CashNetUSA Loan Review 2020 – READ THIS BEFORE Applying!

The Payday loan space has become really competitive over the past few years, with online lenders making it as seamless as ever to borrow funds at the click of a button. While strong competition is great for you as a borrower, this can make it difficult to assess which lender is best for your needs.

As such, we’ve created a comprehensive CashNetUSA review that covers everything you need to know. Within it, we’ve listed all the key points surrounding fees, eligibility, trustworthiness, and more. By the end of reading it from start to finish, you’ll be able to make an informed decision as to whether or not CashNetUSA is right for you.

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Before you proceed, make sure that you understand the risks of taking out a Payday loan. Missing just a single payment can result in huge fees.What is CashNetUSA?

Launched way back in 2004, CashNetUSA is an online lender like CashUSA and Big Picture Loans that specializes in Payday loans. For those unaware, this means that you borrow money on a short-term basis, and pay it back when you next receive your weekly or monthly salary.

In the 15 years that the lender has been operational, CashNetUSA claims to have provided loans for over 3 million people. While Payday loans is the lender’s hallmark offering, CashNetUSA also offers installment loans and line of credit products.

As is the case with most Payday loan lenders, CashNetUSA is required to have an individual lending licence in each of the states that it operates in. As it doesn’t hold licenses in all US states, you will need to check whether you qualify for a loan. Nevertheless, if you do, then the amount of interest that you pay will vary depending on where you are based.

It is also worth noting that the lender is part of the Enova International group, which is a blue-chip company traded on the New York Stock Exchange. The group consists of a number of other well-known Payday loan lenders, such as QuickQuid, Headway Capital, On Stride Financial, and NetCredit.

What are the Pros and Cons of CashNetUSA?

CashNetUSA Pros:

✅Allows those with poor credit to borrow short-term funds

✅Credit scores of 300+ accepted

✅Fast application process

✅No collateral required

✅Loans can be acquired for any purpose

✅Established since 2004

CashNetUSA Cons:

❌ Not all US states are serviced

❌ Not clear on interest rates as this varies state-by-state

❌ Charges an origination fee (if applicable)

How does CashNet USA compare to other lenders?

CashNet USA is a popular payday loan provider founded in 2004. In its more than a decade of service the company has lend out to more than 3 million people. However the lender doesn’t operate all U.S states due to lack of license. Check n Go, Ace Cash, as well as Speedy Cash gives Cashnet USA a run for its money as we’re about to see in the following comparison of their loan amount, credit score requirement, interest rates and payback period.

CashNet USA

- Borrow limit extends from $100 to $3,000 depending on the type of loan and the borrower’s state of residence

- Requires a credit score of at least 300

- Annual interest rates starts from 89% to 1,140% on payday loans

- 2 weeks to 6 months payback period

Check n Go

- Borrow limit of $100 to $500

- Requires a credit score of 300 to 850 points

- Fee rate starts from $10 to $30( depending on the State of residence)

- 3 to 18 months payback period

Ace Cash

- Borrowing limit starts from $100 – $2,000 (depending on state).

- No credit score check

- Fee rate on $100 starts from $25 (State dependent)

- Loan repayment period of 1 to 3 months

Speedy Cash

- Loans from $100 to $5,000 ( collateral security may be required)

- Accepts bad credit score

- Payday repayment period starts from 7 to 14 days depending on your pay schedule

- Annual rates of 459.90% ( varies depending on state of residence)

How Does CashNetUSA Work?

Similarly to other loan providers like Elastic, CashNetUSA allows you to apply for three types of loans via its online platform. This includes a Payday loan, installment loan, and a line of credit. Once you head over to the CashNetUSA homepage, you will be required to select the state that you live in, the type of financing product you need, the amount you need to borrow, and for how long.

The good thing about the initial application process is that the search will not have an impact on your credit score. As such, you’ve effectively got nothing to lose by exploring your eligibility.

While an application with CashNetUSA cannot have an impact on your credit score, the search might still appear on your report. As such, make sure that you do not get in the habit of applying for too many loans.Before you complete your application, you will also need to provide some basic information regarding your current financial circumstances. This will include your current household income, your current and historical relationship with debt, and whether or not you are a homeowner.

Once you submit the application, CashNetUSA will usually give you an instant pre-approval decision, alongside the rates that they can offer you. If you are happy with the fundamentals, you’ll be required to provide some additional information. Finally, once you sign the digital loan agreement online, CashNetUSA usually transfer the funds into your checking account the next working day.

What Types of Loans Does CashNetUSA Offer?

CashNetUSA offers three types of loan products. Here’s a brief explanation of how each product works.

✔️ Payday Loans

A Payday loan is where you borrow money for a short period of time – usually until you next receive your weekly/monthly paycheck. The funds will be automatically taken from your checking account on the date that you get paid.

✔️ Installment Loans

A traditional loan is sometimes refereed to as an installment loan. In a nutshell, these are loans that you pay back over a fixed number of months, at a fixed rate of interest. Unlike Payday loans, installment loans are usually taken out for a minimum period of 1 year.

✔️ Line of Credit

A line of credit loan allows the borrower to draw down money as and when they need it, up to an agreed amount. The interest is charged on the amount of money you actually borrow, as opposed to the amount of credit you have in reserve. Take note, you’ll need to pay a transaction fee every time you do draw money out.

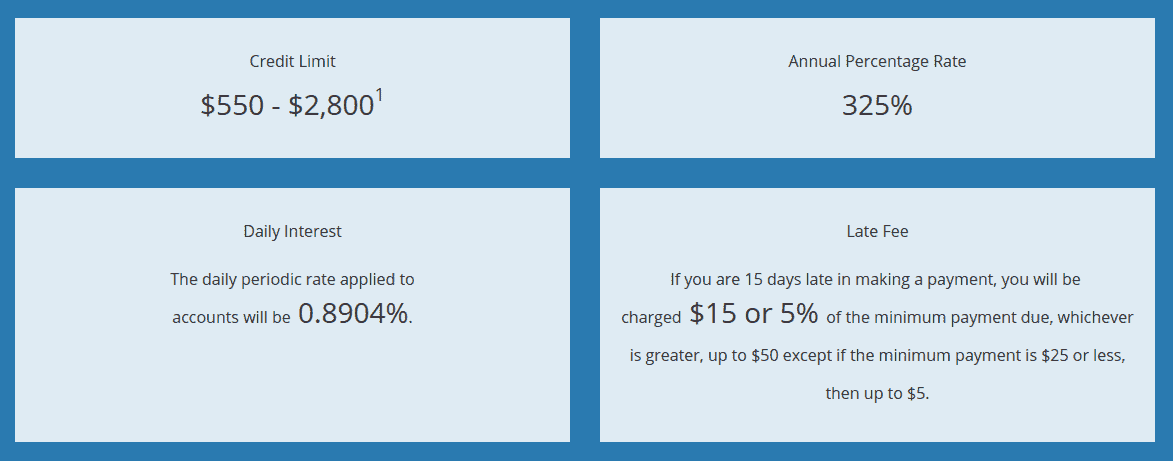

How Much Does CashNetUSA Cost?

There is no one answer to the amount that a CashNetUSA loan will cost you, not least because it depends on a number of individual factors. The amount that you are offered can vary depending on the follow metrics:

❓The type of loan you apply for (Payday loan, installment loan, line of credit, etc)

❓The amount you need to borrow

❓How long you need to borrow the funds for

❓The US state that you reside in

❓Your current FICO credit score

❓Your debt-to-income ratio

❓Your current household income

You will only be able to view your lending rates once you make an application with CashNetUSA. However, the initial application does not impact your FICO credit score – regardless of whether or not you are approved.With that being said, it’s probably a good idea for us to give you a couple of examples, with the view of giving you a ball-park figure of how much a CashNetUSA loan will cost you.

💸Payday loans can come with an APR rate of 86.9%, all the way up to 1,140%

💸Alternatively, if you decide to opt for a Payday loan across multiple installments, then this averages an APR rate of 435%.

💸If you’re after a line of credit, this will cost between 24% and 299% APR. Moreover, you will also need to pay a 15-25% transaction fee every time you draw down money.

💸If you’re looking for a more traditional installment loan, then this can cost anywhere from 187.3% to 388.9%.

As you will see from the above examples, the amount that you will pay can vary considerably. With that being said, it makes it difficult to assess whether or not the lender is competitively priced, insofar that it will all depend on the specific rate I are offered.

For example, if you were able to get the best Payday loan rate possible – 86.9%, then this is highly competitive (industry average is 400% APR). On the other hand, if you were offered the highest rate – 1,140%, then you would be best off looking elsewhere.

Depending on the state that you are residing in, you might also be required to pay an origination fee. Ranging from 1% to 5%, this is charged as a fee to cover the cost of arranging the loan.Am I Eligible for a CashNetUSA Loan?

Before you assess whether or not your financial circumstances qualify you for a loan, you will need to find out if you live in an eligible state. As noted earlier, CashNetUSA can only offer loans in states that it holds a regulatory license. Moreover, your location will also dictate the type of loan that you can apply for.

Check out the list of supported states below, across the platform’s three financial products.

✔️ Payday Loans

Alabama, Alaska, California, Florida, Hawaii, Louisiana, Maine, Michigan, Minnesota, Nevada, North Dakota, Oklahoma, Oregon, Rhode Island, Texas, Washington, Wyoming

✔️ Installment Loans

California, Delaware, Illinois, Mississippi, Missouri, New Mexico, Ohio, South Carolina, Texas, Wisconsin

✔️ Line of Credit

Alabama, Idaho, Kansas, Tennessee, Utah, Virginia

In terms of the fundamentals, you will of course need to ensure that you are a US resident, and that you are in possession of a valid social security number. Credit score wise, you’ll need to have a FICO score of at least 300, which falls within the Poor Credit threshold.

While CashNetUSA does not state what your minimum income needs to be, this will at the very least need to fall in-line with state requirements. This will vary from $1,500 and $3,600, depending on the state in question. As with any online lender, CashNetUSA will determine your eligibility by looking at your current debt-to-income ratio too. As such, if you have a lot of outstanding debt at the time of application, you might be denied.

How Much can I Borrow From CashNetUSA?

The amount that you can borrow from CashNetUSA will once again depend on the state that you reside in. If you are after a Payday loan, the amounts on offer range from $255, up to a maximum of $3,400.

When it comes to installment loans, the highest amount that you can borrow is also $3,400, which is available in the state of California only. Other states such as Mississippi and Illinois have much lower caps, and thus, have a maximum borrowing amount of just $1,000.

If you’re after a line of credit and you’re based in an eligible state, you will be able to obtain a maximum of $2,000.

What if I Miss a Payment?

If you miss a payment with CashNetUSA, this could lead to a number of unfavourable consequences. First and foremost, you might need to pay a late payment fee. The amount that you pay, if at all, will depend on the regulatory framework of the state you live in. In some cases, this can be as much as 5% of the loan amount if payment is more than 10 days overdue. If you borrowed $1,000, this would end up costing you $50 in fees,

It’s best to understand the late fees payable in your respective state before applying. However, it must be noted that you shouldn’t be applying for a loan if you feel that a late payment is possible.On top of the risk of late payment fees, you also need to consider the impact on your FICO credit score. As is standard with all US lenders, a late payment will be reported to credit rating agencies. If you are already in possession of a bad credit score, this could be highly detrimental.

The best advice that we can give you is to contact the team at CashNetUSA if you think you might miss a payment. You might be able to negotiate a more flexible payment plan in doing so.

Customer Service at CashNetUSA

As an online-only lender, CashNetUSA does not have any physical branches. Instead, everything is completed online, or if you prefer, by telephone. Nevertheless, if you need to contact a member of the support team, you have the following options.

📱Phone: 888.801.9075

📧 Email: [email protected]

💬 Live Chat

✍️ In Writing: 175 W. Jackson Blvd., Suite 1000 | Chicago, IL 60604

The customer service team works 6 days per week. Standard opening hours, displayed in Central Time (CT), are listed below.

⏱️ Monday-Friday: 07:00 – 22:00

⏱️ Saturday: 08:00 – 17:00

⏱️ Sunday: Closed

CashNetUSA Review: The Verdict

If you do need to obtain short-term financing and you’re in possession of bad credit, then it’s likely that CashNetUSA will be able to help. In fact, the platform accepts FICO credit scores from just 300+. With an established online reputation that exceeds 15 years, alongside the required regulatory licenses in all of the states it operates in, CashNetUSA is a notable option across all of its three product offerings – Payday loans, installment loans, and lines of credit.

However, our only slight gripe is that it is really difficult to assess how the lender compares with its industry counterparts. This is because the rates on offer can vary wildly depending on where you are based. As such, the only way you can find out how much your required loan structure is going to cost you is to fill out the online application form. Nevertheless, the application won’t have an impact on your credit score – irrespective of whether or not you are approved.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary of loaning Terms

FAQ:

How do I repay my Payday loan with CashNetUSA?

If you’re taking out a Payday loan with the lender, then the amount will be taken out of your checking account automatically. This is usually on, or just after, the date that you receive your salary.

Will CashNetUSA accept me if I have a really poor credit score?

While there is no guarantee that you will be accepted, CashNetUSA does accept FICO credit scores of 300 and upwards.

How long does it take for CashNetUSA to transfer my funds?

Most CashNetUSA loans will be transferred the next working day. However, if the lender needs more information from you, it can take longer.

Does CashNetUSA charge an origination fee?

This will depend on the state that you live in. If CashNetUSA are able to charge an origination fee, then they likely will.

US Payday Loan Reviews – A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up