Lending Club Review 2021 | Understanding P2P Loan Providers

If you are looking to invest your money and earn a higher interest rate than you would in brick and mortar bank or borrowing money conveniently, peer to peer lending might be the answer for you. But the real challenge is choosing the platform that will work for you.

If you are looking to invest your money and earn a higher interest rate than you would in brick and mortar bank or borrowing money conveniently, peer to peer lending might be the answer for you. But the real challenge is choosing the platform that will work for you.

To help you with that, we have reviewed one of the big names in the peer-to-peer lending industry, LendingClub. Read on to find out if it fits you right.

-

-

What is LendingClub?

LendingClub is an American peer-to-peer lending company based in San Francisco California. It became the second P2P platform in the country after its launch in 2006, a few months after Prosper. It is also the largest by far with over 3 million customers. The company claims to have issued loans worth more than $47 billion as of 31st March 2019. In 2014, LendingClub became the first peer-to-peer lender to register with the Securities and Exchange Commission (SEC). The platform acts as an intermediary connecting borrower to investors and is one of the companies that shaped peer to peer lending to what we know it as today.

LendingClub Pros

LendingClub ProsFor investors:

- Easy to diversify your investment by investing in many loans

- Low minimum investment per loan makes it available for anyone

- The site is easy to use

- It is possible to invest and re-invest your returns, thus increasing your portfolio

- Potentially higher returns than conventional fixed investments, such as bonds

For Borrowers:

- Long term loans – you can stretch repayment period up to 5 years

- Average minimum credit score – the minimum acceptable credit score of 600 is not very high

LendingClub ConsFor investors:

- Loans are unsecured – this means if the borrower defaults, there is no easy way to recoup the money.

- LendingClub charges 1% service fee that eats into your potential gains

For borrowers:

- Origination and other fees – the platform charges between 1% and 6% to cover origination costs, you must factor the fee during your loan request because it is deducted before transfer to your bank account. Other fees include $7 if you pay by check and 5% or $15 late fee, whichever is greater.

- Time taken before funding – you require about 7 days for your loan to be available, other platforms can do that in a day.

How Lending Club works

Similar to peer-to-peer lenders such as Funding Circle, LendingClub connects borrowers to investors. It screens borrower requests and presents the accepted ones to investors for funding. It then collects the repayments earning 1% plus other fees charged to the borrower and distributes the rest to investors.

LendingClub is mostly known for personal consumer loans although it also offers small business loans and lines of credit, patient solutions and more recently, Auto refinancing. The platform offers personal loans up to $40,000 at interest rates between 6.95% and 35.89% depending on the risk group you are in.

What Types of loans are offered by Lending Club?

Personal loans – these are loans for home improvements, credit card refinancing, debt consolidation, and unexpected expenses among others. The loan amount offered is up to $4000 and the APR ranges from 6.95% to 35.89%. Personal loans have no prepayment penalties or down payments.

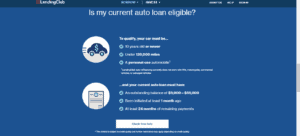

Auto refinancing loans –LendingClub has a dedicated program set up to refinance existing car loans. To qualify, the car must be 10 years old or less, under 120,000 miles and for personal use only. The platform does not work with motorcycles, commercial vehicles, RVs or salvaged vehicles. The loan must have been initiated a month before, have $5,000 to $55,000 outstanding balance and at least 24 months remaining payments. The interest rates are between 2.24% to 24.99%. Note that LendingClub does not offer refinancing for specific models such as Isuzu, Hummer and Suzuki, ensure you confirm before applying.

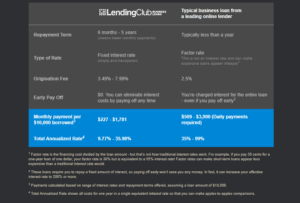

Small Business loans – these range from $5000 to $500,000. To be eligible, the business must have at least $50,000 annual sales, no recent bankruptcies or tax liens, 20% minimum ownership and at least 12 months in business. The repayment term is between 1 to 5 years at a total annualized rate of 9.77% to 35.98%.

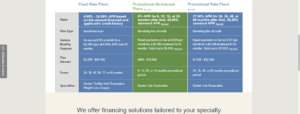

Medical loans – the company also offers patient solutions to pay for typically uncovered medical expenses including dentistry, hair restoration, weight loss surgery, and fertility procedures. They offer several plans for patient solution loans: The fixed rate plan that offers up to $50,000 at 4.99% to 24.99%. No interest plan capped at $32,000 with 0% interest for the first 6-24 months after that it gets a standard 26.99% APR and the promotional rate plan also capped at $32,000 at 17% APR for 24 to 60 months and 26.99% thereafter.

How LendingClub grades loans

After you apply for a loan, LendingClub assigns you a credit grade based on the amount you want to borrow, income, debt level and creditworthiness. The grade assigned determines the interest rate you will pay as a borrower or the interest you will earn if you are an investor. The riskier the loan, the more interest charged or earned.

The LendingClub loan rating ranges from A to G with 5 levels in each grade.

- Grade A – level 1-5 interest rate ranges from 6.46% to 8.81%

- Grade B – level 1-5 10.33% to 13.08%

- Grade C – level 1-5 13.90% to 17.19%

- Grade D – level 1-5 17.97% to 28.80%

- Grade E – level 1-5 28.90% to 29.0%

- Grade F – level 1-5 29.35% to 30.75%

- Grade G – level 1-5 30.79% to 30.99%

You can check your expected interest rates through a quick pre-approval service offered by the lender. If it is favorable, you can submit a full application and documents. The information you provide in your application determines the loan grade you will be assigned and the APR consequently. If your loan is approved, all you have to do is wait for the investors to fund your loan and then it is transferred to your bank account.

Do I qualify for a LendingClub loan?

To be eligible for a loan on the platform, you must:

- Be at least 18 years old

- Be a US citizen or a permanent resident

- Have a minimum credit score of 600

- Have a DTI (debt to income) ratio of less than 40%

Currently, LendingClub does not accept loan applications from Iowa and Idaho residents.

Investing in LendingClub

Peer to peer lending works in such a way that the investor is the lender that provides funds through a platform to the borrower. LendingClub is no different. If the loans are repaid, the idea is that the investor should earn higher interest rates than he could anywhere else. But due to the risk of loan delinquency, you must diversify your portfolio to minimize losses.

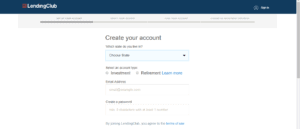

How to start investing in LendingClub

The first step is opening an account. Setting up an account is pretty easy and quick. First, you need to choose the type of account you want to open from the multiple accounts types LendingClub offers, individual, general investment, retirement or a corporate account. There are also other options such as joint accounts, trust and custodial or accounts for minors.

You are also required to state which state you live in because of the platform’s current state and financial suitability conditions regulations. Residents of five states are unable to use all or part of the company’s services. Residents of Alaska, Pennsylvania, North Carolina and New Mexico are unable to purchase notes on the primary market but are allowed to trade in the Folio Investing Note Trading platform. Ohio residents are currently unable to purchase notes or trade on both markets.

Other required details include email address, name, address, phone number, date of birth and social security number for tax reporting and fraud prevention. If Lendingclub cannot verify your identity right away, you will be required to upload an ID, passport, or utility bills. Military ID is not accepted.

The minimum investment amount for the general investment account is $1000 and $5500 for the IRA account.

Choosing investments on LendingClub

The platform allows you to choose an investment according to your risk appetite. The loans with the highest risk are likely to earn you the highest returns but on the downside, they are also more likely to default. LendingClub assigns loans grade A to E and a subgrade 1 to 5 for each loan. The grade A1 is the least on the risk scale and therefore earns the lowest interest. E5 has the highest risk but earns the highest returns.

To minimize the risk, you should buy fractions of loans called ‘notes’. The minimum amount per investment is $25 therefore, you can spread the initial $1000 investment across 40 different loans. This way, if a loan defaults you only lose $25 instead of the whole investment.

The platform works with Folio investing to offer Note Trading Platform, which is just a secondary market where you can buy and sell LendingClub notes to and from other investors.

Automated investing

LendingClub allows you to set an automatic investment strategy (Auto Invest tool) where you pre-select your loan preferences. This is a great option for people with less time to choose borrowers manually.

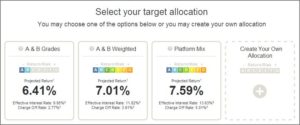

The auto invest tool gives you three options to choose from. Each preset has its own risk yield. If none of the options meet your criteria or risk appetite, you can manually specify the yield you want and your funds will be automatically invested.

You can turn auto investing on or off at any time.

Risks associated with investing in LendingClub

Investing in peer-to-peer lending comes with a number of risks that you must be aware of. They include:

- Default – this is the biggest threat to you getting your money back. Although LendingClub screens and approves loans individually and with verifiable documents, it is not a guarantee that the loan will be repaid. For instance, you invest in one loan and it defaults, you stand the risk of losing your entire investment. The best way to minimize this risk is by diversifying your investment as much as possible.If a borrower misses a payment by 15 days, they are charged a late fee of 5% of the amount due or $15, whichever is greater. After 120 days, the loan goes into a ’charge off’ status where the company expects no further payments. The company may attempt to sell off the loan to a third party, if successful, the investors will receive a percentage of the recovered amount.

- Liquidity – if you need to raise capital quickly, you may struggle to sell your notes on the secondary market when there is low liquidity. You might even be forced to accept a lower price than you bought it.

- Early loan payment – LendingClub does not charge extra for loans repaid before the term ends, therefore, if a borrower pays his loan early, it will negatively affect your long-term returns.

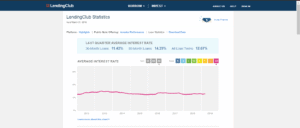

How much can I earn on LendingClub?

The amount you can earn depends on several factors, including your risk appetite, default rates, early loan repayments and how well you diversify your portfolio. In the last quarter (from January – March 2019), the platform average interest rates were 11.43% for 36-month loans, 14.29% for 60-month loans. The average return on all loans was 12.67%.

The platform charges investors 1% service fee of each payment they receive. This is used to cover account maintenance fee, collection fee, processing and distribution fees. Put in mind that profits are taxed as regular income.

Generally, you should expect annual yields of between 5% and 8.7%, which is still better than keeping your money in a savings account. Loans with longer terms (5 years) pay more than 3-year loans by around 2%. This, however, increases the risk level.Who is eligible to be an investor?

- To be an investor, you must be above the age of 18 years and have a social security number.

- Residents of California must have at least $85000 income and a net worth of the same, exclusive of home, home furnishings and automobile. Or, a net worth of $200,000 with the same exclusions. Or, invest less than $2500 in notes.

- Residents in other states must have an annual income of at least $70,000 and a net worth of the same (excluding home, home furnishings and automobile) or a net worth of at least $250,000 with the same exclusions.

- Must not be residents of Ohio (all platforms), Alaska, New Mexico, Pennsylvania and North Carolina (can only invest in the Secondary market only).

- Can only invest 10% of your net worth or less.

LendingClub Review: Verdict

LendingClub is one of the largest peer-to-peer platforms in the world having facilitated more than $47 billion in loans and over 3 million customers. The size of the company and their 13 years of experience lets borrowers and investors know they are working with a solid entity. From a borrower’s perspective, it is a great choice if you are looking to borrow a lot of money without going through a bank. Especially if you have a good credit score.

It also provides a suitable way for investors to earn regular passive income. However, you must be well aware of the risks that come with it. And just like any other investment, there will always be a rest of losing money.

FAQs

Can I get my money back before the loan matures?

Yes, if you want to opt out early, you can sell your notes on the secondary market. This, however, depends on the market forces, if the liquidity level is not sufficient in the secondary market, you may be forced to sell your loan at a loss. Also, there is no guarantee that you will be able to sell your loan on the secondary market.

Is income from LendingClub taxed?

Any gains from P2P lending are taxed as ordinary income, that is the interest gained after deducting losses from the defaulted loans.

Can I switch payment methods after receiving my loan?

Yes, you can switch to any payment method of your choice.

What happens in case of a natural disaster and you cannot make your payment?

If you are affected by a natural disaster, LendingClub will not charge you late fees for a minimum of 30 days and will not make payment calls for a minimum of 30 days.

Can I change my due date?

Yes, you can permanently move the payment date of your loan or delay the monthly payment by changing it in your account or contacting them, however, this will affect the interest you pay at the end of the loan. Paying earlier will result in you paying less interest.

Can I open an account on LendingClub with a security freeze on my credit file?

LendingClub will be unable to verify your identity, therefore, you have to disable the freeze temporarily until your identity has been verified.

Peer 2 Peer - A-Z Directory

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up