Tesla (NYSE: TSLA) has lowered the prices of select Model Y variants in China and launched lower-priced versions of Model S and Model X in the US as the Elon Musk-run company looks to spur sales.

Tesla lowered the prices of two variants of its Model Y crossover in China by around $2,000 and offered a “limited-time insurance subsidy” of around $1,100 on Model 3. The company started cutting prices in China in Q4 2022 and has since lowered car prices across multiple countries – including the US which is its largest market.

Tesla launches lower-priced versions of Model S and Model X

Separately, the company launched lower-priced versions of its Model S and X. These two are its premium models but their combined sales in its total sales mix have gradually fallen and are in the low single digits now.

Most of Tesla’s sales come from the Model 3 and Model Y and while it does not provide a separate breakdown of these models, it said that the Model Y was the best-selling model globally in the first quarter of 2023, after excluding pickup models. It was the first time in history that an EV model was the best-selling model, beating the wide army of ICE (internal combustion engine) models from legacy automakers.

Tesla lowers car prices in China

Tesla’s price cuts have led to a price war and Chinese EV companies including Xpeng Motors and NIO have also lowered car prices – the latter did so a few months after categorically denying that it would join the price war.

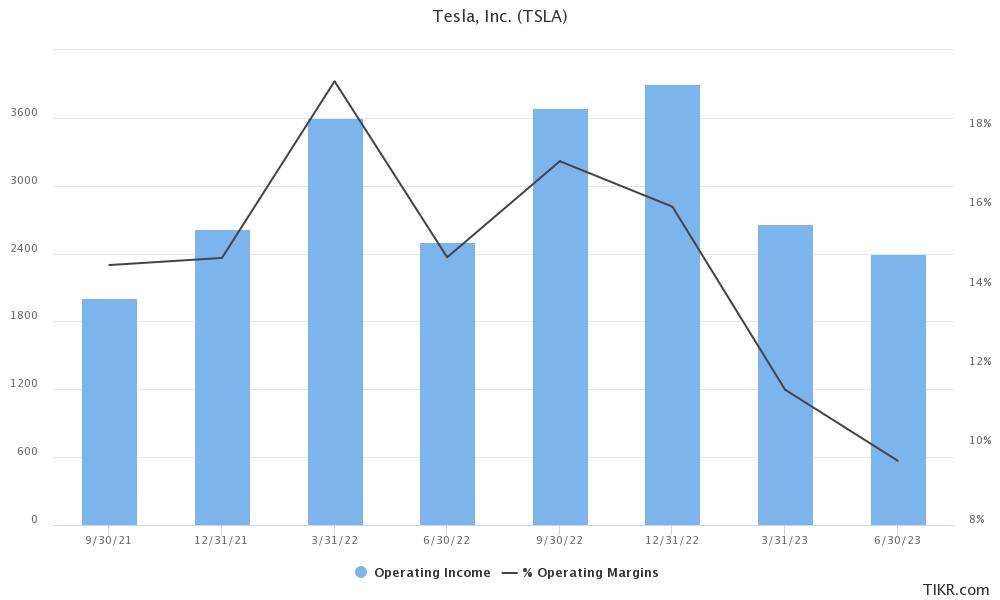

The price cuts have taken a toll on Tesla’s profits also and its operating margin plummeted to 9.6% in the quarter and fell to single digits. The company’s operating margin fell steeply in the first quarter also due to the price cuts.

Musk has meanwhile defended the price cuts and said during the Q1 earnings call that “We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin.”

Ford scales back EV program amid the price war

The price war might also take a toll on startup EV companies almost all of which are anyways struggling with perennial losses. Even Ford scaled back its ambitious EV production targets amid the brutal price war and now expects to hit a production goal of 600,000 units by 2024 instead of 2023.

Alluding to the EV price war, Ford said, “Contribution margin and EBIT margin were both negative with pricing and volume pressures intensified, and that’s impacting all OEMs. Given the rapid and dynamic gain on the pricing environment, we no longer expect to see contribution margin breakeven for our Gen 1 products this year.”

The company however still expects the Model e to reach a pre-tax profit margin of 8% by 2026. Notably, Tesla still has industry-leading margins even as its margins have more than halved over the last few quarters.

Ford also lowered the prices of the F-150 Lightning

The EV price war has worsened and Ford even lowered the price of its F-150 Lightning by as much as $10,000. However, during the earnings call the company said that despite the price cut, the model’s prices are above what they were at the time of the launch. The model would compete with Tesla Cybertruck whose deliveries would begin later this year.

It said, “While EV adoption is still growing, the paradigm has shifted. EV price premiums over internal combustion vehicles fell more than $3,000 in the second quarter and nearly $5,000 in first half. We expect the EV market to remain volatile until the winners and losers shake out.”

Musk believes self-driving would drive profits for Tesla

Musk meanwhile believes that Tesla’s self-driving technology would drive its profits in the coming years. In response to a question on Tesla’s gross margins, Musk said during the Q2 earnings call, “The short-term variances in gross margin and profitability really are minor relative to the long-term picture. Autonomy will make all of these numbers look silly.”

He added that the current full self-driving (FSD) price of $15,000 is on the lower side. Musk also said that “I know I’m the boy who cried FSD, but man, I think — I think we’ll be better than human by the end of this year.”

Notably, for the last many years, Musk has been promising level 4 autonomy for Tesla cars but they are still not fully autonomous. Musk acknowledged that his previous timelines on FSD haven’t worked out and said “I’ve been wrong in the past. I may be wrong this time.”

Musk sees autonomous driving as key to Tesla’s valuation and during the earnings call, he said that the company is in talks with a OEM to license its FSD. The company has already partnered with multiple automakers including Ford, General Motors, Rivian, Mercedes, and Polestar to share its Supercharging network.

Evercore ISI expects Tesla to cut prices in other markets

After Tesla lowered car prices in China, Evercore ISI which has an “in-line” rating on Tesla said it expects the company to lower car prices in the US and EU which would lead to a margin compression of 100 basis points sequentially in the third quarter.

Ahead of Tesla’s price cut in China, Bank of America sounded an alarm over its sales in China. Analyst John Murphy said in a note, “With the 31% MoM drop, TSLA’s July deliveries on [an] absolute basis were well below the YTD average of ~80k and closer to the level seen in early 2022.”

Murphy added, “As such, while the price cuts helped TSLA in clearing out inventory at the end of 2022 and spurred demand in China through 1H, those benefits appear to have been short-lived.”

Meanwhile, Tesla’s price cuts have raised fears that the EV price war might only escalate as companies try to offer competitive prices. There looks no easy way out from the mess and even China’s automotive association gave up on efforts to reach a truce in price war over antitrust concerns.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account