Options Trading for Beginners 2022

There are lots of ways to start trading financial securities, but options trading is a bit different than any other trading method out there. Though it may seem complicated at the beginning, once you understand the basic rules and the logic of this form of trading, you will be able to take advantage of options whether you decide to use options for day/swing trading or as a hedging tool.

Options trading has large potential but also a high level of risk. Unlike other trading methods, options trading requires high analytical skills and a basic understanding of options trading terminology.

In this guide, we’ll go through all the necessary aspects of options trading, explain what is options trading, how the options market works and include some popular brokers to help you get started.

-

-

Step 1: Open an Options Trading Account

As we mentioned, the first step you should take is to find the right trading platform. Obviously, you can trade options on an exchange, but you will have to pay high commissions and brokerage fees. Another way to enter the options market is via a CFD broker, which provides CFD options trading on a derivative (secondary) market. CFDs are basically a private contract created between you and another participant in the market (it could be the broker or another trader). At the time of writing, there are only a few CFD brokers that offer CFD options trading:

1. Plus500 - Online Options Trading Platform Through CFDs

Plus500 is one of the few CFD brokers out there that offer options trading. The broker allows you to trade on options with up to 5:1 leverage on a huge selection of financial instruments across various markets that include shares, indices, commodities, and forex. Take note that Plus500 does not charge any additional commission related to options trading activity except the buy and sell spread.

When it comes to regulation, Plus500 is a well-regulated broker, registered in several financial authorities including CySEC, FCA, and ASIC.

OUR RATING

- Plus500 offers a huge selection of options to trade across different markets

- The broker offers a leverage ratio of 1:5 on options trading

- One of the most well-reputed brokers in the market

- Plus500 does not offer a desktop-based trading platform

- Plus500 is not yet available in the United States

80.5% of retail CFD accounts lose money. Sponsored ad2. AvaTrade - Online Trading Platform for Options Trading

AvaTrade is another CFD broker that offers CFD options trading, but what makes AvaTrade an ideal broker for that purpose is not only the fact that it provides options on its platform but also that it provides a specially designed trading platform for options trading; the AvaOptions. The AvaOptions is an innovative platform, with high-end functionality.

For those who are looking for a professional options trading platform, AvaTrade is the right choice.

OUR RATING

- Regulated by top regulators - Central Bank of Ireland, ASIC, BVI, CySEC, FSA, ADGM, and FSCA

- Offers an innovative trading platform for options trading

- AvaTrade provides unique trading tools and educational material

- AvaTrade does not accept clients from the United States

- Limited selection of products

Sponsored ad3. IG - Options Trading Provider in the UK

IG is a well-established broker with more than 40 years of experience in the industry. The UK-Based broker operates in many countries across the globe with more than 17,000 products to trade on. IG is also one of the few brokers to offer options trading for its clients through a range of platforms including but not limited to MetaTrader4.

The broker offers special conditions for traders in the UK, though any trader from a supported country can get access to options trading via IG.

Our Rating

- IG offers a wide range of more than 17,000 products to trade on

- The broker offers a commission-free options trading (except on shares)

- IG allows you to choose daily, weekly, monthly and quatery option contracts

- Options trading is not available in the United States

- IG charges inactivity fee

Sponsored adStep 2: Learn How the Options Market Works

What is Options Trading?

Options are a type of derivative financial instrument traded on exchanges. An option is basically a contract that allows an investor to buy or sell an underlying instrument at a specified price and date. There are two types of options: calls and puts. While call options mean that the strike price is higher when the underlying asset rises, put options are the opposite. For example, if the price of an oil barrel in the market is $28 (let’s assume that the current month of the year is March), and a trader wishes to buy a $30 June call option contract, then a trader can trade on the option’s price until the date of expiration, meaning options are a tradable asset. Though the trader’s target for the oil’s price is above $30 at the time of the delivery, the majority of day/swing traders close all positions before the delivery date. An option contract can be based on different underlying securities such as stocks, commodities (grains, energy, softs), indices, currency pairs, ETFs, bonds, etc.

Believe it or not, but the first evidence of options trading can be traced back to 332BC when Thales of Miletus bought the option to buy an olive harvest at a future date. By doing that, Thales has created the first options contract in history. In the late 16th century and the beginning of the 17th century, options were created for the purpose of hedging, mainly for wheat, corn and soybean farmers, but nowadays, options have also become a tool of speculation.

How the Options Trading Market Works

Options are an asset known as derivatives as they derive their value from the underlying asset. In simple terms, an option contract gives you the right to buy or sell an underlying asset at a specified date, price and even place for deliverable commodities such as oil, wheat, and corn.

There are several marketplaces for options trading: Stock options are traded on stock exchanges, commodity options are traded commodity option exchanges such as CME, NYMEX, and ICE, and currency pairs options are traded on exchanges such as CME or through the over-the-counter market. Regardless, once you have chosen the underlying asset, you will have to find the exchange in which the asset is being traded and track the options’ prices on the exchange.

Another important key factor in options trading is the difference between American options and European options. The main difference between these two types of options relates to the right of exercise of the option. European options enable the investor to exercise the option only at expiration date only while American options allow investors to exercise the option at any time before the expiration date.

Step 3: Choose an Options Trading Strategy

Well, that’s the fun part of options trading. Before we delve into options trading strategies, let’s understand how options are priced. There are five factors that influence options prices, according to the famous Black and Scholes model: the strike price, the current price of the underlying asset, time to expiration, interest rate, and the volatility of the underlying asset.

Another popular way to determine the value options is the Greek letters: Delta, Theta, Gamma, Vega, and Rho. These letters measure the sensitivity and risk of the option to various parameters.

Options Trading Strategies

There is a large number of options strategies (at least 30), but we have included here only the most used and popular trading strategies to help you get started.

Take note that options strategies can be categorized into bullish, bearish and neutral.

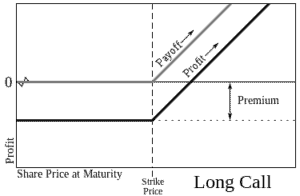

Long Call

The long call option strategy is the most basic and simple options trading strategy whereas a trader buys a call option with the prediction that price of the underlying asset will rise.

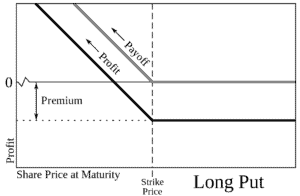

Long Put

The same as the long call option, the long put option refers to a trading strategy that involves the buying of the put option, meaning the investor believes the price of an underlying asset will fall.

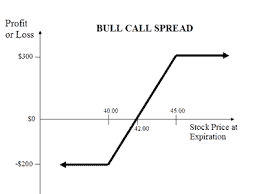

Bull Call and Put Spread

A bull call spread is a bullish options trading strategy that involves the buying of two call options. This difference between the strike price of the two contracts if the profit while the benefit of this strategy is the limit amount of loss. The bull put spread is the same strategy but with the belief that the price underlying asset will drop.

Long and Short Straddle Option

A long straddle is a trading strategy in which a trader buys a long call and long put option on the same underlying asset with the same expiration date and strike price. By doing that, the trader creates a position with unlimited profit and limited potential loss. This type of strategy should profit if the underlying asset makes a big move either up or down, meaning it is neutral.

Conclusion

Options trading was once considered a hedging tool for farmers and producers who had to protect their crops and unexpected price changes in the market. Since the 1987 crash, options trading has become mainstream and with the rise of technology, a growing number of applications enable traders to trade options.

Options trading is not a simple process – you’ll have the get the necessary skills and be familiar with options trading terminology.

FAQs

Is options trading safe?

Well, options trading is a risky business like any other type of trading. It is a legit market that actually operates since the 16th century when it appeared at the time of the Tulip mania. If you choose the right broker, then you can rest assure that options trading is completely safe.

How can I join options trading?

There are plenty of ways to start trading options. If you are looking for a broker that charges low commissions, Plus500 and AvaTrade are great options to start with.

How much money do I need to start trading options?

Options requires a low budget, hence, you won’t have to break the bank if you want to start trading options. Plus500, for instance, requires a minimum deposit of $100.

See Our Full Range Of Trading Resources – Traders A-Z

Tom Chen

View all posts by Tom ChenTom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. He has a B.A. in Economics and Management and his work has been published on a range of publications, including Yahoo Finance, FXEmpire and NASDAQ.com.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up