Popular Futures Trading Accounts for Beginners 2026

To help you understand how futures trading works and get a grasp on its surrounding dynamics, we’ve put together this comprehensive guide which covers the basics around futures trading.

It delves into the ins and outs of futures and some popular trading platforms.

-

-

Step 1: Open a Futures Trading Account

Criteria For Choosing Popular Futures Trading Platforms

Below are our most recommended futures trading account providers. They are all licensed and regulated by various top-tier financial authorities in the world so you can be assured that they can provide you with robust and secure trading platforms.

Some of the other factors we looked at are listed below.

- Company reputation

- Security features of the trading site

- Specific features (charting tools, indicators and educational resources)

- Fees and other charges

1. TD Ameritrade – Robust Trading Platform

Founded in 1975, TD Ameritrade was one of the first online brokerage firms in the US. It offers an all-round trading experience with a robust set of tools and features for all investor levels.

When it comes to trading futures on TD Ameritrade, there are a number of obvious advantages. First, its account minimum requirement, which is $1,500, is relatively low. It offers a day trading margin of 25% and a lot of futures products to trade 24 hours a day, 6 days a week. Day trading on margin requires a $15,000 minimum and offers virtual trading capabilities.

Second, thanks to the highly-renowned desktop-based trading platform, Thinkorswim, order entry and execution is fast. With the vast array of tools that it has to offer, traders have their work cut out as far as technical analysis and charting go. Its research and data are also above par.

One of the impressive features that will come in handy during futures trading is ThinkBack. Using this feature, you can backtest your strategies and find out what works for you before actual trading. It is also possible to replay historical markets by the tick.

On the downside, it charges $2.25 for every contract, in addition to regulatory and exchange fees. For frequent traders, the high commissions are a major turn-off.

Futures Trading Fees:

- Futures trading - $2.25 per contract (plus regulatory and exchange fees)

- Margin day trading – 25% ($15,000 minimum)

Our Rating

- Excellent trading platform

- Comprehensive research and analysis tools

- Top-notch education features for beginners

- High trading commissions

Sponsored ad2. Interactive Brokers – Popular for Professionals

Founded in 1977, Interactive Brokers has been around longer than most of its competitors. Its suite of features specifically targets professional traders. It has a wide reach, serving at least 125 markets globally. The service is extremely popular with the institutional community, with a good number of hedge funds operating accounts here.

With regard to futures trading, one of the major benefits of using this service has to do with its low margin rates. These go as low as 1.41% for high net-worth traders.

Its trading platform, Trader Workstation (TWS), is highly customizable and has more than 65 order types. This makes it ideal for placing all manner of trades. For expert traders, the configuration options are limitless. There are programmable hotkeys and watchlists that can have as many as 338 columns.

A major downside to using this service is the fact that you will need to make a $100,000 minimum deposit to operate a margin account. Even though it has tried to simplify the platform for newbies, the slew of possibilities can be overwhelming to a beginner.

Futures Trading Fees:

- Futures and futures options trading - $0.85

- Margin rates – 1.91% to 1.41%

- Minimum deposit account opening - $10,000

- Minimum deposit for margin accounts - $100,000

Our Rating

- Highly competitive fees

- Customizable features

- Plenty of order types and access to numerous markets

- Not the most user-friendly platform

- High initial deposit for margin accounts

Sponsored adFeatures to Look for When Choosing a Futures Trading Platform

Here are some of the most important factors to keep in mind when choosing a trading platform:

- User-friendliness

Different platforms are designed to suit different target groups. Make sure to find one that suits your trading needs.

While Interactive Brokers is a great platform, it is not the most beginner-friendly choice. Its features favor more knowledgeable traders. TD Ameritrade’s Thinkorswim, on the other hand, is an impressive trading platform, but it has a steep learning curve.

- Tools

Depending on your trading style and technical needs, you need to assess the suitability of a trading platform’s suite of tools. Beginners need a comprehensive educational section and an opportunity to practice using a demo account. Pros, on the other hand, require a more advanced platform with robust research and analysis tools.

TD Ameritrade is renowned for its desktop trading platform which is home to a remarkable collection of tools.

- Fees

If the fees on a given platform are excessively high, they will inflate transactional costs and lower your overall gains. Find a platform that provides proper value for money and offers a transparent fee structure.

While Interactive Brokers has highly competitive fees, opening an account here requires a $10,000 initial deposit and $100,000 for margin accounts. TD Ameritrade excels in other areas but is rather expensive.

- Markets

Based on your trading needs, you need a service that offers access to the required futures markets. The higher the number of markets you can access on a given site, the better. That way, you will not need to find a new provider when you choose to extend the scope of your trading.

Interactive Brokers offers access to 125 markets in 31 countries.

- Trading Platform Performance

How reliable is a given service when it comes to order execution? Does its trading platform have frequent downtimes and outages that could impact your trading? Find a futures trading platform with impeccable performance for smooth trading.

TD Ameritrade excels in this regard thanks to its time-tested Thinkorswim desktop trading platform.

Step 2: Learn How the Futures Trading Market Works

What is Futures Trading?

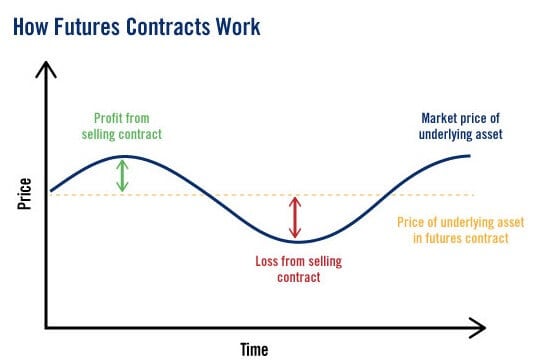

Before we get into futures trading, we need to understand the term ‘futures.’ It refers to derivative financial contracts between two parties, stipulating that they will sell or buy an asset at a specified future date and a set price.

Regardless of the market price of the asset at the time the agreement stipulates, the seller must sell or the buyer must buy the asset at the agreed price. The idea behind the practice is to safeguard against the possibility of wild swings in prices that may occur in the future.

For example, a distributor of fuel may want to sell a fuel futures contract to protect the business against a possible price drop. At the same time, a delivery truck company may want to lock in a good fuel price to avoid a sudden increase. These two can create a futures contract to buy or sell 10 million liters of fuel in 60 days at a price of $1 per liter.

Not everyone in the market is interested in hedging product prices. Investors can use these very contracts to speculate on the price direction of a financial instrument. Trading futures does not involve taking possession of the contracts. Rather, it is a way to make money from the price fluctuations of the assets.

To illustrate, if fuel prices increase before the aforementioned contract expires, it would become more valuable. The holder may choose to sell it and subsequent holders can keep buying it and selling it, wagering on the movements of fuel price.

How does Futures Trading work?

When it comes to futures trading, you can hold two basic positions (short or long). If you hold a short position, this means that you agree to sell the asset in question upon contract expiry. In the long position, you agree to buy the asset upon contract expiry.

In order to make a profit from this, you want to go long when you believe an asset’s price will increase in a certain span of time. When you believe it will decrease, it’s time to go short.

To understand how it all works, consider an example of going long when trading stocks futures. You enter into a futures contract in March to buy 50 shares of Johnson and Johnson (JNJ) stock on July 1 at $100 per share. The contract is worth $5,000.

On May 15, the value of JNJ stock rises to $110. At this point, you may decide to sell early so as to make a profit. By selling your 50 shares contract, you will get a total of $5,500, making a $500 profit.

Going short works in a similar way. Based on the same example, however, if the value of JNJ stock drops to $90 on May 15, you can buy back the contract to make a profit. By buying it at the new price, you spend $4,500 for a contract worth $5,000. As such, your prediction that the stocks would go down makes you a $500 profit.

An interesting aspect of trading these contracts is that you only need to pay a fraction of the full contract price. This is referred to as buying on margin. Typically, margins range between 10% and 20% of the contract price.

If you buy the aforementioned JNJ stocks’ futures contract at 20% margin, you would only need to pay $1,000 instead of $5,000.

Futures trading does not always work as expected. In case you go long on JNJ stocks and the value drops to $90 instead of increasing, that would mean a loss. You would end up selling a $5,000 contract at $4,500, thus making a $500 loss. For this reason, this form of trading is considered high-risk, especially for stocks.

Assets for Futures Trading

There are plenty of assets available for futures trading. These include:

- Stock index futures e.g. the S&P 500 Index and the Dow Jones Industrial Average

- Commodity futures e.g. natural gas, beef, grain and crude oil

- Precious metal futures e.g. silver and gold

- Currency pair futures e.g. the EUR to USD future or the GBP to USD future

- US Treasury futures

Step 3: Choose a Trading Strategy

Though futures trading holds massive potential for profitability, doing it wrong can result in costly mistakes. Whether you are new to the futures market or have been at it a while, keeping in mind the following tips will help you establish a viable trading strategy:

- Understand the Market

Futures fall under a class of financial products known as derivatives. This implies that their prices are derived from other assets, e.g. currencies or stocks. In order to trade them successfully, it is imperative to understand market price, trends and other dynamics.

- Focus on your Interests

Everyone, including seasoned traders, agrees that futures trading is hard work. You need to always stay on top of news reports, read market commentary, analyze charts and many more. If you try to follow too many markets, you will likely fail because you will not give any of them sufficient attention.

- Understand the Asset

Start out by identifying a handful of assets whose futures are commonly traded. Study their price patterns, the dynamics of supply and demand and how external factors affect them. For instance, if you are thinking of trading corn futures, find out how weather affects its price. Identify major sellers and buyers among other factors.

- Learn the Art of Independent Thinking

Try not to let financial news and short-term price action shape your outlook as these can be extremely volatile. When you make a prediction based on research and analysis, learn to stick to your technical evaluation despite of temporary storms. Of course, this only applies until the price gets to your stop loss and there is no other recourse.

- Choose Contracts Wisely

When trading futures, choosing contracts can be one of the most challenging aspects. In order to get it right, find out the margin requirement and the spread (the difference between bid and ask price). Go for contracts with high liquidity as these attract lower costs when entering and exiting the market.

- Practice Backtesting

To get a sense of the market and hone your trading strategy, try backtesting. By doing so, you will get a chance to see how a contract would perform in a real trade. You can also set the entrance and exit parameters and even automate your trading strategy.

- Know when to Cut your Losses

Never let a loss become devastating before calling it quits. Admitting you were wrong may be a hard pill to swallow, but sticking to a losing position will have a far worse effect.

Step 4: Place a Futures Contract Order

Once you have created an account, verified your identity and deposited funds to your account, simply search for the asset you want to trade on. For instance, you can search ‘Oil’ and you’ll see it on the broker’s search bar.

You will then be able to see the page for oil. Aside from the chart and stats for oil, you’ll also see relevant news and posts about it.

Once you’re ready to place an order, click on the ‘Trade’ button.

Your futures contract order should specify all the different contract parameters such as the unit of measurement, currency unit of the futures contract, and the quantity of goods covered by the futures contract.

Conclusion

Futures trading is considered to be a complex art, a high-risk yet high-reward endeavor. Based on the above information, however, it is clear that mastering the art is by no means impossible.

FAQs

What is the difference between futures and options?

While futures contracts obligate the holders to buy/sell an asset at expiry, options contracts give them the right to do so, but it is not mandatory.

What are futures markets?

Futures markets refer to places where traders and investors can buy or sell futures contracts. Some of the well-known examples include the Chicago Mercantile Exchange and the New York Mercantile Exchange.

What is a margin call in futures trading?

It is a demand from a brokerage company to its customers to top up their margin account to reach the initial margin level. Typically, a stockbroker makes this call when the value of an investment drops below a certain set level (maintenance level).

What is a tick in a futures contract?

A tick basically means the smallest possible price fluctuation that a futures contract can have. You can find the tick size and value of a contract under Contract Specifications, which are published on the exchange where the contract trades.

See Our Full Range Of Trading Resources – Traders A-Z

Nica

Nica

View all posts by NicaNica specializes in financial technology and cryptocurrency. At her young age, she was already able to work with a Y Combinator-backed startup and another startup founded by Harvard graduates.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up