Oil futures are advancing for a second day during today’s early commodity trading action after the Organization of Petroleum Exporting Countries (OPEC) decided to stick to its previously outlined scheme of progressively hiking its daily crude output by around 2.1 million barrels from May to July.

Both West Texas Intermediate (WTI) and Brent futures are advancing north of 1% this morning, with the US benchmark trading at $68.4 per barrel – the highest price since October 2018 – while the international benchmark is nearing the $71 level for the first time since May 2019.

OPEC and its allies decided to maintain these progressive output increases during the 17th Ministerial Meeting held virtually on Tuesday while the cartel’s Secretary General – Mohammad Sanusi Barkindo – provided positive guidance on the demand front as he stated that daily consumption should move above 99 million barrels per day during the fourth quarter of 2021 – a figure that would put oil’s demand back at pre-pandemic levels.

The cartel’s decision to maintain the pace of its previously announced rollout plan is the primary driver behind this two-day uptick in oil prices as market participants may have priced in the possibility of a higher-than-planned output hike.

Meanwhile, the situation with Iran was also addressed by OPEC’s Secretary General. However, the head of the cartel emphasized in a statement that “the expected return of Iranian production and exports to the global market will occur in an orderly and transparent fashion”.

This was interpreted as a signal that the additional output coming from the Middle East country should not disrupt the state of the market as increased demand post-COVID should fully absorb the additional intake.

Analysts from Eurasia Group addressed the matter in a note to clients released yesterday. “Over the medium term, OPEC+ will most likely adjust its policy to prevent the addition of Iranian barrels from derailing its market balancing strategy”, the firm wrote.

Moreover, the United States Transportation Security Administration (TSA) reported the highest number of passengers screened in a single week since the onset of the pandemic, with a total of 11.9 million people moving through the country’s airports during the week ended on 30 May while a total of 1.9 million passengers traveled on Memorial Day, this being the second biggest daily count since the virus crisis started.

What’s next for oil futures?

Later today, estimates for US crude inventories will be provided by the American Petroleum Institute (API) a day before the release of the Energy Information Administration (EIA) regular weekly update. According to data from Koyfin, analysts are estimating a strong 2.11 million drop in crude stocks along with a 1.39 million decline in gasoline inventories.

A beyond-expected drop or an unexpected buildup could affect the price action seen by oil futures in the following days. However, the market appears to be quite satisfied with the outcome of yesterday’s OPEC meeting and that could maintain the current constructive attitude toward crude for a while.

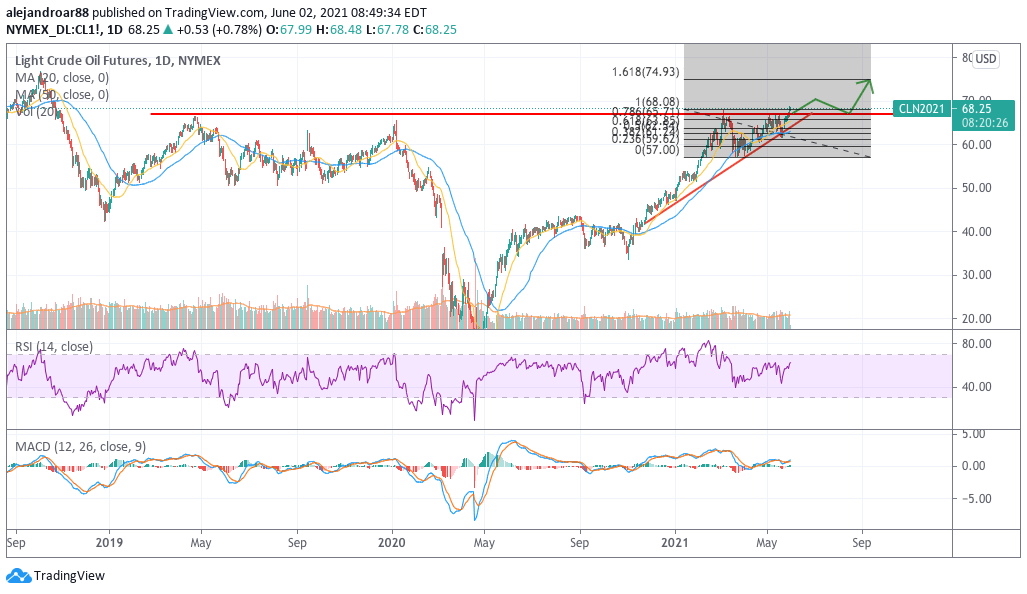

The outlook for oil futures remains bullish based on a break of a long-dated resistance we mentioned in a previous article with a first target set at $75 per barrel for the WTI and $73 for the Brent for the following weeks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account