Gold prices could top $4,000 per ounce level over the next three years, according to analysts — but they add two factors could stop the yellow metal’s surge.

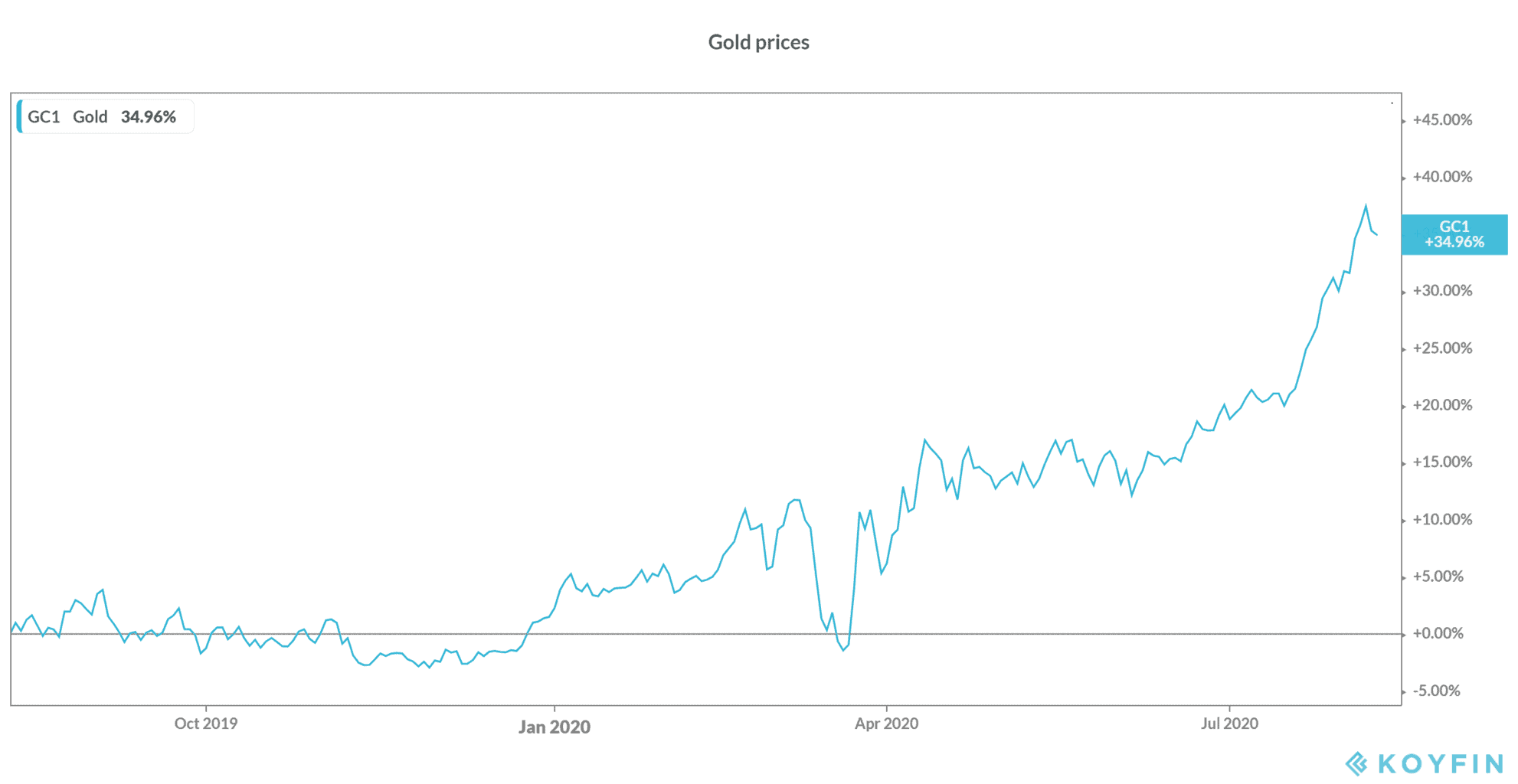

Gold prices have surged during the pandemic rising almost 36% for the year. Last week, it breached its all-time highs that it hit in 2011 and rose above $2,000 per ounce for the first time ever. The rally is not over and could potentially double over the next three years.

Gold at $4,000 per ounce?

“It’s quite easy to see gold going to $4,000,” Frank Holmes, chief executive at investment firm US Global Investors speaking to CNBC on Monday. “We’ve not seen this level where central banks are printing money at a zero interest rate. At zero interest rates, gold becomes a very, very attractive asset class.”

He also said the G-20 bloc is “working together like a cartel and they’re all printing trillions of dollars.” Printing money is a bullish driver for gold prices as investors flee to hard assets like precious metals when central banks resort to printing money.

Also, the current interest rate environment allows a rally in gold prices. Gold prices do well in low interest rate environment, while investors ditch it for interest-bearing instruments when interest rates are high.

Most economists say a low interest rate regime looks here to stay for long as central banks would not risk raising rates as it may derail the economic recovery.

Monetary easing is here to stay

US Federal Reserve chairman Jerome Powell summed the policy perfectly in June. “We’re not thinking about raising rates,” Powell said in June. “We’re not even thinking about thinking about raising rates.”

Yung-yu Ma, chief investment strategist at BMO Wealth Management US largely agreed with Holmes, but pointed to two factors that could derail the gold rally.

Yung-yu sees the US elections and a possible vaccine for the coronavirus as the factors “that could change that trajectory” for the yellow metal. He said: “We think … especially the vaccine has potential to shift some of those positive factors that are working right now in the favor of gold.”

On Tuesday, Russia claimed that it has developed a vaccine for the coronavirus and it has even been administered to President Vladimir Putin’s daughter.

US elections and gold

New York-based research provider Third Bridge Group expects the yellow metal to fall below $1,600 after the elections. However, it expects prices to rally next year.

“The elections are now less than 100 days away and Trump had recently suggested delaying it, raising concerns he will seek to circumvent voting in a contest where he currently trails his opponent by double digits,” said Refinitiv’s Cameron Alexander, manager of precious metals research.

Along with these factors, investors should also watch for two more factors. One is the expected weakening of the US dollar that’s generally positive for dollar-priced commodities. A weaker US dollar makes gold more affordable in other currencies.

The escalation in US-China trade war is another bullish driver for prices for the precious metal, as safe havens tends to do well in times of geopolitical tension. US-China relations are at their worst level in decades and a quick rebound looks unlikely irrespective of the US election results.

Gold looks set to maintain its upward trajectory. Looking at its price relative to equities, gold, the yellow metal is currently at 0.6 times the S&P 500, way below the 2011 highs of 1.7 times. Since 2014, gold as a percentage of the S&P 500 hasn’t been above 0.7 times.

You can buy gold through any of the reputed brokers for gold. You can also trade using binary options

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account