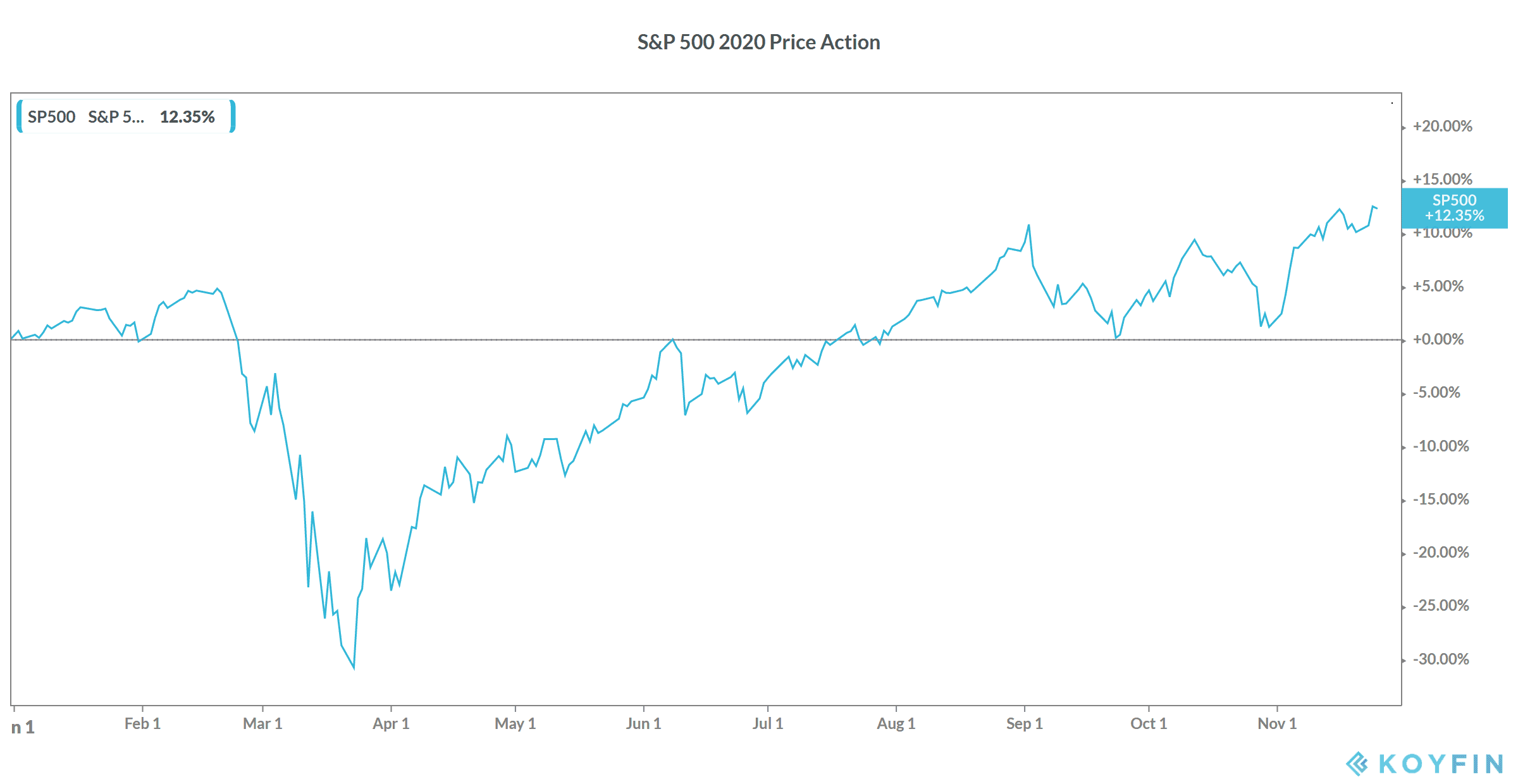

We’re now approaching the end of 2020 which has been a volatile year for US stock markets. After plunging in February and March, US markets have not only recovered but scaled new highs. Now, Barclays has come up with the stocks that it forecasts could deliver higher returns in 2021.

US stock markets in 2020

Looking back at 2020, US stock markets have whipsawed this year and created many records. The 11-year-old record bull market finally ended this year and US markets recorded the sharpest 30% decline ever. However, the recovery was equally swift and markets rebounded after hitting their lows on 23 March.

Firstly, it was the massive monetary and fiscal policy stimulus that lifted US stock markets. However, tech stocks soon took over market leadership and rallied to record highs as investors poured money into US tech stocks anticipating an increase in the pace of digitization.

The tech rally of 2020

Stocks like Amazon, Apple, and Netflix soared to record highs and catapulted the tech heavy Nasdaq index to record highs. As US tech companies started to display some weakness after September, we saw a sectoral shift into cyclical and value stocks amid positive news flow over COVID-19 vaccine candidates. Joe Biden’s election as the US president further fueled the rally in US stock markets. Green energy companies and cyclicals have especially rallied since Biden’s election.

Barclays advises to buy these stocks for 2021

Barclays expects the S&P 500 to hit 4,000 by the end of 2021. Based on current price levels, Barclays target represents over 10% gains from the S&P 500 in 2021. So far in 2020, the S&P 500 has gained 12.3% and is trading near its record highs. The tech-heavy Nasdaq Composite Index has gained over 34% in 2020 led by sharp gains in tech stocks like Tesla and Zoom Video Communications.

Barclays expects cyclical stocks to rally in 2021 as high efficacy vaccines finally control the COVID-19 pandemic. It expects earnings per share growth to drive the markets next year. In 2020, while S&P 500 earnings have fallen, we have seen an expansion in multiples that has taken markets higher. Now, with US stock market multiples looking rich, earnings growth could take the baton in 2021.

BP stock could deliver high returns in 2021

Barclays top pick for 2021 is energy giant BP which it sees delivering almost 64% returns next year. The other two stocks that it sees delivering high returns are ABN Amro and BT whose stock prices it is forecasting would rise 50% and 47% respectively next year.

“Central banks and governments have ammunition left to help sustain the recovery, financial conditions are favourable, and there is pent-up demand given resilient disposable income, high savings and recovering profits,” said Emmanuel Cau, Barclays’ head of European equity strategy.

Barclays’ strategy for 2021

He added, “Given the large output gaps, we expect expansionary monetary and fiscal policies to remain firmly in place. The China recovery is broadening, while in the US and Europe, consumer spend and capex should both rebound, and services catch up with manufacturing.”

Cau expects bond yields to rise next year. He also sees the US dollar weaking in 2021 which can give rise to a reflation trade. Cau expects value and cyclical stocks to outperform next year based on his assumptions.

In September, billionaire investor Howards Marks also said that he would bet on beaten down and cyclical stocks for higher returns

Stocks to sell in 2021

Barclays expects Lufthansa shares to lose 46% next year. It expects Dutch payments company Adyen to fall 34% in 2021 while it expects the shares of British online supermarket Ocado to fall 30.5% next year.

Key factors to watch in 2021

In 2021, there are several key factors that investors need to watch. The first would be to see how much of a reversion on consumer behavior do we see after the vaccine is administered. While COVID-19 vaccines are expected to be available as early as December, it remains to be seen whether consumers have the same degree of confidence venturing outdoors as they did before the pandemic.

Can inflation hurt stock markets next year?

Secondly, it would be crucial to keep a watch on inflation. Commodity prices barring energy have been strong this year and we could see some inflation in 2021. If oil prices also rise next year, inflation could become a major problem for central banks globally.

To be sure, in August, the US Federal Reserve announced a new policy framework where it would target average inflation. This would basically mean that it wouldn’t jump to raise rates as soon as inflation ticks to its 2% target. That said, if inflation rises, it could put pressure on central banks to reconsider their hyper accommodative monetary policies.

Another aspect to watch would be Joe Biden’s economic policies as the 46th US president. While markets would expect him to keep an accommodative fiscal policy for now, he has vowed to raise taxes as well as capital gains taxes. A tax hike would be the last thing markets would want at this juncture.

How to buy stocks

You can trade in stocks through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

If you are not well equipped to research stocks or want to avoid the hassle of identifying and investing in stocks, you can pick ETFs that invest in value stocks, cyclicals, and industrials to play the sector rotation from tech to cyclical stocks.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account