Global financial services company UBS has put its weight behind gold and sees prices hitting $2,000 per ounce by the end of this year—an upside of almost 6% from current levels.

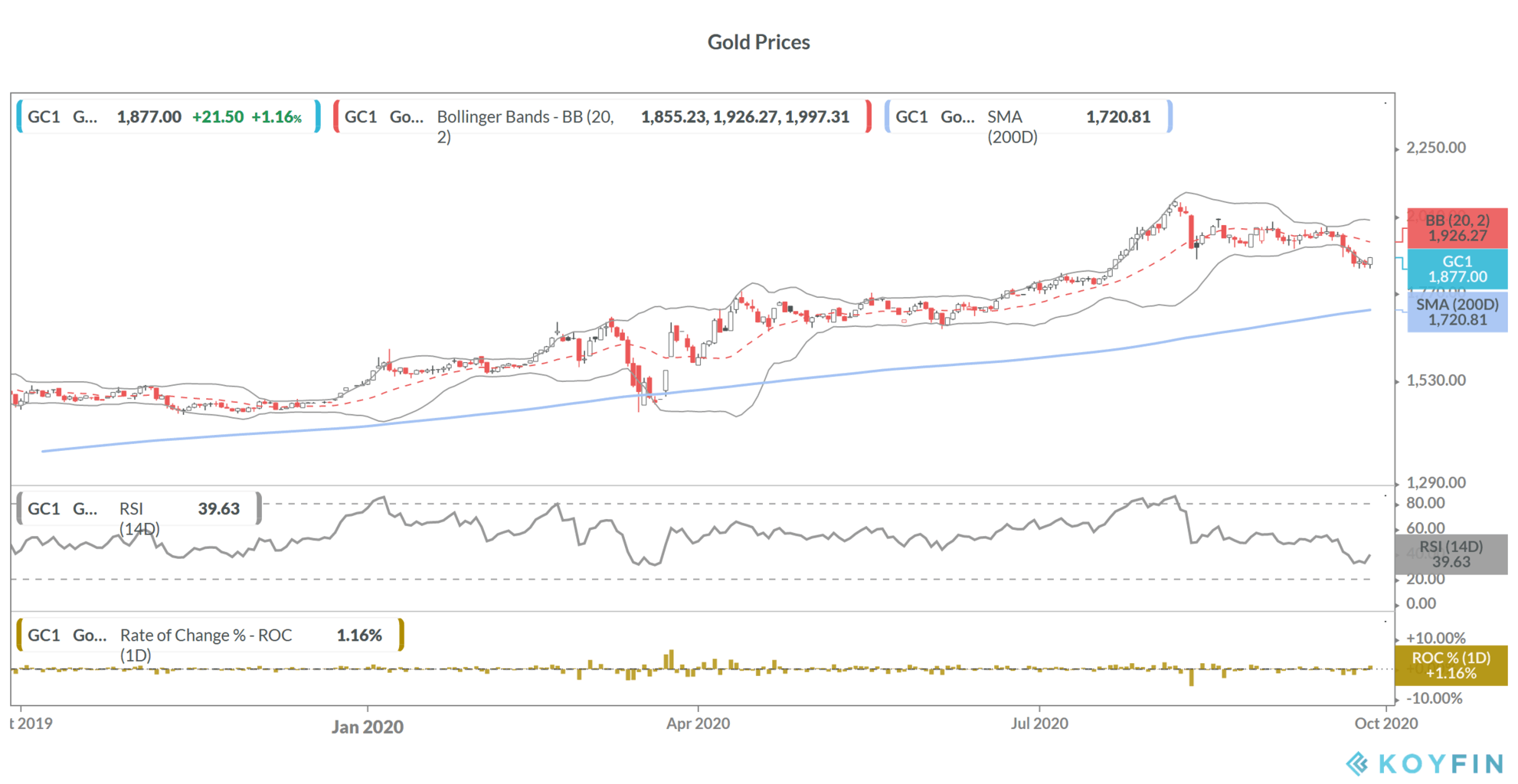

Gold gained 1.1% yesterday and was trading 0.3% higher in early trading today at $1,888 per ounce. While prices have come off their last month’s highs, when they hit their all-time highs, breaching the previous highs set in 2012, the yellow metal is still among the best performing asset class this year with a year to date gain of 23.5%. In comparison, the S&P 500 is up only around 3.7% over the period.

Last month, reports of the Russian vaccine for COVID-19 triggered a sell-off in gold prices. Meanwhile, UBS is forecasting better days for the precious metal that shines in times of economic uncertainty.

UBS is positive on gold

“We like gold, because we think that gold is likely to actually hit about $2,000 per ounce by the end of the year,” said Kelvin Tay, regional chief investment officer at UBS Global Wealth Management.

Calling the yellow metal a “very good hedge,” he said that “In (the) event of uncertainty over the U.S. election and the Covid-19 pandemic, gold is a very, very good hedge. And its recent weakness represents a great entry point for investors.”

UBS advises Chinese government bonds

Tay also recommends Chinese government bonds. Next year, Chinese government bonds are set to be included in the FTSE Russell’s World Government Bond Index. Chinese bonds that currently yield around 2.5% as compared to a ten-year treasury yield of 0.6% in the US, could see billions of dollars of inflows after the inclusion.

Yesterday, the Canadian pension fund also said that it intends to invest in Asia over the next five years. That said, investing in emerging markets comes with its own sets of risks including currency risk.

Other brokerages also positive on gold

While there is differing opinion over the precious metal’s outlook, most brokerages advise buying gold. Bank of America is forecasting the yellow metal to reach $3,000 per ounce by the end of 2021. Frank Holmes, chief executive at investment firm US Global Investors expects prices to reach $4,000 per ounce, forecasting a more than 100% rally over current levels.

Looking at fund managers, Bridgewater Associates, which is led co-chairman by Ray Dalio invested over $400mn in gold in the second quarter. Dalio recommends maintaining an asset allocation into gold. On the other hand, Berkshire Hathaway chairman Warren Buffett has advised against buying the yellow metal many times. That said, in the second quarter, Berkshire Hathaway added a gold mining company Barrick Gold to its portfolio.

Accommodative fiscal and monetary policies

Earlier this month, the US Federal Reserve signaled no rate hikes until 2023. Lower interest rates as a positive for gold prices. As a non interest bearing instrument, the yellow metal has a negative correlation with interest rates and it tends to do well when interest rates are low and vice versa.

The outlook for the US dollar is also bearish given the low interest rates in the US coupled with the country’s surging fiscal deficit that is set to reach the highest level since World War 2. Given the fiscal easing, which is not expected to overturn anytime soon, US debt to GDP looks set to breach the psychologically crucial 100% in 2021. A combination of rising fiscal deficit, low interest rates, and economic uncertainty bodes well for gold prices.

How to invest in gold?

You can buy gold either in physical form or in digital form. You can buy the yellow metal through any of the reputed brokers for gold. Alternatively, you can also trade in precious metals through CFD (Contract for difference). We’ve compiled a list of some of the best CFD brokers.

If you are looking at a long-term allocation, you can also invest in a gold ETF. By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account