As the price of gold rockets to all-time highs exchange-traded funds (ETFs) continue to see record inflows as investors flock to the yellow metal to hedge against a potential spike in inflation.

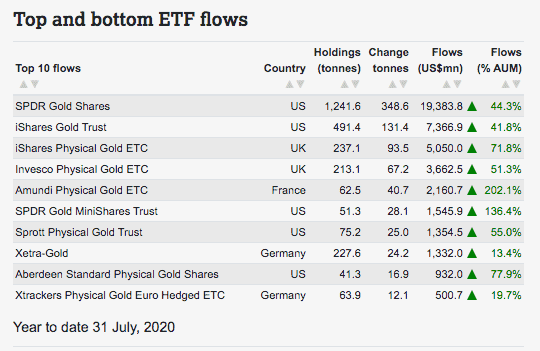

So far this year, gold ETFs have taken in roughly $49bn according to data from the World Gold Council, with US-based funds leading the tally seeing $32bn of inflows, followed by European funds, with $14.6bn of inflows this year.

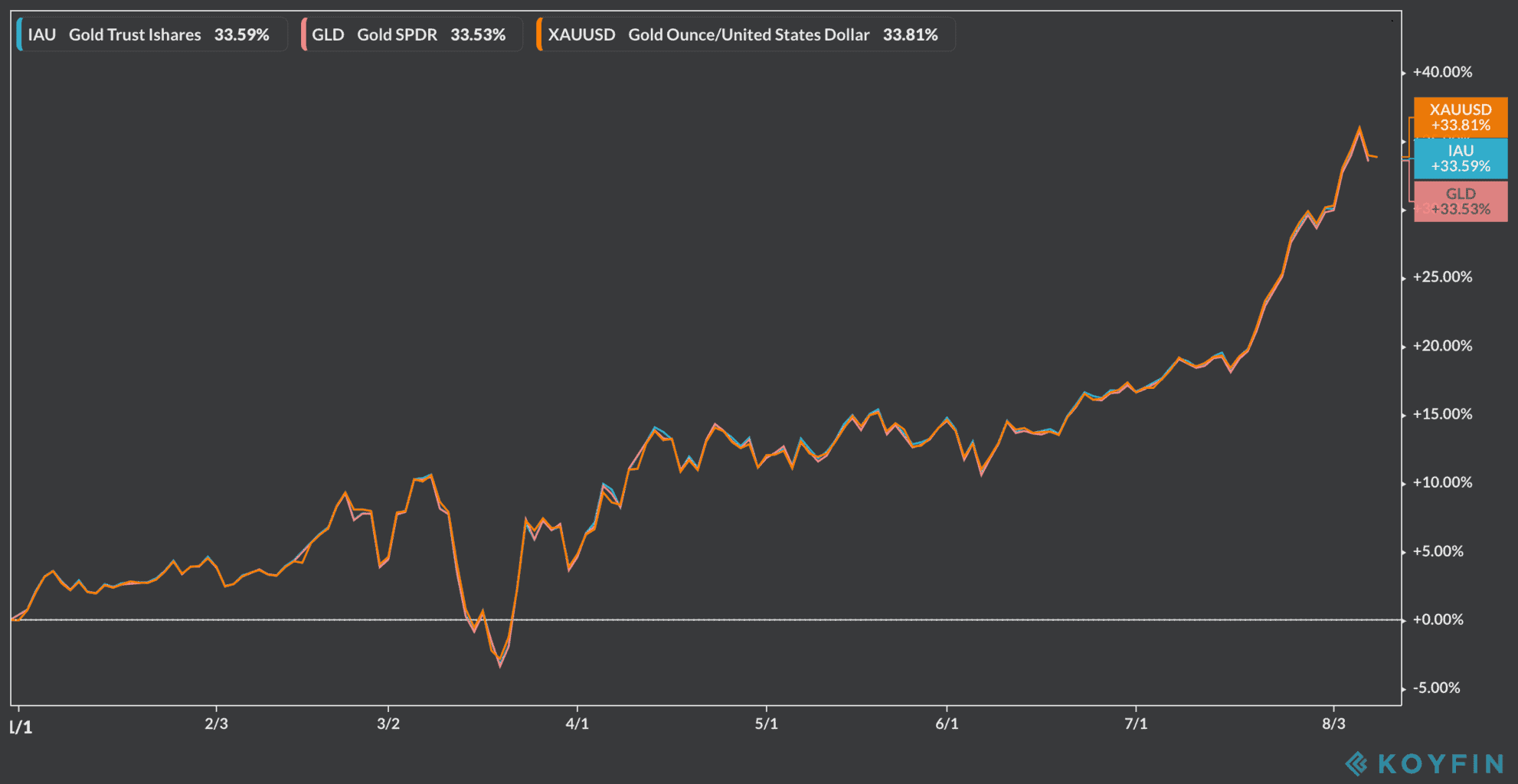

Unprecedented global stimulus by governments due to the pandemic and resultant expectations of currency debasement and inflation have buoyed gold’s appeal as an insurance, driving it 34% higher so far this year.

Global holdings of gold-backed ETFs and similar products have hit a new all-time high of 3,785t and the price of gold hit a record high of $1,976 per troy ounce by the end of July, leaving global assets under management standing at $239bn. The price of gold managed to break its all-time high a few weeks later, hitting $2,021 per troy ounce in early August.

As the gold fever continues, investors – especially those who are in it for the long-haul – need to work out which ETF offers them exposure to the yellow metal’s rise at the lowest cost.

How do gold exchange-traded funds (ETF) work?

Exchange-traded funds (ETFs) are financial vehicles that hold a basket of securities that seek to mirror the performance of the actual assets they track.

In the case of gold ETFs, their purpose is to fluctuate in line with the price of gold – usually tracked by the spot price of gold in US dollars or by the price of gold’s front-month futures contract.

To do this, ETFs hold physical bullion or they can also purchase derivatives such as futures or options to mimic the performance of gold.

Investors should look out for two things: performance and expenses.

In terms of performance, a gold ETF must demonstrate a strong record of closely tracking the price of this commodity.

The expense ratio is another variable to keep an eye on, as expensive ETFs can end up eating up a sizable portion of gains, especially when held over a long period.

Most popular & cheapest gold ETFs

According to data from the World Gold Council, the most popular ETF so far this year is the SPDR Gold Shares ETF (GLD) managed by World Gold Trust Services. This ETF has taken $19.4bn in inflows year-to-date, making it by far the most popular fund, followed at a distance by the iShares Gold Trust (IAU) managed by Blackrock, which has seen $7.4bn in inflows during 2020.

Meanwhile, the cheapest gold ETF out there – according to SeekingAlpha.com – is the Aberdeen Standard Physical Gold Shares (SGOL) offered by Aberdeen Standard Investments, which has an expense ratio of 0.17% per year, meaning that a $10,000 investment would generate $17 in expenses for investors.

This US-listed fund has received $932m in inflows for the year and it is followed by the Granite Shares Gold Trust (BAR) managed by GraniteShares LLC, which also charges 0.17% in expenses per annum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account