How to Buy Zoom Stock

Not long ago, Zoom was one of many tech stocks being outshined by the likes of Amazon, Google, and Netflix, but since large swaths of the US and UK began working remotely in response to COVID-19, Zoom’s stock price has more than doubled.

While some investors might warn never to jump into a stock in the middle of such a meteoric rise, no one wants to miss out on profits, either. Zoom likely isn’t going anywhere as remote work becomes an increasing part of the modern workplace. So, the dramatic price increase over the past few weeks might just be the beginning of a much longer upward trajectory.

If you want to get into Zoom stock, this guide will cover everything you need to know. We’ll highlight three of the best brokers you can use to buy Zoom, plus discuss the company’s prospects for the future.

-

-

How to Buy Zoom Stock in 3 Quick Steps

Want to get your hands on Zoom shares before the price can rise any higher? Here are the three essential steps you need to take to buy Zoom stock.

[three-steps id=”199880″]Where to Buy Zoom Stock

To purchase Zoom stock, you’ll need a trading account with a broker that offers you stocks listed on the NASDAQ stock exchange. There are plenty of options for this, but it’s worth taking the time to find a reliable and trustworthy broker that doesn’t charge excessive fees. Here, we’ve picked out our top three recommendations.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed overview of providers

1. eToro - Best for Social Investing

Wondering whether Zoom is all hype or the next Amazon? eToro can help you figure it out by letting you ask what other traders think. This broker offers a full-fledged social network where you can follow other investors, start discussions, and even copy other traders’ portfolios. We especially like that Zoom has its own stock page where you can see what other investors are saying about this stock.

Another thing that’s great about eToro is that you can own Zoom stock outright. Many online brokers only let you trade contracts for differences (CFDs), which are derivatives that let you speculate on the price of a stock without actually owning it. Since Zoom doesn’t pay dividends, this isn’t a huge difference. But, if Zoom grows bigger, holding the stock means that you’ll be eligible for any future dividends the company pays out.

eToro is also a good choice if Zoom isn’t the only stock you’re planning to add to your portfolio. The platform gives you access to more than 800 stocks on exchanges around the globe, as well as forex and commodity trading. This broker also doesn’t charge trade commissions, although you’ll want to watch out for withdrawal and inactivity fees.

Our Rating

- No Trade Commissions: Just pay the spread when trading

- Global Stocks: Trade Zoom plus stocks in Asia or Europe

- Social Trading: See what other traders think about a stock

- Withdrawal Fees: Costs $5 per withdrawal

- Limited Charts: Doesn’t offer a comprehensive charting software

75% of investors lose money when trading CFDs.2. Plus500 - An Exceptional Broker for Trading CFDs

If you want to trade CFDs instead of owning Zoom shares outright, Plus500 is the best broker for the job. Why might you want CFDs? First and foremost, they allow for leverage trading. With Plus500, you can put, say, $100 down to trade up to $2,000 worth of Zoom stock. Additionally, buying CFDs lets you short Zoom stock, so you can profit even if the price drops from its current high. Together, these options can be a great way to take advantage of Zoom’s current volatility. Just remember that there is a risk involved when trading and that losses could occur if the traders are not familiar with the broker or the instrument they have chosen to trade with.

On top of that, Plus500 does away with trade commissions and still offers some of the tightest spreads we’ve seen. If you want to keep using Plus500 for trading beyond buying and selling Zoom, the platform gives you access to CFDs for hundreds of stocks globally plus dozens of currency pairs and popular commodities.

Plus500 is for experienced traders but does come with user-friendly charts and simple price alerts. Don’t plan to lean on this broker too heavily for technical analysis. It doesn’t include access to a dedicated charting software like MetaTrader, and the built-in technical studies are fairly limited. Plus500UK Ltd authorized & regulated by the FCA.

OUR RATING

- CFD Trading: Offers leverage and shorting

- Tight spreads and no trade commissions

- Beginner-friendly: Easy to use charts and alerts

- Minimal Research: Doesn’t offer advanced trading software

- Interest Fees: You’re charged interest for holding leverage overnight

80.5% of retail investor accounts lose money when trading.3. StashApp - Best Broker for US Investors

If you’re inside the US, extra red tape means that you’re not allowed to open accounts at many top online brokers, but StashApp gladly accepts US traders and has plenty of features to offer. The platform doesn’t have a minimum deposit and charges just $1 per month for a basic account, with no additional fees for trading. Better yet, you get access to thousands of US stocks (Zoom included), ETFs, and bonds.

StashApp stands out in particular for allowing you to invest in fractional shares. The broker lets you buy as little as $1 worth of Zoom or any other stock, regardless of what that stock is currently priced at. As the price of Zoom shoots up, having the ability to invest in multiple shares is a huge benefit for traders who don’t have hundreds of dollars lying around.

We also like StashApp because it encourages good financial habits. You can schedule transfers from your bank account to your trading account to encourage investments for the long-term. There’s also a round-up option, which lets you send the spare change from debit card transactions to your brokerage account. StashApp even offers retirement accounts, which have some tax advantages, in addition to standard investment accounts.

Our Rating

- No Minimum Deposit: Start trading with as little as $1

- Retirement Accounts: Invest in Zoom for the long-term

- Fractional Shares: You can buy portions of shares for less money

- No Research Tools: Doesn’t include any charting capabilities

- Cannot Short Stocks: No option to bet against the market

How to Buy Zoom Stock from eToro

Want to buy Zoom stock right away but don’t know how to get started? We’ll walk you through the process of trading Zoom using our top-rated broker, eToro. This is a great option for getting started quickly because it makes it possible to deposit funds and start trading in just a few minutes. Even if you opt for a different broker, the steps we’ll outline here are largely similar between trading platforms.

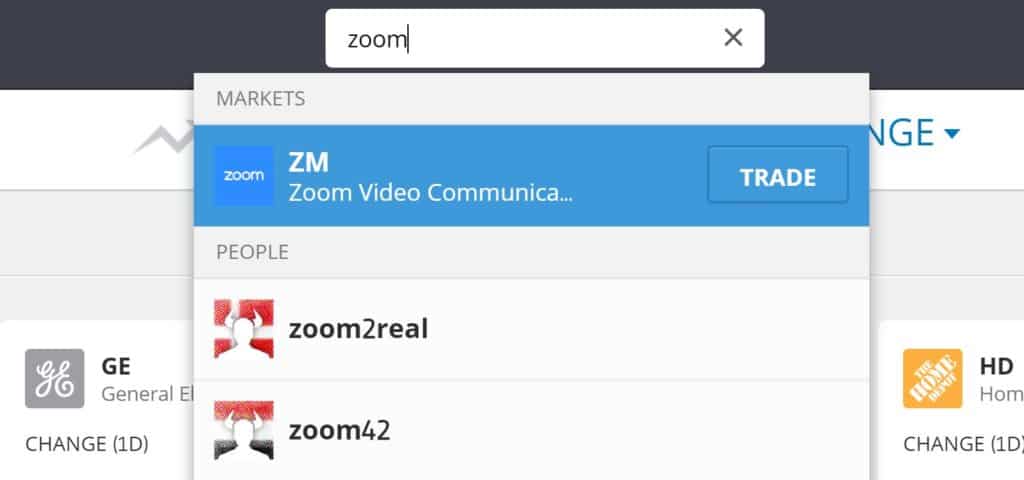

Step 1: Search for Zoom (ZM) Stock

You can browse through all 800-plus stocks that eToro offers for trading. But, to speed things up, just search for ‘ZM’ (Zoom’s ticker symbol) in the search box at the top of the page.

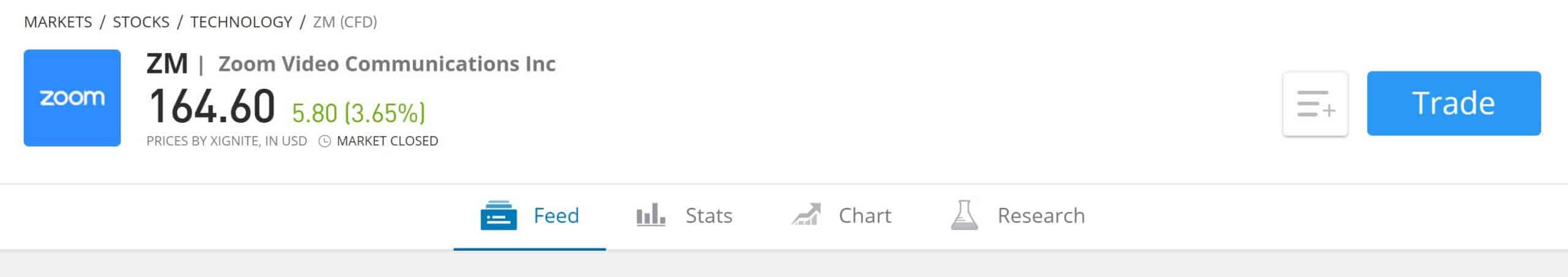

Step 2: Click on ‘Trade’

Click the ‘Trade’ button to start filling out an order for Zoom stock.

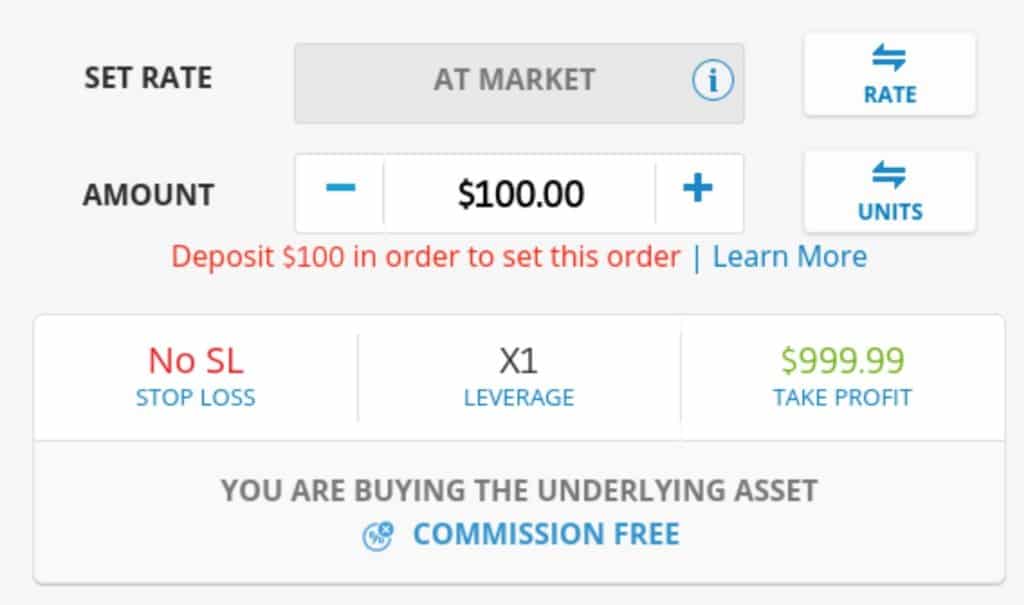

Step 3: Set Up Order and Buy Zoom Stock

At this point, you’ll be taken to an order form that tells eToro how much Zoom stock you want to buy and how you want to execute your trade. Let’s take a closer look at some of the options you have when placing your order:

- Set Rate: This is the price at which you will buy Zoom stock. If you leave it as ‘At Market,’ eToro will buy the stock at its current price. Alternatively, you can set a specific price above or below the current market rate. eToro will only buy Zoom stock if the price rises or falls to the price you specified.

- Amount: This is the amount of Zoom stock you want to buy, in dollars. You can click the ‘Rate’ button if you’d rather specify how many shares of Zoom stock you want to buy.

- Stop Loss: It’s always a good idea to set up a stop loss when purchasing a stock. This is a price, below the price you’ve specified to buy Zoom at, at which eToro will automatically sell your stock. Setting up a stop loss ensures that you can’t lose too much money in case Zoom stock starts to fall.

- Take Profit: A take-profit level is like the opposite of a stop loss. When Zoom stock reaches a certain price, eToro will automatically sell your shares to realize your profit. This is helpful if you want to cash out your position at a certain price rather than hold Zoom indefinitely.

Click ‘Buy’ to complete your trade.

Why Invest in Zoom?

Still not sure whether Zoom is a worthwhile investment? Let’s take a look at the bulls’ case for why Zoom stock has a lot of growth potential over the long-term.

Note: Always perform your own investment research on top of reading our advice. It’s your money and you should be well-informed about where it’s going.Zoom is Profitable

One of the best reasons to consider investing in Zoom is also the simplest; this company actually makes money. That may sound like a no-brainer for a major company, but the fact is that much of the US tech sector is built on companies that are yet to turn a profit.

At the end of 2019, Zoom reported a full-year profit of just over $25 million. The company nonetheless has plenty of cash on hand to capitalize on its newfound popularity and no major debt.

Even better, Zoom’s revenue is growing at an unheard-of rate in 2020 thanks to the COVID-19 crisis. Year-over-year revenue for the second quarter is up 78%, and Zoom recently brought on major enterprises like HSBC and Johnson & Johnson as customers. That’s an extremely encouraging sign and Zoom is only likely to increase its profits as the world transitions to a new normal.

Remote Work is the New Normal

Remote work was slowly gaining in acceptance prior to COVID-19, but with a huge portion of the US now working from home, Zoom has become a tool that virtually everyone is familiar with.

That bodes extremely well for the company in the future. There are numerous experts forecasting that remote work will be much more widespread even after the pandemic recedes, meaning more individuals and companies will be relying on software like Zoom. In addition, as individuals have turned to Zoom to chat with friends and family, they’re likely to stick with the platform thanks to its superior audio and video quality.

All of that points to Zoom’s recent customer growth being part of a broader trend, not just a blip in response to the coronavirus crisis.

Zoom is Investing in Itself

One of the things we like best about Zoom is that the company isn’t just sitting on all the new cash it’s brought in. It’s using that revenue to make improvements to the platform and bring in even more customers.

More than 20% of its software engineers are tasked with developing features that customers themselves have requested. Among the 300 new features that Zoom released last year was the ability to change your screen background, which has been something of a hit in recent months.

While security has recently been something of a hiccup for Zoom, the company has responded to those problems speedily. Thanks to this attention, the public seems to have largely forgiven the company for the privacy flaw. Plus, Zoom knows going forward that security is something it needs to spend more time on in order to retain users’ trust.

About Zoom Stock

Zoom was founded in 2011 by Eric Yuan, who remains the company’s CEO, and the video conferencing software made its debut in 2013. It wasn’t until 2019, though, that the company IPO’d on the NASDAQ stock exchange at a price of $62 per share.

Throughout 2019, the stock bounced around between that IPO price and the $100 level. But as the scale of the coronavirus crisis in the US and abroad became clear in early March 2020, the stock rocketed upwards.

Zoom is already a large-cap stock, with a total market capitalization of more than $45 billion. But, it still has plenty of room to run if more and more people in the US and around the world turn to this company for video meetings and remote work.

Should You Buy Zoom Stock?

Right now, there are numerous analysts and stock picking services thing everyone who will listen to buy Zoom stock. The company has performed extremely well not just in the past few months, but since it’s stock debuted in early 2019. The few security hiccups it’s users had piled into the software have largely been resolved and the future looks bright for this video conferencing tech company.

It’s impossible to tell just how high Zoom’s stock price will fly. There’s always a chance that the current rise is short-lived in response to COVID-19. But more likely than not, Zoom will continue to prosper in the years to come and early investors will reap the benefit of massive growth in the share price.

FAQs

Does Zoom offer its software in other countries?

Yes, Zoom is available widely outside the US. The software is used in Canada, the UK, Europe, and even Asia. There are just a handful of countries where Zoom is unavailable or restricted.

Do institutional investors like banks own shares of Zoom?

Zoom’s top owners are investment firms, although it’s shareholder base looks very different from larger tech companies like Microsoft or Amazon. Morgan Stanley, Vanguard, and Fidelity together own about 10% of Zoom stock. The founder, Eric Yuan, also owns more than 15% of Zoom shares.

Does Zoom pay dividends?

Zoom doesn’t pay dividends, nor is it likely to. Historically, few mid- to large-sized US tech companies have paid dividends to investors.

What stock exchange is Zoom listed on?

Zoom is listed on the NASDAQ stock exchange in New York.

Can I buy fractional shares of Zoom stock?

If you don’t have hundreds of dollars to invest, you can still purchase shares of Zoom. All three of the brokers we recommended allow you to buy fractional shares. So, you can start trading with as little as $1.

See Our Full Range of Stock Buying Resources

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up