Hargreaves Lansdown Share Dealing 2021 Review

Hargreaves Lansdown share dealing is one of the most well-known of UK-based investment platforms. Founded in 1981 by Peter Hargreaves and Stephen Lansdown, it boasts over 1.3 million customers, holds £96 billion on behalf of its clients (as of 14 May 2021), and is a FTSE 100 index constituent.

If you’re looking for a great online share dealer, Hargreaves Lansdown may be the right one for you. With thousands of stocks listed on 23 exchanges and access to 3,000 funds, excellent research tools to inform your decisions and one of the best customer service offerings in the industry, it provides an excellent platform for beginner and seasoned investors alike.

In this Hargreaves Lansdown share dealing review, we will assess the broker’s investment offerings, platform, fees, research & analysis tools, customer support and more to help guide your choice.

-

-

Get Started with Hargreaves Lansdown

Our Rating

- Thousands of stocks from over 23 markets

- Pick your own investments or choose a ready-made portfolio

- Investment ideas and research from expert analysts

- Manage your account via website, HL app or phone

- FTSE 100 Company

Investments can go down as well as up so you may get back less than you invest.

Investments can go down as well as up so you may get back less than you invest.About Hargreaves Lansdown

Established in 1981 by Peter Hargreaves and Stephen Lansdown, Hargreaves Lansdown share dealing has grown from a small Bristol broker to one of the leading investment platforms in the United Kingdom. Today, it looks after around £96 billion of client funds, boasts 1.3 million users and generates almost half a billion pounds in annual revenues. Listed on the London Stock Exchange since 2007, Hargreaves Lansdown today is a member of the FTSE 100 index, a testament to its success.

Established in 1981 by Peter Hargreaves and Stephen Lansdown, Hargreaves Lansdown share dealing has grown from a small Bristol broker to one of the leading investment platforms in the United Kingdom. Today, it looks after around £96 billion of client funds, boasts 1.3 million users and generates almost half a billion pounds in annual revenues. Listed on the London Stock Exchange since 2007, Hargreaves Lansdown today is a member of the FTSE 100 index, a testament to its success.Hargreaves is a broker-dealer that offers stocks & shares, lifetime and junior individual savings accounts (ISAs), a range of pension and retirement planning products (SIPPs, annuities, drawdown and UFPLS lump sums), a share dealing account and the choice of more than 3,000 investment funds to invest in. Unlike many retail investment platforms, it also offers a financial advice service in addition to more common services such as foreign currency exchange. In something of a first for a leading retail broker it has introduced an Active Savings account that lets you pick and mix the best savings accounts for your cash.

The fund & share dealing account provides access to shares listed on 23 stock exchanges and lists more than 1,500 exchange traded funds (ETFs), over 3,000 funds, 150 or more bonds and 300-plus investment trusts.

Hargreaves Lansdown is regulated by the Financial Conduct Authority (FCA), and eligible deposits up to £85,000 benefit from investor protection through the government’s Financial Services Compensation Scheme (FSCS).

Pros and Cons of Hargreaves Lansdown Share Dealing

Pros:

- Thousands of stocks on over 23 UK, European and North American markets

- Pick your own investments or choose a ready-made portfolio

- Investment ideas and research from expert analysts

- Fully regulated by the Financial Conduct Authority

- Publicly listed company and member of the FTSE 100

- Excellent customer service

- Manage via website, HL app or Bristol-based helpdesk

Cons:

- Bond offering limited vs. peers

- No demo account yet. Register for alerts for latest on demo availability

What Can You Trade on Hargreaves Lansdown Share Dealing?

Hargreaves Lansdown share dealing offers thousands of stocks, ETFs, bonds and funds.

Stocks and ETFs Trading

Hargreaves Lansdown offers thousands of stocks listed on all major European exchanges (London, Amsterdam, Deutsche Boerse, Paris …) and on key North American exchanges including the NYSE, NYSE Arca, NASDAQ and the Toronto Stock Exchange.

Over 1,500 ETFs are also available to trade, including a wide selection of trackers for all major indices (S&P 500, FTSE 250, CAC 40 etc.), industry-specific ETFs (e.g. Biotech, Car Manufacturing…) and other themed funds (growth, small-cap, commodities-based etc.).

Europe North America London Stock Exchange Lisbon Stock Exchange Canadian Venture Exchange London International Luxembourg Stock Exchange NASDAQ Amsterdam Stock Exchange Madrid Stock Exchange NYSE Brussels Stock Exchange Oslo Stock Exchange NYSE ARCA Copenhagen Stock Exchange Paris Stock Exchange Toronto Stock Exchange Deutsche Boerse Exchange Stockholm Stock Exchange Frankfurt Stock Exchange Swiss Stock Exchange Helsinki Stock Exchange Vienna Stock Exchange Irish Stock Exchange Italian Stock Exchange Hargreaves Lansdown supports popular order types (market, limit and stop-loss), and foreign stock prices are quoted and traded in pounds so you don’t have to hold foreign currencies.

Hargreaves Lansdown share dealing also allows its customers to register for purchasing shares in initial public offerings (IPOs).

Bonds and Gilts

The Fund & Share account with Hargreaves Lansdown also allows you to buy & sell hundreds of bonds.

On top of traditional corporate bonds, Hargreaves offers Gilts (government debt: UK equivalent of fixed-rate US Treasury Bonds), Index-Linked Gilts (government bonds with variable coupon), Permanent Interest Bearing Shares (“PIBS”, the equivalent of subordinated debt that pay much higher coupons) and various other fixed income securities.

Hargreaves Lansdown offers an additional neat perk to its customers: the opportunity to see and subscribe to upcoming bond launches.

Funds and Investment Trusts

Hargreaves Lansdown’s team of investment experts manage Hargreaves Lansdown’s own fund products: Funds-of-Funds (HL Multi-Manager Funds) and a range of equity funds (HL Select Funds).

HL Select funds are concentrated portfolios of what it describes as high-quality shares (usually 30–40 stocks per portfolio), tailored for long-term investors. An example is the HL Select Global Growth Shares, a fund of global equities. Top 10 holdings by weightings as at 30 July 2021 were: Visa, Microsoft, Carsales.com, Koninklijke Philips, GoDaddy, Pernod Ricard, Alphabet, Zebra Technologies, Booking Holdings and the London Stock Exchange. Investors in the fund can view the weighting of each stock and the rationale for including it in the portfolio. Investors in the fund (and in most HL Select funds) can choose to invest in the accumulation units (all dividends paid are reinvested in the fund), or income units (dividends are paid to the investor in cash, i.e. not reinvested in the fund).

For additional diversification, HL Multi-Manager Funds allow you to invest in themed pools of funds. There’s an annual management fee to pay for Hargreaves Lansdown’s research and transaction costs. An example is the HL Multi-Manager UK Growth. It has an ongoing charges figure (OCF) of 1.33% plus an annual management charge of 0.45%, with its top two holdings as at 30 June 2021 being Majedie UK Equity and Lindsell Train UK Equity ). The fund sits in the Investment Association’s UK All Companies sector. Although it underperformed its benchmark by 2.35% in the 12 months to January 2021, it generated a return for investors of 10.99% in that time period.

Hargreaves also offers over 300 investment trusts and Real Estate Investment Trusts (REITs), publicly-listed entities who invest in multiple asset classes including real estate.

To help investors make fund selections for a balanced well-diversified portfolio there is the Wealth Shortlist, which currently comprises 71 funds selected by Hargreaves Lansdown analysts. Investors should always do their own research before buying a fund or other investment product, so treat broker lists as a resource to provide guidance and ideas and not as recommendations.

Trading and Other Fees

In addition to the range of investment opportunities, the number and size of fees you pay is a key factor to consider when choosing a broker. While Hargreaves Lansdown offers rebates for more frequent trading, it remains a rather expensive share dealer compared to its more low-cost peers.

Shares, ETFs and Investment Trusts Dealing Fees

For Funds & Shares account holders, commissions on each order (buy or sell) for shares vary according to your trade volume of the previous month:

Number of Orders Fees 0–9 orders £11.95 per order 10–19 orders £8.95 per order 20+ orders £5.95 per order In addition, foreign shares are traded in pound sterling but incur a foreign exchange charge based on the value of your trade:

Value of Your Trade Fees First £5,000 1% Next £5,000 0.75% Next £10,000 0.5% Amounts above £20,000 0.25% SIPP account holders incur a 0.45% annual management charge for holdings valued up to £250,000. For holdings valued at between £250,000 and £1 million the charge falls to 0.25% and for amounts in excess of £1 million the charge is 0.1%.

The stocks & shares ISA’s annual charge is up to 0.45%, tapering in the same way as for SIPPs, but there is no charge at all for amounts above £2 million.

Hargreaves Lansdown caps charges at £45 per year for ISAs and £200 for SIPPs.

Fund Dealing Fees

There are no fees associated with buying and selling funds on Hargreaves Lansdown, however, fund holders will incur a yearly management fee on the value of the funds they own:

Value of Your Holdings Fees First £250,000 0.45% £250,000–£1 million 0.25% £1 million–£2 million 0.1% Over £2 million No charge The Multi-Manager funds will come with their own individual charges, which you will have to review on a case-by-case basis.

Bonds & Gilts Dealing Fees

All bonds, gilts and PIBS orders that can be executed online will be subject to the same rates as shares, as listed above. A large portion of fixed-income securities can however only be traded by phone. In this case, Hargreaves Lansdown charges a 1% fee, with a £20 minimum and £50 maximum.

Other Fees

Hargreaves Lansdown share dealing charges other fees for services such as automatic dividend reinvestment (1% of the trade value, min. £1 max. £10) and government tax and levies (on a per-deal basis, varying fees according to country of origin of the shares).

Unlike some of its peers, Hargreaves Lansdown does not charge inactivity fees, account opening fees or deposit/withdrawal fees.

Deposits & Withdrawals

Depositing money on your Hargreaves Lansdown account is fast and free, but the broker only supports GBP. You may still deposit in a foreign currency, but you will be subject to the currency conversion fee listed above.

Deposits can be made via debit and credit cards as well as via bank transfers. Credit card deposits are instantaneous, but bank transfers can take up to two business days to display in your balance.

Depending on the account type, minimum deposit amounts can vary. However, if you register for the standard Funds & Shares account, the minimum deposit is just £1 with a debit card or £25 via bank transfer.

Because Hargreaves Lansdown is regulated by the FCA, your funds are deposited and kept in a segregated trust account with Tier-1 banks. This effectively means that if Hargreaves Lansdown went bankrupt, you could still get your deposited money back. If there’s a shortfall in your client/money assets the FSCS can compensate.e

Withdrawals are also free, and the money will be deposited in your account (card or bank transfer) in two business days.

Hargreaves Lansdown does not support electronic wallets such as PayPal.

Platform Features

Beyond the tradable securities, a key dimension of our Hargreaves Lansdown share dealing review is to evaluate the broker’s platform features. Trading with Hargreaves Lansdown is made easy via their web-based and mobile platforms. Both are well-designed and intuitive for beginners. Hargreaves Lansdown does not offer a dedicated desktop application or integration with popular trading software such as MetaTrader.

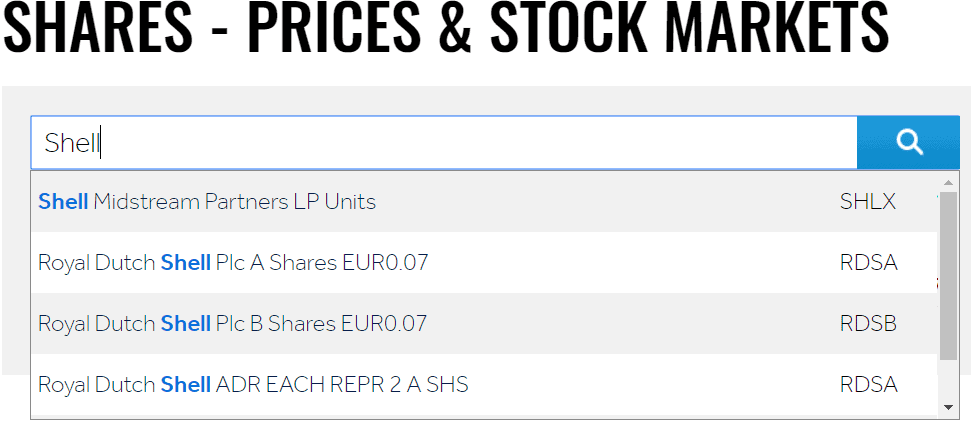

Search Tool

Its powerful search tool will allow you to find stocks, funds and other tradable securities easily, even if you do not know the ticker. An advanced search tool is also available for funds, for example, to help you browse funds and trusts by manager or by Investment Association (funds) or Association of Investment Companies (trusts and venture capital trusts) sectors.

Company Profiles

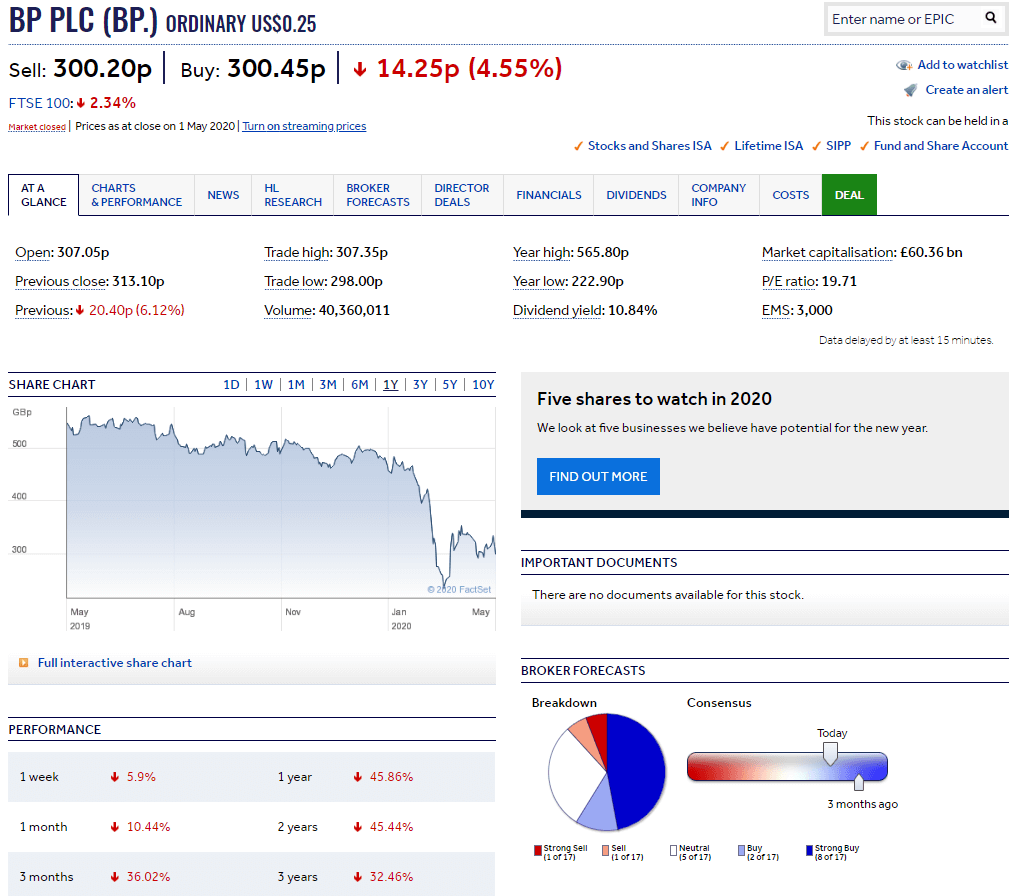

Hargreaves Lansdown offers detailed information on companies, including price, performance, financial metrics and financial statements for the past five years.

You will also be able to access news reports, a calendar of upcoming events and detailed broker forecasts, including a history of ratings and price targets for each major broker covering a company.

The newsfeed is particularly useful, as it contains not only updates on the company itself but also on its sector, on all relevant M&A activity and major company announcements.

The HL Research section is excellent and extremely useful, providing users with a detailed commentary by Hargreaves Lansdown analysts about a company’s recent performance and expectations for the future. It also contains a summary of the latest quarter’s earnings report and a list of previous commentaries on the company so you can follow it over time.

The Director Deals section is also very handy, particularly in the context of potentially distressed companies. This feature allows you to see a detailed rundown of which director bought or sold how many shares of the company, when, why and at what price. Keeping an eye on insider transactions can provide valuable additional information on what insiders think of the company and its prospects.

Charting Tools

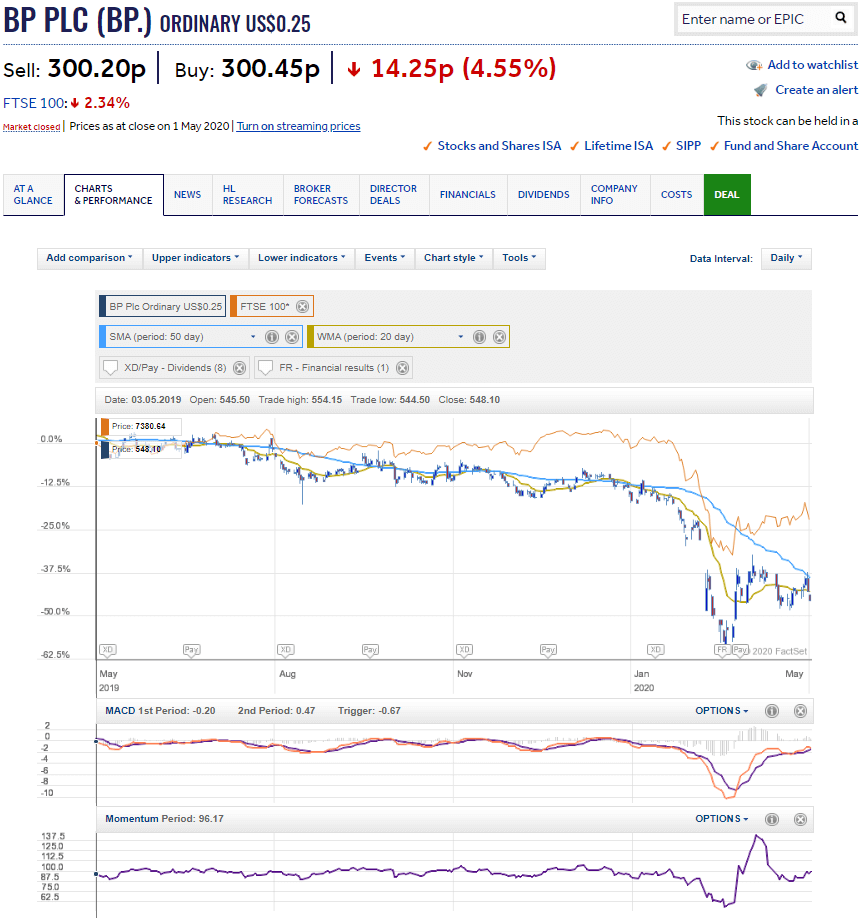

Hargreaves Lansdown’s charting tools are excellent.

You can chart a security’s price six different ways, add dozens of technical indicators from simple moving averages to advanced trend and cyclical analysis tools.

It is also possible to add other stocks, currencies, commodities and sector or market indices for comparisons, and to plot events on the chart to correlate observed trends with certain events: earnings, dividends, director dealings, broker forecasts upgrades and downgrades etc.

Research

One of the highlights of the Hargreaves Lansdown platform is the extensive research it provides, not only on individual securities but also on asset classes, sectors and markets.

Research at the security level includes an analysis of past performance, key business drivers and the broker’s own view on the future of the stock. Every quarter, Hargreaves Lansdown analysts will dissect a company’s latest results and report the key figures and latest developments in a briefing note that will be available under the HL Research section of the stock page.

The research section also includes stock tips, news analysis and commentary on the latest trends that affect the stock market more broadly. The newsfeed component pulls headlines and business news from various sources, offering sector reviews and press round-ups.

The only downside of the research section is the absence of a stock screener to focus in on securities that meet certain criteria. This is however not a frequently encountered feature in the online stockbroking world.

Investors should conduct their own comprehensive research based on a variety of sources and tools before buying or selling a stock. Consider taking professional advice from a financial adviser.

Educational Resources

Generally, Hargreaves Lansdown’s education resources are geared toward beginners, with an introduction to risk and returns, diversification, basics of stock and fund picking, and other useful introductory lessons.

Past this point, the education resources are somewhat limited, although the excellent research tools help compensate. Hargreaves Lansdown share dealing does not have a free demo account as yet to allow beginners to paper trade before starting to invest their own money.

Financial Advice and Portfolio Builder

Beginners or investors seeking advice will find many useful resources on Hargreaves Lansdown’s platform.

Hargreaves Lansdown employs dozens of professional financial advisers who can provide paid advice to help you build your portfolio and investment goals. You can book a free consultation with one of them before deciding to seek advice. Alternatively, seek the help of an independent financial adviser, although such services are not free.

Beyond investment advice, Hargreaves Lansdown offers additional features such as Portfolio+ and Master Portfolios that allow you to access pre-made portfolios and tailor them to your risk tolerance and investing goals.

Customer Support

Hargreaves Lansdown customer support can be reached via phone or email during the working week. They are extremely responsive, offer detailed and relevant answers, and will not hesitate to go out of their way to help you solve any issues you may face.

Hargreaves Lansdown does not offer 24/7 customer support or a live chat function on their platform.

Watchlists and Alerts

Like many of its peers, Hargreaves Lansdown share dealing allows you to create stock watchlists to receive alerts for price movements, company-specific news or major events; dividends, insider trades etc.

Placing Orders

Placing orders on Hargreaves Lansdown is also straightforward, with standard order types (market, limit, stop loss and stop trailing) and more exotic ones (e.g. “fill or kill”) also available.

In the section devoted to your account, you will find handy tools to help you track the performance of your portfolio and clearly visualise the fees you’ve paid to understand your net profit and loss position (P&L).

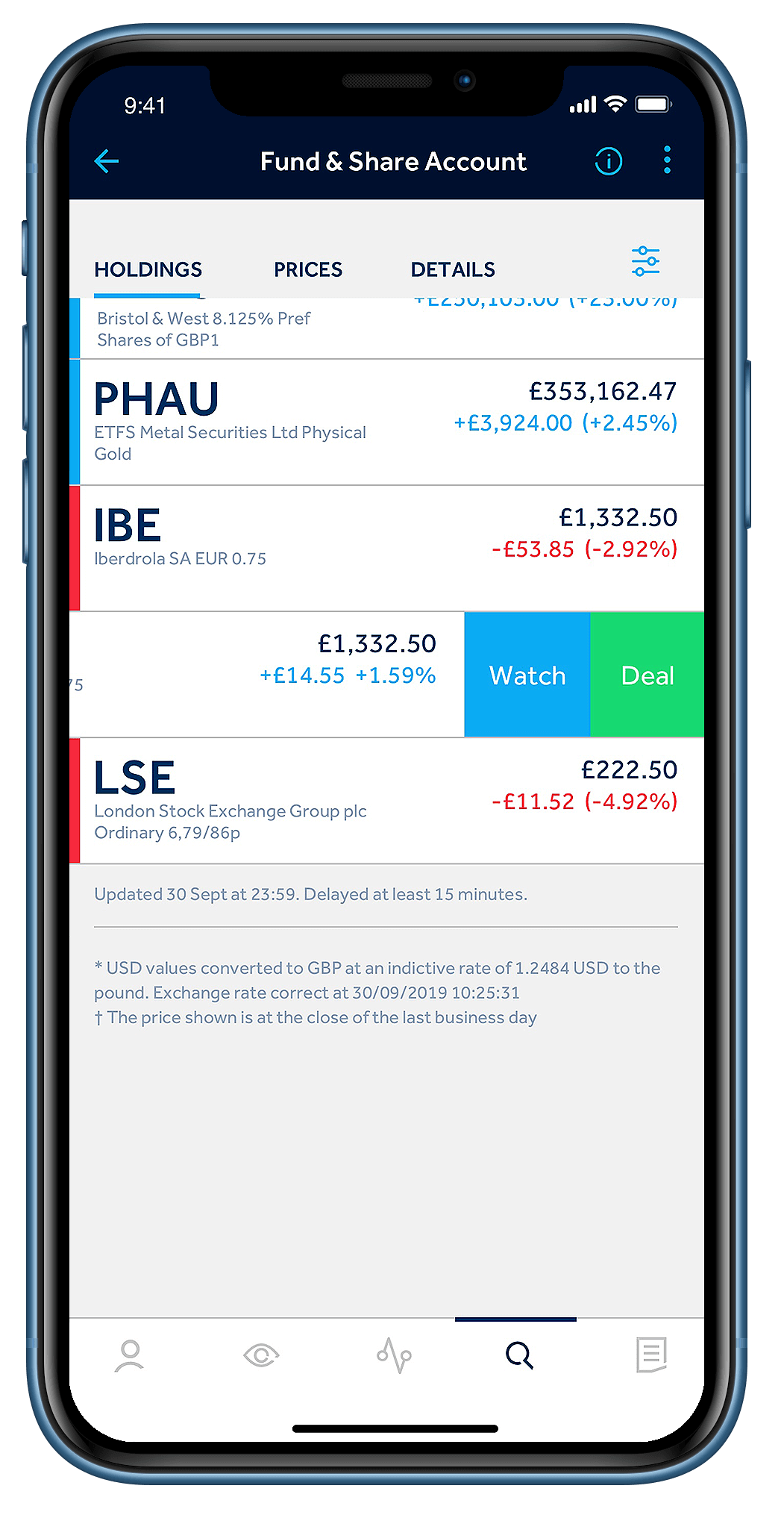

Mobile App

Hargreaves Lansdown’s HL Live mobile app is well-designed, easy to use and makes the trading experience a breeze. Users can access research and fundamentals on the go, use full-screen charting with a range of analysis tools, and place orders.

The app features Face ID and fingerprint login and is available on the Apple App Store and on Google Play.

How is Hargreaves Lansdown Regulated?

Hargreaves Lansdown is regulated by the UK’s Financial Conduct Authority (FCA). It has been around since 1981, meaning that it has successfully weathered several financial crises, a testament to its resilience.

Your funds are kept in a segregated account at a Tier-1 bank and all clients (UK and EU) benefit from investor protection in case of fraud or bankruptcy for up to £85,000. Hargreaves Lansdown also guarantees negative balance protection, meaning that under no circumstances can you lose more than the amount you deposited.

Hargreaves Lansdown is a publicly listed company on the London Stock Exchange and is a member of the FTSE 100 index. This involves significant regulatory scrutiny, auditing and frequent reporting that can assuage concerns over the safety of using Hargreaves Lansdown for your investing needs.

Getting Started with Hargreaves Lansdown Share Dealing

Now that we have reviewed Hargreaves Lansdown Share Dealing, let’s show you how to get started.

Opening an account with Hargreaves Lansdown is a simple process and can be done in minutes if you have all the available documents to hand. Fund & Shares accounts are restricted to UK residents. If you do not have permanent residency in the UK, you should consider other trading platforms.

Before opening your account, you will need your credit or debit card (or your bank account information) and your National Insurance number for identification purposes. This will help Hargreaves Lansdown automatically perform the identity check in the background.

Step 1: Choose an Account Type

As mentioned in this guide, Hargreaves Lansdown’s main trading account is its Fund & Shares account. This account is subject to the same fees and charges as the others but does not incur custody fees for holding your securities for you.

You can, alternatively, choose to open an ISA or a SIPP account with Hargreaves Lansdown These products provide tax-efficient wrappers for the shares, ETFs and trusts you purchase and hold within them. With an ISA you get a £20,000 tax-free annual allowance.

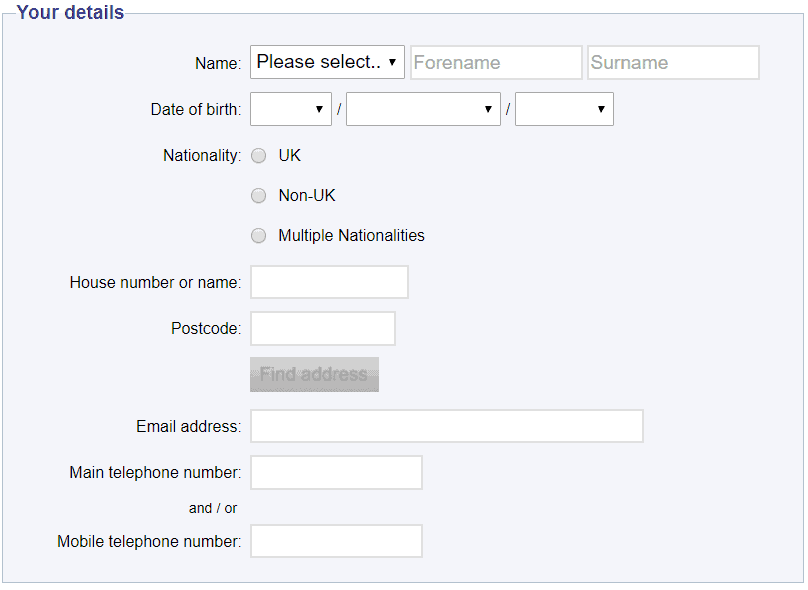

Step 2: Fill Out Basic Information on the Registration Form

To begin your account application, Hargreaves Lansdown share dealing will ask you for basic personal information, including:

- Name

- Date of Birth

- Nationality

- National Insurance Number

- UK Address

- Email Address

- Phone Number

Note that Hargreaves Lansdown needs to validate your address: if it does not automatically recognise it, you will not be able to apply online and will need to complete a mail-in application form.

Note that Hargreaves Lansdown needs to validate your address: if it does not automatically recognise it, you will not be able to apply online and will need to complete a mail-in application form.Step 2: Fund your Account

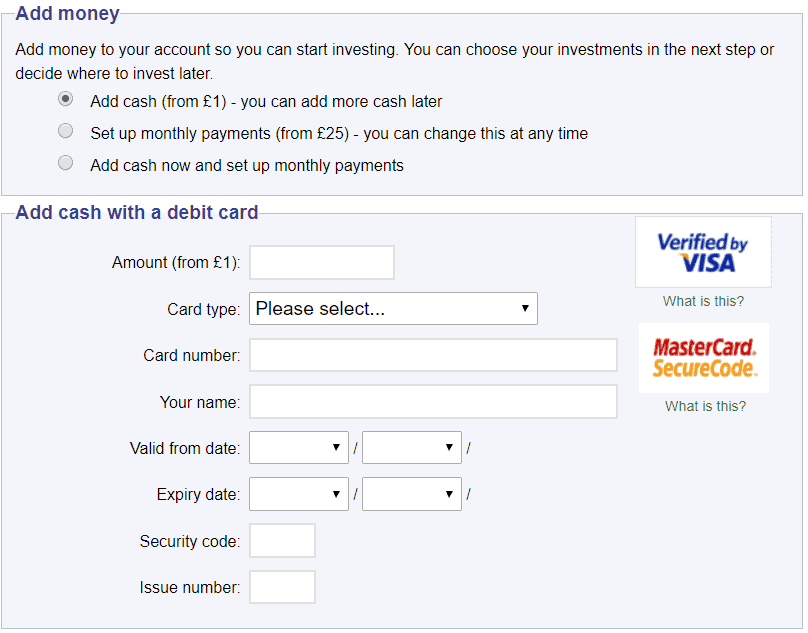

Once you have filled in your information, Hargreaves Lansdown will require you to make an initial deposit of £1 by credit or debit card. You may only deposit pounds sterling, but other currencies are accepted and converted into sterling subject to a currency conversion fee.

You will also have the opportunity to choose regular deposits, and to use Direct Debit to fund your account via bank transfer (£25 minimum).

Step 3: Submit Identity Verification

Once you’ve funded your account, Hargreaves Lansdown will require you to upload documents to prove your identity. This can be a colour photo of your passport or a bank statement.

You will also be asked to submit a scanned utility bill from the past three months showing your name and your address.

Step 4: Trade

Once you have submitted the necessary information, you are ready to start trading. Do your own research, review Hargreaves Lansdown’s research briefs, make sure you understand the fees and get started.

The Verdict

Hargreaves Lansdown is one of the most well-known online brokers in the UK, founded in 1981 and publicly listed on the LSE. In this Hargreaves Lansdown share dealing review, we highlighted some of the key features that make the broker stand out.

With its great charting and research tools, its user-friendly platform and its wide variety of stocks, funds, fixed-income securities and trusts, Hargreaves Lansdown is a one-stop-shop for beginners and seasoned investors in the UK.

Hargreaves Lansdown’s customer service is excellent and account opening is quick and easy. The only downside is its higher-than-average dealing and management fees, although these are compensated by superior service and resources on the platform.

Ready to start trading? Sign up for an account with Hargreaves Lansdown, fund it and dive in.

Get Started with Hargreaves Lansdown

Our Rating

- Thousands of stocks from over 23 markets

- Pick your own investments or choose a ready-made portfolio

- Investment ideas and research from expert analysts

- Manage your account via website, HL app or phone

- FTSE 100 Company

Investments can go down as well as up so you may get back less than you invest.

Investments can go down as well as up so you may get back less than you invest.Glossary of Trading Platform Terms

Platform Fee

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per trade

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

Margin

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social trading

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy Trading

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instruments

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

Index

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

Commodities

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investment

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limit

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day traders

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

FAQs

Is Hargreaves Lansdown safe?

Hargreaves Lansdown is regulated by the FCA, offers negative balance protection and investor protection for up to £85,000. It is also a publicly listed company, meaning that it is subject to close scrutiny from auditors and the markets, so you can trade with confidence.

Who can trade with Hargreaves Lansdown?

Hargreaves Lansdown offers different account types, including Fund & Shares, ISA and SIPP. However, these accounts are limited to UK residents, and you need a proof of address and a National Insurance number to confirm your identity.

What are the main fees to trade on Hargreaves Lansdown?

The major fees are dealing fees (per trade), annual management fees for funds, currency conversion fees for deposits from foreign currencies or purchase of foreign shares, and annual custody fees for ISA and SIPP accounts. There are no deposit and withdrawal fees.

Can I trade on desktop or integrate with major trading platforms (e.g. MT4)

Hargreaves Lansdown does not offer a desktop trading platform, and does not integrate in major platforms like MetaTrader 4 and 5. Traders will have to rely on Hargreaves Lansdown’s excellent web and mobile platforms.

What payment solutions does Hargreaves Lansdown support?

Funding your account on Hargreaves Lansdown can be done via credit & debit card (Visa and Mastercard) or via bank transfer. You may choose to auto-transfer funds.

Can I get financial advice on Hargreaves Lansdown?

Hargreaves Lansdown offers a free consultation with a financial advisor and subsequent paid financial advisory sessions. It also offers a wide range of DIY tools to construct your portfolio and reach your investment goals.

See Our Full Range Of Forex Brokers Resources – Brokers A-Z

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up