Billionaire investor and chairman of money manager Oaktree Capital Howards Marks sees value in “out of favor” investments like real estate and stocks in the hospitality and entertainment sectors.

Howard Marks sees opportunity in beaten down sectors.

Marks admitted that “It’s not easy to find opportunities today.” He added “You get to a point where everything is selling at a fair price relative to the very low interest rate but still at very low prospects of returns. And I think that’s where we are.” “So where are the opportunities today? The opportunities are in the things that are out of favor,” said Marks.

Commenting on the polarization in the US stock markets, Marks said “I think we’ve developed a real dichotomy between the things that are obviously successful but expensive, and the things that look low-priced but are challenged in terms of business. And big money will be made by buying the latter which works in my opinion.”

Polarization in US stock markets

There has been a lot of polarization in the US stock markets this year. While tech stocks, many of whom have been termed “stay at home” stocks have moved to record highs, sectors like aviation, entertainment, and hospitality fell to multi year lows.

Looking at the S&P 500’s year to date performance, the top 20 stocks have gained over 50% each while the bottom 20 stocks have lost almost 50% each. Energy, cruise line, aviation, and retail stocks are among the biggest losers on the S&P 500.

The beaten-down sectors, like the ones Marks is recommending, could bounce back once we have a successful and well-recognized medicine for the coronavirus.

Marks on the recent crash in US stock markets

Marks on the recent crash in US stock markets

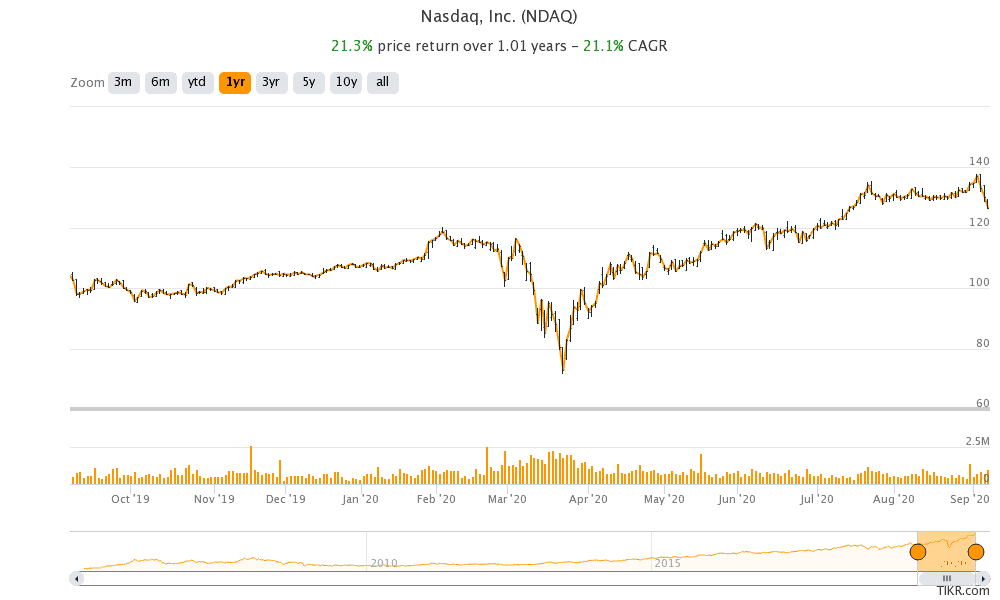

US stock markets have tumbled over the last three trading days with tech stocks falling the most. Marks, however, is not reading much into the crash and advised buying quality stocks for the long term.

“Remember that the market went up roughly 60% from the low of March 23 to the other day, and now it’s given back 6% so it’s still way off from the bottom, it’s still in the vicinity of what was an all-time high set in February,” said Marks.

While Marks sees tech stocks as expensive, he said they can “still make people a lot of money.” While some see tech stocks in a bubble, Rick Sherlund vice chairman of technology investment banking at Bank of America feels that tech stocks are not in a bubble and hold long term potential.

Tech stocks in 2020

In the tech space, Apple, Amazon, and Netflix have respectively gained 64%, 78%, and 60% so far in 2020 and Apple became the first company ever to command a market capitalization of $2tn.

US stock markets look set to open on a positive note today after three days of losses and the Nasdaq up 1.9% in pre markets.

You can trade in stocks using several instruments including CFD or Contract for Difference. We’ve compiled a list of some of the best brokers for CFDs. We’ve also compiled a handy guide on how to short stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

Marks on the recent crash in US stock markets

Marks on the recent crash in US stock markets