Goldman Sachs expects a bull market in commodities next year and sees 30% returns over the next 12 months from a basket of commodities.

“Given that inventories are drawing this early in the cycle, we see a structural bull market for commodities emerging in 2021,” said Goldman Sachs analysts led by the head of commodity research Jeffrey Currie.

Which commodities are Goldman Sachs bullish on?

Goldman Sachs is particularly bullish on non-energy commodities like metals and farm products. “In our view, base metals and agriculture have more near-term upside than oil, with smaller inventories to move through before prices begin to rise,” said Goldman Sachs analysts.

It has cited strong demand in China as a bullish driver for commodity prices. Goldman Sachs also sees adverse weather conditions as a bullish driver for the prices of agricultural products.

China is the biggest consumer of almost all the commodities. It also has the lions share in supply side dynamics for many metals like steel and aluminum. However, since the country is not self-sufficient in its raw material needs it is dependent on imports for key commodities like copper and iron ore.

Chinese demand has bounced back

China’s demand environment tends to have an outsized impact on commodity prices. For instance, commodities tumbled in 2015 amid concerns over a hard landing in the Chinese economy. Looking at 2020, while the rest of the world is still grappling with the pandemic and the resultant economic turmoil, the Chinese economy has returned to growth after the slump in the first quarter. A strong Chinese economy has helped metals like copper to rise to multi year highs.

Goldman sees inflation returning

“We see trends in rising social need, alongside investor complacency over inflation, as raising the political risks of policy with an inflationary bias,” said Goldman Sachs analysts. They added “Accordingly, we expect an increased rotation into commodities as an inflation hedge.”

Commodities tend to do well in periods of high inflation. A weaker dollar is another positive for commodity prices as they have a negative correlation with the dollar. Commodities are traded in the US dollar so a fall in the greenback makes commodities cheaper to buy in other currencies.

While the US dollar was strong in the early days of the pandemic, it has been weak thereafter. A massive fiscal and monetary policy stimulus has pressurized the greenback. Also, many see the fall in the US dollar as a reflection on how the country has handled the pandemic. The US has the highest number of virus cases as well as fatalities globally.

How commodities could react to US elections?

Goldman Sachs sees a bullish case for commodities if Joe Biden wins the upcoming US elections. It expects US copper demand to rise 2% every year for the next five years under Biden’s plan. That said, commodities had rallied in 2016 after Donald Trump’s surprise election. Trump had vowed to invest substantially in the infrastructure sector in his tenure. Infrastructure investments boost demand for commodities like steel, aluminum, and copper. However, Trump’s trillion-dollar infrastructure plan never really took off even as the President delivered on some others of his pre-election promises like the tax reforms.

Goldman Sachs provides a forecast for commodities

Goldman Sachs has also provided its forecast for different commodities. It expects gold prices averaging $2,300 per ounce in 2021. Currently, the yellow metal is trading around $1,915 per ounce. Most brokerages have a bullish view of gold.

Bank of America is forecasting the yellow metal to reach $3,000 per ounce by the end of 2021. Frank Holmes, chief executive at investment firm US Global Investors expects prices to reach $4,000 per ounce, forecasting a more than 100% rally over current levels.

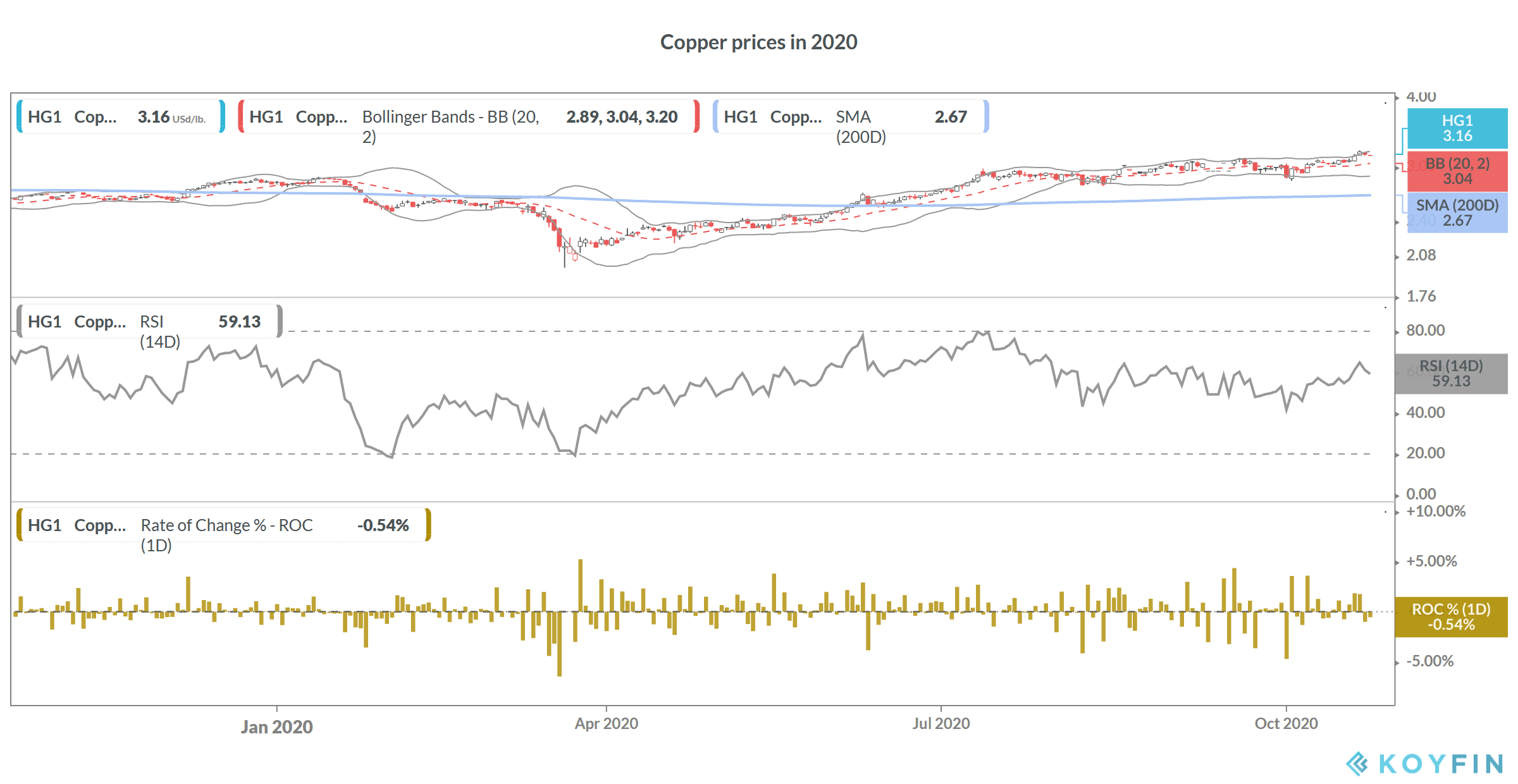

Copper prices

Goldman Sachs expects copper prices to rise to $7,500 per metric ton over the next 12 months. Currently, spot copper trades just under $7,000 per metric ton. Copper prices have gained over 13% so far in 2020. Notably, copper is seen as a barometer of the global economy given its diverse usage in industries ranging from construction, automobiles, and consumer goods.

How can you trade and invest in commodities?

There are several ways through which you can trade and invest in commodities. You can trade them through any of the best online commodity brokers. You can also invest in some commodities through binary options. There is a list of some of the best binary options brokers.

If you are not well versed in investing in commodities and still want to have exposure to them, you can consider ETFs. There are ETFs that give you exposure to a basket of commodities as well as those focused on a specific commodity like copper or oil.

By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account