Bridgewater Associates, which is led co-chairman by Ray Dalio invested over $400m in gold in the second quarter. While the yellow metal has come off their record highs, it is still among the best performing asset class this year, rising more than a quarter, with some forecasting prices to double over the next two or three years.

Bridgewater Associates’ 13F filing showed that the fund invested over $400m into the SDPR Gold Trust and the iShares Gold Trust, two of the biggest gold ETFs. The SPDR Gold Trust and the iShares Gold Trust were the fund’s two biggest buys in the second quarter.

The other three in Bridgewater Associates’ top five buys were Alibaba and two China-focused ETFs, indicating that the fund is bullish on China whose recovery from the pandemic has been exemplary.

ETF inflows hit record highs: Have you invested yet?

The SPDR Gold Trust is Bridgewater Associates’ second-largest holding accounting for 15.3% of its portfolio. In absolute terms, the ETF totaled over $900m in its portfolio. The iShares Gold Trust was Bridgewater Associates’ fifth-largest holding accounting for 4.5% of its portfolio. Together these two ETFs account for almost 20% of Bridgewater Associates portfolio.

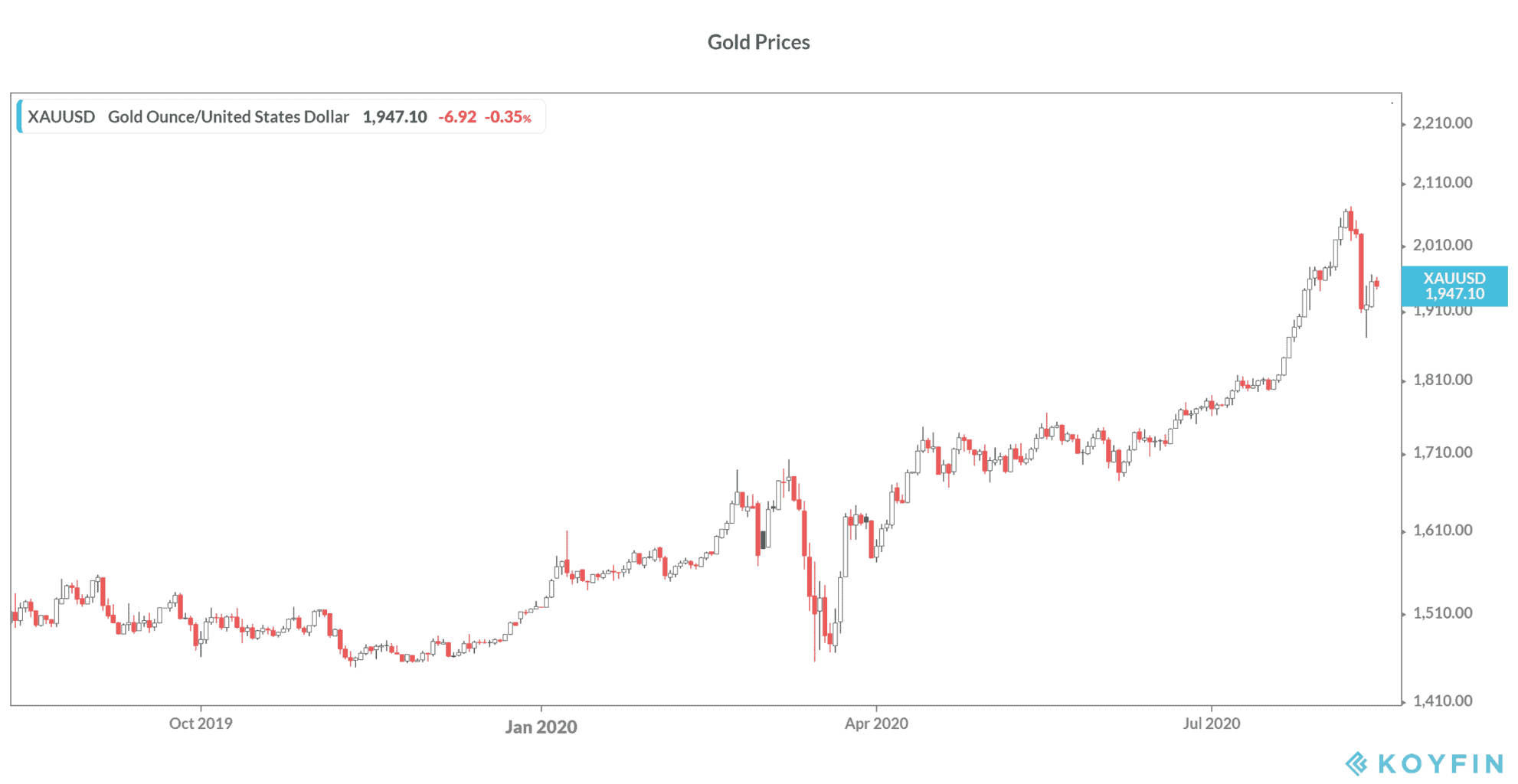

Last week, the yellow metal rose past $2,000 per ounce, hitting their all-time highs breaching the previous highs that they hit in 2011. In today’s trade, the yellow metal was trading 0.25% down at $1,949 per ounce. After hitting their highest level of $2,071 per ounce last Friday, prices have come under pressure.

Gold prices fell 5.6% on Tuesday, their worst fall in seven years on reports that Russia has developed a vaccine for the coronavirus. However, most medical experts do not agree with the country’s assertions as the sample size is too low, and the time period too small to call the vaccine a sure shot remedy against the virus.

Does Gold outlook looks positive?

The global economy is supportive of gold prices. Most analysts expect the US dollar to weaken which would be positive for the yellow metal. Commodities generally have a negative correlation with the US dollar.

The US Federal Reserve is also not expected to reverse its easing cycle anytime soon. “We’re not thinking about raising rates,” Powell said in June. “We’re not even thinking about thinking about raising rates.” Low interest rates lift demand for non-interest bearing assets like precious metals.

US President Donald Trump’s administration will also have to come up with another stimulus package to bail out the US economy. The stimulus would put more pressure on the US fiscal deficit that already looks set to climb to the highest level since the Second World World.

A rising US fiscal deficit is good for gold. So is the deterioration in US-China relations, over trade and democratic rights in Hong Kong and of Uighurs Muslims, as the yellow metal tends to shine in periods of geopolitical turmoil.

Investors have poured money into the yellow metal this year and inflows into gold ETFs have hit record highs. So far, the strategy has worked well for investors and the yellow metal is up 26% for the year despite the recent fall.

Analysts expect gold to rise further

Frank Holmes, chief executive at investment firm US Global Investors expects the yellow metal to hit $4,000 per ounce, more than double the current level.

In April, Bank of America raises its 18-month price target to $3,000 per ounce. Goldman Sachs is also bullish on the yellow metal.

Looking at its price relative to equities, the yellow metal is currently at 0.6 times the S&P 500, way below the 2011 highs of 1.7 times. Since 2014, gold as a percentage of the S&P 500 hasn’t been above 0.7 times.

Billionaire investor Dalio, who is credited with correctly predicting the 2008 Global Financial Crisis has been bullish on gold for quite some time now. In January, speaking to CNBC’s Squawk Box on the sideline of the World Economic Forum in Davos Dalio said “Cash is trash,” and “a bit of gold is a diversifier.”

“What are [central banks] going to hold as reserves? What has been tried and true? They are going to hold gold. That is a reserve currency, and it has been a reserve currency for a thousand years,” added Dalio

From an asset allocation perspective also, financial planners advise allocating some money to gold that generally has a negative to low correlation with equity markets.

You can buy gold through any of the reputed brokers. You can also trade using binary options

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account