How to Buy Citigroup Stock for Beginners

Citigroup is a multinational bank and financial service company that offers a wide range of services. It is headquartered in New York and was started in 1998 when banking giant Citicorp merged with financial corporation Travelers Group.

The company is incorporated in the New York Stock Exchange (NYSE) and owns Citicorp and several other local and international subsidiaries.

Citigroup is considered the third-largest bank in the US competing with JPMorgan, Wells Fargo, and Bank of America. It is on the list of the most prominent and most stable financial institutions in the world – considered to be too big to fail. In terms of the number of countries it operates and the customer base, it is one of the largest banks in the world.

In this article, we review three top online brokerages where you can buy and sell Citi stock and give you a step by step guide on how to buy Citi Stocks.

-

-

3 Quick Steps to Buy Citigroup Stock

Want to buy Citi Stocks right away? Follow this 3-step guide:

[three-steps id=”197324″]Where to Buy Citigroup Stock?

Before you can buy Citigroup stocks, you should first have an account with a licensed and regulated stock broker.

Below is a review of our highest recommended brokers.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Provider Detailed Overview

1. eToro – Best Stock Broker for Worldwide Customers

Founded in 2007, eToro is one of the most popular online trading platforms that list the Citigroup stock. It is an easy-to-use copy trading platform where you can copy the strategies of other professional traders. With a trust score of 91, it is considered to be one of the most secure and reliable stockbrokers you can find online.

eToro is regulated by top-tier authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investment Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

The key feature of the eToro trading platform is the simplicity of its copy trading platform. There are numerous experienced traders on the platform who are willing to be copied. This accessibility enables you to mimic their successful strategies in real-time. Although other trading platforms have introduced copy trading, none has been able to merge it with social trading like eToro.

To open an account on eToro, you will need to deposit a minimum of $200. However, the minimum initial deposit for Australia and US residents is only $50. Some of the accepted deposit methods include debit/credit card, PayPal, Skrill, and Neteller and while you deposit via wire transfer, the minimum for this is $500.

Our Rating

- Easy to use platform

- Simple account opening process

- Outstanding copy-trading feature

- High fees

75% of investors lose money when trading CFDs.2. Plus500 – A Comprehensive CFD Broker to Trade Citigroup Stock

Plus500 is a leading global trading platform that started its operations in 2008. It is famous for allowing its customers to trade more than 2,000 financial instruments through CFDs. It also has a simple design that is intuitive and best suited for experienced traders alike.

It is a safe and secure way to buy Citigroup stock CFDs. Plus500UK Ltd is authorized & regulated by the FCA, Cyprus Securities Exchange (CySEC), Australian Securities and Investment Commission (ASIC), and Monetary Authority of Singapore. These are some of the most reputable regulatory agencies in the world.

To keep things simple, Plus500 has only two types of trading accounts: the live trading and the demo account. Opening an account is straightforward, and you will only need to provide your basic information. There is also no time limit on how long you can use the demo account.

Although Plus500 does not impose commissions on CFD trading, it maintains several trading fees. These include the overnight fee thats deducted from your account if you leave a position open overnight or throughout the weekend as well as a $10 monthly inactivity fee if you don’t log in for three consecutive months.

Our Rating

- Numerous payment options

- Unlimited demo account

- Five free withdrawals per month

- Limited research resources and tools

80.5% of retail CFD accounts lose money.3. Stash Invest – Best USA Broker

Stash Invest is the best budget-friendly stock broker you can find today. It is an ideal option for people with limited investment capital and without any prior investing/trading experience. The process of choosing investments on its platform is very quick and easy.

Its trading platform has made investing affordable and accessible. For instance, there is no minimum amount required to open an account. Also, it allows you to buy a fraction of a company’s stock if you don’t have enough money to buy it as a whole.

Stash Invest offers three main pricing options. There is a beginner plan that costs $1 a month and comes with a basic brokerage account, banking account and free financial guidance. There is also the $3 per month growth plan account that offers retirement investing, taxable brokerage, and other banking options. Then there is Stash+ plan costs $9 per month. It is the most robust option wand features all the aspects of the other two accounts as well as two custodial accounts. Plus, if you deposit $300 within 30 days, you will be given a $50 bonus.

Dividends offer impressive returns and long-term growth. Recently, Stash Invest started offering free dividends reinvestment. This means that you can now automatically reinvest dividends across a wide variety of investment products.

Our Rating

- $50 bonus

- Expansive educational content

- Free dividends reinvestments

- Costly monthly fees

How to Buy Citigroup Stock from eToro

eToro is one of the best stock trading platforms that you will allow you to easily buy Citigroup stocks.

Assuming that you have already created an account, verified your identity and made your first deposit, below are the necessary steps you need to take to buy Citigroup stock from eToro.

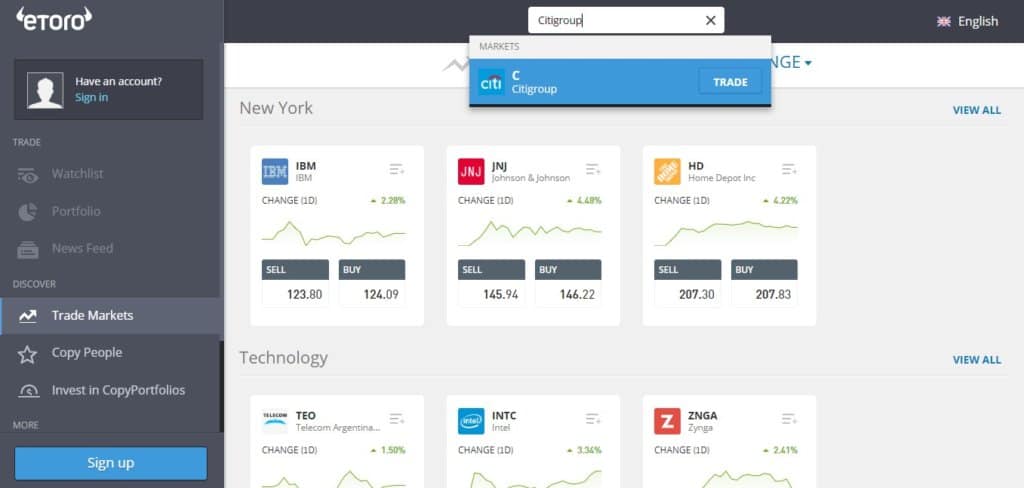

Step 1: Search for Citigroup stocks

You can use eToro search bar to search for Citigroup stocks. When you type the market symbol or company name, the relevant results will appear automatically.

Apart from the price chart, you will also get important information about the stock such as the company’s income statement, balance sheet and other research tools. This will enable you to make an informed decision of whether to buy or short the stock.

Step 2: Click on ‘Trade’

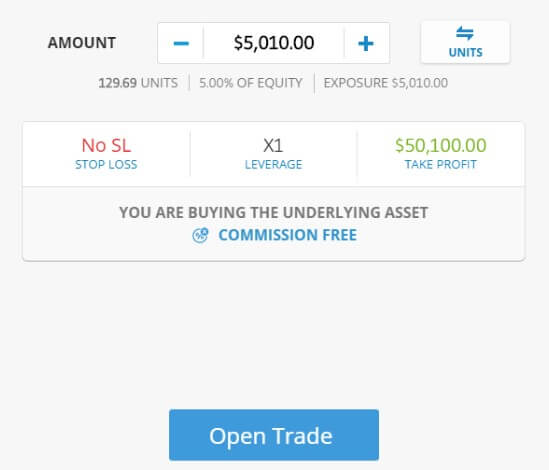

You will now need to click on the ‘Trade’ button, which will then create your order form.

Step 3: Buy Citigroup Stock

After funding your eToro account and searching for Citigroup stock, you can make a buy order for any amount of Citigroup stock you want to purchase.

Click the ‘Open Trade’ button to place specific details of your buy order. A new window will pop up wherein you can tweak the parameters of your buy order.

Why Invest in Citigroup?

Earnings Per Share Growth

Many investors are looking for investment options that can generate consistent cash flow. One of the things they do is buying stocks that offer dividends, which pertain to the distribution of the company’s earnings to shareholders. A lot of studies have shown that dividends make up a big part of long-term returns.

In the first quarter of 2020, the Citigroup stock price has changed significantly. At the moment, the company is paying a dividend of $0.51 per share. The dividend yield is 5.15%, which is higher than the rates offered by equally prominent players in the industry.

In terms of dividend growth, the current annualized dividend is set at $2.04, which is a 6.3% increase from last year. The company has increased its dividend 5 times on a year-on-year (YOY) basis in the last five years. The continuity of this trajectory will mainly depend on its earnings growth and payout ratio. In the 2020 fiscal year, Citigroup is expecting substantial earnings growth.

Growth in Core Business

The company has been taking steps to reduce its expenses and streamline operations in a bid to improve its profit margins. Recently, it is reducing teh number of branches and shifting to digital and embracing digital banking.

Undervalued Stock

The company has a P/B ratio of 0.78x against the industry’s average of 1.37x. Looking at this ratio, it seems like the Citigroup stock is undervalued. This makes it an ideal option for both short-term and long-term investors.

Committed to Rewarding Shareholders

The company has a reliable repurchase program. This, coupled with its increased dividend, is an indication that the company has good capital strength and is committed to rewarding its shareholders.

Excellent Expense Management

In the last four years, the company has been able to successfully reduce expenses at a compound annual growth rate (CAGR) of 9.2%. Cost management measures such as reducing legacy assets and closing some of the physical branches will lead to bottom-line growth in the long-run.

About Citigroup Stock

Citigroup Company Background

To get a full overview of Citigroup, we will look at the histories of both the Citicorp and Travelers Group companies that merged to form Citigroup.

Citicorp

Citicorp roots can be traced back to June 16, 1812 when City Bank of New York was chartered with a $2 million capital. The bank started its operations on September 14 of the same year to serve a group of New York merchants. Samuel Osgood was elected as the first president of the bank. After joining the US national banking system in 1865, the bank changed its name to The National City Bank of New York. By 1895, it was the largest bank in the US. In 1914, it opened its first overseas branch in Bueno Aires.

The acquisition of the International Banking Corporation in 1918 enabled it to become the first American bank to exceed the $1 billion mark in terms of assets. By 1929, it was the biggest commercial bank in the world. As it continued to grow, the bank became an innovator of various financial services such as compound interest on savings, unsecured personal loans, and negotiable certificates of deposit, etc.

In 1955, the bank’s name was changed to The First National City Bank of New York, which was later shortened to First National City Bank. The bank started the credit card sector by introducing the ‘everything card’ system that later became MasterCard. It reorganized its operations into a single bank holding company to become the First National City Corporation and formally to ‘Citicorp’ in 1974. The First National Bank then changed to Citibank, which launched Citicard and started 24-hour ATMs.

Travelers Group

At the time of the merger, Travelers Group was a company with diverse financial interests organized by Sandy Weill. It can be traced back to 1986 when Weill bought the commercial Credit Division of Control Data Corporation. It was a small division that was rejected by the parent company. However, through cost-cutting and motivating employees, Weill rebuilt the company and merged it with Primerica. Through the process, he also acquired a securities firm, Smith Barney. The new company adopted the name Primerica and acquired Travelers Insurance and Shearson. Later, the company changed its name to Travelers Group.

The merger between the Citicorp and Travelers Group was announced to the world on April 6, 1988, creating a $140 billion firm with close to $700 billion assets. In this deal, Travelers Group got all Citicorp shares for $70 billion. Also, shareholders from both companies owned about half of the new firm. It maintained the ‘Citi’ brand name and the distinctive Traveler’s Group red umbrella as the corporate logo. Also, the chairmen of both companies became co-chairs and co-CEOs.

Citigroup Stock

The NYSE symbol of Citigroup stock is C.

The last time Citigroup experienced a decline in its earnings was in 2016. Ever since then, its overall earnings per year, as well as Citigroup’s stock price, have only gone up.

From 2017 to 2018, its earnings grew by 25%. The earnings growth slightly slowed down in 2019, gaining only 20%. In 2020, Citigroup’s earnings growth is projected to increase by a mere 5%.

The annualized dividend for Citigroup stock in 2019 was $2.04 per share, which is 6.3% higher than the dividend it paid in 2018.

During the first quarter of 2020, the highest price of Citigroup stock was $81.91.

What Else Should I Know About Citigroup?

In 2009, the Citigroup Company recognized into two operating units as a recovering plan from the financial crisis. The retail and institutional client business was put under Citicorp while the brokerage and asset management under Citi Holdings. Citicorp remained as a single company handling the traditional banking services, and Citi Holdings was tasked with managing riskiest investment assets. However, in 2016, Citigroup stopped reporting separate results from the Citi Holding subsidiary.

The company started coming back to profitability in 2010 when it made $10.6 billion profit from a $1.6 billion loss the previous year. In a bid to expand the retail banking operations, the company introduced digitized smart banking branches in New York, Washington, South Korea, and Tokyo. In addition, it continued revamping all its branches. At the moment, Citigroup holds the following divisions:

- Citigroup Global Markets, Inc.

- Citi’s Institutional Clients (ICG)

- Corporate and Investment banking

- Capital Markets Origination

- Citi Private Bank

- Treasury and Trade Solutions (TTS)

- Citicorp

- Citinanamex

Should I Buy Citigroup Stock?

In 2019, Citigroup showed solid earnings growth. However, due to the US-China trade war affecting the global market, some investors may have reservations about investing in the Citigroup stock. But should you?

Citigroup stock has a composite rating of 50, with a strong EPS rating of 91. According to Investor’s Business Daily (IBD), investors should consider stocks with a composite score above 80. This makes Citigroup stock worth adding to your portfolio. Also, Citigroup is a formidable financial institution with diversified business interests.

Based on these, we can conclude that is highly recommended to buy Citigroup stocks.

Right now, Citigroup stock is nowhere near the pre-2008 crisis. The company has argued that it can anticipate global changes for its clients since it has more businesses concentrated outside the US than most of its rivals. However, it also means that it is more susceptible to frictions abroad. Furthermore, just like other big financial institutions in the US, its profitability is affected when the Federal Reserve cuts interest rates.

A good stock is the one that can maintain consistent earnings growth. The last time the company’s earnings growth slightly dropped was in 2016. Up to now, the company has been keeping a positive earnings growth. In 2018, Citigroup’s earnings grew by 25%. However, due to challenges such as the China-US trade war, the earnings growth declined to 20% in 2019. Still, the company is expected to increase its earnings growth by 5% in 2020.

The 2019 third-quarter results showed earnings per share growth but lower overall revenues. Fortunately, its return on common equity was 12.2%. This was more than the company’s projection of 12%. Also, the company’s fourth-quarter results surpassed its expectations.

Additionally, reorganization efforts have always been proven fruitful and could also swing future revenue and earnings growth. For instance, in 2018, the company revamped its entire retail bank business and concentrated more on the credit-card sector. Allegedly, the company is also fusing its capital markets division with the investment banking business.

Conclusion

Citigroup is the third-largest financial institution in the US and a major player in the global financial industry. If you are looking for new stocks to invest in, then Citigroup stocks should be part of your list.

Once you’re ready to buy Citigroup stocks, make sure to use one of our recommended stock brokers above so you can enjoy a smooth and secure stock trading experience.

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

How can I buy Citigroup stocks?

Currently, Citigroup does not offer initial direct stock purchases. However, once you are a shareholder, you can buy stock directly through the Direct Stock Purchase plan. Aside from this, there are numerous online trading platforms like eToro that can help you buy Citigroup stocks.

How can I get assistance with my Citigroup stock purchase?

It is highly recommended that you contact your stock broker or financial adviser. Alternatively, you can refer to the stockholder service page for available information and resources.

What is the ticker symbol for Citigroup stock?

Citigroup stock is traded under the ticker symbol ‘C.’

Where can I get Citigroup’s annual report?

All available documents can be downloaded from its official website.

Why am I having trouble viewing Citigroup webcast?

The use of pop-up blocking software can cause the webcast not to work. Make sure to turn it off before viewing again Citigroup’s webcast.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up

Citicorp roots can be traced back to June 16, 1812 when City Bank of New York was chartered with a $2 million capital. The bank started its operations on September 14 of the same year to serve a group of New York merchants. Samuel Osgood was elected as the first president of the bank. After joining the US national banking system in 1865, the bank changed its name to The National City Bank of New York. By 1895, it was the largest bank in the US. In 1914, it opened its first overseas branch in Bueno Aires.

Citicorp roots can be traced back to June 16, 1812 when City Bank of New York was chartered with a $2 million capital. The bank started its operations on September 14 of the same year to serve a group of New York merchants. Samuel Osgood was elected as the first president of the bank. After joining the US national banking system in 1865, the bank changed its name to The National City Bank of New York. By 1895, it was the largest bank in the US. In 1914, it opened its first overseas branch in Bueno Aires. At the time of the merger, Travelers Group was a company with diverse financial interests organized by Sandy Weill. It can be traced back to 1986 when Weill bought the commercial Credit Division of Control Data Corporation. It was a small division that was rejected by the parent company. However, through cost-cutting and motivating employees, Weill rebuilt the company and merged it with Primerica. Through the process, he also acquired a securities firm, Smith Barney. The new company adopted the name Primerica and acquired Travelers Insurance and Shearson. Later, the company changed its name to Travelers Group.

At the time of the merger, Travelers Group was a company with diverse financial interests organized by Sandy Weill. It can be traced back to 1986 when Weill bought the commercial Credit Division of Control Data Corporation. It was a small division that was rejected by the parent company. However, through cost-cutting and motivating employees, Weill rebuilt the company and merged it with Primerica. Through the process, he also acquired a securities firm, Smith Barney. The new company adopted the name Primerica and acquired Travelers Insurance and Shearson. Later, the company changed its name to Travelers Group.