Tesla stock is trading sharply lower in US pre-market price action today after the company released its earnings for the first quarter of 2023 which showed that price cuts have taken a toll on its margins.

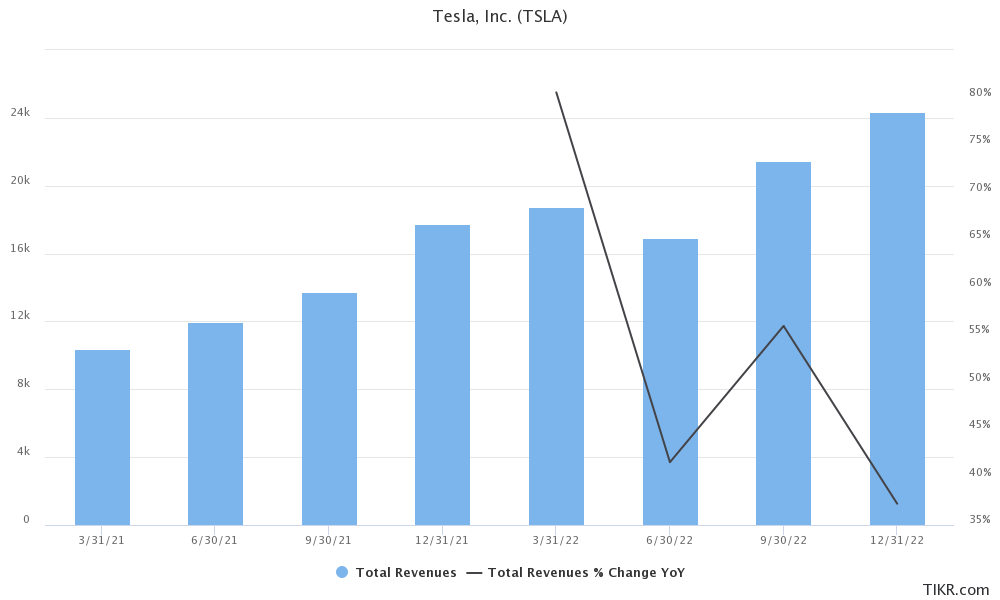

Tesla reported revenues of $23.33 billion in the quarter which were 24% higher YoY and in line with analysts’ estimates. In the first quarter, Tesla produced 440,808 cars and delivered 422,875 of these.

The company’s adjusted EPS of 85 cents was also in line with estimates. However, its operating margin fell to 11.4% in the quarter – as compared to 16% in the fourth quarter and 19.2% in the first quarter of 2022.

The company did not disclose the automotive gross margin – a key metric that markets were looking for – but said that it “reduced sequentially.”

Tesla posts inline earnings

Tesla’s earnings were largely in line with estimates but the margins fell more than expected. For instance, analysts were expecting its operating margins at 12.2% in the quarter but the metric came in at 11.4%.

Tesla has lowered car prices multiple times this year and the Model 3’s base price in the US is now below $40,000 for the first time ever.

Early in the earnings call, Musk talked about the decision to cut prices and said, “We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin.”

Tesla still has among the best margins in the auto industry

He added, “while we reduced prices considerably in early Q1, it’s worth noting that our operating margin remains among the best in the industry.”

To be sure, there is certainly merit in Musk’s statement as legacy automakers like Ford and General Motors make single-digit operating margins.

Also, legacy automakers are struggling to make profits in the EV business and Ford has forecast that its EV segment – which it rechristened Model e – will lose $3 billion this year.

In its shareholder deck, Tesla took a swipe at competitors and said, “As many carmakers are working through challenges with the unit economics of their EV programs, we aim to leverage our position as a cost leader.”

The company’s manufacturing prowess is among its biggest advantage at a time when the EV competition is ramping up globally.

Also, it has among the cleanest balance sheet with negligible debt and a massive $22.4 billion cash. Despite investing billions every year in building new plants, Tesla’s cash pile has soared over the last few years.

Musk blames Fed for slowing car sales

During the earnings call, Musk talked about the uncertain economic environment and predicted “stormy weather for about 12 months.” The billionaire has been predicting a US recession for almost a year now and has said that Fed’s rate hikes would amplify one.

He reiterated similar views during the Q1 earnings call and said “every time the Fed raises the interest rates, that’s equivalent to increasing the price of a car. It makes the cars less affordable because people are able to buy cars as a function of what they can afford on a monthly basis.”

He added, “So that’s — so it’s just almost directly equivalent to a price increase is any kind of interest rate increase.”

Musk on the macro slowdown

Musk also blamed the economic uncertainty for the slowdown in car sales. He said, “Then the other factor is whenever there is uncertainty in the economy, people will generally postpone new — big, new capital purchases like a new car.”

He added, “This is natural human reaction. So, if people are reading about layoffs and whatnot in the press, they’re like, well, they might be worried about — they might be laid off. So, then they’ll be, naturally, a little more hesitant than they would otherwise be to buy a new car.”

Incidentally, Tesla itself laid off some full-time employees last year while Twitter which Musk acquired last year has laid off around 80% of its workforce.

Musk has justified Twitter’s layoffs and said that if not for the aggressive cost cuts the social media company would have gone bankrupt.

Musk said Tesla can go fully autonomous this year

During the earnings call, Musk said, “I hesitate to say this, but I think we’ll do it (full autonomy) this year.” Markets meanwhile don’t seem to buy his argument as the Tesla CEO has made such comments almost every year since 2015.

Musk stressed multiple times during the earnings call on how autonomous driving sets it apart from competitors.

He said, “we’re the only ones making cars that, technically, we could sell for 0 profit for now and then yield actually tremendous economics in the future through autonomy. No one else can do that. I’m not sure how many people will appreciate the profundity of what I’ve just said, but it is extremely significant.”

Last year, Tesla raised the FSD (full self-driving) price from $10,000 to $15,00 and Musk believes that it would eventually rise to $100,000.

Musk is known for his flamboyant comments during the earnings call and during the previous two earnings call he forecast that Tesla could eventually become the biggest company globally with a market cap in excess of the combined market caps of Apple and Saudi Aramco – the world’s two biggest companies.

Tesla Energy revenues spiked

Meanwhile, Tesla’s Energy revenues rose 148% YoY to $1.53 billion and accounted for 6.5% of the revenues which is a first-quarter record.

Previously, Musk predicted that the Energy business would become even bigger than the automotive business.

During the Q1 earnings call, he clarified that the Energy business might become bigger than the auto business in terms of “total gigawatt hours deployed” even as it’s a possibility that automotive revenues might be ahead of the Energy segment.

Other key takeaways from TSLA’s earnings

During the earnings call, Tesla said that Model Y was the best-selling vehicle in the US in the first quarter, after excluding pickups.

The company unveiled its Cybertruck pickup in 2019 but it is running behind schedule. During the earnings call, Musk said, “we continue to build Alpha versions of the Cybertruck on our pilot line for testing purposes” and said that deliveries should begin in the third quarter of this year.

He added, “As with all new products, it will follow an S curve, so production starts out slow and then accelerates.”

Previously also Musk predicted that the model’s mass production would begin only in 2024.

Overall, despite inline earnings, Tesla stock is trading lower as markets seem spooked by the steep fall in margins.

While Tesla stock has come off its 2023 highs it is still up around 48% for the year and is among the best-performing S&P 500 stocks this year.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account