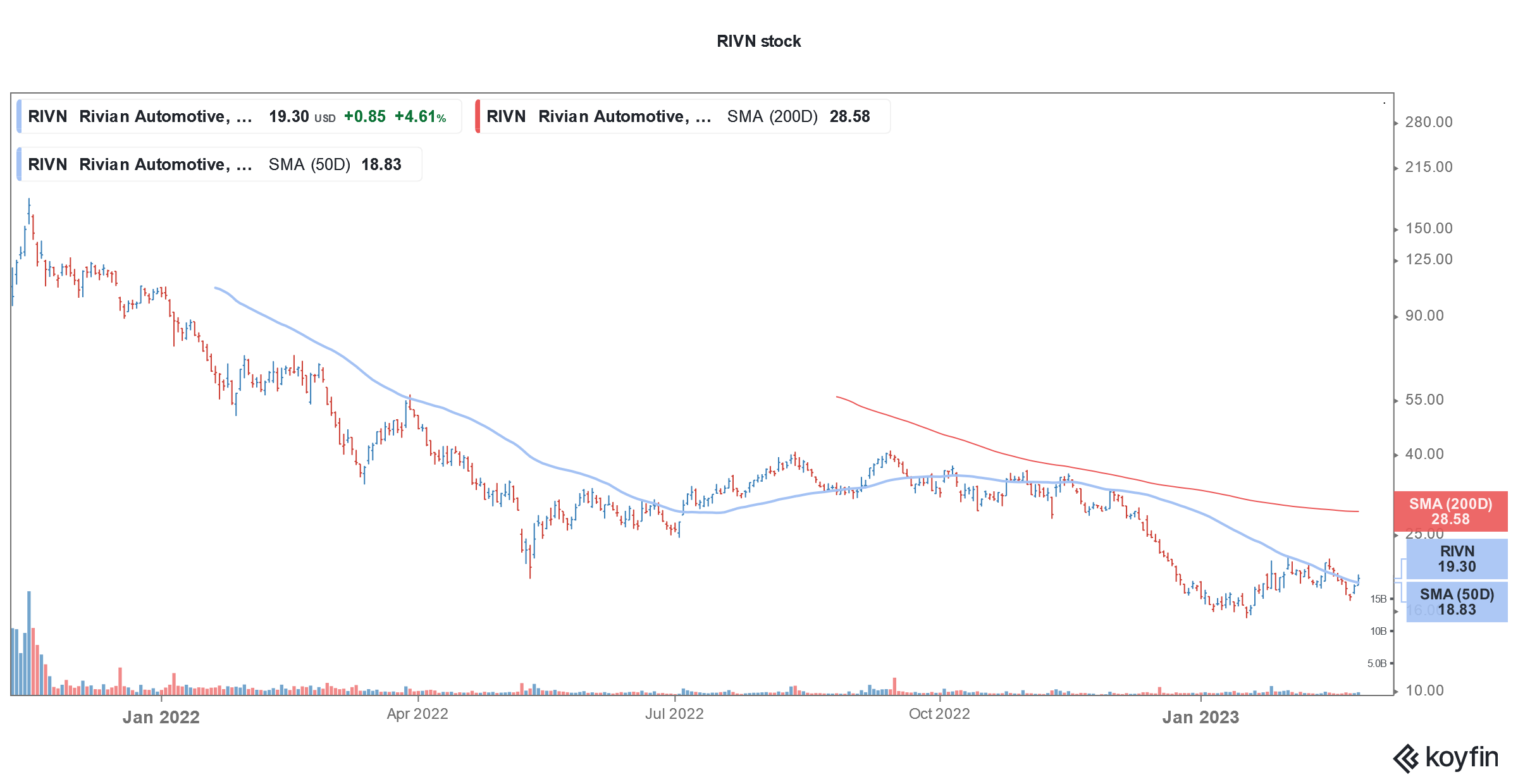

Rivian (NYSE: RIVN) stock is trading sharply lower in US premarket price action today after it reported mixed earnings for the fourth quarter of 2022. Here are the key takeaways from the company’s earnings report.

Rivian reported revenues of $663 million which fell well short of the $742 million that analysts expected. Rivian produced 10,020 vehicles in the fourth quarter and delivered 8,054. In 2022, it produced 24,337 cars and delivered 20,332 of these. The company’s production fell short of its guidance.

Lucid Motors, which reported its earnings last week, also missed revenue estimates. There were several similarities between the earnings of both these companies.

Rivian stock falls after mixed Q4 2022 earnings

Like Lucid Motors, Rivian also posted a narrower-than-expected loss in Q4. RIVN posted an adjusted per-share loss of $1.73 while analysts were expecting the metric at $1.94. It lost $1.72 billion in the quarter which was less than the $2.46 billion net loss in the corresponding quarter last year.

Its losses have been in the $1.70 billion ballpark for three quarters now. Rivian has been looking to cut costs and has announced two rounds of layoffs over the last year.

The company also recalled around 13,000 cars. It is the second recall for the company in less than a year.

Rivian expects to produce 50,000 cars in 2023

Rivian expects to produce 50,000 cars in 2023. This would imply a YoY growth of over 100%. However, the guidance trailed analysts’ estimates by a wide margin. Notably, Lucid Motors guided for a 2023 production of between 10,000-14,000 cars. At the top end of the guidance, the company expects to nearly double its production in 2022.

However, the similarity ends here. Lucid Motors admitted that it is no longer constrained by supply and has the capacity to produce more cars. The company admitted that it needs to work on brand awareness. Lucid Motors said that it has a world-class product and just needs to market it better.

While the company’s CEO Peter Rawlinson, a former Tesla employee, sees it as an “entirely solvable problem” markets are perturbed over the apparent slowdown in EV demand growth.

Rivian would not provide preorders

Meanwhile, like Lucid Motors, Rivian would also not provide preorders. During the Q3 2022 earnings call, it said that it has 114,000 preorders which were higher than the previous update.

Lucid Motors on the other hand reported a fall in reservations for two consecutive orders.

EV demand growth is slowing down

Rivian meanwhile tried to downplay demand concerns. In response to an analyst question over weakening demand for electric cars, RIVN CEO Robert Scaringe said, “Certainly what we’re witnessing in the macro and what we’re seeing in terms of interest rate is, I think, across the industry, having an effect of moderating overall demand.”

He added, “But what we would say is, and as we think about it, the demand backlog that we have is very robust. It gives us a clear line of sight until well into 2024.”

Rivian maintained that it is still constrained by supply. It also said that its 2023 production would be weighted towards the second half of the year as it expects supply chain pressure to ease by then. Also, the company is taking downtime in the first quarter which would impact production.

RIVN cash burn increased in the quarter

Rivian’s cash burn was $2.2 billion in the fourth quarter. The company ended 2022 with cash and cash equivalents of $11.6 billion. The company’s cash pile has gradually come down since the IPO as it continues to burn billions of dollars of cash every quarter.

The company expects its cash to fund its business through 2025. During the earnings call, it said, “We continue to evaluate a variety of capital markets available to Rivian ranging across the capital structure. We plan to employ a portfolio-based approach as we look to maintain a strong balance sheet position.”

Last year, several EV companies like Lucid Motors, Nikola, and Arrival raised cash amid the continued cash burn.

Rivian 2023 guidance

Rivian said that it expects to post a gross loss in 2023. Its CFO Claire McDonough however added, “we anticipate improving on a dollar basis for the year as we reduce our cost of goods sold per vehicle produced, improve our average selling prices per vehicle and begin to see our LCNRV charge decline.”

RIVN expects its adjusted EBITDA to be -$4.3 billion in 2023, $900 million lower than in 2022. The company expects its capital expenditure to be around $2 billion in 2023 and 2024.

Rivian is targeting a total annual production capacity of around 600,000 cars between its Normal and Georgia plants. It aspires to capture 10% of the global automotive market share which might seem a tall ask considering the massive competition. The company is currently producing the R1T pickup, R1S SUV, and EDV (electric delivery van). At the upcoming factory in Georgia, Rivian would produce the affordable R2.

RIVN expects to become gross profit positive in 2024

Meanwhile, Rivian said that it expects to become gross profit positive in 2024. It said that the cash burn would “improve meaningfully” in 2025. Over the long term, the company is targeting a gross profit margin of 25%, a high teen EBITDA margin, and a 10% free cash flow.

Like fellow startup EV companies, Rivian faces the proverbial moment of truth as it scales up deliveries and sets up new plants. While it is customary to compare every startup EV company with Tesla, the Elon Musk-run company has managed to prove its mettle against all odds.

Not all EV companies might be able to repeat the magic as is quite evident over the last year. Rivian is backed by Amazon and Ford. However, the latter has sold most of the shares and now holds just around 1% of Rivian. With EV competition and price war heating up, Rivian seems to have a rocky road ahead as it tries to prove its mettle.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account