Former Twitter executives have sued the social media company seeking reimbursements of over $1 million related to legal expenses.

The lawsuit was filed by Parag Agarwal, Twitter’s former CEO, Ned Segal, Twitter’s former CFO, and Vijaya Gadde who was the company’s former chief legal officer.

Musk fired the company’s top executives soon after he acquired the company in October. He has since been slashing the company’s workforce and according to reports Twitter’s headcount is now only about 30% of what it was before Musk’s acquisition.

These former executives have argued that Twitter is liable to pay the legal expenses for any proceedings that are related to their former corporate roles.

Former Twitter executives sue the company

Aaron Zamost, a spokesman for Gadde and Segal said “Once again, Twitter has failed to honor its contractual obligations to pay its bills.”

This is another lawsuit that Twitter has faced since Musk acquired the company. The company is also facing lawsuits from landlords, vendors, and consultants over unpaid bills.

Musk has been on a cost-cutting spree and has taken aggressive actions to lower the company’s cost base including shutting down some offices.

By his own admission, Twitter’s ad revenues have plunged by half as many advertisers have shunned the platform.

Musk restored Trump’s account

Musk took several decisions related to accounts restoration and suspension that did not go down well for many. For instance, while he restored Donald Trump’s Twitter accounts, he suspended the accounts of many journalists, and that too unannounced.

Musk subsequently restored the accounts of journalists but the damage was done. Multiple surveys have shown Tesla has lost popularity since Musk acquired Twitter.

Twitter now charges for verified accounts

While Twitter’s ad revenues have plummeted, the company has started charging for account verification in order to diversify its revenue base. The company charges $8 monthly if the subscription is taken on the web and $11 monthly if the subscription is taken on Google and Apple app stores.

The company did away with the legacy blue tick verification from April but according to most estimates, only a tiny fraction of accounts have opted for the paid verification which might not be enough to compensate for the revenue loss from falling ad sales.

Musk has also made contradictory statements about the company’s finances. While last year he said that Twitter bankruptcy was still an option, earlier this year he said that the platform is now nearing breakeven.

Notably, Twitter has a massive debt pile to service as Musk also took loans to acquire the platform.

Musk lowers Twitter’s valuation

Musk acquired Twitter for a mammoth valuation of $44 billion last year. The billionaire had backed out of the deal apparently over the higher valuation but eventually relented after Twitter sued him to fulfill his obligations.

During Tesla’s Q3 2022 earnings call, Musk acknowledged that he overpaid for the company.

Meanwhile, he has now slashed the company’s valuation by over half to $20 billion. He however said that the company’s valuation could rise to $250 billion eventually.

Musk on Tesla valuation

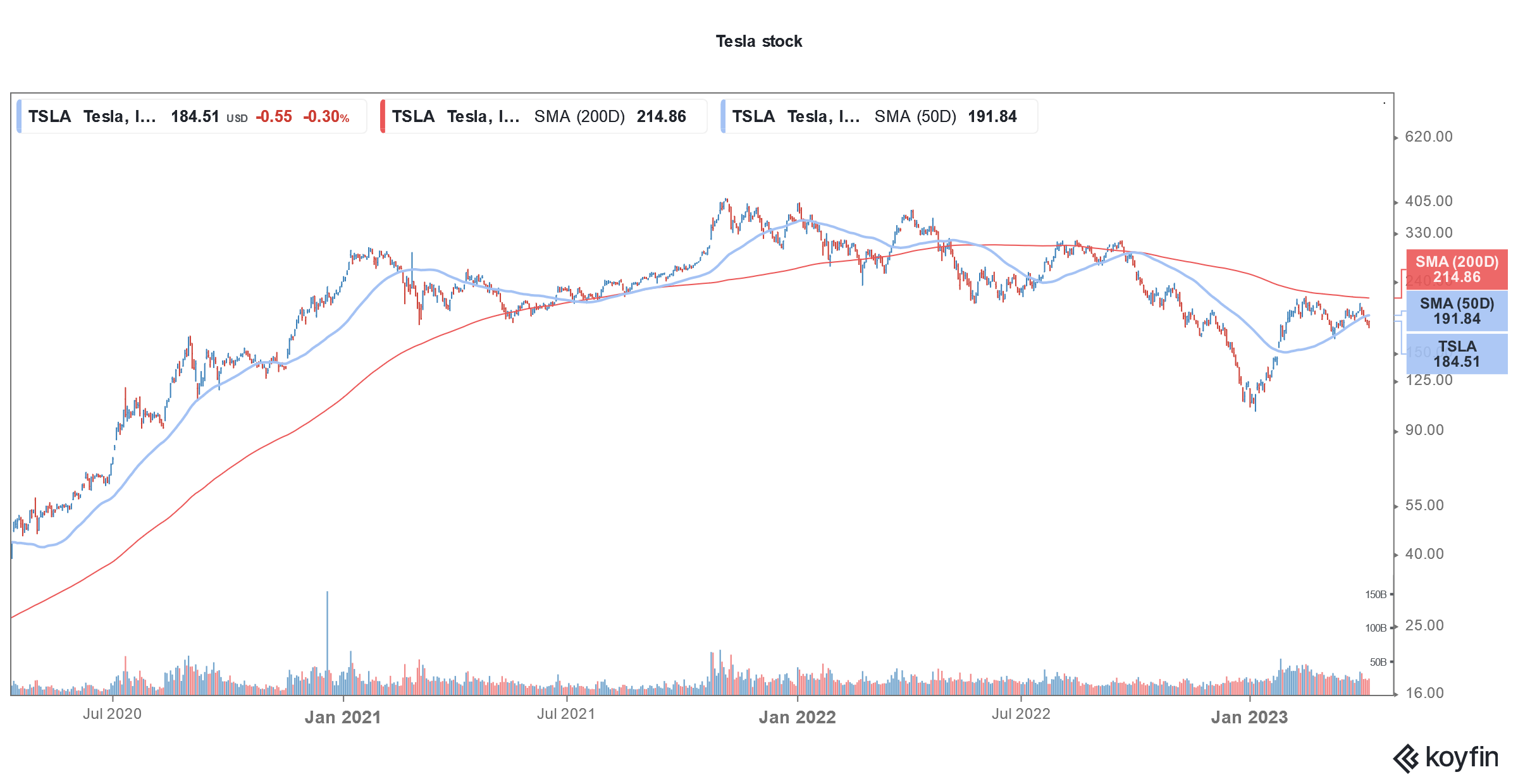

Musk making tall claims on valuation is not something new. During the Q3 2022 earnings call, Musk said that Tesla’s market cap can far exceed current levels. He said, “I see a potential path for Tesla to be worth more than Apple and Saudi Aramco combined. That doesn’t mean it will happen or that it will be easy, in fact it will be very difficult, require a lot of work, very creative new products, expansion and always good luck. But for the first time I’m seeing, I see a way for Tesla to be, let’s say roughly twice the value of Saudi Aramco.”

Tesla has been lowering vehicle prices

Tesla intends to sell 20 million cars annually by the end of this decade. This is roughly twice what the current market leader Toyota sells every year. Tesla has so far maintained that it is a supply-constrained company. However, a section of the market is getting apprehensive that it is moving towards a demand-constrained company amid a slowing economy.

Notably, Tesla’s production has been higher than deliveries for the last many quarters and it has had to cut car prices multiple times to spur demand.

Musk previously said that he would quit as Twitter CEO

As Tesla’s stock price plunged after Musk’s Twitter acquisition, he said in December that he would quit as the company CEO once he found someone “foolish enough” to lead the company.

However, since then he hasn’t said anything about the subject. Tesla stock meanwhile has soared this year and is among the top 10 S&P 500 gainers.

As for Twitter, the platform has primarily been run as per Musk’s whims and fancies. The microblogging site has tagged BBC and NPR as “state-funded media.” BBC has objected to the tagging.

Also, Twitter removed the blue verified status of the New York Times after the publication did not subscribe to Twitter Blue. The company singled out the publication which has often criticized Musk.

Overall, it has been less than six months since Musk acquired Twitter and far from the turnaround that Musk is targeting, the platform continues to face newer issues.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account