Forex Trading: Learn How to Trade in 2025

Forex trading, also known as forex exchange, FX, or Currency trading, is the art of trading global currencies. Forex trading is virtual and is conducted online by different entities that come together to form the global forex market.

These players make up the largest and most liquid global market whose daily transaction volumes exceed $5 Trillion.

We detail the four steps you need to start trading and also review some of the best brokers you may consider registering with in this guide.

-

-

In the global currency market, currencies are usually listed in pairs. The price at which each pair is traded usually does not remain steady but rather changes very rapidly in a matter of seconds. In other words, exchange rates at which currency pairs are traded change according to the forces of demand and supply. Such currencies whose rates are determined by market forces are known as “floating currencies”. Only floating currencies can be traded in the global online forex market. Currencies whose rates are fixed, or which are subjected to a “managed float” system where there is still some form of government interference, cannot be traded in the online forex market.

The sole aim of any kind of trading activity anywhere in the world is to be able to sell the product or the asset at a higher price than it was bought for. Trading may also be done by selling an asset for a high price and purchasing that asset once more at a lower price, thus retaining the asset and also having some profit on the transaction.

These two scenarios also play out in the trading of currencies. Currency trading involves two currencies: you have to use one currency to buy another, or you sell one currency to get another. Either way, the trade has to be done at a reference price: a price that is agreeable to both buyer and seller for the transaction to occur. This is known as the rate of exchange or exchange rate.

Step 1: Choose a Trading Platform

1. IG Markets – Online brokerage with most competitive forex spreads

IG Markets is listed company, registered and regulated by leading financial regulatory authorities including CFTC in the US and UK’s FCA. The brokerage firm has been around for over four decades and therefore comes off as one of the most experience and reputable Forex trading platform in the world.

Throughout the years, the broker has blended technology and innovation to come up with one of the most technologically advanced and innovative Forex trading platform. Their proprietary online trading systems are, for instance, riddled with highly sophisticated trading analysis, market research, and educational tools.

The account creation process on IG US is easy and straightforward. There are no minimum deposit amounts, no deposit or withdrawal fees and the forex trading fees are highly competitive.

Additional information:

- No. of supported currencies: 95

- EUR/USD spread: 0.7 pips

- Best feature: Widest range of education and research resources for beginner traders

Our Rating

- The brokerage platform features well researched educational tools

- Supports a wide variety of payment and withdrawal options

- IG is highly regulated and a reputable forex broker

- Charges inactivity fees of $12 per month if account if left unattended for 24 months

- No phone support

Sponsored ad2. Oanda – Best for low easy to use trading platform

The Oanda online trading platform is characterized by highly competitive spreads and sophisticated trading analysis and research tools. But it probably is better known for its commission free forex trades and discounted trading fees for high volume traders.

The Oanda account opening process is relatively easy and you don’t need any initial minimum deposit. Other features characterizing Oanda include maintaining one of the most advanced and feature-rich trading platform. This has a friendly user interface and integrates highly customizable charts as well as API technology.

Additional information:

- No. of supported currencies: 70

- EUR/USD spread: 1.0 pip

- Best feature: Discounted trading fees for volume traders

Our Rating

- Allows traders to trade forex with leverages of up to 1:50

- Oanda features highly advanced proprietary trading platform with impressive indicators and tools

- Easy and straightforward account registration for a platform that’s accessible on the web and as mobile app

- You will need a minimum $20,000 deposit to open the premium trading accounts

- Limited forex trading pairs available here

Sponsored ad3. TD Ameritrade – The most advanced proprietary trading platform

TD Ameritrade takes prides in itself as the online trading brokerage with the most transparent fees structure – no hidden fees. We also note that it has a highly advanced trading platform that integrates a host of both proprietary and third party trading analysis and market research tools.

It also was one of the first forex brokerage to include social sentiments from Twitter in its list of indicators. The broker recently introduced the innovative Think or Swim trading platform that has over time been hailed as one of the most educative platform. It is available in the Web Trader as well as in the form of downloadable desktop and mobile trading apps.

Plus its is gradually shifting towards social trading as evidenced by the creation of chat rooms where pro and beginner forex traders can engage one another freely and share ideas or trade strategies.

Additional information:

- No. of supported currencies: 80

- EUR/USD spread: 1.0 pip

- Best feature: The highly advanced Think or Swim trading platform with over 400 indicators and tools

Our Rating

- Features a sophisticated but easy to use Think or Swim trading platform that make it beginner friendly

- Its trading platform is highly customizable and features 400+ trading analysis tools and indicators

- TD Ameritrade is a highly regulated forex brokerage

- Broker assisted trades can quite expensive.

- One may consider the number of supported currency pairs limited

Sponsored adStep 2: Learn about Forex Trading and the FX Markets

What is forex trading?

You can trade forex in quite a few different ways. You can buy and sell currencies simultaneously, or buy one and sell another at the same time.

In the past, forex transactions were made through brokers but with online trading, you can use derivatives such as CFD trading.

With leveraged products like CFDs, you can open and close trading positions but you do not take ownership of the asset like you do with cryptocurrencies, you simply take a position on that asset and will profit based on the rise or fall of that asset’s value.

How is the FX Market Structured?

The online forex market does not have a central location. Stock markets usually have a physical exchange.

The New York Stock Exchange is located on Wall Street, while the commodities markets operate from the Chicago Mercantile Exchange located at the less well known Cermak Rd address. The forex market, however, has no central location.

Rather, the forex market is virtual and global. Connectivity is maintained via the internet, and this connection is what links all the participants in the online forex market together.

So who are the participants in the online forex market?

- Central Banks

- Institutional traders such as hedge funds, prime brokers, major banks, retail brokers.

- Retail traders.

Some central banks occasionally come to the currency market to buy or sell large quantities of either their own currencies in exchange for other currencies, in an attempt to artificially alter the exchange rates of their currencies.

This process is also known as currency intervention.

The Bank of Japan and the Swiss National Bank have at various times, performed actions that are tantamount to currency interventions. These are not regular events and only occur once in a while. It may even take several years for a central bank to intervene sequentially.

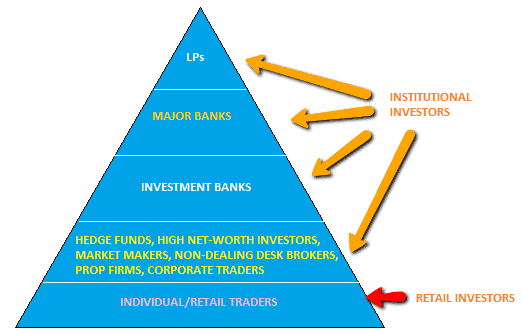

The image below shows the hierarchy of the forex market.

However, central bank interventions are important because their actions can alter the demand-supply dynamics of currencies very quickly. More commonly, central banks will affect interest rates as a consequence of their monetary policy actions.

When central banks intervene in the currency market, they perform large transactions with major banks that constitute the liquidity providers in the interbank market.

The next level of market participation comes from institutional traders.

They constitute 90% of the daily transaction volumes in the market. The 2016 Triennial Survey of the Bank of International Settlements puts daily turnover in the forex market at $5.1 trillion.

That gives us an idea of just how much daily volume comes from the banks, hedge funds, prime brokers and market makers that make up the institutional traders. Institutional traders provide the bulk of market liquidity in the FX market.0

At the bottom of the ladder are the retail traders.

They are the individual traders who open accounts with a few hundreds or thousands of dollars with a retail broker. They account for 10% of the market volume.

Due to the very small component of liquidity that they contribute, they cannot participate in the interbank market directly. Therefore, they rely on market makers to generate pricing and trade executions from the liquidity chunks that the market makers have acquired from the interbank market.

What differentiates Forex from other financial markets?

- The forex market trades 24 hours a day, 5 days a week from 10 pm GMT on Sunday to 10 pm GMT on Friday. During Daylight Savings Time, the market hours open and close one hour earlier.

- The forex market has the greatest daily turnover. At $5.1 trillion daily volume, this makes the forex market the most liquid in the world. Such liquidity ensures that trades are executed in a matter of seconds.

- Forex trading involves the pairing of currencies. Currencies are therefore always traded in pairs.

- In a currency pairing, the currency listed on the left is referred to as the base currency, while that on the right is the quote currency or counter currency. Therefore, in the EUR/USD, the US Dollar is the counter currency.

- The exchange rate displayed for a currency pair is always the amount of the quote currency that can buy 1 unit of the base currency. If EUR/USD is 1.2782, it means that it will take $1.2782 to buy 1 Euro.

- The forex market is a virtual market. You can connect to this market using your internet-connected computer or hand-held device, log into a trading platform provided by the forex brokers.

- Forex trades do not expire. They can remain open for as long as the trader wants if the Take Profit/Stop Loss price targets for the trade have not been achieved.

- Overnight positions will attract an interest charge. Long positions on currency pairs where the base currency has a higher interest than the counter currency will earn an interest rate differential, while short positions on currency pairs where the base currency has a lower interest will be charged an interest rate differential. This differential in interest rates is also known as the rollover swap.

Step 3: Understand key aspects of market analysis and Trading

Here are some elements of forex trading. It is important to understand these elements as they play a crucial role in a trader’s ability to trade the market effectively.

-

Fundamental Analysis

Exchange rates of forex pairs are wholly determined by forces of demand and supply. These forces are observable as a schedule of macro and micro-economic events known as the economic news calendar (aka the Forex News Calendar). No other market has such a schedule. The forex news calendar is a compendium of news releases on economic variables or political events which will ultimately sway the sentiment of the major market participants to either buy or sell a currency in exchange for another. Analyzing these news releases in order to determine whether to buy or sell a currency is known as fundamental analysis.

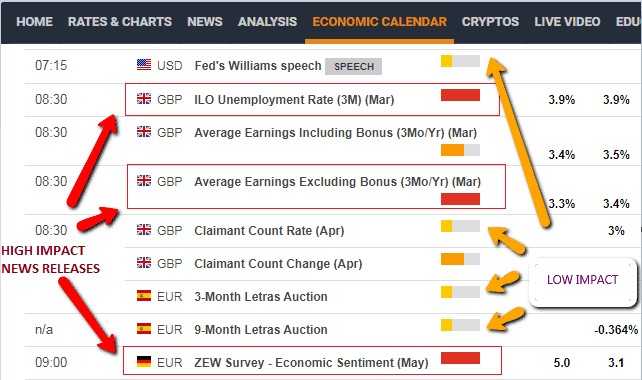

There are various fundamental news releases in an economic calendar. These are divided into low-impact, medium-impact, and high-impact news events. There are many versions of the economic news calendar online, and you will also find this calendar on the MT4 platform. Typically, the impact of a news release can be color-coded or it can be assigned stars according to the level of market impact.

- Low-impact news are assigned a green color, one to two stars and generally do not cause movements in currency pairs.

- Medium-impact news are assigned an amber color, three stars and usually move the currencies very minimally. Usually, these movements are not enough to create trading opportunities.

- High-impact news events are assigned a red color, four to five stars, and usually, create sufficient volatility to cause significant movements in currency pairs. The high-impact news are the tradable news items and are the ones mostly followed by market participants.

Economic Calendar on FXStreet

What are the high impact news events, and why do they sway the sentiment of market participants?

- Interest Rate Decisions

- Gross Domestic Product (GDP)

- Employment Data

- Manufacturing Data

- Inflation data: Producer Price Index and Consumer Price Index (PPI and CPI)

Due to the variation in economic conditions in different countries which produce the currencies being traded, some of the high-impact news releases listed above may be more important in one country and less important in another.

Furthermore, some news releases tend to affect just more than one currency. For instance, GDP and manufacturing data out of China tend to affect the Australian Dollar, as the Australian economy depends on a lot of exports of raw materials to China’s industries.

It should also be noted that what may constitute low or medium impact news for one currency, can actually be of high impact with regards to another currency. Therefore, it is best to search the Economic Calendar to see just which high-impact news are listed for a particular currency pair.

-

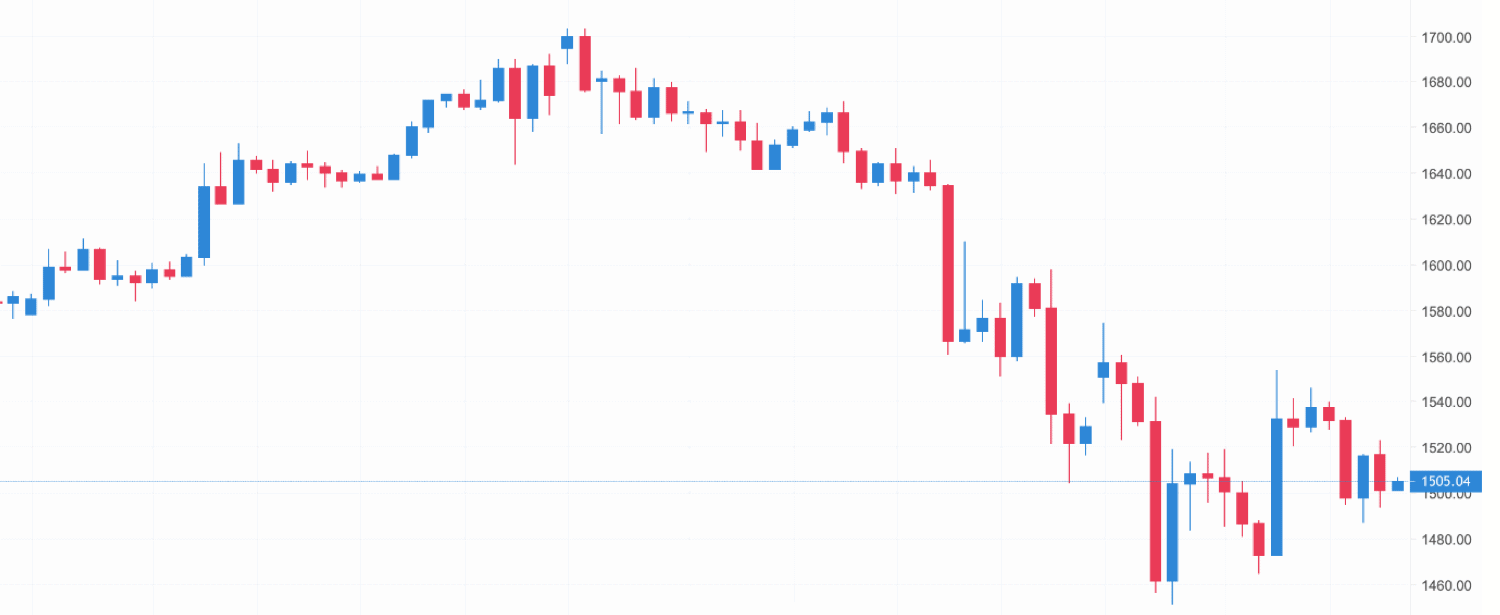

Technical Analysis

The price information of currency pairs is displayed on the charts. Currencies can, therefore, be analyzed using technical analysis. Technical analysis involves the use of patterns, candlesticks, wave patterns and indicators, all in a bid to forecast future price action and to make timely trade entries.

-

Leverage/Margin Requirements

In order to ensure that traders can afford to set up forex trades with far less money, the concept of leverage was introduced. Leverage is a mechanism that allows traders to perform trades of a higher amount than their capital can ordinarily carry. In forex leverage, the trader contributes a small portion of the required capital to collateralize the trade. This is known as the margin. The broker provides the rest of the capital.

Leverage in forex stretches from 1:2 and is capped at 1:20 for FX minors and 1:30 for FX majors on the trading platforms of UK and EU platforms. Australian brokers still offer a leverage cap of 1:500. Brokers in other parts of the world offer varying caps on leverage, with the most popular being 1:500.

Currency movements are very small, usually in the order of 4 or 5 decimal places. So a change in value in a currency pair is usually in the order of 1 pip, or 0.0001 points. If a currency pair were to change the value by 25 pips, this would only be a move of 0.0025 points, which is very small indeed.

In order to magnify the monetary value of the change in the exchange rate, large volumes of trade must be performed. In forex, trade volumes are measured in lots, with a Standard Lot being equivalent to $100,000. If you were to use $100,000 to trade a change in 25 pips, this would equate to a change of 100,000 X 0.0025 = $250. The question is: how many retail traders can afford to $100,000 to trade a typical forex position? There are not many who can afford this.

Margin requirement = cost of the trade volume/leverage

To use our previous example, a leverage of 1:30 will mean that the trade only requires 100,000/30 or $3,333 to trade a Standard Lot. For a mini-lot which is 1/10th of a Standard Lot, the requirement is only $333. Even with leverage, the full value of any profit or loss for a trade is settled on the trader’s account.

-

Spreads

Forex trades on retail trading platforms do not attract commissions. Rather, each trade is charged a spread once the position is opened, which is the difference between the bid and ask prices in a currency quote. Forex trades on institutional trading platforms, or on ECN/non-dealing desk platforms are charged both spreads and commissions. Commissions are usually charged as a flat rate per Standard Lot on both the trade entry and exit.

-

Price Quotes

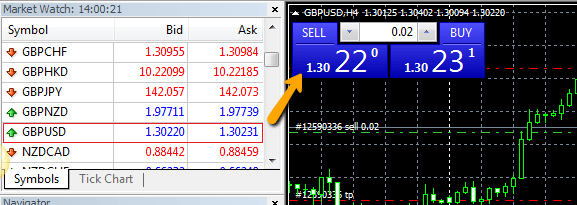

Forex exchange rates are quoted in pairs. A price quote has a price on the left, known as the Bid price, and a price on the right known as the Ask or offer price. Long trades are fulfilled at the asking price, and short trades are fulfilled at the bid price.

If GBP/USD is quoted at 1.30220/1.30231, the bid price is on the left (1.30220) and the asking price is on the right (1.30231).

-

Trading Volumes

Sizes of forex positions are measured in lots. A Standard Lot is worth $100,000. It is the standard reference for position sizing in the forex. 1 lot can be subdivided into mini-lots (0.1 to 0.99 lots), and micro-lots (0.01 to 0.099 lots).

-

Monetary Value Per Pip

A PIP stands for Percentage Interest Point. This is the smallest unit of measurement of a change in exchange rates for a currency pair. The monetary value of a Standard Lot of a currency pair is $10 per pip. How is this calculated?

- 1 pip = 0.0001 points.

- 1 Standard Lot = 100,000 units of a currency.

- Monetary value per pip = 100,000 X 0.0001 = 10 units.

Using the same calculation, 1 mini-lot is worth $1 per pip, and 1 micro-lot is worth 10 cents per pip.

How Forex Trading Works

As defined above, forex trading is the buying or selling of one currency against another, in an attempt to profit from the change in the initial rate at which the two currencies were exchanged. This is the reason for currencies being traded in pairs. Profiting from forex can occur from price movements in both directions. If you are buying, you profit when prices go up. If you are selling your profit when currency rates drop. This is how both trading scenarios work.

i) Profiting from an Increase in Exchange Rates

A forex trader profits from an increase in the exchange rate if the base currency (i.e. the currency which is listed on the left side in a currency pair) is bought.

In other words, if the trader is buying the GBP/USD, or going long on the GBP/USD, a profit will be made if the rate at which the transaction occurred goes up and the trade is exited at the new price.

- For example, if Trader Kobe feels that the exchange rate on the GBP/USD will go up, he would have to buy or “go long” on the GBP/USD. He buys 2,500 British Pounds at an exchange rate of 1.3000. He will, therefore, spend $3,250 to acquire 2,500 GBP.

- In the forex trading world, this trade would be to go long on the GBP/USD at 1.3000.

- In a few hours, the rate rises from 1.3000 to 1.3120. To get a profit, Kobe closes the trade by selling his 2,500 British Pounds at the new rate, getting $3,280 back.

- Kobe’s profit would be $3,280 – $3,250, which is $30.

In the real world of forex, trades are leveraged. If Kobe decides to use a leverage of 1:10 for this trade, this means he would only need a tenth of the total cost of the trade ($2,500). Therefore the cost to Kobe would be 1/100 of $2,500, which is $250. So Kobe would only need to put down $250 in margin for the trade.

ii) Profiting from a Decrease in Exchange Rates

A trader can also profit if exchange rates fall. To do this, the trader would have to sell or “go short” on the currency that the trader believes will weaken in value. Let us illustrate this using another trade by Kobe.

- This time, Kobe feels that the US Dollar will weaken relative to the Japanese Yen and decides to sell S13,000 for Japanese Yen at a rate of 100 Yen to 1 US Dollar. He gets 1.3 million Yen in this transaction.

- In 2 days, the exchange rate is now 98.20 Yen to the US Dollar. Kobe decides to use his Yen to re-acquire the US Dollar. He will get $13, 238 in return using this new exchange rate.

- Kobe’s profit will be $13, 238 – $13,000 = $238.

This is how money is made in the forex market. You can buy an undervalued currency and gain from it when it increases in value, or you can sell an overvalued currency and profit when you reacquire it at an undervalued price.

Practical forex trading on a forex platform will have to account for the following:

- A spread is paid to the broker for the currency pair being traded. Different currency pairs have different spreads.

- The trader will have to choose from various leverage provisions.

- The trader must use an appropriate trade volume, and this trade volume must conform to risk management principles.

Step 4: Opening a Trade

Step 1: Start by creating forex trading account with the broker

Start by completing the user profile by filling such personal information as your name, email, address.

Then verify the account by emailing your photo and a copy of your government-issued identification document.

The broker will also test your day trading experience and ask questions about the amount of disposable income you have at hand.

Step 2: Deposit cash

To activate your account and trade the different Forex pairs on the platform, you will first need to fund your account.

The minimum initial deposit for any trading account is $50 and you can transfer these funds in in through bank wire, card or PayPal.

Step 3: Forex trading alternative A: Buy and sell manually

You only need to click on the Trade Markets icon under Discover tab on your user dashboard.

This open up a window that in turn lists all the tradable assets on the platform, from cryptos to Forex pairs.

Click on your preferred forex pair to reveal the buy and sell options and start trading.

Step 4: Forex trading alternative B: Copy trades

You can use the copy trading feature if you are a beginner, are a part time trader with not enough time to analyse the forex markets or simply want to boost your win-loss ratio.

This allows you to copy the trade entry, trade exit and risk management settings of the experienced traders on the platform.

To copy Forex trades, Click on discover icon on your user dashboard and select Copy Trades. It will direct you to another window with a list of all the veteran Forex traders whose trades you are allowed to copy.

Types of Forex Brokers

There are two categories of forex brokers in the forex market. You’ll find a more detailed explanation in our article Best Forex Brokers for 2022: Comparison of the Top 7 Forex Brokers.

a) Market Makers/Dealing Desk (DD) Brokers:

They operate the dealing desk model. This model generates prices and offers trade execution from the dealing desk department. This is where the bulk of retail forex trading is done. Market makers bridge the liquidity gap between retail traders and the interbank market. These brokers offer the popular MT4 and MT5 trading platforms, as well as other platforms that cater to the retail end of the market.

b) Non-Dealing Desk (NDD) Brokers:

This is the institutional-style brokerage model where pricing and execution of trades are handled by the liquidity providers in the interbank FX market. There is no dealing desk intervention. Liquidity needs mean that only traders with a lot of money to spare can open accounts with NDD brokers. These brokers offer complex trading platforms, most of which are proprietary in nature and have additional features that go beyond trading alone.

What You Need to Start Trading

To trade forex, you need the following:

- Access to forex markets can be achieved using a trading platform provided by a broker.

- You sign up to an account and verify your identity by submitting an international passport, or drivers’ license depending on the country you live in, and often a utility bill or bank statement.

- You must have a funded trading account. You will need trading capital with which to provide margin to conduct your forex trades. This requires access to a payment method that is acceptable to your broker

- You must have some level of training to understand how to trade the forex market. Many brokers now offer introductory courses on forex trading for beginners.

- You must have a secured connected terminal in the form of a Desktop, Tablet or Mobile in order to buy and sell currencies on the platform.

Currency Acronyms

Every currency can be abbreviated with 3 alphabets, according to the ISO Standard 4217.

This standard picks the first two letters in a currency acronym from the country of origin and the first letter from the currency name. There are few exceptions (such as the MXN, which is the Mexican Peso. Here, MX comes from Mexico, but the currency name is represented with an N).

Here is a list of currencies, their 3-letter acronyms, and their symbol.

Country/Currency Acronym Symbol Australia Dollar AUD A$ Great Britain Pound GBP £ Euro EUR € Japan Yen JPY ¥ Switzerland Franc CHF SFr. US Dollar USD $ China Yuan/Renminbi CNY ¥ Mexico Peso MXN Mex$ New Zealand Dollar NZD NZ$ Poland Zloty PLN zł Russia Rouble RUB ₽ Singapore Dollar SGD S$ South Africa Rand ZAR R South Korea Won KRW ₩ Sweden Krona SEK kr Turkish New Lira TRY ₺ United Arab Emirates Dirham AED د.إ Currencies: Major, Minor and Exotic

The currency pairs in forex are divided into major, minor and exotic currencies. The major currencies are the most liquid currencies in the forex market. In descending order, these are the top 10 currency pairs by liquidity and traded volumes in the forex market.

- US Dollar

- Euro

- Japanese Yen

- British Pound

- Australian Dollar

- Swiss Franc

- Canadian Dollar

- Renminbi (Chinese Yuan)

- Swedish Krona

Constituting more than 80% of trading volume in the FX market, the major currency pairs include:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CHF

- NZD/USD

- USD/CAD

The minor currency pairs (or FX minors) include the following:

- EUR/GBP

- EUR/AUD

- GBP/JPY

- CHF/JPY

- NZD/JPY

- GBP/CAD

- EUR/JPY

- CAD/JPY

- EUR/CAD

- GBP/CHF

The exotic currency pairs are relatively illiquid pairs and carry very wide spreads as a result of their illiquidity.

Exotic currency pairs usually feature the currency groupings of the Swedish, Danish and Norwegian Crowns, South African Rand, Mexican Peso, and Turkish Lira.

- USD/SEK

- USD/NOK

- EUR/TRY

- USD/TRY

- USD/SEK

- USD/DKK

- USD/ZAR

- USD/HKD

- USD/SGD

- USD/MXN

These lists are by no means exhaustive. On your forex platform, you will probably see more minor and exotic currency pairs than are listed here.

Forex Courses

If you are interested in some forex trading training, there are plenty of video trading courses.

A good forex trading course should include:

- The best forex trading platform to use and how to get the most out of it

- Basic charting skills including using support & resistance with Fibonacci retracement levels

- How to find the best entry point, stop-losses and take profit levels

- Explanation of what using leverage means and the risks that come with it

- How to scale into a position

- Understanding different time-frames on charts and making short term vs long term trades

Forex Books

We’ve put together a brief list of books people may read if you are interested in getting into the forex trading industry.

- “Currency Forecasting” by Michael Rosenberg

- “How to make a living trading foreign exchange” by Courtney Smith

- “Trading in the Zone” by Mark Douglas

- “Reminiscences of a stock operator” by Edwin Lefevre

- “The Candlestick Course” by Steve Nison

Glossary of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQs

What is FX Trading?

Forex trading is the buying and selling of currencies in order to generate a profit from the exchange rate differentials that occur between the currencies in question, as they are subjected to the vagaries of market forces.

How many forex pairs are there

The number of forex pairs you will find on a trading platform differs from broker to broker. However, we can comfortably state that there are no less than 50 currency pairs in the forex market.

Can I perform technical analysis using the MT4 platform?

The MT4 platform is loaded with charts and all kinds of tools that are commonly used for technical analysis. Some MT4 brokers also offer their clients access to a technical analysis service from Trading Central.

What is the margin requirement for me to trade forex?

On EU/UK forex platforms, you can trade major forex pairs at a leverage of 1:30, and minor forex pairs at a leverage cap of 1:20. International brokers located outside the UK and EU provide forex leverage that can be as high as 1:500.

Can I use my forex VPS on my MT4 broker?

The MT4 platform is suitably built for use with a forex Virtual Private Server (VPS). Some MT4 brokers also provide free access to a forex VPS for traders who have funded live accounts.

See Our Full Range Of Trading Resources – Traders A-Z

Edith Muthoni

Edith Muthoni

View all posts by Edith MuthoniEdith is an investment writer, trader, and personal finance coach specializing in investments advice around the fintech niche. Her fields of expertise include stocks, commodities, forex, indices, bonds, and cryptocurrency investments. She holds a Masters degree in Economics with years of experience as a banker-cum-investment analyst. She is currently the chief editor, learnbonds.com where she specializes in spotting investment opportunities in the emerging financial technology scene and coming up with practical strategies for their exploitation. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2025 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkPrivacy policyScroll Up