With a YTD loss of 25%, Rivian stock (NYSE: RIVN) is underperforming the markets as well as EV (electric vehicle) peers in 2023. Can the startup EV company recover from the lows? Here’s what Wall Street thinks.

2022 was a bad year for EV stocks, to say the least. Tesla had its worst year ever and the Elon Musk-run company lost 65% in 2022. Things were no different for other EV stocks as investors shied away from the once-booming sector.

However, 2023 so far has been a decent year for EV names and Tesla has gained over 56%. The stock fell to a multi-month low on the first trading day of the year but has since rebounded.

EV stocks have recovered in 2023

Other EV stocks have also recovered and Lucid Motors is up around 20% despite reporting disappointing earnings and providing a dismal 2023 production guidance. NIO is down just about 6% while fellow Chinese EV company Li Auto has gained 11%.

Even Xpeng Motors, which has now disappointed markets with its earnings and deliveries for the last many months, is down just about 5% and is outperforming Rivian.

The Global X Autonomous and Electric Vehicles ETF has also gained 20% YTD as investors have bought into beaten-down growth names.

Meanwhile, Rivian has continued to slump and there have been instances when its market cap has fallen below the humongous cash on its balance sheet. It’s quite unusual for companies to trade at negative enterprise values, as has been the case at times with Rivian.

ContextLogic (NYSE: WISH) is another stock that trades at negative enterprise value. However, the company’s earnings have been terrible and its revenues are a fraction of what they were in 2021. Its losses have also swelled while its user base has plummeted.

Why is Rivian stock underperforming?

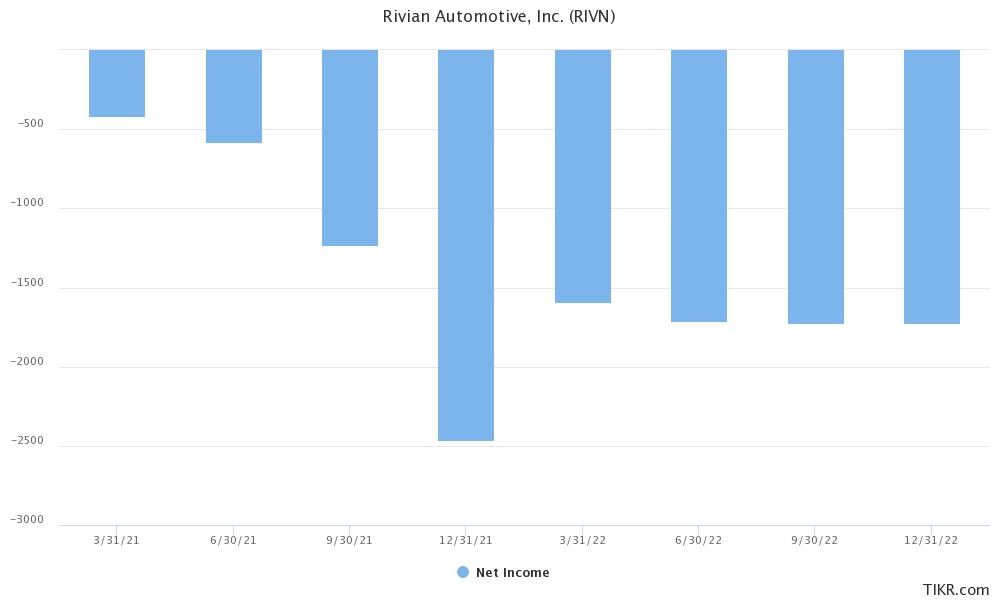

Markets are still wary of perennially cash-guzzling businesses like Rivian. The company burnt around $6 billion worth of cash last year.

The company ended 2022 with cash and cash equivalents of $11.6 billion. The company’s cash pile has gradually come down since the IPO as it continues to burn billions of dollars of cash every quarter.

The company expects its cash to fund its business through 2025 but still announced a $1.3 billion convertible bond issue earlier this month.

The stock fell after the news of the capital raise. Lucid Motors also raised around $1.5 billion through a stock sale last year. The stock might have fared poorly this year but seems to be holding up on rumors of a buyout by Saudi Arabia.

The kingdom, which sees EVs as a long-term driver, is the largest stockholder of Lucid Motors and the company is setting up its second plant in Saudi Arabia.

Rivian is looking to end its exclusive deal with Amazon

As for Rivian, Amazon is its largest stockholder. Ford used to be the second largest stockholder but the company has since sold most of the shares. Apart from being the largest customer, Amazon is also a key buyer for Rivian and has placed an order for 100,000 electric delivery vehicles.

Meanwhile, Rivian is looking to end its exclusive agreement with Amazon as the e-commerce giant is considering buying only about 10,000 of these vehicles in 2023.

An Amazon spokesperson said, “While nothing has changed with our agreement with Rivian, we’ve always said that we want others to benefit from their technology in the long run because having more electric delivery vehicles on the road is good for our communities and our planet.”

Notably, Amazon has been looking to cut costs and has announced two rounds of mass layoffs and also stopped construction at its HQ2 in Virginia.

Some early RIVN adopters are not very happy

While in general Rivian cars have received rave reviews and last month topped JD Power’s EV ownership study, some early adopters are left disappointed. The Business Insider reported the ordeal of one Chase Merrill who found his Rivian R1S SUV dead and did not receive the requisite assistance from Rivian.

He paid a towing fee of $2,100 to get the car to the nearest service station and Rivian only reimbursed the fee after the story broke out.

Last year also, Rivian irked buyers by raising car prices for buyers who had already made the reservation. After much hue and cry it waived the price hike for buyers who had reservations.

RIVN missed the 2022 delivery guidance

Rivian reported revenues of $663 million in Q4 2022 which fell well short of the $742 million that analysts expected. Rivian produced 10,020 vehicles in the fourth quarter and delivered 8,054. In 2022, it produced 24,337 cars and delivered 20,332 of these. The company’s production fell short of its guidance.

Rivian said that it expects to post a gross loss in 2023 but expects to become gross profit positive in 2024. It said that the cash burn would “improve meaningfully” in 2025. Over the long term, the company is targeting a gross profit margin of 25%, a high teen EBITDA margin, and a 10% free cash flow.

RIVN is expanding its capacity

Rivian is targeting a total annual production capacity of around 600,000 cars between its Normal and Georgia plants. It aspires to capture 10% of the global automotive market share which might seem a tall ask considering the massive competition. The company is currently producing the R1T pickup, R1S SUV, and EDV (electric delivery van). At the upcoming factory in Georgia, Rivian would produce the affordable R2.

Wall Street analysts on Rivian stock

Morgan Stanley is bullish on Rivian stock and its target price implies the stock almost doubling from these levels. In a client note, it said, “While the stock offers a rather wide risk/reward skew ($5 bear case to $55 bull case) we remain compelled by the company’s differentiated product, scalable end markets, cost cutting potential, cash balance, and valuation.”

Canaccord expects Rivian stock to almost triple and finds its $1.3 billion capital raise a positive. It is also constructive on the company ending its exclusive deal with Amazon and said, “To date, Rivian’s commercial vehicles have been bound to Amazon. However, we see significant room for additional market share from new partners,” they wrote.”

Bank of America, which has a $40 target price on Rivian said in a note “We maintain our Buy on RIVN, which is predicated on our view that it is one of the most viable among the start-up EV automakers and a relative competitive threat to incumbent OEMs (and possibly to other automotive-related verticals).”

Can RIVN be the next Tesla?

Like fellow startup EV companies, Rivian faces the proverbial moment of truth as it scales up deliveries and sets up new plants. While it is customary to compare every startup EV company with Tesla, the Elon Musk-run company has managed to prove its mettle against all odds.

It remains to be seen if Rivian can achieve scale and sustainable profitability like Tesla, especially with the EV competition rising significantly.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account