Check ‘n Go Loan Review 2020 – READ THIS BEFORE Applying!

With this lender, you might be able to get cash fast regardless of your credit rating. But is it your best choice?

In our comprehensive review of the lender, we take a look at the crucial aspects that define a good lender and determine whether Check ‘n Go matches up. By the end of it, you will be in a position to make an informed decision.

Read the full list of the best payday loan apps providers 2026

-

-

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

What is Check ‘n Go?

Founded in 1994, Check ‘n Go is a financial service provider which seeks to solve users’ short-term financial problems. The lender offers a variety of solutions for different types of borrowers in the 28 states where it operates.

Its lending services are accessible in 961 physical stores across the said states. And while you can apply for a loan in Son at one of these stores, you can also do so online.

The services available differ from one state to the next, as do the loan limits and rates. But thanks to its easy application process, you can get a loan approved in minutes. We’ll find out more about that in a bit.

Check ‘n Go is a short term loan provider with mixed online reviews and high lending costs. Its services are available in 28 states and include a variety of options for different users. Notably, they also offer some longer term loans, offering great flexibility for borrowers.Pros and Cons of a Check ‘n Go Loan

Pros

- Easy and straightforward application process

- Quick approval

- Fast funding

- Though its services are limited to 28 states, it is one of the most widespread payday loan lenders as the loan is only legit in 34 states

- Lender considers Friday a weekday and could fund Friday loans immediately unlike most lenders

Cons

- You may have to fax your documents if you do not qualify for a faxless application which could increase the cost of an application and slow things down

- Website user interface makes it difficult to navigate

- Offers services in only 28 states

- In some states where the lender only offers installment loans, they have the same high rates as payday rates

- No information on the site’s FAQ section about payday loans

- The site is not transparent on fees and rates

Check ‘N’ Go loans compared to other loan service providers

Check N Go is a bad credit loans provider that operates physical stores and processes online loan applications from over 28 states across the country. It specializes in payday loans but also offers installment loan to anyone with a minimum credit score of 300. The direct lender boasts of easy and straightforward loan application process, fast approval and fast funding. But how doesn’t the lender compare to such other loan service providers in the country like CashNet USA, LendUp, and Oportun.

Check N Go

Check ‘n’ Go

- Borrow from $100 to $500

- Minimum credit score of 300 FICO

- Fee rate starts from $10 to $30( depending on the State)

- Payday loan repayment period of between 2 and 4 weeks

CashNet USA

- Borrow limit extends from $100 to $3,000 depending on the type of loan and the borrower’s state of residence

- Requires a credit score of at least 300

- Annual interest rates starts from 89% to 1,140% on payday loans

- 2 weeks to 6 months payback period

LendUp

- Loan amount of $100 – $1,000

- No credit score check

- An annual payment rate of 30% to 180%

- Loan repayment period of 1 to 12 months

Oportun

- Loan limit starts from $300 to $9,000

- No minimum credit score required

- Annual loan APR of 20% – 67%

- Loan should be repaid in a span of 6 to 46 months

How does a Check ‘n Go loan work?

The lender is licensed to offer services in 28 states. But given the fact that some loan products like payday loans are only legal in 34 states, it can be said to have widespread reach. Note that they do not have brick and mortar stores in every state where they operate.

Therefore, you might have to make your application online if there are no stores in your state of residence. However, the only difference between an in-person and online application is the amount of time it takes to access funds.

Though the application requirements for online and in-person applicants are the same, the latter process can take a mere 15 minutes if you have everything in order. Once your loan gets approved, you will get all the relevant details.

These include the loan fee, term date and APR. For a payday loan, you will have to write a post-dated check for the full amount to the store. In exchange for this, the lender will give you cash.

If, on the other hand, you make application online, you need to fill out the required details and go through the documents as well as the loan agreement. Within minutes of submitting your application, you may be able to find out whether the loan has been approved.

In certain cases, you may have to fax some documents but in others, you might be eligible for a faxless loan. The downside is that you can only find this out after submitting your application. Mostly, qualifying online borrowers get their funds in one business day.

Also, see how you can improve your credit score with a credit repair loan

What loan products does Check ‘n Go offer?

Check ‘n Go offers three major loan products for its customers. These are:

I. Payday loans

Payday loans are comparable to cash advances, in the sense that you have to pay them back when you receive your next paycheck. They usually attract the highest rates, but given that repayment is one-time, it can come in handy during emergencies. Loan amounts range from $100 to $500 and are repayable between 2 and 4 weeks.

In each state where the lender operates, the regulations governing various loans differ significantly. For instance, in California, there is a maximum cap on payday loan fees of $17 for every $100.

But in other states where there are no caps on such loans, the lender charges the highest fees of up to $30 for every $100 borrowed. The lowest amount it has been known to charge is $10 per $100. To determine applicable rates for your state, you have to check the website for the pertinent details.

II. Installment loans

With installment loans from the provider, you can borrow amounts ranging from $100 to $3,000. The service is only accessible in some states. It is known to be a great choice for borrowers looking for longer repayment periods and more flexible terms. Repayment terms usually range between 4 and 8 months.

However, in some cases, the platform charges the same interest rates for these loans as it does for payday loans. This means that over a longer repayment terms, it can be extremely expensive.

Under the installment loan umbrella, there is a product known as the Choice Loan which is in-store only. Applicants of this loan product can access between $200 and $5,000. It works like an installment loan but lets you choose how long you want your repayment period to be. You also choose how much you want to pay on each installment.

That means greater flexibility. Unfortunately, it is only available in 10 states at present.

III. Prepaid debit cards

For even greater flexibility, you can get a prepaid debit card. This provision works through MasterCard and once again, the amount for which you qualify and rate depend on your state of residence. The card differs from credit cards and checking account debit cards in that you can load money onto them.

What other store services does Check ‘n Go offer?

Apart from short-term loan options, Check ‘n Go also offers a variety of other store services which also center around financing. These include:

- Check cashing (1.99% fee)

- Cash advances

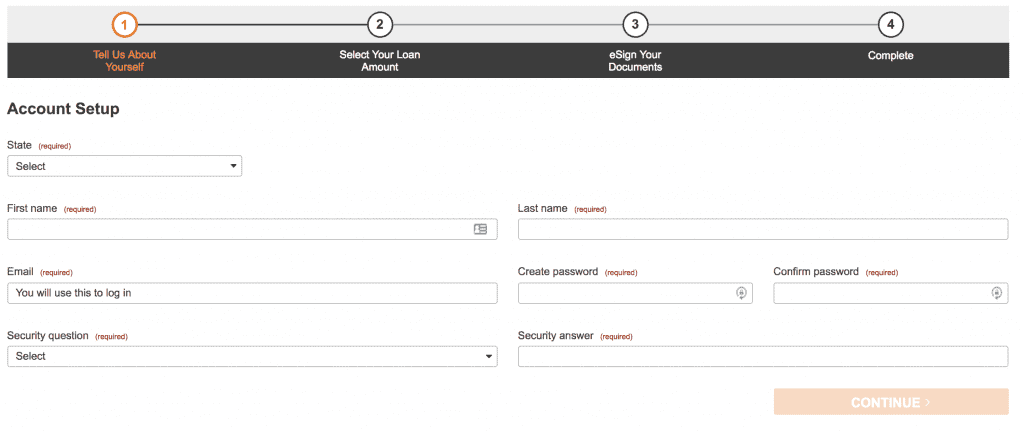

Check ‘n Go Account Creation and Borrowing Process

Here are the steps to follow to create an account and borrow funds on the platform:

1.Visit the Check ‘n Go website and click on one of the links to get started. This will take you to the account setup section.

2. Enter your personal details starting with your state, name and then your email address.

To create your account, enter a password and select a security question and answer.

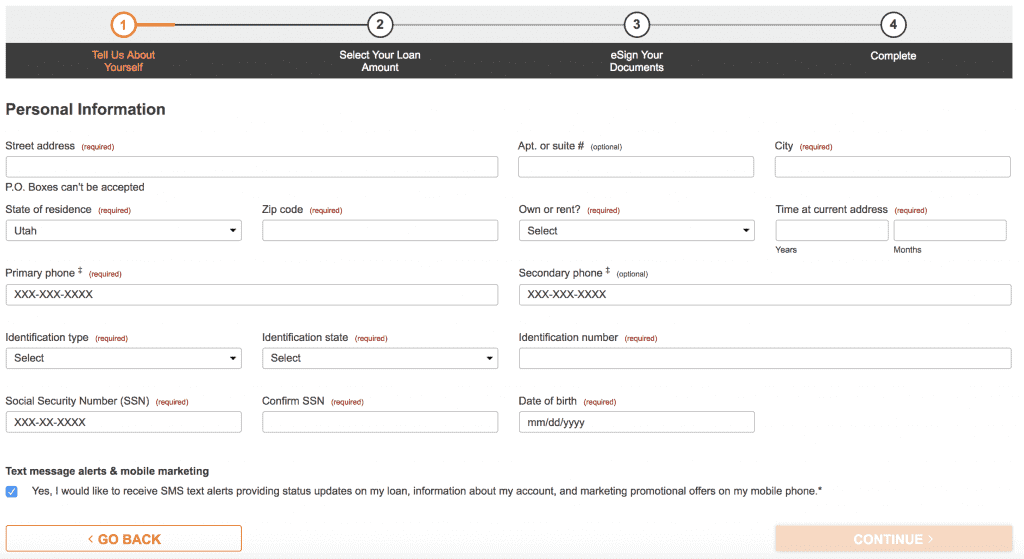

3. Provide additional details about yourself such as your address, housing details, phone number, social security number and date of birth.

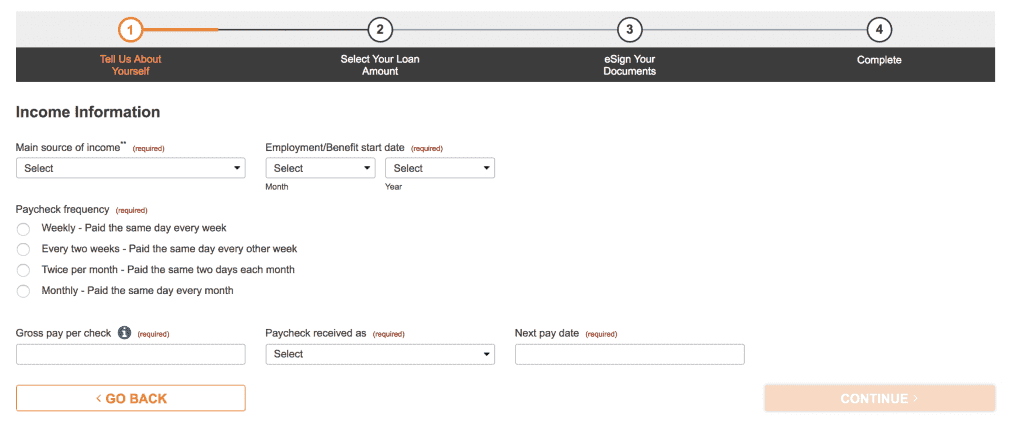

4. Enter your income information and bank details.

5. Agree to the terms and conditions then submit your application.

In case you qualify, you will get a prompt to select the loan amount, sign the documentation and complete the process.

It’s essential to be cautious during the sign up process for these products. This is because you can end up owing two to three times what you borrow on the longer-term loans, and many have difficulty repaying the short-term loans without reborrowing.Eligibility Criteria for Check ‘n Go Loan

To be eligible for a loan on the platform, here are the qualifications you need to meet:

- Be at least 18 years old

- Have a verifiable source of regular income

- Have a valid form of identification

- Have no outstanding loans on the platform

- Have a valid bank account which has your name on it

- Be able to meet all the guidelines the lender requires for your state of residence

- Minimum credit score of 300

Information Borrowers Need to Provide to Get Check ‘n Go Loan

When filling out an online or in-store application here are some of the details you need to provide:

- Personal information such as state of residence, full name and email address

- Phone number

- Social security number

- Income information

- Bank information

What states are accepted for Check ‘n Go loans?

In some of the states where the service is available, you can find stores. But in others, you may have to apply online. Before making an application, confirm that the service as well as the product you want is available where you live.

Here are some of the states where the lender operates:

[one_third]- Alabama

- California

- Delaware

- Illinois

- Florida

- Idaho

- Iowa

- Indiana

- Michigan

- Kansas

- Kentucky

- Mississippi

- Missouri

- Nevada

- New Mexico

- Oklahoma

- Ohio

- South Carolina

- Rhode Island

- Tennessee

- Texas

- Wisconsin

- Utah

- North Dakota

- Maine

- Nebraska

- Hawaii

What are Check ‘n Go loan borrowing costs?

The costs of borrowing from this provider vary by state and according to the applicant’s credit history. The site is not transparent on these rates and it is difficult to get accurate figures unless you apply for a loan.

Check ‘n Go Customer Support

An online check about the lending service will reveal mixed reviews. A good number of complaints have to do with poor customer support. Similarly, some who have visited the physical stores complain about bad experiences with staff members.

Not surprisingly, ConsumerAffairs.com shows a site rating of 1.3 out of 5 stars. Similarly, even though it has an A+ rating on the Better Business Bureau, it has at least 200 unresolved complaints.

Clearly, its customer support has a lot to work on. It might be a great idea to visit a branch and get a feel yourself before signing up for services.

Is it safe to borrow from Check ‘n Go?

Check ‘n Go happens to be among the founding members of the Community Financial Services Association (CFSA). It also holds licensing in all the states where it runs operations. The website claims to have industry-standard encryption to keep user data safe.

Based on these, there are no glaring security concerns. But as with any other online platform, breaches are always a possibility. So, carry out a cost-benefit analysis before uploading sensitive information.

Check ‘n Go Review Verdict

Check ‘n Go is offers significant flexibility when it comes to short-term lending options for when you are stuck in a financial rut. Its services are accessible in a majority of the states where payday loans are legal. And the fact that it has almost 1,000 stores adds credibility to the brand.

Unfortunately, its patrons seem to have lots of complaints against the lender’s customer support. Like many other short-term lenders, who are known for their high rates, there is limited transparency about borrowing costs.

Overall, it can be said to be an average service provider, but you should only consider it if you are in a really tight spot financially.

Apply for a Payday Loan Now! | Best Payday Lender 2020

Our Rating

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

Glossary Of Loaning Terms

FAQ

Does Check ‘n Go run credit checks?

No. The lender does not run credit checks with any of the three top credit reporting agencies. But they do look at other databases to establish your credit rating.

Does the lender charge application fees?

Yes. Check ‘n Go will charge you a financing fee every time you take out a loan.

What is the procedure for repaying a Check ‘n Go loan?

If you make your loan application online, the platform will automatically deduct the amount from your account on due date. But when you apply in-store, you will issue a post-dated check to the store. They will cash the check on the due date. If you opt to make payment in cash ahead of time, note that you may have to pay prepayment fees.

Do I have to be employed to qualify for a loan?

No. You simply need to have a regular, stable income as proof that you can repay the loan. While this can take the form of a paycheck, it can also be your earnings from social security, disability payments or any other recurring income stream.

Do I have to have a checking account to get a loan?

No. The platform requires that applicants have either a savings or a checking account so as to transfer funding electronically.

US Payday Loan Reviews – A-Z Directory

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up