Canada Pension Plan Investment Board (CPPIB) that had around $330bn assets as of 30 June plans to invest a third of its funds into emerging markets in the next five years. The fund sees India as an important investment destination. Should you also invest in emerging markets like India and what are the ways to do it?

“We expect to invest up to one third of the Fund in emerging markets by 2025 and India is a key component of that,” said Suyi Kim, CPPIB’s Asia Pacific head, in an email to CNBC. The fund also plans to invest in Australia, Japan, South Korea, and Greater China. Currently, over a third of the fund’s assets are invested in US markets.

Canada’s pension fund bets big on India

“Our investments in India span different asset classes including infrastructure, real estate, public and private equities, funds and co-investments and credit,” said Kim. She added, “We see domestic consumption, technology and increasing demand for infrastructure to support the growth underpinning many of the themes and opportunities we look at in India.”

CPPAIB already has an office in India has invested in some Indian companies including Kotak Mahindra Bank. The Indian economy has been witnessing a growth slowdown over the last two years that has been made worse by weak balance sheets in the financial sector. S&P Global sees a slow recovery in the Indian banking sector and expects it to reach pre-pandemic levels by only 2023.

S&P Global on Indian banks

“We have taken negative rating actions on Indian banks and (non-banking financial institutions) as operating conditions have deteriorated through the crisis,” S&P Global said in a report.

CPPAIP meanwhile is not perturbed by the credit crisis and instead sees some opportunities in the sector. “The ongoing credit issues in the financial services industry, which have been exacerbated by the pandemic’s impact on the economy, also present interesting investment opportunities to provide long-term, stable capital to select financial institutions and companies to finance India’s next growth cycle,” said Kim.

Investments in emerging markets can be risky

Investing in emerging markets can be risky. Along with the risk of investing in stocks, that by itself is risky, you take several other risks when you invest in emerging markets. These include political risk and currency risk. Also, regulations can be lax in some emerging markets as compared to developed markets. Corporate governance policies in emerging markets can be less robust as compared to those in developed markets. Liquidity could also be lower in emerging market stocks.

However, emerging markets grow at a high rate which tends to reflect in their stock markets also. From a diversification perspective also, you can allocate some funds towards emerging market stocks.

How can you invest in emerging markets like India?

Some of the brokers let you trade in emerging market stocks. You can select from any of the best online stock brokers. You can also invest in emerging market indices through binary options. There is a list of some of the best binary options brokers.

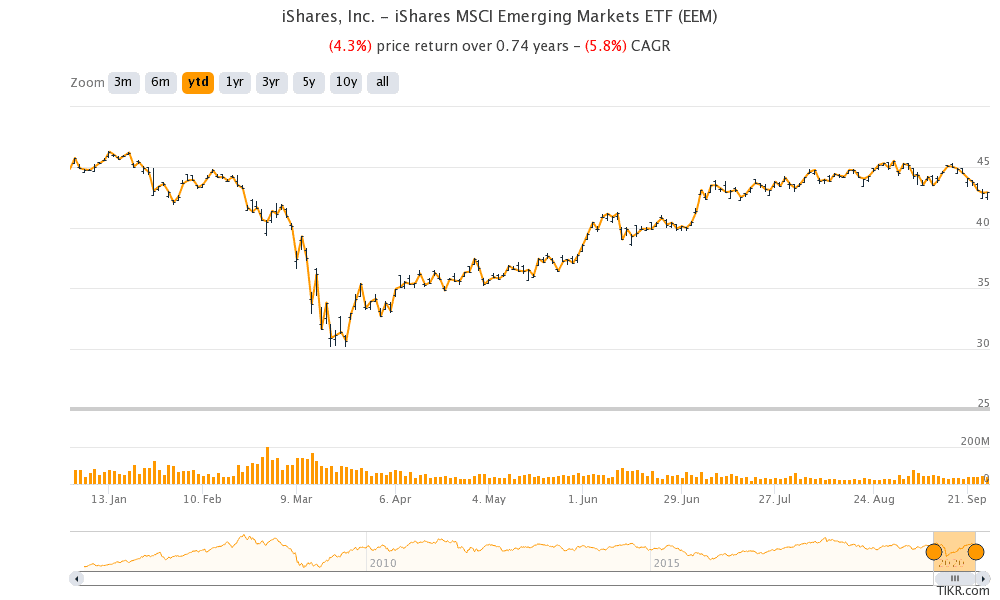

If you are not well versed in investing in stocks and still want to have exposure to emerging market equities you can consider ETFs. There are ETFs that give you exposure to a basket of emerging market stocks as well as those focused on a single country.

By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account