How to Buy Alphabet (Google) Stock Online in 2026

Most people know Google as the most used search engine in the world and, indeed, Google.com records approximately 8.7 billion monthly visits, according to Similar Web, which obviously makes it the most visited website in the world.

But Google is more than just a search engine. The company provides a broad range of internet services that include web and mobile app email (Gmail), cloud storage for businesses and consumers, GooglePlay, YouTube, a news aggregator, a web browser (Google Chrome), self-driving cars, Google Android, computers, and the language translation service.

Due to the wide range of services and applications, Google’s stock is one of the best stocks to own these days. So, if you are thinking about buying Google (Alphabet) stock, you have landed in the right place. In this article, we will show you the the basics of how to buy Google’s stock, review three top brokers that offer this stock, and provide information regarding Google’s company and its stock performance.

-

-

Details of top stock brokers online:

1. Plus500 – CFD Broker to Trade Alphabet (Google) Stock

Plus500 is a leading broker that specializes in offering stock CFDs. Authorized and regulated by the FCA, ASIC, and CySEC, Plus500 has excellent trading terms when it comes to stock trading including Alphabet (Google). When you are trading Google on Plus500, you will be buying the stock via a contract for difference (CFDs).

This means that you will not own the security, but you will be able to speculate on the price of the stock. But unlike traditional brokerages that require high margin requirement for short-selling positions, you’ll have the option of going short at the same margin requirement as buying the stock. The broker allows you to trade on the stock with an initial margin requirement of 5%, and a spread of 1.25.

Furthermore, Plus500 features several risk management tools including the negative balance protection, guaranteed stop order, and trailing stop orders, which can be useful for day traders.

Plus500 has an email and push notifications on market events as well as alerts on price movements on a specified instrument. On the negative side, Plus500 does not provide the MetaTrader4 nor the MetaTrader5, however, its trading platform is intuitive and user friendly.

Our Rating

- A wide selection of risk management tools

- There are no commissions for stock trading

- Competitive spreads

- MetaTrader4 is not available

- Limited advanced research tools so best for advanced traders

- Does not offer signal or social trading

76.4% of retail investor accounts lose money when trading CFDs. Sponsored ad.2. Stash Invest – Best Trading Platform for US Traders

Founded in 2015, Stash Invest is a new trading app registered by the Securities Exchange Commission (SEC) in the United States. Stash Invest makes it easy to start trading a selection of more than 1800 stocks and Exchange Traded Funds (ETFs) with a minimum deposit of $5. The platform is suitable for traders in the United States who wish to invest small amounts in order to buy stocks including the Alphabet (Google) stock. Stash is different in the way that it offers users to buy fractional shares so you can trade a small portion of Alphabet stock. Keep in mind that stocks or funds dividends will be automatically reinvested via the DRIP tool.

The platform has three account types with fixed commissions: A beginner account with a fixed charge of $1 per month, a growth account with a fixed charge of $3 per month, and the Stash+ account with a fixed charge of $9 per month.

The bottom line, Stash Invest is an excellent platform for beginner investors in the United States that wan to easily execute orders in the market without having special trading skills and knowledge.

Our Rating

- A low minimum deposit of $5

- Regulated by the Securities Exchange Commission (SEC)

- No inactivity fee

- Stash Invest charges a monthly fee

- Only US stocks available

Sponsored ad.How to Buy Alphabet (Google) Stock

Simply follow the steps below to complete your Alphabet (Google) stock purchase.

Note: You will first need to open an account, upload your ID, and deposit some funds. You can then proceed to buy Alphabet (Google) stock in a matter of minutes!Step 1: Search for Alphabet (Google) Stock

Once you have completed the account creation process and your account has been approved, log in to the trading platform and search for Google stock on the top search box.

Step 2: Click on ‘Trade’

Next, you will be transferred to Google’s stocks page where you can view feeds from twitter, stats, charts, and research tab. Then, click on the ‘Trade’ button to continue.

Step 3: Set-Up a Market Order and Buy Alphabet (Google) Stock

Now, you will have to set up your order that includes the amount of the transaction, the leverage ratio, the order type (market or limit order), and stop-loss and take-profit orders. Keep in mind that you can change the stop-loss and take-profit levels anytime you want.

To complete your order, click on the ‘Set Order’ button.

Why Do People Invest in Alphabet (Google)?

As we mentioned above, Alphabet (Google) is not just a search engine as the company’s efforts to expand its services to new fields and regions across the world. In recent years, Google has been investing a lot of resources in order to develop new products and applications that include the Google Maps, Google Assistant, Android, YouTube, Google Chrome, Google Drive, Google Analytics, Google Translate, Google’s autonomous car, Google Play, Google Music, etc.

Note: Never purchase shares in Alphabet (Google) – or any company for that matter, without doing your own research. The positive investment notes listed below are subjective, so there’s no guarantee that the Alphabet (Google) stock will increase in value. In fact, you could just as easily lose money.Google Continues to Grow

Google has recently reported earnings for its first quarter of 2020. The company had revenue of $41.2 billion, a net income of $6.8 billion, and earnings per share (EPS) of $9.87. The Alphabet was surpassing revenue estimates but missed analysts’ expectations on earnings. As a result, Alphabet shares rose as numbers include the impact of the coronavirus pandemic.

Diversification Business Strategy

As we mentioned above, Alphabet (Google) is not just a search engine as the company’s efforts to expand its services to new fields and regions across the world. In recent years, Google has been investing a lot of resources in order to develop new products and applications that include the Google Maps, Google Assistant, Android, YouTube, Google Chrome, Google Drive, Google Analytics, Google Translate, Google’s autonomous car, Google Play, Google Music, etc.

Google Aims to Become a Dominant Force in Artificial Intelligence (AI)

If you believe that Artificial Intelligence technology will change the world, then you should believe in Alphabet (Google). Last year, the company has announced the TensorFlow, an open source platform for machine learning. Moreover, Google has also announced a huge breakthrough in its quantum computing when it reached a revolutionary milestone in October.

About Alphabet (Google) Stock

Company and Stock history

Google started as a research project by Larry Page and Sergey Brin in 1996 at Stanford University in Stanford, California. The company was officially founded on September 4th, 1998 at Menlo Park California United States and went public on August 19, 2004. Page and Brin first named the company BackRub but changed it to Google after a misspelling of the word Googol which refers to a famously huge number (equals to 1 followed by 100 zeros).

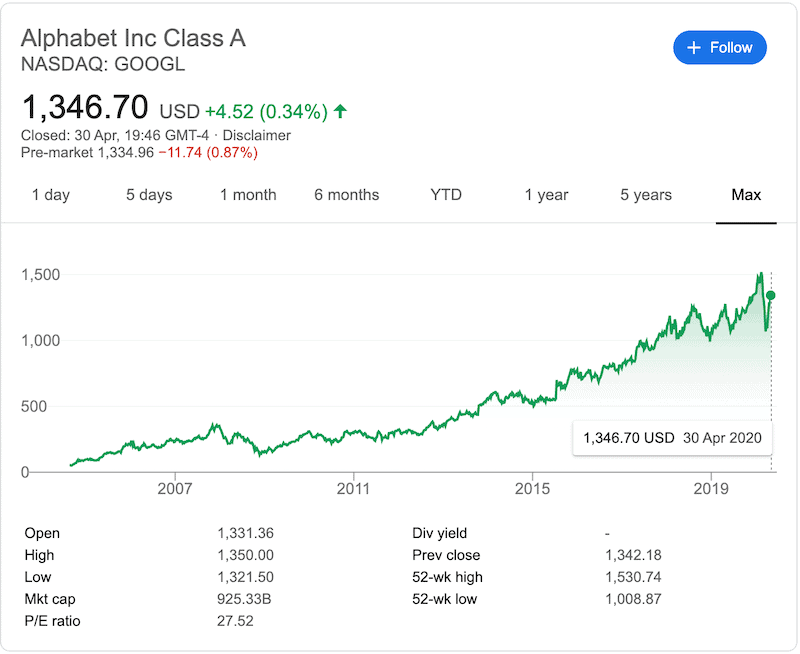

On August 19, 2004, over 19,605,050 stocks were issued on the NASDAQ stock exchange at a price of $85 per share. On August 18, 2005, another 14,25,265 shares were offered to the public. In 2014, Google has created two classes of shares; Class A Shares (SYMBOL: GOOGL) and Class C Shares (SYMBOL: GOOG). The main difference between the two classes of shares is the first has voting votes while the second has no right to participate in voting.

Alphabet (Google) Stock

Google shares were first offered to the public on August 19, 2004, at a price of $85 per share. Since then, the stock has been on a long-term uptrend, with an all-time high of 1524.87 on February 19, 2020. Like any other company in the world, the coronavirus pandemic had an impact on Google, however, Alphabet remains one of the most valuable companies in the world. Even though the coronavirus crisis is hurting Google’s (and YouTube) advertising which caused a drop in the stock’s price, Google’s revenue continues to rise. In the first quarter of 2020, Google’s total advertising revenues rose to $33.76 billion from $30.59 billion in 2019.

Google’s main income is from advertisements. As a matter of fact, 82% of the Alphabet’s total revenue was made by Google advertising in the first quarter of 2019. But Google’s strength might be that the company continues to expand to new industries and technologies such as cloud computing, Artificial Intelligence, autonomous cars, and operating systems.

In recent years, Google has been part of the FAANG stocks group, a term that was coined by Jim Cramer, the host of Mad Money on CNBC. FAANG refers to the stocks of five big tech American companies: Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX); and Alphabet (GOOG). Even though there’s a discussion about whether Google stock is overpriced, the company has shown resilience and continues to expand exponentially.

FAQ

How much were Alphabet (Google) stocks originally?

When Google went public in 2004, the company offered its shares at a price of $85. One year after the initial IPO, on August 18, 2005, Google announced another round of public offering at a market price.

Is Google and Alphabet the same company?

In 2015, Google renamed itself to Alphabet and created a subsidiary company called Google. Alphabet Inc., in fact, is run by Google’s co-founders Larry Page and Sergey Brin and has additional businesses that include Waymo, X Development, Calico, Nest, Verily, Fiber, Makani, CapitalG, and GV. When you buy GOOG stock, you are in fact buy Alphabet incorporation

Does Google (Alphabet) pay dividends?

At the time of writing, Google (Alphabet) has never paid a dividend to its shareholders. One of the reasons for not paying dividends to its shareholders is the company’s desire to continues its growth and expansion, meaning, the company prefers investing its profits rather than paying dividends.

What stock exchange is Alphabet (Google) stock listed on?

Both Alphabet Inc Class A (GOOGL) and Alphabet Inc Class C (GOOG) type of stocks are listed on the NASDAQ exchange.

What is the symbol for Alphabet (Google) stock on NASDAQ?

Alphabet (Google) has two symbol tickers that represent two different share classes: Alphabet Inc Class A (NASDAQ: GOOGL), and Alphabet Inc Class C (NASDAQ: GOOG).

Can I short Alphabet (Google) stock?

Yes you can. CFD brokers such as Plus500 allow you to short-sell stocks, including the Alphabet (Google) stock.

-

Tom Chen

Tom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.