American biotech Moderna said the US government will fund the development and manufacture of a potential vaccine for Covid-19 in a deal worth up $483m.

The Biomedical Advanced Research and Development Authority (BARDA), part of the US Department of Health and Human Services, will fund development of the vaccine mRNA-1273 up through approval by US regulators and will also help with efforts to scale manufacturing of the drug.

Massachusetts-based Moderna developed the potential vaccine — from the genetic sequence of the virus to delivery of a vial that could be tested — in a record-breaking 42 days.

The firm’s vaccine is one of the first to begin human trials — a group of 45 healthy adult volunteers. Moderna said if the trial is successful, it could reach final-stage testing by fall 2020. There are currently 70 Covid-19 vaccines in some stage of development, according to the World Health Organization.

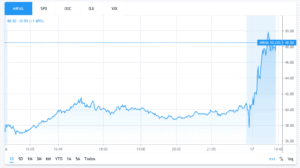

Moderna (NASDAQ: MRNA) is up just over 14% at $46.34 in Friday afternoon stock trading session. The stock has jumped 140% this year.

The company expects to move forward to Phase 2 trials, a stage that involves testing the vaccine on larger groups, by the second quarter of this year, while Phase 3 trials could begin during the fall of 2020.

Moderna Chief executive Stéphane Bancel (pictured) said: “By investing now in our manufacturing process scale-up to enable large scale production for pandemic response, we believe that we would be able to supply millions of doses per month in 2020 and with further investments, tens of millions per month in 2021, if the vaccine candidate is successful in the clinic.”

BARDA director Rick Bright added: “Delivering a safe and effective vaccine for a rapidly spreading virus requires accelerated action. BARDA’s goal is to have a vaccine available as quickly as possible”.

Moderna shares are traded in the NASDAQ exchange and you can buy them through a stock broker or you could also trade CFDs or engage in spreadbetting to profit from any price fluctuations in the price of Moderna shares.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account