US stock futures are starting the week on a negative tone as they are sliding slightly from last week’s record highs while investors await more earnings reports from top corporations including Coca-Cola (KO) and United Airlines (UAL).

The three major indexes in the United States ended last week at record highs, with the S&P 500 advancing 1.37% at 4,185 while the Dow Jones Industrial Average and the tech-heavy Nasdaq 100 finished at all-time highs as well, up 0.98% and 1.42% at 34,200 and 14,041 respectively.

This positive performance was primarily fueled by a retreat in US Treasury yields, while America’s largest banks including JP Morgan (JPM), Morgan Stanley (MS), Goldman Sachs (GS), and Citigroup (C) reported strong earnings as a result of a boom in their market-facing business units. Meanwhile, retail sales data painted the picture of a strong comeback from the US economy aided by the government’s latest COVID stimulus bill.

However, future contracts of major indexes are sliding this morning, with the Nasdaq 100 leading the downtick as it is retreating 0.25% while E-mini futures of the S&P 500 and the Dow Jones are down almost 0.2% each as well.

The economic calendar for the week is lighter than usual, with the Johnson Redbook Index – which measures the performance of retail sales in the US – scheduled to be released tomorrow along with data covering existing home sales, which will be published on Thursday.

Perhaps the most important economic data release this week will be the IHS Markit PMI Index for the United States and multiple key nations in Europe including France, Germany, the United Kingdom, and the Eurozone as a whole.

Today’s retreat in US stock futures seems to contradict the usual uptick that tends to follow a weaker dollar and lower Treasury yields, as the US dollar index is plunging 0.5% in early forex trading activity at 91.122 while Treasury yields are dipping 0.3 basis points at 1.580%.

This week’s performance in US stock futures and indexes will probably be driven by upcoming earnings releases from top corporations in the United States, with Netflix (NFLX), Procter & Gamble (PG), and International Business Machines (IBM) being among those that will be publishing their results in the following two days.

In regards to this week’s outlook, Matthias Scheiber, the global head of portfolio management for Wells Fargo, commented: “Risk is coming down, volatility is coming down … we see the slow reopening of global economies, the rollout of the vaccine and the huge catch-up in demand so from that perspective it should be positive for economic growth”.

What’s next for US stock futures?

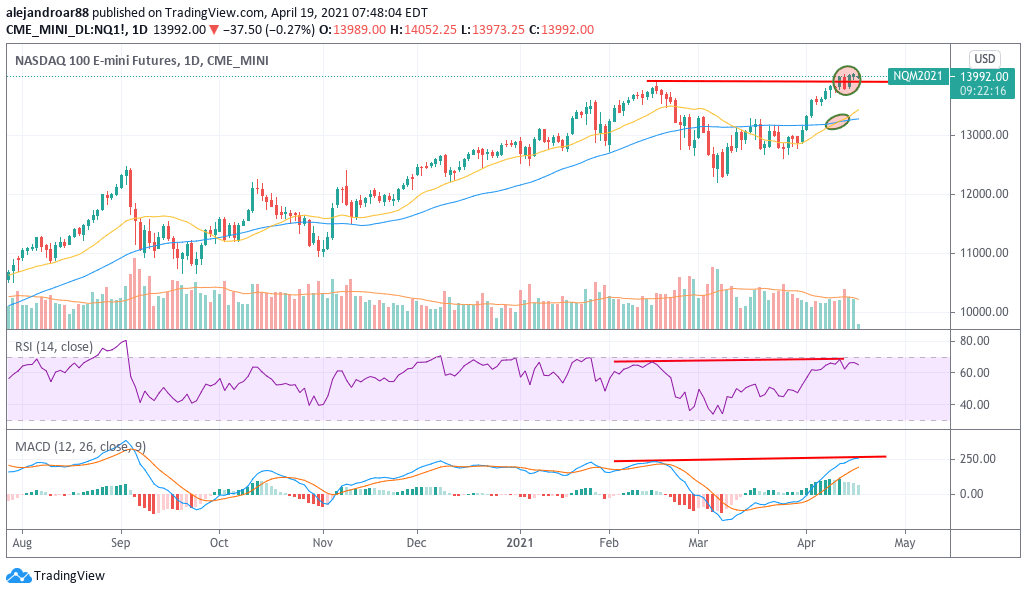

As we reported last week, the 13,900 area was the resistance to overcome for the Nasdaq 100 and that particular goal was accomplished by the end of last week while the index is hovering above that mark this morning in early futures trading action as well.

That break is instilling a bullish tone to this week’s upcoming price action with both the RSI and the MACD posting higher highs to accompany the uptrend.

Moreover, a golden cross has taken place last week, with the 20-day moving average now crossing above the 50-day MA. The last three times this has happened, the tech-heavy index has moved higher for two months at least, which reinforces the thesis that we could witness new record highs in the Nasdaq for a while.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account