Rivian stock (NYSE: RIVN) is trading higher in US price action today after it posted better-than-expected earnings for the first quarter of 2023 and also maintained its 2023 guidance. Here are the key takeaways.

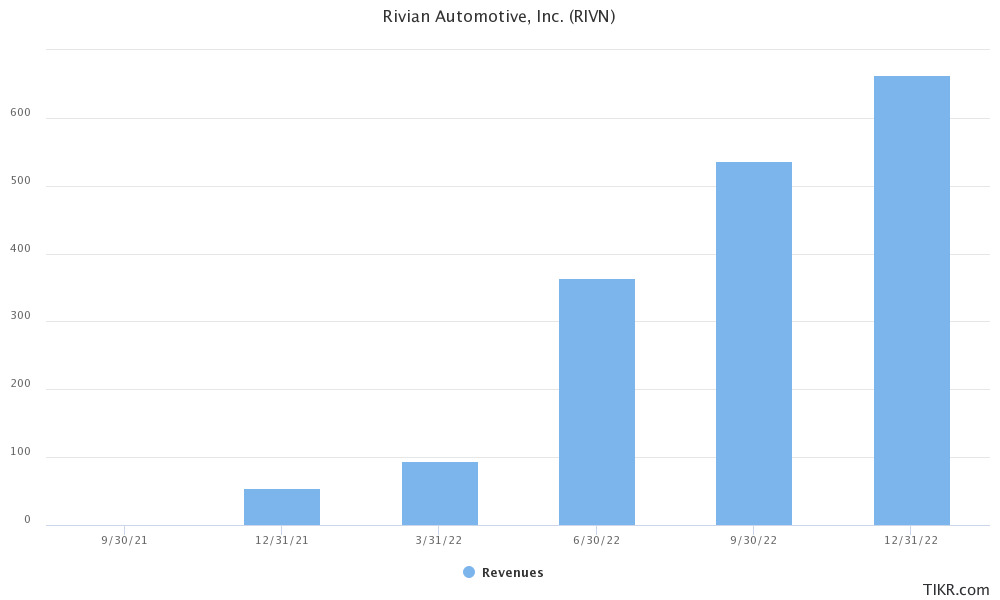

Rivian reported revenues of $661 million in the March quarter which were ahead of $652 million that markets expected.

Rivian produced 9,395 vehicles in the first quarter of 2023 and delivered 7,946 of these. The deliveries were largely in line with estimates but both the production and deliveries fell as compared to the fourth quarter.

Rivian beats Q1 2023 earnings estimates

Rivian posted a per-share loss of $1.25 which was narrower than the $1.59 that analysts expected. It also maintained its 2023 production guidance of 50,000 units.

In his prepared remarks, RJ Scaringe said, that the company’s 2023 priorities are “unchanged.” He added, “The team remains focused on ramping production, driving cost reductions, developing the (upcoming) R2 platform and future technologies and delivering an outstanding end-to-end customer experience.”

Rivian’s earnings and the market’s response are in stark contrast to Lucid Motors which released its earnings a day before.

Not only did Lucid Motors miss both topline and bottomline estimates for the quarter – but also lowered its 2023 delivery guidance.

The Peter Rawlinson-led company now expects to produce “over 10,000” cars in 2023 while the previous guidance was between 10,000-14,000 units.

Lucid Motors is battling demand issues and Rawlinson reaffirmed that the company needs to work on its brand awareness.

RIVN on demand concerns

Responding to an analyst question on the demand for RIVN cars, CEO Robert Scaringe said that the company’s order backlog extends “well into 2024” – reiterating what he said during the previous earnings call.

Notably, both Rivian and Lucid Motors have stopped providing reservation numbers which markets see as a sign of tepid demand.

He added, “the engagement we have with customers and the level of satisfaction that our early customers the first 35,000-or-so customers are having really creates a powerful flywheel where our biggest, and I would say, most important advocates are the buyers of our vehicles.”

Rivian is looking to cut costs

Like fellow startup EV companies, Rivian continues to burn cash and posted negative free cash flows of $1.8 billion in Q1 2023 – wider than the $1.45 billion in the corresponding quarter last year.

Among others, an increase in inventory was a drag on cash flows even as it was somewhat compensated by lower capex in the quarter.

Rivian ended the quarter with $11.78 billion in cash which excludes the $1.5 billion revolving credit facility.

During the quarter it raised $1.5 billion in cash through the sale of convertible bonds. Given the perennial cash burn, startup EV companies have had to raise cash at frequent intervals to keep their operations running.

Previously, Rivian said that it has enough cash to fund its operations until 2025.

RIVN maintained its guidance

Apart from the deliveries, Rivian also reaffirmed its 2023 adjusted EBITDA guidance of $4.3 billion loss and capex of $2 billion.

Also, Rivian said that it still expects to become gross profit positive by the next year. The company said that the increase in capacity utilization would drive half of the incremental margin expansion.

The remaining half it said would be split between higher vehicle prices and lower raw material costs.

Notably, all these factors are key headwinds for Rivian. A lot of its orders were placed before it hiked vehicle prices. The company did try to pass on the price increase on pre-orders but backed off after buyers protested.

Also, it has purchase contracts at higher prices. Raw material costs have fallen significantly over the last year and Rivian said that it is negotiating with suppliers for better terms.

Amazon is RIVN’s biggest stockholder

Rivian is targeting a total annual production capacity of around 600,000 cars between its Normal and Georgia plants. It aspires to capture 10% of the global automotive market share which might seem a tall ask considering the massive competition.

The company is currently producing the R1T pickup, R1S SUV, and EDV (electric delivery van). At the upcoming factory in Georgia, Rivian would produce the affordable R2 where production is slated to begin in 2026 – one year behind the original schedule.

Notably, Amazon is the largest Rivian stockholder and has placed an order for 100,000 EDVs with the company.

In response to an analysts’ question on whether Rivian is looking to sell EDVs to other customers also, Scaringe said, “we’re, at this point, continue to focus from a production point of view on really the single customer with Amazon. And in terms of looking beyond the exclusivity into other customers, we do see a broad set of needs in the commercial space.”

He added, “it’s been something we’ve been working very closely with Amazon on to allow us to pursue these other customers as quickly as possible.”

EV competition

Meanwhile, the competition in the EV industry is increasing, and Rivian faces tough competition from General Motors’ Silverado and the GMC Hummer, and Ford’s F-150 Lightning.

The electric pickup segment is still an attractive proposition as the competition is not as high as sedans and SUVs. Also, Tesla which has been at the forefront of the price war still does not have an electric pickup. The Elon Musk-run company expects to begin the deliveries of its Cybertruck later this year but does not expect mass production until 2024.

in an apparent reference to Tesla, analyst John Murphy of Bank of America asked Rivian whether the company would consider a “lifetime revenue opportunity” from the vehicle and sell at a lower price now and make revenue from other streams in the future.

Scaringe responded, “that we certainly see as part of the business in the long term. And above and beyond self-driving, there are other opportunities to create meaningful recurring revenue. And some of those, we’ve started to launch and initiated already with our insurance product, with some of the financing products that we have.”

Meanwhile, the price war took a toll on Tesla’s margins in the first quarter and the stock fell after the earnings release. Most other EV companies including Lucid Motors, Nikola, and Fisker also disappointed with their Q1 2023 earnings.

Rivian meanwhile managed to impress markets with its first quarter earnings and the stock is higher today.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account