Tesla stock (NYSE: TSLA) is up in US premarket price action after the company raised prices across all models barring Model 3 in the US. Also, Elon Musk said that he would step down as Twitter’s CEO.

This is the second price hike by Tesla in less than a month and the company raised the price of Model Y by $250 and that of the higher-priced Model S and Model X by $1,000 each.

Together Model 3/Y account for the bulk of Tesla’s deliveries and the combined share of Model S/X was a mere 2.5% in the first quarter.

Tesla announces price hike in the US

Tesla said that Model Y was the best-selling vehicle in the US in the first quarter, after excluding pickups.

Meanwhile, after the price cuts, Model Y’s base price would be $47,490 while the long-range and performance variants would respectively start at $50,490 and $54,490.

Model X’s base price is now $98,490, while Model S starts at $88,490.

That said, despite the current round of price hikes, Tesla cars now sell for a lot lesser than they did at the beginning of the year.

The company slashed car prices across Europe and North America in January after it missed Q4 2022 delivery estimates.

It then continued to slash prices multiple times often to the displeasure of buyers who ended up buying cars at higher prices.

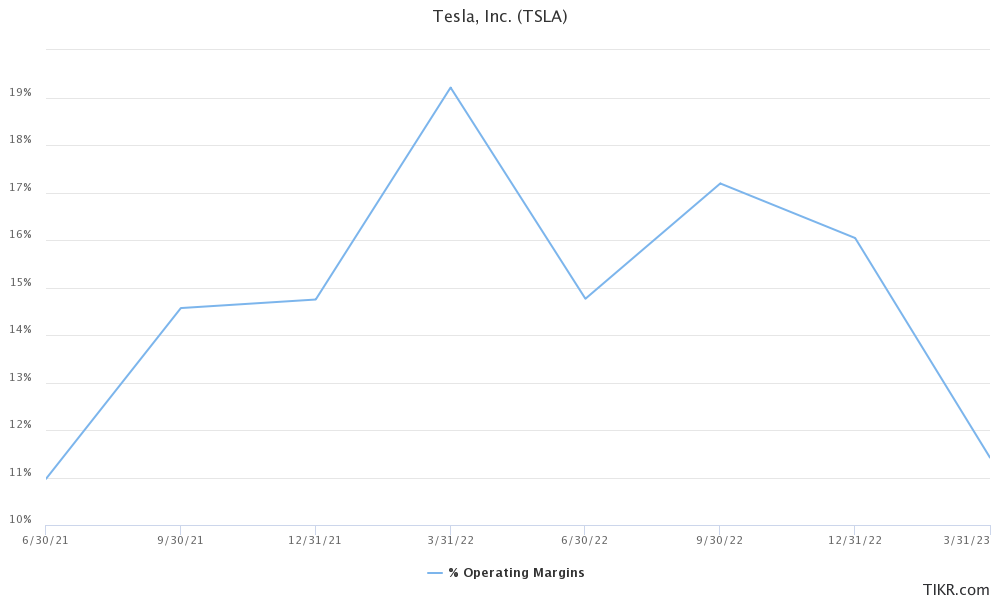

Tesla profit margins fell due to price cuts

The price cuts took a toll on Tesla’s profit margins in the first quarter. For instance, its operating margin fell to 11.4% in the quarter – as compared to 16% in the fourth quarter and 19.2% in the first quarter of 2022. Wall Street analysts were expecting its operating margins at 12.2%.

The company did not disclose the automotive gross margin – a key metric that markets were looking for – but said that it “reduced sequentially.”

Musk defended price cuts during the earnings call

Early in the earnings call, Musk talked about the decision to cut prices and said, “We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin.”

He added, “while we reduced prices considerably in early Q1, it’s worth noting that our operating margin remains among the best in the industry.”

To be sure, there is certainly merit in Musk’s statement as legacy automakers like Ford and General Motors make single-digit operating margins.

Legacy automakers are struggling to make profits in the EV business and Ford has forecast that its EV segment – which it rechristened Model e – will lose $3 billion this year.

Also, EV startups are struggling with perennial losses. Lucid Motors reported a per-share loss of 43 cents in Q1 2023 – which was much wider than the per-share loss in Q1 2022 – and also higher than what the markets were expecting.

Rivian also posted a per-share loss of $1.25 in the first quarter and reported negative free cash flows of $1.8 billion during the period.

EV startups are losing money

In its Q1 2023 shareholder deck, Tesla took a swipe at competitors and said, “As many carmakers are working through challenges with the unit economics of their EV programs, we aim to leverage our position as a cost leader.”

The company’s manufacturing prowess is among its biggest advantage at a time when the EV competition is ramping up globally.

Musk believes Tesla can make profits even by selling cars at breakeven levels

During the Q1 2023 earnings call, Musk stressed multiple times during the earnings call on how autonomous driving sets it apart from competitors.

He said, “we’re the only ones making cars that, technically, we could sell for 0 profit for now and then yield actually tremendous economics in the future through autonomy. No one else can do that. I’m not sure how many people will appreciate the profundity of what I’ve just said, but it is extremely significant.”

In an apparent reference to Tesla, analyst John Murphy of Bank of America asked Rivian during the Q1 2023 earnings call whether the company would consider a “lifetime revenue opportunity” from the vehicle and sell at a lower price now and make revenue from other streams in the future.

Rivian CEO RJ Scaringe responded, “that we certainly see as part of the business in the long term. And above and beyond self-driving, there are other opportunities to create meaningful recurring revenue. And some of those, we’ve started to launch and initiated already with our insurance product, with some of the financing products that we have.”

Musk to step down as Twitter CEO

Meanwhile, in another important development, Musk has said that he’s finally stepping down as Twitter CEO. Tesla stock crashed last year after Musk acquired Twitter as markets feared that it would consume a lot of Musk’s bandwidth.

Also, after the acquisition it became apparent that Musk’s Twitter antics are hurting Tesla’s brand.

During the Q4 2022 earnings call though Musk denied any damage to the Tesla brand pointing to his ever-rising Twitter followers.

However, Cathie Wood who is among the most vocal Tesla bulls said that many people would not buy Tesla cars now given the controversies surrounding Musk.

She however added, “But if he does what we think he’s going to do on the cost side, there are a lot of people who will use economics as their guide. Better car, better economics. And I think there are a lot more of those people than there are of the naysayers around Twitter.”

All said, markets are rejoicing Musk stepping down as Twitter CEO and the stock is trading higher today.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account