Netflix (NYSE: NFLX) released its earnings for the first quarter of 2023 yesterday after the markets closed. While the stock initially crashed following the release it subsequently recovered and is trading flat in US premarket price action today.

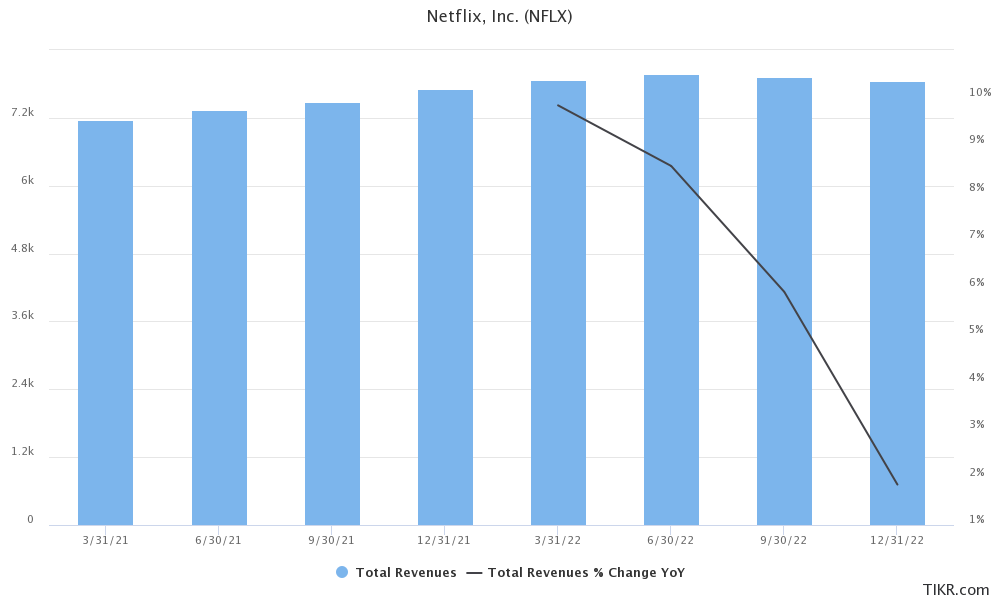

Netflix reported revenues of $8.16 billion in the quarter which was slightly short of the $8.18 billion that analysts expected. The metric rose 3.7% in the quarter which is higher than the 1.9% growth in the previous quarter.

Meanwhile, the company’s adjusted EPS fell to $2.88 in the quarter – down from $3.53 in the corresponding quarter last year. It was nonetheless ahead of the $2.86 that analysts were expecting.

Netflix reports mixed results for Q1 2023

Netflix added 1.75 million net subscribers in the quarter which was significantly below the 2.3 million that analysts expected. It had a total of 232.5 million global paying subscribers at the end of the first quarter.

Netflix’s subscriber growth has come down. For instance, last year it added around 9 million subscribers which were nearly half of the previous year.

Also, in Q1 2022 it lost subscribers – partially because of its decision to exit Russia after the country invaded Ukraine.

However, Netflix has admitted to peak penetration in developed markets like the US and most of its new subscribers have been coming from emerging markets in Asia and Latin America where the average pricing is much lower than in developed markets.

Netflix launched an ad-supported tier

Last year, Netflix launched its ad-supported tier which it named “Basic with ads” priced at $6.99 per month in the US. In contrast, the Basic plan comes at $9.99 per month while the Standard plan is priced at $15.49 monthly.

While Netflix did not specify how many of its new subscribers in the quarter were for the ad-supported tier, it said that the average revenue per user under the plan is even higher than the Standard plan.

In its shareholder letter it said, “While it’s still very early days, we continue to be pleased with our progress across all key dimensions: member experience, value to advertisers and incremental contribution to our business. Engagement on our ads tier is above our initial expectations and, as expected, we’ve seen very little switching from our standard and premium plans.”

NFLX to launch a marketplace for ad inventory

It also said, “Given current healthy performance and trajectory of our per-member advertising economics, particularly in the U.S., we’re upgrading our ads experience with more streams and improved video quality to attract a broader range of consumers.”

Netflix partnered with Microsoft for its ad-supported tier. In its shareholder letter, it said that it is launching a “programmatic private marketplace” which it said would create “more buying options for Netflix ad inventory using Microsoft’s sales platform.”

Netflix to crack down on password sharing in the US in Q2

Last year, Netflix said that according to its estimates nearly 100 million households used shared passwords to watch its content. It has started to crack down on password sharing and introduced “paid sharing.”

The company expanded the feature to Canada in the first quarter and said that it would roll out the feature in the US this quarter.

It added that in Canada which it believes is a “reliable predictor for the US” the paid subscriber base is now higher than what it was before the rollout of paid sharing.

It said, “While we could have launched [paid account sharing] broadly in Q1, we found opportunities to improve the experience for members. We learn more with each rollout and we’ve incorporated the latest learnings, which we think will lead to even better results.”

It added, “while this will shift some of the membership growth and revenue benefit from Q2 to Q3, we believe it will result in a better outcome for our members and our business.”

NFLX guidance

Netflix has now stopped providing guidance for subscribers and instead gives revenue and EPS guidance.

It forecast revenues of $8.242 billion in the second quarter which is below the $8.476 billion that analysts were expecting and implies a YoY growth of 3.4% – lower that the growth in the first quarter.

The company forecast an EPS of $2.86 in the quarter which was again lower than the $3.05 that analysts were expecting. Netflix posted an EPS of $3.20 in the second quarter of 2022.

It however raised the full-year free cash flow guidance to $3.5 billion – up from the previous projection of $3 billion.

Separately, the company announced that it would wind down its DVD shipping business later this year.

It said, “our goal has always been to provide the best service for our members but as the DVD business continues to shrink that’s going to become increasingly hard.”

Netflix on competition

Netflix also talked about competition in its shareholder letter and said “competition remains intense as we compete with so many forms of entertainment.”

It said that for traditional media companies, streaming is like a revenue diversification “as they manage through the hard transition from legacy businesses to streaming.”

It added that tech peers are focusing more on sports streaming.

Netflix summed up by saying, “We don’t focus too much on the competition because we’ve learned over the years that consistently great execution (better movies, TV series, and now games, better discovery and buzzier, more creative marketing) is the key to our long term success. We succeed by getting a bit better, a bit faster than the competition every month.”

All said, streaming competition is real and companies are pricing their plans competitively in order to attract as well as retain existing users.

Disney is focusing on streaming profitability

However, at least Disney has pivoted from focusing solely on subscriber growth to an intense focus on profitability.

Barring Netflix, not many streaming companies are posting profits and would sooner than later face shareholder ire over the losses.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account