8 Best Bitcoin Loans Sites in 2021

Since bitcoin’s humble beginning over a decade ago, it has evolved into a flourishing ecosystem. To a great extent, the world perceives it as a store of value. But it also fits the definition of an asset. And like any other asset, you can use it to secure a loan.

Getting a bitcoin loan is more or less like getting a loan in US dollars or any other fiat currency. However, it comes with a number of outstanding benefits as well as risks.

In this guide, you will find out everything you need to know about bitcoin loans. Using this information, you can determine whether or not they are suitable for you. But first things first, what are bitcoin loans?

-

-

What are bitcoin loans?

In the simplest terms, bitcoin loans refer to loans that one can access using the digital asset as collateral. Within the bitcoin ecosystem, one of the most popular investment strategies is fondly referred to as HODLing. It basically entails holding on to your bitcoin regardless of price.

The word which started out as a misspelling of “HOLDing” rapidly caught on in the community. With time, it became an acronym for Hold on for Dear Life, which is appropriate given the asset’s volatility.

As a result of the prevalence of the strategy, lots of bitcoin community members have large bitcoin holdings. And bitcoin loan no collateral is a way to put these holdings to good use.

Instead of having to sell their holdings when in need of funds, HODLers can instead put them up as collateral and access financing.

Some platforms also allow investors to invest in loans using their bitcoins in a peer-to-peer lending system. Notably, lending platforms accept a wide range of major cryptocurrencies, not just bitcoin.

However, due to the volatility of the coins, most providers will only offer low loan-to-value (LTV) loans. In some cases, the maximum is 50% LTV. This means you will need to provide crypto assets worth double the loan amount. You will, therefore, require sufficient collateral if you are to get loan approval.

Also, read the 7 best Bitcoin wallets in 2026 and beyond

How to get a bitcoin loan?

In some ways, a bitcoin loan no credit check works in the same way as a traditional bank loan. But there are noteworthy differences. Just like you would do for a bank loan, you will need to make an application and provide the collateral. The bank, in turn, reviews the application and if it approves your request, you get the funds.

However, a major difference between the two is that bitcoin loans do not require credit checks or extensive KYC. As such, it is pretty easy to get the loan.

To begin with, you will need to identify the platform you will borrow through as there are many scams. Ensure you do your due diligence before starting the process as many bitcoin loan providers have scammed people out of their hard-earned money before. BitConnect and Lendconnect are prime examples of this.

Apart from lender authenticity, you would also need to consider the amount you need to borrow. Loan sizes differ significantly from one lender to the next. Another important consideration is the loan to value ratio and interest.

Once you assess these important aspects, you may proceed to the application stage. If a lender approves your loan, you will likely need to provide the collateral before disbursement. Some platforms may also require complete identity verification.

What are the pros and cons of a bitcoin loan?

Pros- No credit Checks – Crypto loans typically require digital collateral. This means that all manner of borrowers, even bad creditors who cannot access loans from financial institutions can be able to obtain loans. Bitcoin lenders assess your creditworthiness by looking into other factors other than your credit score.

- Fast – The loan approval speed is usually higher than in traditional loans. Although this may vary between lenders, it is mostly a faster alternative than going through a traditional lender.

- Opportunity to get passive income – Bitcoin hodlers can earn extra income by lending their crypto to borrowers as they wait for the markets to be favorable.

- Better rates – Borrowers can find favorable loan terms such as lower interest rates in comparison to traditional loans

Cons- Volatility – Bitcoin is infamous for its volatility. For example, after the announcement of the Facebook digital coin Libra, it climbed almost 55% in a week to reach an 18-month price high. A few weeks later, it dropped over 10% after calls for Libra scrutiny from politicians and regulators.

- Lack of regulation – Bitcoin is not regulated in all jurisdictions. When dealing with borrowers or in countries where it is not regulated, it is difficult to receive any support in case things go wrong.

- If you lend your crypto for the long term, you may be unable to take advantage of price spikes.

- Scams – There have been many cases of scams in the past. Beware of too good to be true deals.

Best Bitcoin Lending Platforms 2021

Here is our list of 5 best bitcoin loans platforms you can use in 2021 and their pros and cons.

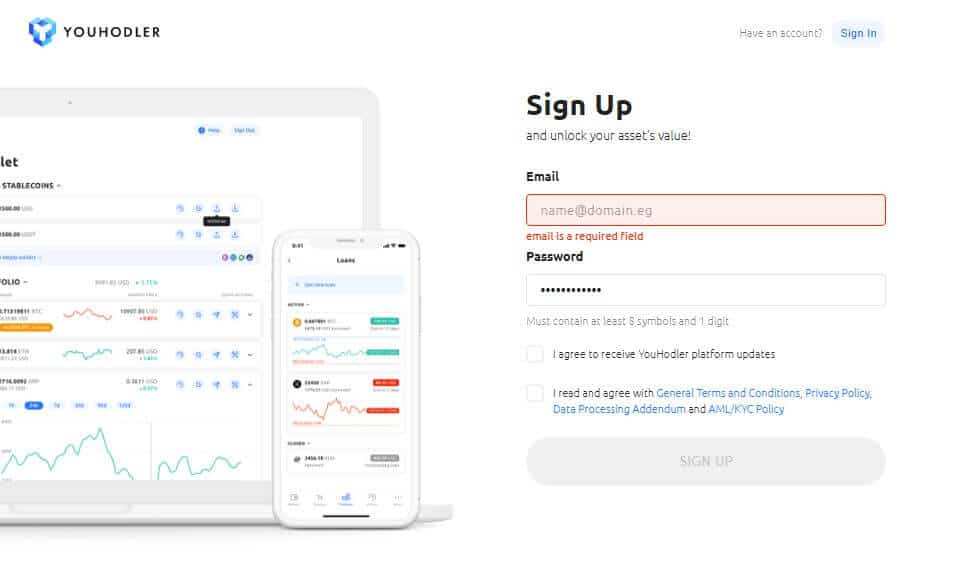

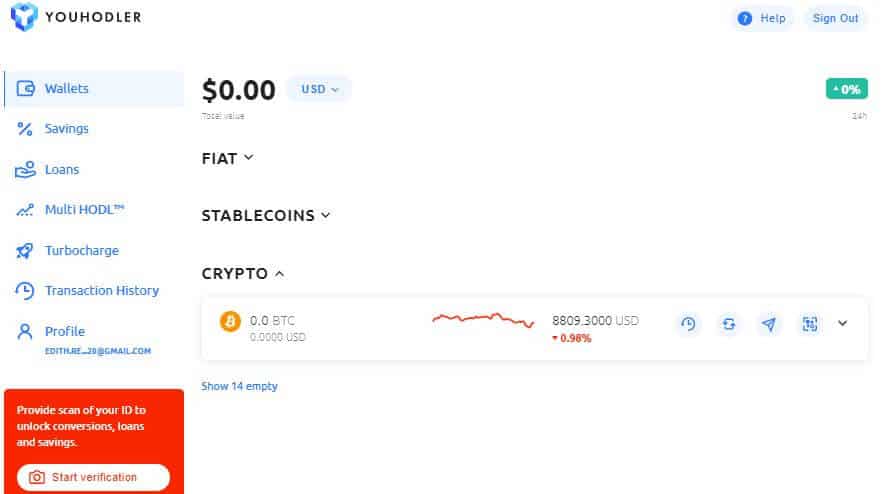

1. YouHodler – The highest LTV offer in the market

YouHodler is a fintech company that focuses on providing crypto-backed loans in fiat currencies and stable coins. They support a number of popular cryptocurrencies including BTC, ETH, LTC, BCH, XRP and XLM among others.

Through their bitcoin loan, they allow borrowers to hold their digital assets while accessing necessary funds.

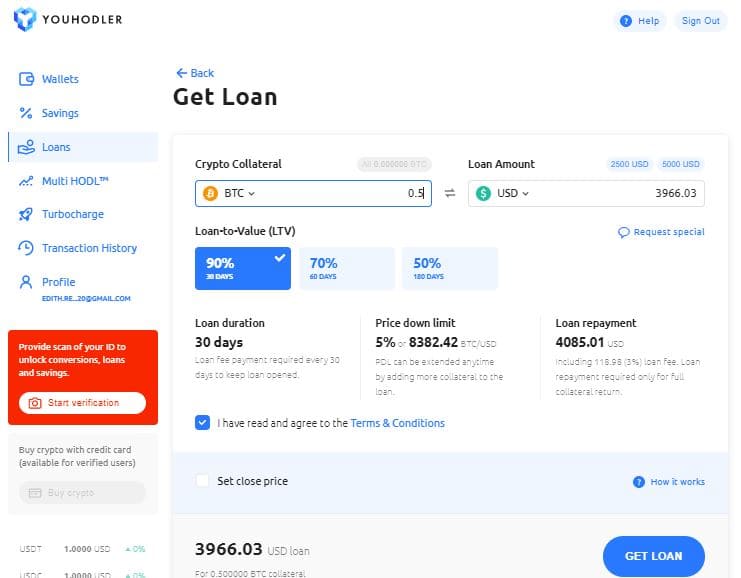

Since its inception, the platform has processed over $15 million in loans and served over 5,000 customers from all corners of the globe. It boasts one of the most competitive rates in the market, offering up to 90% LTV.

You can get a minimum loan of $100 and a maximum of up to $30,000 for between 30 and 180 days from this platform.

The platform is popular for its convenient lines of credit, which you can request on a recurring basis indefinitely. Being a bitcoin loan no credit check, it uses a straightforward process for all kinds of borrowers with fast approval process.

Once you access a loan or credit line on the platform, you can make an instant withdrawal via your credit card or through a crypto withdrawal.

Here is how to access funding from the lender:

- Visit YouHodler and click on “Open Account”

- Sign up for an account by providing your email address and password

- Transfer crypto assets to your wallet on YouHodler to serve as collateral

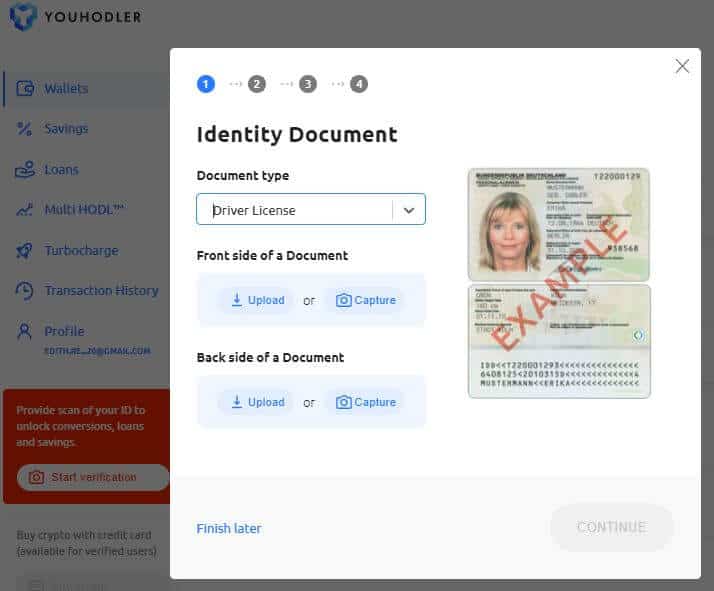

- Verify your identity through the platform’s automated KYC procedure

- Once they reflect in your account, approval for the loan takes mere seconds and the lender releases funds almost instantaneously.

YouHodler is an approved member of the Blockchain Association, an independent self-regulatory organization (SRO) and a provider of External Dispute Resolution (EDR). As such, its members have access to advanced compliance technology as well as efficient dispute resolution under the Blockchain Association Financial Commission.

Our Rating

- One of the highest LTVs in the market

- Offers a wide variety of digital assets to choose from

- You can get a loan in fiat or stablecoins

- Low loan limit

2. Bankera Loans – Best for the safety of your digital assets

Bankera loan is a crypto-backed line of credit specialist that prides itself on the transparency of their rates as well as the safety of their cold storage systems. The lender has been around for over 6 years through which time more than 1 million crypto traders and investors have trusted it with the safety of their crypto coins.

In addition to security, Bankera Loans prides itself on maintaining one of the most expansive credit lines that allow individuals to borrow between €25 and €1 million against up to 75% of their collateral. Plus it has an expansive credit repayment period of up to 12 months.

Opening a line of credit with Bankera starts with signing up and creating your user account. Depositng your loan collateral: the lender accepts EUR, BNK (native coins), USDT, BTC, ETH, XEM, DASH. You then need to choose your preferred loan-to-value percentage (that determines the loan terms) and request for the credit line.

At the standard credit line level (€1000-€5000 loan), loan APR starts from 8.95% if you access less than 25% of your collateral, 11.95% if using 50% of your deposit as collateral, and 14.95% if you are using 75% of your collateral.

Our Rating

- Maintains a straightforward credit line application process

- Accepts a relatively wide range of digital currencies

- Maintains extended credit limits and the loan repayment period of €1 million and 12 months respectively

- Will only accept BTC and ETH as collateral if you wish to use more than 25% of collateral value

- Will only support EUR fiat currency

3. BlockFi – The only crypto account to offer compound interest and trading

BlockFi offers loans using your cryptocurrency as collateral. It means that when you take out a loan they give you USD while you provide them with your Bitcoin (BTC), Ether (ETH), or Litecoin (LTC) as security holding.

As with most investments where returns are viewed over a long term period, it not uncommon for personal circumstances to change. You may find yourself in a situation where you need liquidity, but don't want to release your assets. Instead of selling your crypto holdings at a potential loss, you can use your cryptocurrency as collateral to take out a crypto-backed loan. This allows you to balance your need for hard currency, whilst not losing out on your long term investment.

Crypto Loans can be used for projects such as buying a home, an interesting option given that most lenders won't let you pay for a home using cryptocurrency. Alternatively, you may wish to diversify your investments in order to manage your risk profile, while others have used the service for more mundane uses like consolidating debt, paying off other expenses or making a big purchase.

BlockfFi claims the application process only takes two minutes. You fill in the form, entering the amount of money you wish to access and the cryptocurrency you wish to use as collateral. The LTV (loan to value) ratio has an upper limit of 50% and a lower threshold of 20%. BlockFi will then perform a soft credit check and aim to respond within two hours with a decision and breakdown of the offer calculation. The offer will contain an origination fee, usually 1% - 2%, and an APR.

APR is based upon

- Your credit score

- The amount requested

- You location

- The LTV ratio

Our Rating

- Quick and easy cryptocurrency lending

- Leverage your cryptocurrency for a cash loan

- 12 month loan duration

- Minimum of $15,00 required in crypto assets

- Interest rates are variable

4. Nexo - Most advanced platform for crypto loans

Nexo is a blockchain-based platform that issues crypto-backed loans to users worldwide. It is powered by Credissimo, a European Fintech group. The lender markets it as ‘the world’s first instant crypto credit line.

On this platform, HODLers can get loans in fiat without having to relinquish their crypto ownership. Since its birth in 2007, the company has processed over $700 million for its over 200,000 users. It supports over 45 fiat currencies and has over $1 billion in loan requests.

The lender secures all crypto assets with BitGo, which is insured by Lloyd’s and has the backing of Goldman Sachs.

Here are the steps to follow when borrowing from Nexo:

- Register on Nexo and complete your KYC Deposit your crypto assets to your new Nexo account

- Wait until the collateral reflects in your account

- Once this happens, you will receive an instant credit line whose amount will depend on the LTV that the Nexo Oracle calculates for you

You can repay part of or the entire loan at any time after which you can withdraw your collateral Nexo’s APR starts from 8% if you are using Nexo tokens as collateral. Otherwise, the APR is 24.9%. The LTVs vary from one cryptocurrency to the next.

Here are some of the rates you can expect on the platform:

- 50% for BTC and ETH

- 40% for XRP

- 90% for stablecoins

- 35% for LTC 30% for BNB 15% for NEXO.

Nexo loan limits range between $500 and $2 million with a 12-month term which the lender may renew on request.

Our Rating

- It is powered by Credissimo – a leading European FinTech with a proven track record

- Fully live platform with 256-bit encryption security

- No fee – fixed interest rate model

- The 8% base APR is misleading as it is applicable only if you use NEXO tokens

- Some people see it as a SALT rip-off

5. Celsius Network - Fee-free crypto lending

Celsius Network is a crypto peer-to-peer lending platform that provides fiat loans using crypto as collateral and enables investors to earn interest on their bitcoins. The company was founded in 2017 by Alex Mashinsky, Nuke Goldstein and Daniel Leon.

As of July 2019, the platform claims to have originated $2 billion in loans, over $300 million in assets and over 30,000 active wallets.

The platform appeared on the list of Forbes Top 10 companies to watch in 2018. Forbes explained that among the reasons why it featured on the list is that the startup is ‘primed to disrupt traditional banking.

Its goal according to Alex, the CEO, is to bring the next 100 million people into crypto.

The platform has no withdrawal fees, early termination fees or default fees. The platform offers three options depending on the amount you want to borrow. For example, for a $25,000 loan, the APR is 4.95%, for $33, 000 loan, the APR is 6.95% and for a $50,000 loan, the APR is 8.95%.

Here is how to get a loan from Celcius Network:

- Visit the Celsius Network site and use the online calculator to check the borrowing rates

- Download the platform’s app and create an account

- Fill in the required details and request for a loan

Our Rating

- Fee-free – the platform charges no fees or penalties

- No lock up

- No minimum deposit

- Interests for investors are lower than other platforms

6. Bitbond - Best small business loans platform for those without bank accounts

Bitbond is a global lending platform for small business loans through which you can borrow up to $25,000. It was founded in 2013 in Germany.

The company uses blockchain technology for payments instead of SWIFT to keep its fees minimal. Users do not have to have a bank account and this makes the platform ideal for everyone including the unbanked.

It currently has over 165,000 users, has funded over 3,200 loans and originated loans worth over $15 million. The company is also fully regulated and it received its BaFin Licence in 2016.

The platform works like any other peer-to-peer lender. Here’s how:

- When you register as a borrower, you will need to connect your online business accounts such as PayPal,eBay or Amazon

- The lender will then review your application.

- If you get approval, they will email you with your ratings

- Once you confirm the terms and rates and accept them, they will present your application to the investors/lenders who will usually fund your request in 14 days.

The minimum bid the investors can place on your loan is 0.01 BTC.

Our Rating

- Few and transparent charges

- Fixed interest rates

- No credit score is required for loan approval

- 1-3% origination fee

- You can only borrow up to $25000 which is quite low for a maximum

7. SALT Lending - The platform with the most market experience

SALT Lending is a crypto-backed lending platform that was founded in 2016 and gained massive popularity in 2017. SALT is an acronym for Secured Automated Lending Technology. It describes itself as the next generation lending platform for blockchain loans.

The lender uses the tagline ‘hold your assets, spend your cash’. Since inception, they have seen some tough times. Its Salt token fell from a $27 all-time high on its website to less than $0.07. It also got into trouble with the SEC over the $50 million ICO. However, it is still a great platform for crypto borrowers in search of a bitcoin loan no collateral.

Follow these steps to borrow from SALT:

- Create an account on the platform. Although the platform does not perform credit checks, you will still be required to complete the KYC and AML screening

- Once they verify your identity, you can go on and request for a loan

- They will provide instructions on how to send collateral and once you do, they will deposit funds into the select bank account.

- The collateral will remain your property and therefore the price appreciation and depreciation will affect your holdings for the term of the loan.

On Salt, you can borrow from $5,000 to a maximum of $25,000,000. However, these values depend on the jurisdiction and other restrictions. Collateral can be in BTC, DASH, ETH, TUSD, and LTC.

Our Rating

- No monthly minimum payments

- Set pre-established loan terms

- Minimizes taxes as conversion to U.S Dollar is not required

- The loan minimum of $5000 is too high as it means you will have to deposit $10,000 at 50% LTV

- Limited assets can be deposited as collateral

- Not enough educational content

8. Nebeus - The best platform for concurrent crypto-backed loans

Nebeus is a cryptocurrency peer-to-peer platform founded by Sergey Romanovskiy and Konstantin Zaripov in 2015. Based in London, the platform offers users investing, borrowing, card and exchange services, and thus fits the description of a crypto bank.

You can borrow up to €250,000 from this lender using bitcoin or Ethereum as collateral.

Here’s how to access a loan on the platform:

- Create an account on the site

- Choose the loan type Specify the account from which the lender will debit your deposit and the desired loan currency

- Confirm the loan request

- As soon as they withdraw the pledge, the lender will instantly credit your account. They claim you will receive your cash within 5 minutes

Nebeus offers 10.25% APR with the minimum term being 3 months and the maximum 12 months. The minimum pledge is 0.1 BTC or 1 ETH and the maximum is 40 BTC or 200 ETH. You can have an unlimited number of active loans.

Our Rating

- Good rates for lenders

- Straightforward application processes

- Limited information on loans

- The fee may be high considering industry standards

How to Apply for Bitcoin Loans with YouHodler

YouHodler is a crypto-based loan provider that is known for allowing users to obtain loans almost instantly whilst using crypto as collateral.

Here is the step-by-step guide on how to apply for a Bitcoin loan with YouHodler:

Step 1: Start by creating a user account with the YouHodler. You only need to provide your name and a valid email address at this point.

Step 2: Deposit Bitcoins to your YouHodler wallet. This will serve as the collateral for your bitcoin loan.

Step 3: You will need to verify your identity before going any further. Here, YouHodler requires that you submit a copy of a government-issued identification document including passport, driver’s license, national I.D, or Residence Permit. You will also need to provide a photograph of yourself holding your chosen document to complete the personal information and source of funds pages.

Step 4: Click on the loan application tab and specify the number of Bitcoins you wish to set as collateral and the Loan-To-Value (LTV) ratio. The platform automatically calculates the loan amount that you’re entitled to based on your collateral, so if you are happy with the amount offered, agree to the terms of condition and take out the loan.

Step 5: The loan will then be reflected in you account.Best Bitcoin Loans Verdict

Given its obvious advantages, the bitcoin loan no credit check is here to stay. It offers a great way for investors to earn passive income and for borrowers to access much-needed funding without selling their assets.

However, the most important aspect to consider before settling on a lender is their legitimacy. In view of the prevalence of scamming in the cryptocurrency industry, due diligence is critical.

Take time to assess your potential lender, going through user reviews so as to avoid falling victim to scams.

Glossary of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQs

Will I need to provide collateral?

This depends on the lender you choose. Most lenders will require you to put up crypto collateral that they can easily resell online in case you default. Others work on a trust basis to offer bitcoin loan no collateral.

Am I eligible for a bitcoin loan?

Different platforms have different eligibility criteria. Generally, you must be over the age of 18 and have the required collateral. Others will require you to have a steady job, be in a jurisdiction where bitcoin is regulated or just have a high trust score.

Will I need a good credit score to obtain a bitcoin loan?

Most bitcoin lending platforms don’t require you to have a good credit score as they require collateral. They use alternative methods to determine your creditworthiness, such as trust scores based on the information you provide and their ability to verify it.

Where can I get a bitcoin loan?

You can get a bitcoin loan from peer-to-peer crypto lending platforms or bitcoin lending platforms. Depending on your choice, you may deal directly with individual lenders or lending companies.

Can I get a bitcoin loan while staying anonymous?

Yes, it is possible on some forums to get a loan without revealing your identity. However, it will most likely be harder and at higher rates

What if I miss my bitcoin loan payments?

Different platforms deal with this issue differently. Some will reduce your trust score and/or charge late fees while others offer grace periods. Most of the time you will have the option to make partial payments. Ensure you read and understand the terms and conditions of your loan to avoid being surprised later.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

In some ways, a bitcoin loan no credit check works in the same way as a traditional bank loan. But there are noteworthy differences. Just like you would do for a bank loan, you will need to make an application and provide the collateral. The bank, in turn, reviews the application and if it approves your request, you get the funds.

In some ways, a bitcoin loan no credit check works in the same way as a traditional bank loan. But there are noteworthy differences. Just like you would do for a bank loan, you will need to make an application and provide the collateral. The bank, in turn, reviews the application and if it approves your request, you get the funds.