Disney is set to release its earnings on 12 November after the close of the markets. In this article, we’ll discuss what should investors expect from the company’s fiscal fourth quarter 2020 earnings release.

Disney’s earnings estimates

According to the data compiled by Tikr, analysts expect Disney to post revenues of $14.14 billion in the fiscal fourth quarter—a year over year decline of 26%. Disney’s revenues had tumbled almost 42% in the previous quarter also. Analysts expect the company’s revenues to fall in the next two quarters also before turning back to growth in the third quarter of fiscal 2021.

The expected fall in Disney’s revenues is not surprising though. The company’s theme parks in California are still closed which prompted it to announce thousands of layoffs in September. That said, the layoffs were across Disney’s businesses and not limited to the parks segment.

Analysts expect Disney to post a per-share loss of $0.65 in the fiscal fourth quarter as compared to adjusted earnings per share of $1.07 in the corresponding quarter last year.

What should you watch in Disney’s earnings call?

Last month, Disney announced that it is restructuring its business and is shifting its “primary focus” to streaming. “Given the incredible success of Disney+ and our plans to accelerate our direct-to-consumer business, we are strategically positioning our Company to more effectively support our growth strategy and increase shareholder value,” Bob Chapek, Disney’s chief executive had said then.

Focus on streaming

While Disney’s stock had soared after it announced the restructuring, not all analysts were convinced about the move.

“I’ve always thought of Disney as a company that rolls out maybe five blockbusters a year, very high-quality content. Now, I think they’re going to have to dilute quality so they can increase quantity,” said Mark Tepper, president, and CEO of Strategic Wealth Partners. Tepper said that he would consider Disney stock only if it were to fall under $110. The stock at $127.46 on Friday.

Disney suspended its dividend this year

During their fiscal fourth quarter earnings call, Disney management might face probing questions on its shift towards streaming. Also, markets would watch out for some sort of direction on dividend resumption. The company had suspended its dividend earlier this year amid the COVID-19 pandemic. To be sure, Disney wasn’t alone in suspending its dividend and several companies either suspended their dividends or reduced the dividends in order to lower their cash outflow.

As the business environment has improved, some companies have brought back their dividends. While Disney typically does not announce the dividend during the earnings calls, markets would nonetheless lookout for the commentary for the timeline of dividend resumption.

Disney’s tussle with California

Disney had criticized California’s Democratic Governor Gavin Newsom for not allowing the reopening of theme parks in the state. Calling upon California to reopen theme parks, Disney’s Head of Parks Josh D’Amaro said “To our California government officials, particularly at the state level, I encourage you to treat theme parks like you would other sectors.”

He added: “Help us reopen. We need guidelines that are fair and equitable to better understand our future and chart a path towards reopening. The longer we wait, the more devastating the impact will be to the Orange County and Anaheim communities.”

During the fiscal fourth quarter earnings call, Disney management might offer more insights on whether it has been in further talks with California about theme park reopening. Also, the management might touch upon the recent spike in coronavirus infections in the developed world and the impact on its business.

Disney stock in 2020

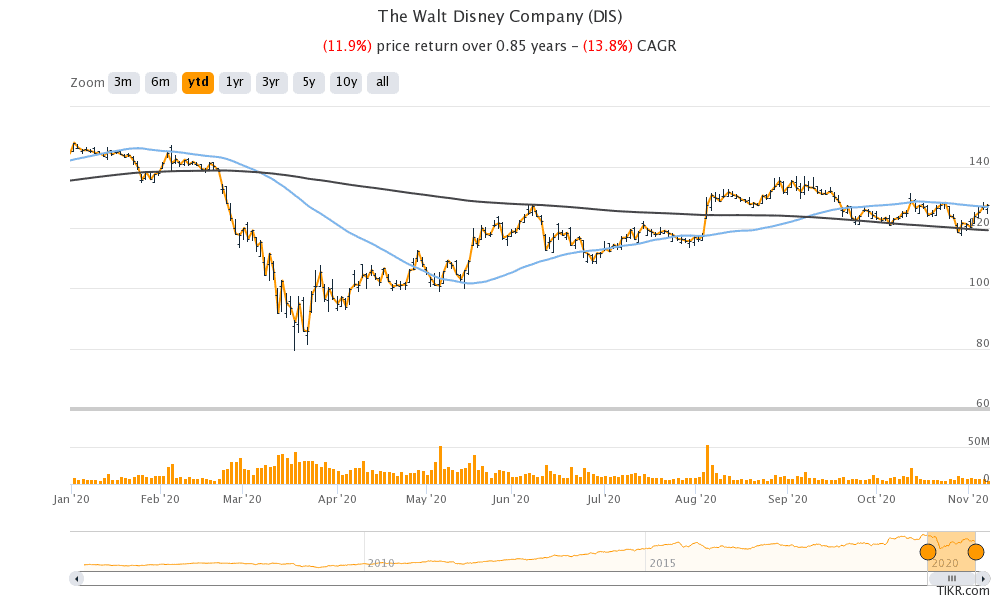

Disney stock has lost 11.9% so far in 2020 and is underperforming the S&P 500. Stock prices of companies like Disney have taken a hit from the pandemic. On the opposite side of the spectrum, the so-called “stay-at-home” stocks like Zoom Video Communications and Amazon have surged this year.

Looking at the technical indicators, in September Disney stock formed a “Golden Cross” which means that its 50-day simple moving average (SMA) crossed above its 200-day SMA. Generally, the golden cross is a bullish technical indicator on previous occasions the formation of the golden cross led to a pop in Disney stock. However, this time Disney stock has been rangebound with a downward bias even after the golden cross.

Disney: Technical and fundamental analysis.

Looking at the current picture, Disney has been finding strong support near its 200-day SMA but facing resistance at the 50-day SMA. On Friday, the stock closed just short of its 50-day SMA. Disney stock would need to break above its 50-day SMA to signal a short-term uptrend.

Looking at the valuation, Disney stock trades at a next 12-month (NTM) enterprise value to revenue multiple of 4.5x and an NTM price to earnings multiple of 125x. While both these multiples are ahead of its long-term averages, it’s because of the fall in near term earnings due to the business disruption caused by the COVID-19 pandemic.

You can buy Disney through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account