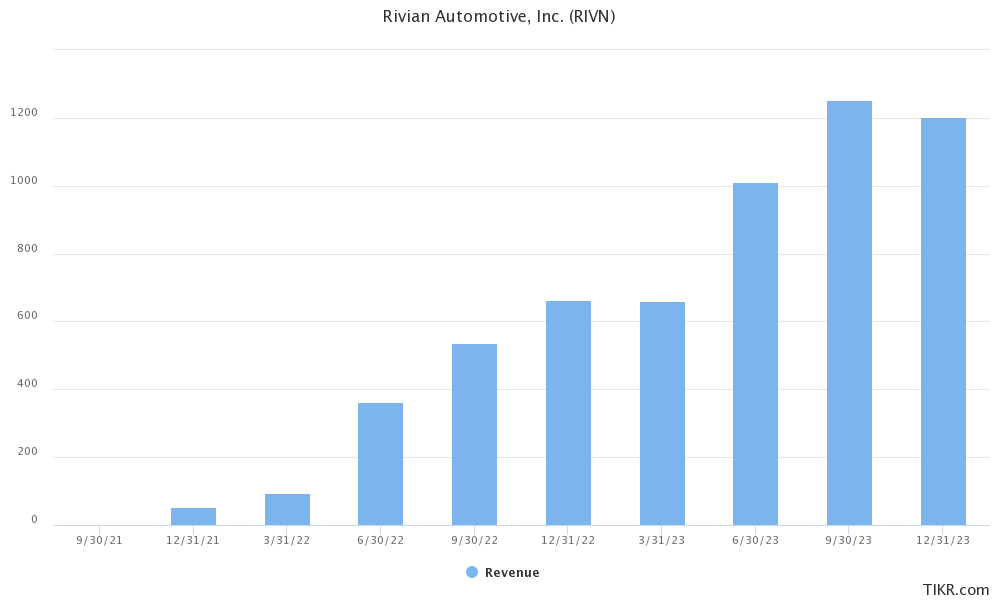

Rivian (NYSE: RIVN) reported its Q2 2023 earnings yesterday beating on both the topline as well as the bottomline and also raised its 2023 production guidance. Here are the key takeaways.

RIVN reported revenues of $1.12 billion which was ahead of the $1 billion that analysts expected. Its gross margins were negative 37% in the quarter as compared to negative 81% in the corresponding quarter last year.

In Q2, Rivian produced 13,992 vehicles and delivered 12,640 of those. The deliveries were well ahead of the 11,000 that analysts were expecting.

Rivian posted better-than-expected Q2 earnings

The company’s gross loss narrowed from $704 million in Q2 2022 to $412 million in Q2 2023. It also earned $34 million from the sales of the sale of regulatory credits and said that it expects them to increase in the future even as they may vary between quarters.

It also increased its 2023 production guidance and its CFO Claire McDonough said, “Based on the progress of our production ramp, including the ramp of our in-house motor, along with the latest understanding of the supply chain, we are increasing our production guidance to 52,000 total units.” Previously it forecast a production of 50,000 units.

The company lowered its projection for 2023 EBITDA loss to $4.2 billion. It also cut the capex guidance to $1.7 billion – which is more of a timing issue. It reiterated that its average capex in 2023 and 2024 would be in the low $2 billion area.

RIVN reiterated its long-term targets

McDonough however reiterated “We see a clear path to our approximately 25% gross margin target, high teens adjusted EBITDA margin target and approximately 10% free cash flow margin target.”

During the earnings call, the company said that during the second quarter, R1S vehicles accounted for 70% of the production of its R1 series vehicles while adding that they are more profitable than the R1T vehicles.

Rivian ended the quarter with a comfortable cash pile of $10.2 billion which would fund its operations until 2025. The company’s CEO RJ Scaringe said, “We will be very thoughtful and intentional on how we secure additional capital to support the growth of the R2 program.”

Rivian significantly improved its vehicle margins

It added that during the second quarter, it integrated the Enduro motors into the Enduro motor variant of the R1 platform. Scaringe said that it is an “important milestone from a cost perspective and will also be instrumental in expanding the consumer market opportunity for our R1 vehicles. We believe the majority of our long-term R1 demand will come from our Enduro motor variants.”

He added that the gross margin per vehicle improved by around $35,000 and stressed “We achieved meaningful reductions in both R1 and EDV vehicle unit costs across the key components, including material costs, manufacturing labor, overhead and logistics.”

Rivian to begin EDV deliveries to Europe this year

Scaringe also provided insights into the electric delivery vehicles (EDVs) and said that the company’s EDVs are in operation in 800 cities in the US and it has also started delivering these to Amazon in Europe.

Notably, Amazon is Rivian’s biggest investor and has also placed an order for 100,000 electric delivery vehicles with the company.

In response to an analyst question on the exclusivity clause on EDVs with Amazon, Scaringe said, that the company is working “closely with Amazon to expand how many of those vehicles are getting out, and of course, that ties to how rapidly we ramp the production of the EDV product.”

He reiterated his previous comments that RIVN “is actively working with Amazon to allow us to sell vehicles outside of Amazon sooner than what was originally contemplated in our contract.”

RIVN talked about its software capabilities

During the earnings call, Rivian also talked about its software capabilities and said, “We believe that our software capabilities, our structural differentiator that will only grow in importance as electric vehicles continue to increase in complexity. Our unique capabilities stem from the intentional decisions we made years ago when we decided to truly take a clean sheet approach to the software stack and electrical hardware in the vehicle.”

Notably, Tesla’s CEO Elon Musk believes that most of the company’s valuation comes from its autonomous business. The company has missed several deadlines to turn fully autonomous but Musk stressed during the Q2 earnings call that the company’s self-driving system would reach L4 or fully autonomous this year.

RIVN R2 to be launched in 2026

Rivian is targeting a total annual production capacity of around 600,000 cars between its Normal and Georgia plants. It aspires to capture 10% of the global automotive market share which might seem a tall ask considering the massive competition.

At the upcoming factory in Georgia, Rivian would produce the affordable R2 where production is slated to begin in 2026 – one year behind the original schedule.

RIVN versus Lucid Motors

Lucid Motors (NYSE: LCID) which released its Q2 earnings a day before Rivian missed revenue estimates on the back of lower deliveries. The company’s net loss also widened to $764.2 million as compared to $555.3 million in the corresponding quarter last year.

Lucid Motors maintained its 2023 production guidance and still expects to produce over 10,000 vehicles in the year. It added that deliveries would rise gradually during the year and it expects the fourth quarter to be its largest.

The company has a total liquidity of $6.25 billion after the $3 billion equity raise and expects the cash to fund its operations until 2025.

Meanwhile, even as LCID stock rose over 12% yesterday, RIVN is almost flat in US post markets despite comfortably beating analysts’ estimates and raising its guidance.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account