Fidelity Investments Review 2021 | Platform, Fees and More

Fidelity is one of the oldest online stockbrokers in the market. Over the years, it has managed to maintain high-quality service and innovation, gaining a reputable name among industry players.

It ranks well among the top performing brokerage service providers in the industry with plenty of options for different types of traders and investors.

In this Fidelity Investments review, we will like to consider its range of features, establishing its strengths as well as weaknesses. By the end of it, you should be in a position to decide whether it is the platform for you.

Some of the questions you may be asking are “Is Fidelity Investments good?” “Is Fidelity Investments legit?” and “Can you trust Fidelity Investments?” Stay put as we uncover answers to these and many more questions in the course of the review.

-

- Step 1: Click the “Open Account” link on the fidelity.com site

- Step 2: Under Investment and Trading, select “Open a Brokerage Account”

- 3. Choose whether this will be an individual or joint account

- Step 4: Indicate whether you are a Fidelity customer

- Step 5: Enter your personal information

- Step 6. Select your desired account features and preferences

- Step 7. Review the selections and confirm

-

- Step 1: Click the “Open Account” link on the fidelity.com site

- Step 2: Under Investment and Trading, select “Open a Brokerage Account”

- 3. Choose whether this will be an individual or joint account

- Step 4: Indicate whether you are a Fidelity customer

- Step 5: Enter your personal information

- Step 6. Select your desired account features and preferences

- Step 7. Review the selections and confirm

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.What is Fidelity Investments?

Initially known as Fidelity Management & research Company, Fidelity Investments has been around since 1946 and has grown steadily over the years. The full-service broker currently holds over $2 trillion in client assets and manages more than 20 million retail brokerage accounts.

Initially known as Fidelity Management & research Company, Fidelity Investments has been around since 1946 and has grown steadily over the years. The full-service broker currently holds over $2 trillion in client assets and manages more than 20 million retail brokerage accounts.Fidelity bought its first computer in 1965 and launched its very first website in 1995. At present, it is considered as one of the world’s largest investment brokerage firms globally together with Robinhood, Ameritrade and others.

The firm provides a comprehensive set of self-guided investment options. However, for investors who would rather have a professional manager or advisory services, it offers that as well. Users can access wealth management and even gain access to a dedicated robo-advisory platform.

Special Features

At one time, it was best known for mutual funds, namely, the Fidelity Funds. But at present, it is highly diversified, offering a complete range of investment products. Notably though, it remains one of the top players in mutual funds. The Fidelity Investments mutual fund, Fidelity Contrafund, has over $107 billion in assets, and is in fact the largest US non-indexed fund.

Unlike most brokerage firms which only operate online platforms, like Charles Schwab, Fidelity has over 140 brick and mortar branches all over the US. This gives users options of working online or in-person depending on preference.

Fidelity Investments offers various types of investments:

- Stocks

- Options

- Fidelity Investments ETF

- Over 10,000 mutual funds (both Fidelity and non-Fidelity inclusive of sector funds)

- Over 40,000 new issue and secondary market bonds as well as certificates of deposit (CDs)

- Retirement and IRAs

- Cash management and investing

- Annuities

- Life insurance (and long-term care insurance)

Notably, there is no Fidelity Investments forex or futures trading.

Promotions

Depending on the size of your investments, there are a number of promotions for which you can qualify:

- $2,500 Fidelity Investments bonus

- 300 free trades if you fund an account with $50,000

- Apple gift card (up to $500)

- “IRA Match” from Fidelity

- 500 free trades for two years if you fund an account with $100,000

Account Minimum

Opening and operating an account with Fidelity Investments broker does not require an account minimum. However, mutual funds usually require a $2,500 account minimum. Notably though, it is possible to avoid the minimum initial investment. All you have to do is to set up automated investments amounting to a minimum of $200 monthly.

Margin trading, on the other hand, requires a Fidelity Investments account minimum deposit of $5,000. There are no Fidelity Investments fees for penny stocks (stocks under $1).

Supported Countries

Fidelity Investments is available to users all over the world. However, there are some features and benefits that are accessible to US users and are usually indicated on the site.

Similarly, the main site is for US residents. But users from other parts of the globe can access the international investment site by clicking on the relevant link on the site. At present, customers from all corners of the globe can trade on 25 different markets supporting 16 currencies.

Languages Supported

The site currently supports English.

Trading Platforms

Basic Web-Based Platform

By default, every user starts off on this basic Fidelity Investments trading platform. This simple trading ticket is accessible by clicking on the trade button on the site. It expands to the left side of the screen.

It is quite powerful as it uses the watch-list feature to offer real-time streaming quotes. It also has mobile apps for iOS, Android and Windows.

These offer basic functionality as you may expect, with support for trading Fidelity Investments stocks, mutual funds, options and ETFs on your mobile device. It also has charting tools and other basic essentials.

Active Trader Pro

The Active Trader Pro is Fidelity Investments’ flagship desktop platform for seasoned traders. It is also available for use on browsers and both are free for all users. In order for a trader to qualify to use this Fidelity Investments trading platform, they have to qualify.

A client has to make a minimum of 36 qualifying trades within a 12-month period (rolling). Alternatively, some users could qualify to access this advanced platform by making a call to get access.

The fully customizable platform offers real-time streaming for market data, account and order updates. Real-time analytics is another great feature, allowing you to make informed trading choices.

You can use this advanced platform to create up to 50 option or equity orders simultaneously as well as to place 20 orders at once using a multi-trade ticket.

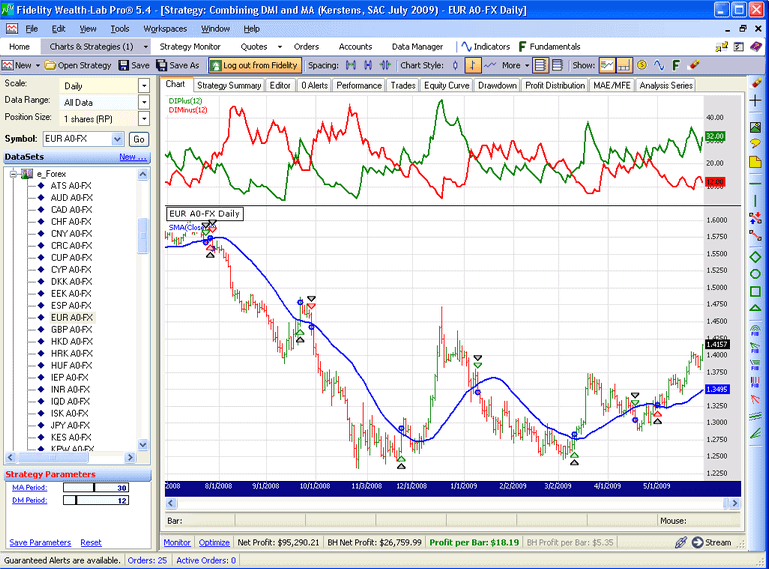

Wealth-Lab Pro

A premium product on the site, Wealth-Lab Pro, is only accessible to customers with a Fidelity Investments account minimum of $25,000. Additionally, they need to be trading at least 36 times during a rolling 12-month period.

It is a desktop-based software for testing strategy and it lets users get access to more than 20 years of daily historical data so as to customize strategies. Users who are not eligible can get their hands on a 30-day free trial version.

Fidelity Investments Mobile Trading Platform

Fidelity also offers a mobile app for basic trading that works on Android, Apple and Amazon devices. For Amazon users, the app includes skills for Echo as well as Eco Show.

The Fidelity Investments app displays plenty of info including market news and global indices. You can deposit checks, transfer funds and pay bills all from the app. Furthermore, you can trade mutual funds on the mobile platform, a unique feature that is not available on most mobile apps.

Options chains allow for trading of derivatives and charting is quite advanced for a mobile app. But it does not offer complex charting or research facilities.

Fees and Limits

Here is a list of fidelity investments trading fees:

Feature Fee Minimum Deposit $0 Stock trade fee $4.95 ETF trade fee $4.95 Options base fee $4.95 Options per contract fee $0.65 Mutual fund trade fee $49.95 Broker-assisted trades fee $32.95 Commission-free ETFs 500 Broker-assisted mutual fund trades 75% of principal amount ($100 minimum to $250 maximum rate) There is no ongoing Fidelity Investment account fee on the platform such as low-balance charge, inactivity or annual fee. Similarly, using Fidelity Investments trading tools does not attract any charges nor does it require any trading minimums.

Account Types

There are a number of Fidelity Investments account options on the platform. These are:

- Taxable brokerage accounts

- Managed accounts

- 529 college savings plans

- Fidelity Go robo-advisor

- Traditional IRAs

- Roth IRAs

- Roth IRA accounts for kids

- Rolover IRAs

- Small business retirement plan (SEP, self-employed 401(k) plans and SIMPLE IRAs

- Investment only retirement accounts

How to Sign up on Fidelity Investments

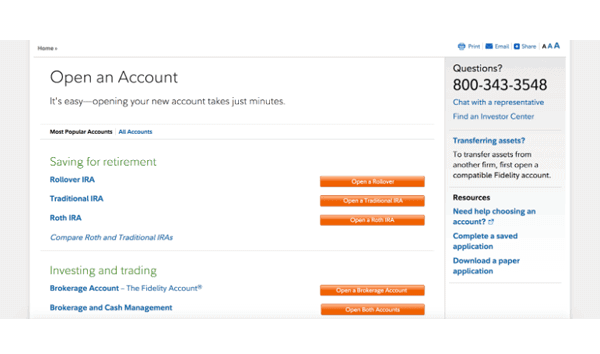

The procedure for Fidelity Investments open account has slight differences depending on the type of account you want to open. But in either case, the site takes you through a simple step-by-step procedure that is easy to follow.

As an example, let us go through the process of opening a Fidelity Investments stock broker account:

Step 1: Click the “Open Account” link on the fidelity.com site

Firstly, go to the Fidelity.com website by clicking here and click on open account.

Step 2: Under Investment and Trading, select “Open a Brokerage Account”

You must then click on ‘open a brokerage account’ in order to move forward. Once done, move on to the right step.

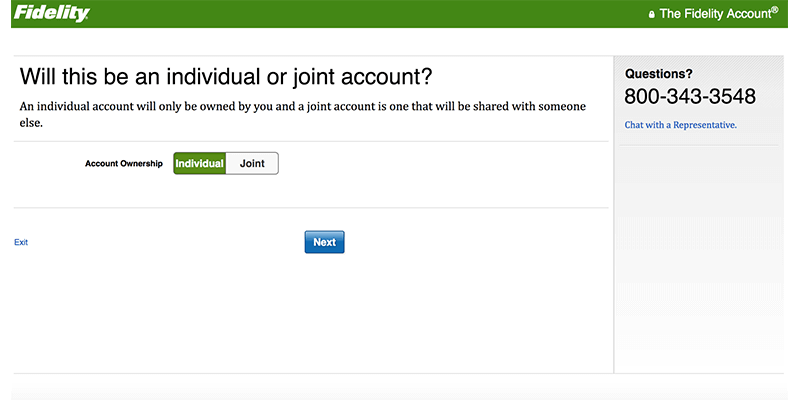

3. Choose whether this will be an individual or joint account

You will then have to choose whether you want to open an individual or a joint account. An individual account with only be owned by you whereas a joint account can be shared with another investor.

Step 4: Indicate whether you are a Fidelity customer

Next, you will need to indicate whether you are a Fidelity customer. If you are the system will prefill your details. If not, click “No”

Step 5: Enter your personal information

You must then enter your personal information for purposes of identity verification before opening the account.

Step 6. Select your desired account features and preferences

Take some time to review the account features available to you. This will help you make the most of your experience with Fidelity and tailor your account to your trading needs.

Step 7. Review the selections and confirm

Finally, review your information and click on confirm. Then go through the customer agreement and accept the terms and conditions.

How to Buy and Sell Stocks on Fidelity Investments

Once you go through the Fidelity Investments sign up process, buying and selling stocks is quite intuitive. To find an order ticket anywhere on the site, simply click the “Trade” link. Alternatively, if you are using Active Trader Pro, you will always have an order entry tab open.

Whether or not you get the best available price when you place a trade depends on how a broker routes the order. Known as price improvement, this in essence is a buy below offer or a sale above bid price.

The platform’s trade execution engine is known to offer clients high rates for price improvement. When using Active Trade Pro, data will stream in real time. But on the basic web-based platform, you can only get an updated quote by refreshing the page.

How to Configure Your Trading Account

Note that even though there is no Fidelity Investments cost for opening a brokerage account, you need a $2,500 investing minimum. To configure your trading account:

- Go through the Fidelity Investments login procedure

- Once you log in to your account, start by funding it if you have not done so. You can use a bank transfer or use another brokerage account to fund it

- Your account is now ready to use. You can start by considering special broker offers or getting tips on how to invest from the education center.

How to Withdraw Funds

To withdraw funds from any of the accounts on the platform, here’s what you need to do:

- Select “Transfer” and choose the account from which you want to withdraw funds

- Specify how you would like to receive the funds

- Enter the amount you want to withdraw in USD

- Specify the tax withholding if applicable

- If you do not have sufficient funds, sell your securities

- Review and then confirm the transaction to initiate processing

Note that for early withdrawals for instance from IRA accounts, you may be subject to additional Fidelity Investments withdrawal fees in form of penalties or extra taxes. To avoid this, find out the specific withdrawal rules that apply in your case.

Delivery times vary according to the transfer type and whether or not you had to sell securities to avail cash. After submitting a withdrawal request, go to the “Activity & Orders” tab to track the withdrawal.

Safety and Regulation

In case you are wondering if Fidelity investments regulated, you will be glad to know that it actually is. It operates under the purview of the US Securities and Exchange Commission (SEC).

Therefore, for anyone who asks “Is Fidelity investments safe?” the answer is yes. Operating under regulatory oversight requires adherence to strict safety measures for user protection.

Education, Research and Data

This is among the areas in which Fidelity shines. Everything about the site is meticulously detailed and there is great in-house commentary. Furthermore, each and every tool is chock full of insights.

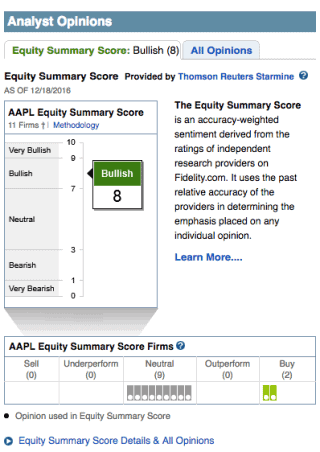

Currently, it features stock research from a total of 19 providers. These include McLean Capital Management, Thomson Reuters, Ned Davis and Recognia. ETF research, on the other hand, comes from six providers while LiveVol, the options analysis software provides options strategy ideas.

On the stock quote pages, you will see an Equity Summary Score which consolidates the ratings from the different research providers.

If you find the numerous options overwhelming, you can take a quiz so as to identify the providers whose investment style matches your own.

Other research capabilities on the site include:

- In-depth research reports available for free download from at least 12 independent research entities.

- The Thomson Reuters StarMine, a unique tool which gathers analyst ratings and then weights them according to their historical accuracy. Using this tool, you can easily tell who has been wrong or right in the past.

- Downgrade and upgrade activity, showing every day’s movers and shakers, with activity collated from over 125 research firms.

- Screeners for Fidelity Investments stocks, ETFs, mutual funds, options and fixed income with tons of data and an intuitive interface.

Customer Service

To begin with, Fidelity has an automated virtual assistant on the site letting visitors type in their questions and get immediate responses. Customer support is also available via phone 24/7 to handle Fidelity Investments complaints and queries.

You can also get in-person assistance by walking into any of their more than 100 brick and mortar branches all over the US. Furthermore, customers can access help on iMessage, Amazon Alexa, Google Assistant and Facebook Messenger.

The company also offers free seminars at their various branches, covering a wide array of topics. Similarly, you can get access to webinars and guides from their online learning center.

Overall, the Fidelity investments rating on customer support is high in almost every respect.

Fidelity Investments vs. Charles Schwab

Fidelity Investments and Charles Schwab both rank highly in most respects. But though their rates are similar on most counts, Charles Schwab beats Fidelity in broker-assisted trades. While it charges $25, Fidelity charges $32.95.

Furthermore, Schwab’s trading platform does not limit users but Fidelity requires Active Pro traders to meet some minimum requirements for qualification.

Fidelity’s mobile app is, however, a lot more advanced and comprehensive than Schwab’s.

At the end of the day, both brokerage firms offer numerous advantages, but Fidelity is best for experienced traders while beginners may have an easier time with Schwab.

Fidelity Investments Pros and Cons

Pros

- Provides full spectrum of investment services

- International trading in 25 markets and 16 currencies

- Impressive customer support

- Fidelity Investments commission rate is competitive

- Leading website research experience

- Comprehensive mobile app

- Industry leader in quality of order execution

- It is a regulated entity

Cons

- Mobile app not so great for trading

- Day traders get no ladder-trading tool on any of the trading platforms

- In the research category, there are no third-party reports available for mutual funds

- Does not offer futures or forex trading

Final Thoughts

From the above in-depth review, it emerges that the platform is indeed reliable and has more strengths than weaknesses.

It offers lots of investment options to suit various users, serves customers on a global scale and has a competitive fee system. Its trading platforms are comprehensive and its education system, thorough.

All in all, it is reasonable to conclude that Fidelity Investments is a great option for investors worldwide.

Glossary of Trading Platform Terms

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What are the options for depositing funds into a Fidelity account?

You can use bank wire, EFT, automatic investments, checks and transfers from Fidelity or non-Fidelity accounts.

How can I transfer funds between Fidelity accounts?

To transfer funds between Fidelity accounts, go to “Accounts & Trade” and select “Transfer Money/Shares.” Follow the prompts on the screen to complete the transfer process.

When should I use Fidelity’s robo-advisor Fidelity Go?

It is advisable to use the robo-advisor if you are a new investor or have a small portfolio. As you learn more about investing and the portfolio grows, you can switch to self-managed investing.

How much does it cost to use Fidelity Go?

You will not require a minimum initial investment to use Fidelity Go. But you need at least $10 to start investing. The advisor charges a 0.35% annual fee on your portfolio, which will be deducted from your account on quarterly basis.

How do I get commission-free trades on Fidelity?

To qualify, deposit the required minimum of $50,000 or $100,000 to qualify for 300 or 500 commission-free trades respectively. You also need to designate an eligible existing account or open one with new assets.

See Our Full Range Of Broker Reviews – Broker Reviews A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Fidelity Investments and Charles Schwab both rank highly in most respects. But though their rates are similar on most counts, Charles Schwab beats Fidelity in broker-assisted trades. While it charges $25, Fidelity charges $32.95.

Fidelity Investments and Charles Schwab both rank highly in most respects. But though their rates are similar on most counts, Charles Schwab beats Fidelity in broker-assisted trades. While it charges $25, Fidelity charges $32.95.