like most about the investment broker is that experienced investors man these support centers. These will not only give qualified answers to your queries – and this is evidenced by the fact that most of our queries never had to be escalated to a higher authority to be resolved- but will also do so on time.

- Competitive research and educational tools:

Merrill Edge runs a dedicated investor education hub section on its website that lets their clients decide on the best investment path. Here, financial education advanced to investors is grouped into topics and products and based on sophistication levels. We are impressed to note that the investment broker’s team of experts develops all the content on this platform.

There also is an optimized guidance and retirement center feature that educates clients on this platform on how to plan for different life goals. It teaches on retirement planning, college planning, and how to prioritize different aspects of your financial life.

And in addition to the in-house investment content, Merrill edge has also partnered with several other third-party investment advice providers. These include and Morningstar, Lipper, CFRA, and Trefis. These have their investment advice packaged in videos, tutorials, webinars, and articles.

- Fee-free debit card and bill payment:

We also liked the fact that Merrill edge investors can access, check their account balances at any of Bank of America ATM free of charge. Plus they have a bill payment option that allows investors to settle different bills directly from your account balance.

- The robo-advisor for beginner traders:

Merrill edge avails three types of investments to their clients. The self-directed investing, guided investing, and guided investing with an adviser. The latter two are commonly referred to as Robo advisory, their systems automate the investment process by looking at your investment priorities and coming up with the best investment strategy. These welcome passive income earners, and don’t need an investor to spend hours on end analyzing markets or trade positions.

What we don’t like

- Restrictions on MarketPro platform:

We feel like the Bank of America and their MarketPro trading platform may be a little harsh on the investors. Unlike most other online brokers that will either avail their pro programs to all their clients or have affordable restrictive policies like low subscription options, Merrill edge has put up relatively exorbitant entry restriction to Market Pro.

- Wide range of trading products:

At Bank of America and Merrill edge, you can only trade less than 4000 mutual funds and a host of ETF and equity funds. This investment product base is relatively low compared to most other online brokerages.

- Work on the uncompetitive trading costs:

Competition and favorable market conditions have in the recent past seen most online investment brokerages resort to cost-cutting. Some have also taken this move a step further by embracing zero-fee trades. This is, however, yet to reflect in Merrill Edge as it still charges the exorbitant $6.95 fee per trade.

Final word:

Merrill Edge is a widely acclaimed online investment broker that draws much of its credibility and reliability from the effectiveness of its parent bank – Bank of America. It boasts of maintaining a wide range of tradeable financial instruments and tradable securities. Its robust MarketPro trading platform and mobile app will also help you stay on top of market trends, analyze prices, and execute trades with utmost ease and accuracy.

However, most of their services, product features, and promotions are biased towards high balance investors. These have access and exposure to a wider range of trading and analysis tools as well as free trades. These plus the platform’s exorbitant trading fees may be viewed as some of the reasons the platform has faced huge resistance in mass adoption, despite being backed by one of the biggest and most prestigious banks in the country.

Glossary of Trading Platform Terms

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Is Merrill Edge Regulated?

Merrill Edge is regulated by the Security Exchanges Commission, the Financial Industry Regulatory Authority and the Securities Investor Commission.

Where Is Merrill Edge Located?

Merrill’s parent company, the Bank of America, is headquartered in North Carolina, USA, with more than 2, 000 branches across the country.

What Is The Difference Between Merrill Edge And Merrill Lynch?

Merrill Lynch was a bank that was acquired by Bank of America in 2009. Merrill Edge is a brokerage that is provided by Bank of America through Merrill Lynch.

How Can I Deposit In A Merrill Edge Account?

Through electronic funds transfer, check and bank wire.

How Secure Is The Merrill Lynch Mobile App?

The Merrill Edge mobile platform has the same security measures as the desktop version. This means the app has the same encryption standards as the website.

Is Merrill Edge A Good Choice For Beginners?

Merill Edge is a good choice for traders and investors of all knowledge levels. Beginners can utilize the rich cache of educational resources, screening tools, and relatively affordable trading costs. Experienced traders will appreciate the advanced MarketPro platform which enables advanced analyses and fast trade execution.

See Our Full Range Of Broker Reviews – Broker Reviews A-Z

Edith Muthoni

Edith Muthoni

View all posts by Edith MuthoniEdith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. She is currently the chief editor, learnbonds.com where she specializes in spotting investment opportunities in the emerging financial technology scene and coming up with practical strategies for their exploitation. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up