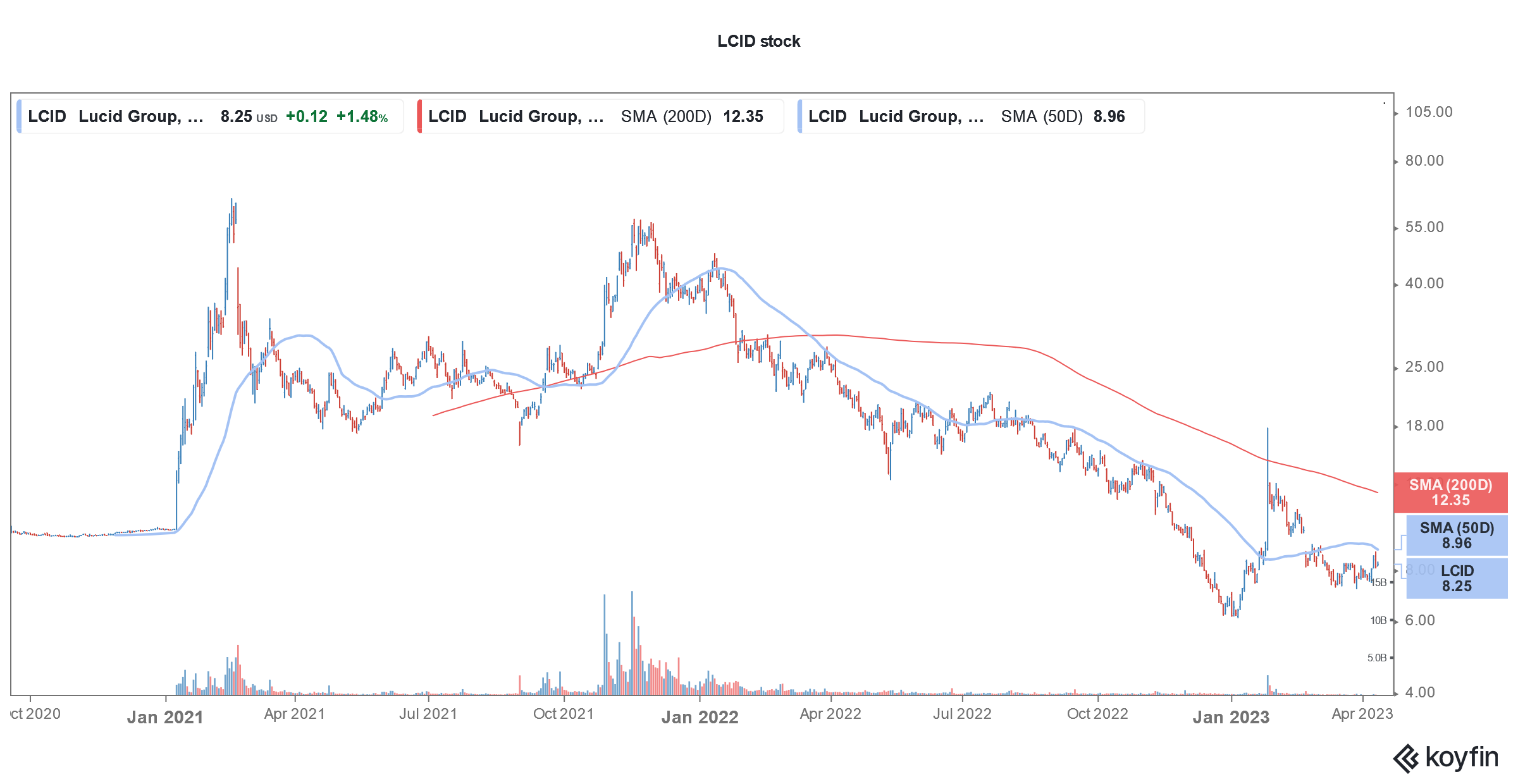

Lucid Motors stock (NYSE: LCID) is trading sharply lower in US premarket price action today after the company reported below-par production and delivery report for the first quarter of 2023.

The company produced 2,314 cars in the quarter and delivered 1,406 of these. The metrics were below the fourth quarter where it had produced 3,493 vehicles and delivered 1,932. Lucid Motors’ Q1 deliveries fell well short of the 2,000 that analysts were expecting.

In February, Lucid Motors said that it expects to produce only between 10,000-14,000 cars in 2023 which its CEO Peter Rawlinson emphasized was below its actual capacity.

Lucid Motors’ Q1 2023 delivery report disappoints markets

In 2022, the company produced 7,180 cars which were way below the original guidance of 20,000. Notably, when Lucid Motors went public in 2021, it forecast deliveries of almost 50,000 for 2023. However, like almost all other EV de-SPACs it is also struggling to meet the forecasts.

To be sure, during their Q4 2022 earnings call, Lucid Motors admitted that it expects Q1 production to be “down significantly on a sequential basis with a corresponding impact on margins” as it transitioned to new vehicle configuration at the Arizona plant.

Lucid alluded to the demand slowdown

While almost all the other EV companies maintain that they are constrained by supply, during the Q4 2022 earnings call, Rawlinson stressed that Lucid is no longer a supply-constrained company but is now producing fewer cars than its capacity to align that with customer demand.

Rawlinson rued that the brand awareness for Lucid is on the lower side. He said, “We’ve got what I only believe to be the very best product in the world. And we’ve just too few people are aware of not just the car, but even the company. And so, we need to amplify my focus now away from production to amplifying customer awareness that we’ve got this amazing car with unprecedented range.”

He termed it “an entirely solvable problem” but Wall Street does not seem to believe so especially with the increase in EV competition.

Q1 deliveries of other EV companies

Delivery reports of other EV companies were also below par. Rivian produced 10,020 vehicles in the fourth quarter and delivered 8,054.

In its prepared remarks, Rivian said that Q1 2023 production and delivery results “remain in line with the company’s expectations, and it believes it is on track to deliver on the 50,000 annual production guidance previously provided.”

Some Wall Street analysts were disappointed with Rivian’s first-quarter delivery report and CFRA Research analyst Garrett Nelson downgraded the stock from a sell to a strong sell.

Nelson said, “The report likely indicates that Rivian has continued to burn through cash at an alarming rate and is nowhere near generating even a gross profit, much less a net profit.”

Tesla cut vehicle prices after the Q1 delivery report

Tesla produced 440,808 cars and delivered 422,875 of these in the first quarter. The company’s deliveries fell short of estimates and the stock fell after the release. The Elon Musk-run company is targeting a production of 1.8 million cars this year.

However, in order to hit that number, it has had to announce multiple price cuts. Analysts don’t rule out more price cuts from Tesla which is the global market leader in BEVs (battery electric vehicles).

EV price war

Tesla’s price cuts have led to a price war in the EV industry and other companies like Ford have also lowered prices. Lucid also offered a $7,500 “credit” to buyers to make its cars competitive.

There have also been layoffs at EV companies and Rivian has laid off around 12% of its workforce over the last year.

In March, Lucid also laid off 1,300 employees which are 18% of its workforce with Rawlinson describing it as a “painful but necessary decision.”

Lucid Motors’ fortunes have nosedived

Lucid Motors’ 2021 merger with Churchill Capital was the biggest SPAC merger until then. It was also the most hyped merger and came at a time when there was an almost unending appetite for EV stocks. Even before the merger, Churchill Capital IV stock rose as high as $65. The stock fell after the merger which has become more of a norm than the exception in SPAC mergers.

Currently, Lucid Motors offers only the Air sedan. During the Q4 2022 earnings call, Lucid Motors said that it has 28,000 reservations for Air which was below the 34,000 that it reported in the previous quarter.

Lucid Motors would not provide reservation numbers going forward

The company’s reservation number fell in the third quarter also and from now on it won’t provide the reservation numbers. Here it is worth noting that these reservation numbers do not include the upto 100,000 EVs that Saudi Arabia might order from the company.

The country’s sovereign wealth fund PIF (public investment fund) is Lucid Motors’ biggest stockholder and the ownership has only risen after the recent stock offering where an affiliate of PIF invested over $900 million.

There were rumors that Saudi Arabia might acquire Lucid Motors but none of the parties have officially commented on the same.

In response to an analyst question on Saudi Arabia taking Lucid private, the company’s CFO Sherry House said, “It’s a policy. Lucid does not comment on market rumors, and so we don’t have anything to say specific to this question.”

Lucid would release earnings on May 8

LCID would release its earnings for the first quarter of 2023 on May 8. During the earnings call, it might provide color into the pricing strategy given the price war. The company might also talk about plans to raise capital as even after last year’s $1.5 billion capital raise, its current cash would fund operations only until the end of Q1 2024.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account