Tesla (NYSE: TSLA) has recalled 362,758 vehicles due to safety concerns over the FSD (full-self driving) software. The recall comes days after Dawn Project ran a commercial during the Super Bowl criticizing the FSD.

Tesla vehicles come with Autopilot which is the standard driver assistance system. In addition, Tesla offers what it calls FSD for $199 per month or a one-time payment of $15,000. Last year, the company raised the FSD price by 50%.

The recall affects 2017-2023 Model 3, 2020-2023 Model Y, and 2016-2023 Model S/X. According to the NHTSA (National Highway Transport Safety Administration), the affected vehicles can “act unsafe around intersections, such as traveling straight through an intersection while in a turn-only lane, entering a stop sign-controlled intersection without coming to a complete stop, or proceeding into an intersection during a steady yellow traffic signal without due caution.”

Tesla recalls vehicles over FSD safety issue

The safety recall report added, “the driver is responsible for operation of the vehicle whenever the feature is engaged and must constantly supervise the feature and intervene (e.g., steer, brake or accelerate) as needed to maintain safe operation of the vehicle.”

Tesla would do an over-the-air update to address the issue. Meanwhile, Tesla CEO Elon Musk believes that it is not a “recall.” Musk, who also owns Twitter, tweeted, “The word ‘recall’ for an over-the-air software update is anachronistic and just flat wrong!”

Musk has been at loggerheads with several government agencies as well as the SEC. He paid a $20 million fine to the SEC over his controversial “taking Tesla private” tweet. However, he recently won a class action lawsuit over the issue recently.

Dawn Project Released an ad criticizing FSD

During the Super Bowl, Dawn Project released a 30-second ad with criticized FSD’s deceptive marketing. The video showed a Tesla Model 3 allegedly running on FSD and said, “Tesla Full Self-Driving will run down a child in a school crosswalk, swerve into oncoming traffic, hit a baby in a stroller, go straight past stopped school buses, ignore do not enter signs and even drive on the wrong side of the road.”

The video said that “Tesla’s Full Self-Driving is endangering the public with deceptive marketing and woefully inept engineering.” It also posed the question that why the regulator allowed FSD in the first place.

Ralph Nader also criticized Tesla FSD

Criticism of Tesla FSD is not new though. The NHTSA is investigating several cases of fatal crashes allegedly involving the FSD. The agency also finds faults with the very name as it is not fully autonomous.

Last month, TSLA disclosed that the US Department of Justice asked for documents related to the FSD.

Last year, former US presidential candidate Ralph Nader called for a ban on FSD. Nader said, “I am calling on federal regulators to act immediately to prevent the growing deaths and injuries from Tesla manslaughtering crashes with this technology.”

He said that the FSD is “one of the most dangerous and irresponsible actions by a car company in decades.”

Musk meanwhile has been quite upbeat about FSD and previously said that the software’s price would eventually rise to $100,000. He has also pointed out that a large part of Tesla’s valuation comes from the software business, which includes the FSD.

Nader meanwhile also lashed out at Musk. He said, “Together we need to send an urgent message to the casualty-minded regulators that Americans must not be test dummies for a powerful, high-profile corporation and its celebrity CEO. No one is above the laws of manslaughter.”

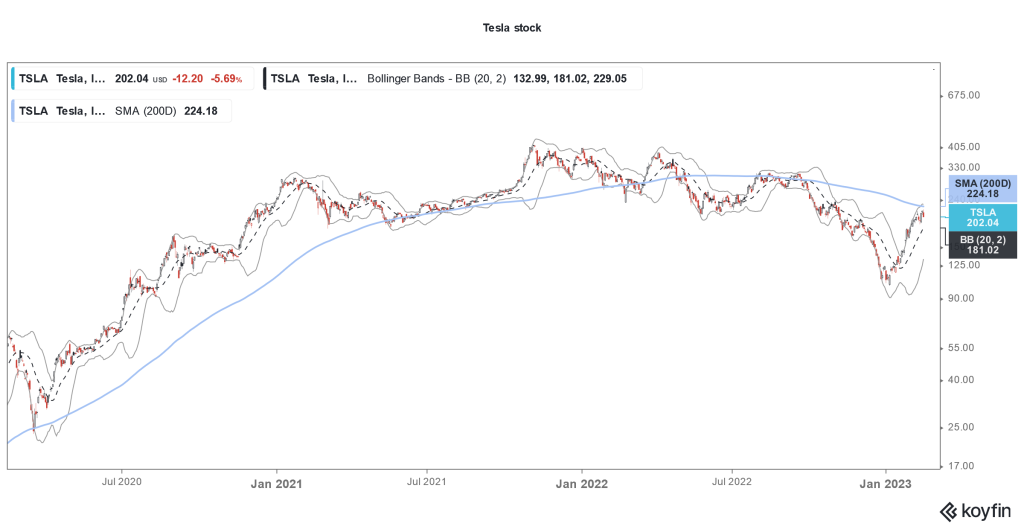

TSLA stock has soared in 2023

Despite all the noise and controversies, TSLA stock has soared in 2023 and is the best-performing S&P 500 stock. The stock tumbled on the first trading day of 2023 after it missed Q4 2022 delivery estimates, but has since rebounded.

In the fourth quarter of 2022, Tesla delivered 405,278 vehicles, a YoY rise of 31.3%. In the full year, its deliveries rose 40% to 1.31 million.

The company’s 2022 deliveries fell short of what the company initially predicted. Initially, Tesla said that its 2022 deliveries would rise 50% YoY while the company’s CEO Elon Musk said that deliveries would surpass 1.5 million. Tesla expects to deliver 1.8 million EVs in 2023.

Munger says BYD is way ahead of Tesla in China

In 2022, BYD Motors, which is backed by Berkshire Hathaway surpassed Teala to become the biggest seller of NEVs (new energy vehicles).

In the fourth quarter of 2022, BYD sold 683,440 vehicles, a YoY rise of 157%. In the full year, it sold 1.86 million cars which were far ahead of Tesla’s 1.31 million deliveries. Here it is worth noting that while Tesla sells only BEVs, BYD also sells PHEVs (Plug-in hybrid electric vehicles).

While BYD outsold Tesla in terms of total sales, the Elon Musk-run company is still ahead when it comes to BEVs. That said, BYD is now catching up with Tesla in BEV deliveries also and some analysts expect it to become the biggest BEV seller in 2023.

Berkshire Hathaway vice chairman Charlie Munger said on Wednesday that BYD is way ahead of Tesla in China.

Bulls See TSLA Stock Going Higher

Cathie Wood of ARK Invest who is among the biggest TSLA bulls said that the stock could rise to $1,500 over the next five years.

Wood meanwhile said that many people would not buy Tesla stock now given the controversies surrounding Musk. She however added, “But if he does what we think he’s going to do on the cost side, there are a lot of people who will use economics as their guide. Better car, better economics. And I think there are a lot more of those people than there are of the naysayers around Twitter.”

Ron Baron also said earlier this month that Tesla stock could rise to $1,500 by 2030. Meanwhile, FSD’s success would be crucial for Tesla as it tries to protect its lead in the EV market which is getting quite competitive with the launch of new models from legacy automakers.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account