Snap stock was trading over 24% higher in pre markets today after posting better than expected third quarter earnings. However, Netflix which also reported its earnings yesterday missed consensus estimates and its stock was trading down in pre markets.

Snap’s third quarter earnings

Snap generated revenues of $679 million in the third quarter which was ahead of the $556 million that analysts polled by Refinitiv were expecting. The revenues increased 52% year over year which Snap’s CEO Evan Spiegel said reflects “the substantial value we drive to both direct response and brand advertisers during this continued period of uncertainty.” He added, “Our success underscores the excitement that our community and our advertising partners have around our innovative products and services.”

A surprise profit

Snap posted a surprise profit of 1 cent per share while analysts were expecting it to post loss of 5 cents per share. Markets gave a thumbs up to Snap’s surprise profit.

Incidentally, Tesla, which is set to release its third quarter earnings today after the close of markets, had posted a surprise profit in the third quarter of 2019 that triggered a rally in its stock price. Since then, Tesla has posted a net profit in every quarter and analysts are forecasting that the Elon Musk-led company would post a net profit in the third quarter of 2020 also.

While Snap’s third quarter earnings were ahead of estimates, Netflix missed consensus earnings estimates. The company’s subscriber growth also disappointed and it gave a weak guidance for fourth quarter also.

Key highlights of Snap’s earnings

Snap’s daily active users in the third quarter rose 4% as compared to the second quarter to 249 million. Its average revenue per user was $2.73 in the third quarter ahead of the $2.27 that analysts surveyed by Refinitiv were expecting.

“The adoption of augmented reality is happening faster than we had previously anticipated, and we are working together as a team to execute on the many opportunities in front of us,” said Spiegel.

Snap management on the outlook

Snap expects its revenues to increase between 47% and 50% in the fourth quarter and expects its daily active users to rise to 257 million. “While there is continued uncertainty about the macro operating environment, we are pleased with the strength of the underlying momentum we have established with our advertising partners, and we remain highly optimistic about the long-term prospects for our business,” said Snap’s CFO Derek Anderson.

Snap also talked about an uptick in advertising rates. Ad spends as well as rates had tumbled in the early days of the pandemic hurting companies like Snap and Facebook that rely on ad revenues.

Facebook’s pain is Snap’s gain

In its earnings call, Snap also alluded to advertisers quitting Facebook over hate speech. Over 1000 advertisers stopped ads on Facebook in July amid the StopHateForProfit campaign. “We saw many brands look to align their marketing efforts with platforms who share their corporate values,” said Snap’s Chief Business Officer Jeremi Gorman. She added, “This gave us an opportunity to engage with advertisers and agencies in real time to ensure that our existing partners as well as new prospects understood our offering in relation to our values.”

Gorman also said that “We implemented a strategy to ensure advertisers investing in Snap found early and sustained success on our platform as they scaled with us, and we believe that the customer service our teams provided, the alignment on our brand safety principles, and the strong ROI that our advertising partners achieved all contributed to our growth this quarter.”

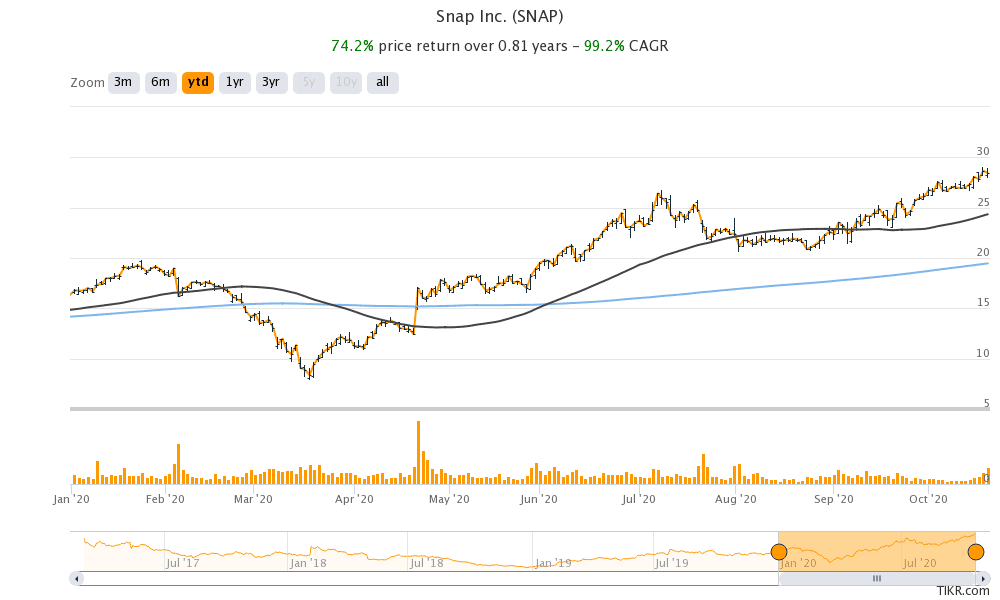

How Snap stock has fared in 2020

Snap stock has gained 74% so far in 2020 and has outperformed the Nasdaq by a wide margin. It has a 52-week trading range between $7.89 and $29.08. Looking at the movement in post markets, Snap stock looks set to hit its new 52-week high today.

According to the estimates compiled by CNN, Snap has a median price target of $28 which is a discount of 1.5% over its yesterday’s closing prices. Its lowest price target of $19 is 33% below its current stock price while its highest price target of $35 represents a 23% upside over yesterday’s closing prices. After Snap’s stellar third quarter results, analysts might revise their target price on the stock.

Currently, 25 out of the 38 analysts covering Snap have a buy or higher rating while 11 rate it as a hold. The remaining two analysts have a sell rating on the stock.

You can buy Snap stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account