Stock Trading | How to Trade Stocks for Beginners 2025

If the thought of stock trading scares you, you’re not alone. People with very little experience in stock trading are terrified by the thought because they fail to understand how the stock market works.

If the thought of stock trading scares you, you’re not alone. People with very little experience in stock trading are terrified by the thought because they fail to understand how the stock market works.

The reality is that investing in the stock market bears risks, but when done in a disciplined manner, it is among the most efficient ways to build up your wealth.

Before you create an account on an online trading platform, you should first know what stock trading is.

Read on to find out what stock trading entails.

-

-

Criteria used to pick our Stock Brokers

- Minimum initial deposit

- Ease of use of the stock broker interface

- Available trading tools and features

- Trading and non-trading fees

- Number of tradable asset classes

- Trading platforms supported

- Broker customer support

Step 1: Open a brokerage account

1. Stash - Best Broker for US Investors

Stash is one of the fastest-growing share and stock investment platforms in the United States. In less than 5 years since its establishment, the investment company that operates both a web-based and mobile app platforms has grown its membership base to 4 million+ individuals.

According to the online stock trading platform, this was made possible by its ease of use, low trading, and nontrading fees as well as an affordable minimum initial deposit requirement. You, for instance, only need $5 to open a stash app and $1 monthly fees.

The app is also riddled with highly practical educational materials to help guide your investment journey. The app is also linked with your checking account and you can authorize it to scrap pocket change and automatically invest it in your preferred stocks.

Our Rating

- Low minimum initial deposit and easy top-up process

- Features a simplistic and easy to use interface

- Completive trading fees on over 30 investment choices

- Doesn’t support the purchase of individuals stocks – just ETFs

- Large accounts are exposed to higher trading fees up to 0.25%

Sponsored ad2. Plus500 - Access a wide range of local and international Stocks CFDs

Plus 500 online brokerage is an industry veteran and a highly reputable shares and stock CFD online broker. It has made its name as a leading online trading platform not just because of its easy-to-use platform but also due to its highly competitive stock and shares trading fees..

You also stand to benefit from the huge array of both local and international shares and stocks availed on the online broker's platform.

Creating an account on the platform is relatively straightforward and you only need an initial deposit of $100. You are also treated to highly advanced trading tools and features on both their web-based trader or the mobile app. These proprietary trader platforms are also laden with education and research materials as well as an unlimited demo account.

OUR RATING

- Features an innovative and easy to use proprietary platform

- Highly competitive trading fees

- Plus500UK Ltd is authorized & regulated by the FCA

- Maintains account inactivity fees

- Limited interface customization options

80.5% of retail CFD accounts lose money. Sponsored adStep 2: Learn How to Trade Stocks

What is Stock Trading?

Stock trading refers to buying and selling shares of a publicly-traded company. A stock trader is typically someone who frequently buys and sells these stocks to capitalize on daily price fluctuations. In stock trading, for every buyer, there is a seller. For example, when you buy 100 shares of stock, someone will be selling 100 shares to you. And when you sell your shares of stock, another person has to buy them.

These frequent traders are betting that they can make some money in the next minute, hour, days, or month, instead of buying stock in a blue-chip company to pass along to their grandchildren someday. These short-term traders hardly sit on a stock.

How Does Stock Trading Work?

For stock trading to work, there must be buyers and sellers. Stock is typically traded by these buyers and sellers on exchanges. The buyer places a market order to purchase shares of stock at their current price or a limit order to buy if the stock reaches a certain price. The order is then matched with up with a seller who has put up shares for sale.

Although there are physical stock exchanges, stock trading is done online. To trade share, you need a stock broker to act as an intermediary to the stock trading. Your broker can be a full-service or an online broker. A full-service broker can place trades on your behalf as well as give you advice about which share of stock to trade. An online broker is a software platform that lets you execute trades yourself.

Stock trading works via a network of exchanges such as the NYSE or the Nasqad. A company lists its shares of stock on an exchange via an initial public offers (IPO). Investors buy these shares, which enables the business or company to raise money and develop its business. These investors can then trade these shares of stock among themselves, which drives the supply and demand of every listed stock.

This supply and demand help dictate the price of each stock or the level at which the people involved – investors and traders – wish to buy or sell. Most of the calculations are done by computer algorithms. Buyers launch a `bid’, which is typically less than the amount a seller `asks’ for. That difference is the bid-ask spread. For stock trades to happen the buyers should increase their price or sellers should decrease theirs.

Historically, stock trading likely occurred in an actual marketplace. Nowadays, the stock market exists electronically, on the internet and through online stockbrokers. Trading occurs on a stock-by-stock basis. However, prices often move in tandem due to political events, news, and economic reports among other factors.

What are Some Stock Trading Courses for Beginners?

If you don’t want to solely rely on books to learn the basics of stock trading, you should try checking out stock trading courses.

Based on statistics, around 90% of traders fail. The major reason for their failure is the lack of trading education and lack of support from a skilled trading mentor. By watching online trading courses made by experienced and well-known traders, you’ll have a higher chance of achieving trading success. Here are two courses that can help you get started.

1. Investors Underground

Nathan Michaud founded Investors Underground in 2008. Aside from excellent training videos, the platform also has a vibrant online chat group for its users. They can freely interact and share tips in the group. The training videos focus on swing trading, OTC trading, and momentum trading. All of the lessons also give more emphasis on technical analysis than fundamental analysis. The strategies that you’ll learn include ABCD charts, short-selling parabolic moves, red-green trading reversals and a whole lot more.

Our Rating

2. Warrior Trading

Ross Cameron, who is also a world-renowned stock trader, founded Warrior Trading. The platform offers a 5-day trial to new users. If you want to continue using the platform, you’ll be asked to pay either a monthly fee or a full fee for the entire course material. Like Investors Underground, it also focuses on momentum trading. Its users commend the user-friendliness of the platform as well as the availability of numerous trading tools and real-time trader chatroom. Many also shared that they were able to learn great strategies for fundamental and technical analysis after going through all the training materials provided by Warrior Trading.

Our Rating

What are Some Stock Trading Books for Beginners?

You can easily gain more knowledge about stock market trading and investing in general by reading books. Below are the best stock market books you should check out.

- The Intelligent Investor by Benjamin Graham and Jason Zweig

- How to Make Money in Stocks by William O’Neil

- When to Sell: Inside Strategies for Stock-Market Profits by Justin Mamis

- Irrational Exuberance by Robert J. Shiller

- Stock Investing For Dummies by Paul Mladjenovic

- A Random Walk Down Wall Street by Burton Malkiel

- Market Wizards by Jack Schwager

- Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies by Jeremy Siegel

- Common Sense on Mutual Fund by John C. Bogle

- One Up On Wall Street: Know to Use What You Already Know To Make Money in The Market by Peter Lynch

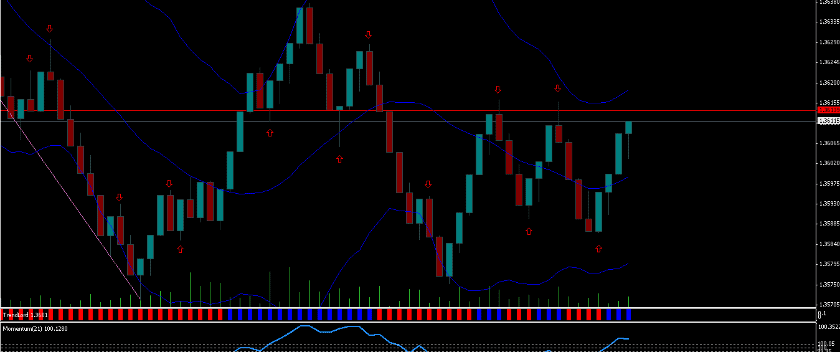

Step 3: Choose a Trading Strategy and Start Trading

After learning about the different online stock brokerages, what to look for in a broker, and how online stock trading works, its time to get your hands dirty. But first, you need to decide the type of trader you would like to be and chose the appropriate trading strategy.

If you, for instance, wish to trade actively throughout the day, consider scalping or other day trading strategies. And if you want to hold onto trades for some time, consider position or swing trading positions. We explain these four in details below:

Day Trading

Day trading is regarded as the most popular active trading method.

As the name implies, day trading is the method of trading (both buying and selling) stocks within the same day. Positions are closed out on the same day they are taken and no position is held overnight.

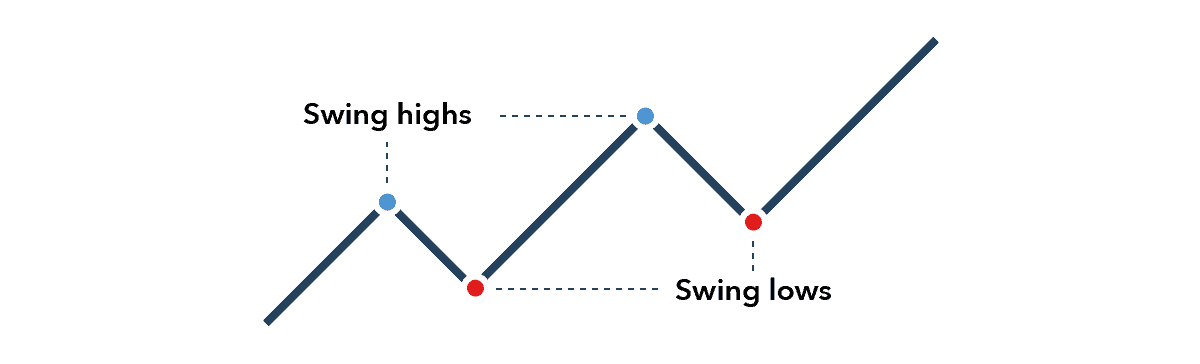

Swing Trading

Swing traders invest in stocks when a trend breaks. When a trend ends, a bit of price volatility occurs as the trend kicks in. Swing trading is done as the price volatility begins.

Trades are often held for over a day. They often create a set of trading rules based on fundamental or technical analysis.

Position Trading

Some investors take position trading to be a form of buy-and-hold strategy rather than active trading.

When done by an active trader, however, the strategy can be a type of active trading. It uses longer-term charts, ranging from daily to monthly, coupled with other strategies to dictate the trend of the market direction. This form of trade can remain active for several days to weeks or longer as the trend demands.

Scalping

This is one of the fastest strategies used by advanced traders. Scalping includes taking advantage of several price gaps that result from order flows or bid-ask spreads.

This strategy works by making a spread or buying stocks at the bid price then selling them at the asking price to find the difference between the two points. A scalper attempts to hold his/her position for a short period, which lowers the risk associated with scalping.

What are the Stock Trading Terminologies for Beginners?

- Buy – You buy stock shares in a company.

- Sell – You get rid of the stock shares you bought. There are two reasons behind this. It’s either you’ve already gained profit from the stocks or you’re trying to cut the losses you’ll incur if you keep holding the stocks.

- Bid – This is the price you are willing to pay for a share of stock.

- Ask – This is the price that the buyers are asking for a share of stock.

- Bid-ask spread – You can get the bid-ask spread by subtracting the amount people want to spend and the amount people want to get. You should get the difference between the bid price and ask price.

- Bull market – This is a market condition which means that the price of stocks is expected to increase.

- Bear market – This is a market condition which means that the price of stocks is expected to decrease.

- Limit order – This will help you execute orders only at or under your purchase price. You can only use this to execute orders only at or above your target sale price.

- Market order – This will help you execute a buy or sell order as quickly as possible.

- Volatility – This implies how fast the price of stocks moves up or down.

- Liquidity – This refers to how fast you can buy stocks as well as sell stocks to get cash.

- Trading volume – This refers to the total number of stock shares that are traded daily. This is a factor that can significantly affect the market’s liquidity.

- Blue stock chips – These refer to large and well-known companies that offer stable dividend payments to its stockholders.

- Dividend – This refers to the earning being paid to a company’s shareholders annually based on the number of stocks that they hold.

- Broker – This refers to a qualified individual who will buy and sell shares for you in exchange for a fee.

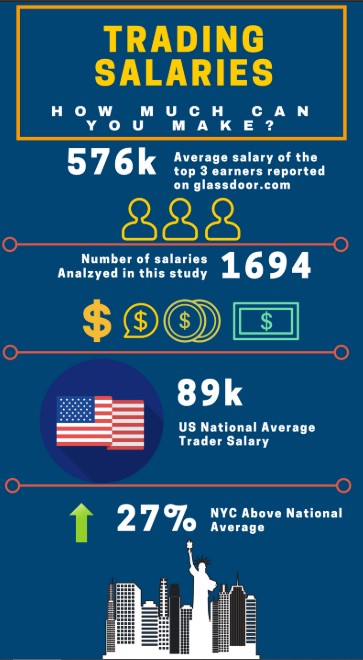

How much do stock traders make?

According to the Office of the New York State Comptroller as well as data gathered by Glassdoor.com, $89,000 is the average annual salary of day traders who are working for companies in the United States from 2002 to 2016. The $89,000 annual salary is 27% more than the average salary of New York City residents.

On the other hand, if you are trading for yourself, the annual profit you’ll make will largely depend on which market you trade, your capital, day trading education, whether all of your trading strategies are effective or not, and how much time you allocate for trading stocks.

Note that day traders often only risk 1% of their total stock or account balance to minimize the risks.

Most day traders see to it that their win rate is at least 50%. They also target to make their gains around 1.5 times higher than their losses. For instance, if they risk $300 on a trade, their target profit for that trade is around $450.

Below is an example of a day trading scenario.

Account balance: $30,000

1% of account balance: $300

Stop loss (equal to buy order price): $0.04

Target ask order price: $0.06

If the stock price is $0.04, a day trader can buy 7,500 shares for $300. There are 100 round-turn trades that day traders can make per month. If the winning rate is 55%, below is the total amount of money a day trader can make within one month.

55 profitable trades: 55 x $0.06 x 7,500 shares = $24,750

45 trades that the trader lost: 45 x $0.04 x 7,500 shares = $13,500

Net profit for one month = $8,250

On average, investing in stock generates an average of 10% per annum but it is important to note that there isn’t a fixed return in stock trading as there are a lots of factors that is affecting the market.

What are Some Tips When Trading Stocks?

- Understand your risk tolerance – This can help you avoid investments which can possibly make you anxious. For example, you shouldn’t have an asset which makes you lack sleep. Anxiety triggers fear which then triggers emotional responses. When you understand your risk tolerance, you can retain a cool head during times of financial uncertainty and be able to make analytical decisions.

- Avoid leverage – In simple terms, leverage means using borrowed money to carry out your stock market strategy. Leverage is a tool. However, it is best suited after you gain experience and confidence in your decision-making abilities. You should minimize your risk when starting out so that you can profit in the long term.

- Build up positions gradually – In stock trading, you should know how to take your time. Successful stock traders buy stocks because they expect to earn via share price appreciation or dividends, etc. over a period of time, like years or even decades. This implies that you can take your time in buying as well.

- Have long-term goals – Why do you want to invest in stocks? When will you need your cash back? Are you saving for college, retirement, or to purchase a home? You should answer these questions first so that you can decide on the best way to invest.

What Not to Do When Trading Stocks?

- Going all in – You should not try to win it all back in stock trading. Even if you have a risk management plan in place, there will be moments when you`ll be tempted to ignore it and make a much larger trade than you normally do. Resist the temptation and stick to your risk management plan.

- Choosing a bad broker – Depositing money with a forex broker is the first step you`ll make. If it’s in financial trouble, poorly run or an outright trading scam, you can lose your money.

- Lack of a stop loss – You need a stop-loss order for every trade you make. It will help you take a significant portion of the risk out of that investment. It will stop you from losing more than you can handle.

- Unrealistic expectations – The stock market is very volatile and dynamic and it can behave in an irrational manner at times. Ensure you have proper strategies to face it. Take stock trading as an investment and not a gamble.

Conclusion

If you`re new to the stock market, you need to know what type of trader you want to be and how you want to invest.

If you have funds and time to participate, stock trading can be a very helpful step forward that can result in great returns. But first, learn how the stock market works and how to play it safe before starting out with your hard-earned cash.

Glossary of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQs

Where can I trade stocks?

To buy and sell stocks, you need to find a good brokerage. Find a good online trading platform and start investing.

See Our Full Range Of Trading Resources – Traders A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up