Chinese EV company Xpeng Motors (NYSE: XPEV) which posted a record net loss of 2.8 billion yuan in Q2 2023 has said that its partnership with auto giant Volkswagen and continued cost cuts would help it narrow losses.

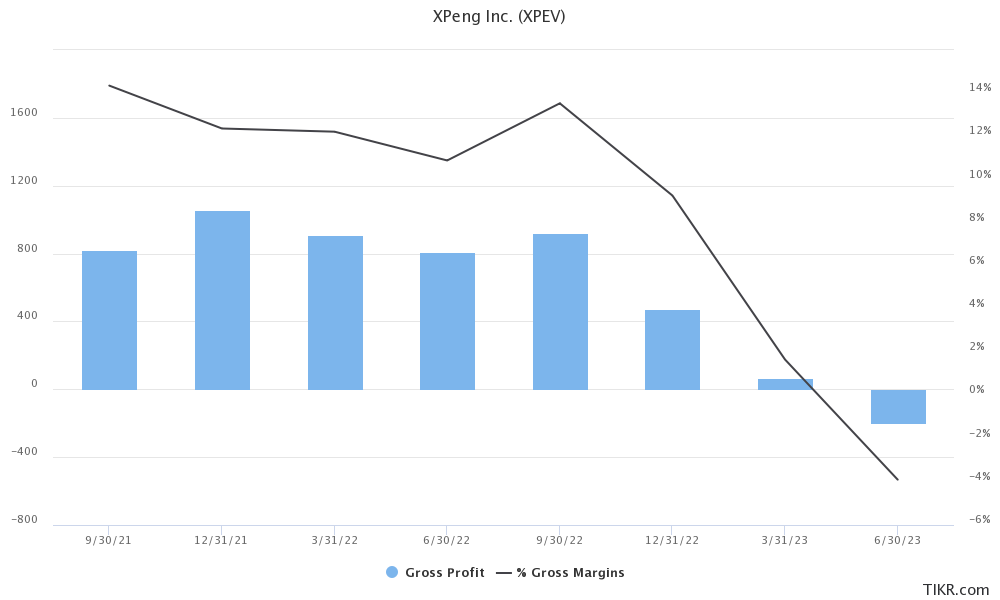

While Xpeng Motors posted revenues in line with analysts’ estimates, its Q2 losses were wider than expected while its gross margins went into negative territory. At its peak, the company posted positive double-digit gross margins.

However, the last few quarters have been quite troublesome for Xpeng Motors, and not only have its deliveries sagged but its losses have also widened.

Xpeng Motors’ deliveries have fallen YoY in 2023

Its monthly deliveries were below 10,000 in all the months in the first half of 2023. It delivered 11,008 EVs in July which was 28% higher than the previous month and the sixth consecutive month when its deliveries rose on a monthly basis. However, as has generally been the case over the last few months, its deliveries fell YoY in the month.

It delivered 52,443 EVs in the first seven months of 2023 which took its cumulative deliveries to 303,521. Last year, Xpeng Motors was ahead of Li Auto in terms of cumulative deliveries but after the splendid performance this year, the latter is now ahead by over 100,000 units.

XPEV began delivering the G6 SUV in July

Xpeng Motors is banking on its G6 SUV – which it priced almost 20% below Tesla Model Y – to revive its fortunes. It delivered 3,900 G6 SUVs in July and added, “The strong sales momentum of G6 has led to a surge in showroom visits, which, in turn, has increased customers’ enthusiasm for other XPENG Smart EV models and the advanced smart technology equipped within.”

It emphasized, “The Company is focused on ramping up the G6’s production with its manufacturing facilities running at its full load. The Company also increased dedicated logistics resources to ensure the speed of G6 deliveries.”

The company began G6 deliveries in July and during the company’s Q2 earnings call, its CEO He Xiaopeng said, “The G6 has become the dominant BEV model in the 200,000 RMB to 300,000 RMB price market segment, turbocharging our sales growth momentum.”

Xpeng Motors’ partnership with Volkswagen

Chinese EV companies are attracting the attention of global investors. In June, CYVN Holdings L.L.C., an investment vehicle majority owned by the Abu Dhabi Government invested around $740 million in NIO by purchasing newly issued shares.

Like Xpeng Motors, NIO’s deliveries also disappointed in the first half of 2023 and its average monthly deliveries were less than 10,000.

Meanwhile, last month, Volkswagen also announced a $700 million investment in Xpeng Motors. Commenting on the partnership, Xiaopeng said during the Q2 earnings call “We’ll continually deepen our cooperation with the Volkswagen Group and build stronger synergies in the next-generation EV platforms, software technologies, and supply chain capabilities, sharing economies of scale.”

Brian Gu, vice chairman and co-president of XPEV reiterated similar views during an interview with CNBC and said, “With the Volkswagen agreement, we also anticipate meaningful contribution to our bottom line starting next year. So that’s also another tool we can use to increase our profitability.”

XPEV expects its losses to narrow

While Xpeng Motors posted its biggest-ever loss in Q2, it expressed optimism that not only will it post positive gross profits in Q4 but also generate positive operating cash flows in that quarter.

Gu said, “In order to gain better profitability, we also have endeavor to spend a lot of time on cost cutting. Later next year, we expect our total vehicle BOM [bill of materials] costs to be reduced by up to 25%. That will give us a big tool to increase profitability as well.”

He added, “From an expense perspective, we went through a very significant business reorganization as well as changes that we have made. We start to see the regaining of the growth momentum that we have in our business.”

China EV demand

There have been concerns over EV demand in China amid the worsening economic slowdown in the country. Most brokerages now expect the country’s GDP growth to be less than 5% in 2023 amid a sputtering economic rebound.

Tesla incidentally lowered vehicle prices in China last week in an apparent bid to increase sales. During the Q2 earnings call, Xpeng was somewhat dismissive of the price war and said that its products are competitively priced.

Gu is also bullish on the demand environment in China and said, “The demand side actually remains pretty robust. I think it continues to grow despite the economic backdrop.” He however cautioned, “But the same time, the competition has intensified in the first half, with more players launching more new models and being very aggressive on price competition.”

The price war might also take a toll on startup EV companies almost all of which are anyways struggling with perennial losses. Even Ford scaled back its ambitious EV production targets amid the brutal price war and now expects to hit a production goal of 600,000 units by 2024 instead of 2023.

Analysts on Xpeng Motors’ stock

Meanwhile, even as Xpeng Motors stock has come off its 2023 highs, it is up handsomely for the year and some brokerages see the stock running higher from these levels. BofA upgraded the stock from neutral to buy while raising its target price from $16.30 to $22.

Jefferies analyst Johnson Wan also upgraded the stock to a buy last month and said, “Harvest season for Xpeng’s AD (autonomous driving) initiatives has just started.”

Wan who now has a $25.30 target price for XPEV stressed that the partnership between Xpeng Motors and Volkswagen signals “the start of China [original equipment manufacturers] exporting technologies to foreign players [and] will help Xpeng to increase its brand image globally.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account