The price of Chewy stock is dropping in pre-market stock trading action today after the company reported its financial results covering the first quarter of its 2021 fiscal year despite exceeding analysts’ forecasts for the period.

The online pet supplies vendor reported quarterly revenues of $2.14 billion for a 31.7% year-on-year jump while exceeding analysts’ expectations of $2.04 billion for the period. This positive performance was primarily led by an increase in the number of active customers along with an uptick in the amount of net sales per customer.

According to the firm’s shareholders letter, Chewy managed to attract 4.7 million new customers during the three months ended on 2 May, which represents a 31.6% increase in the firm’s user base compared to a year ago, ending the period with a total of 19.8 million active consumers.

Meanwhile, net sales per active customer jumped 8.7% to $388 during the period while the company reported a gross margin of 27.6% that resulted in a 420 basis points improvement in the company’s top-line profitability compared to the same period last year.

Like many other companies nowadays, Chewy’s management emphasized the presence of supply shortages, which, according to the firm, resulted in an estimated $40 million in lost revenue. Additionally, the firm also mentioned that it experienced labor shortages during these past three months.

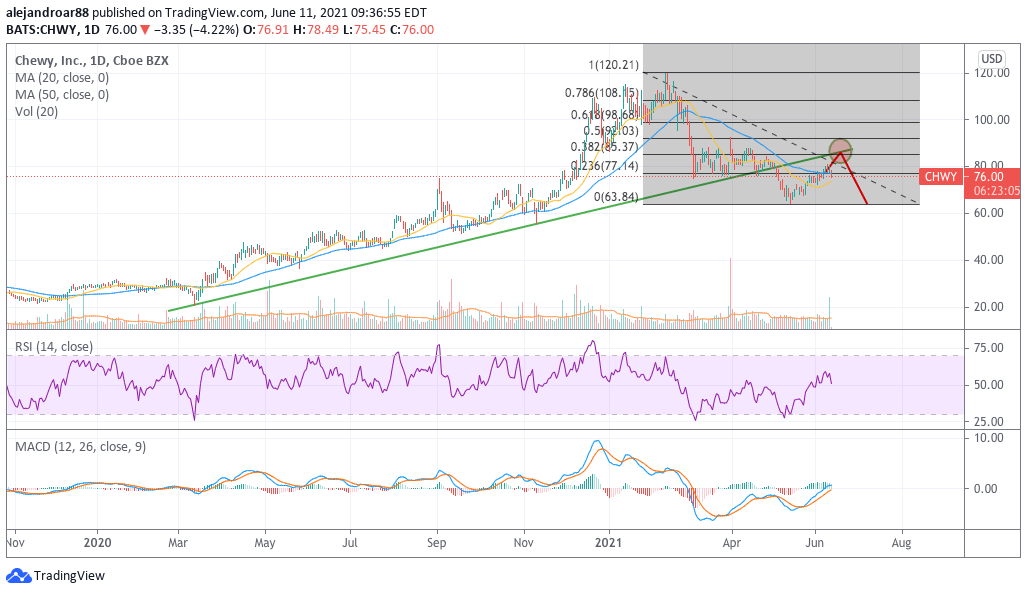

These comments might be the reason why Chewy stock is dropping 1.85% in pre-market action today at $77.9 as investors seem to be fearing that such headwinds could hurt the company’s growth in the following quarters.

However, Chewy’s management maintained its guidance for both the upcoming quarter and full fiscal year, with the company expecting to see its annual sales landing at around $9 billion – a figure that continues to be in line with analysts’ estimates for the period.

Chewy posts its second consecutive profitable quarter

Chewy reported a net income of $38.7 million during its first fiscal quarter, making this the second consecutive quarter in which the company reports a profit. The company attributed this positive bottom-line figure to higher sales, improved gross margins, and a reduction in share-based compensation.

Meanwhile, the firm’s free cash flow ended the quarter at $59 million vs. negative $22 million it reported a year ago while Chewy’s adjusted EBITDA jumped from $3 million in Q1 2020 to $77 million during this first quarter of the 2021 fiscal year which resulted in a higher adjusted EBITDA margins of 3.6% – up 340 basis points from the figure reported a year ago. Finally, cash and equivalents for Chewy expanded to $637 million during the period.

What’s next for Chewy stock?

Based on the management’s revenue guidance for the full 2021 fiscal year of $9 billion, Chewy is being valued at roughly 3.3 times its forward sales – a number that seems quite conservative based on the firm’s historical growth.

If such a target is hit, Chewy’s sales would have grown at a compounded annual growth rate (CAGR) of 43.9% since 2018 even though year-on-year sales growth by the end of 2021 would have slowed down to around 25.9%.

Assuming that the company could continue to grow at a pace of 25% per year for the next 3 years, total sales would almost double by 2024 at around $17.6 billion. At that point, if the market maintains its current valuation multiple of 3, that would result in a market capitalization of $52.8 billion.

Meanwhile, weighted average diluted shares outstanding could be projected to land at around 460 million based on the current growth trend, which results in a forecasted price of $114.8 per share for a 47% upside potential and an 11% CAGR.

Although those gains don’t seem too attractive if we take into account that an 11% CAGR is roughly in line with the average historical returns of the S&P 500 index, it is important to note that Chewy’s multiple could also be expanded if market conditions and the firm’s growth prospects continue to be as strong – or even stronger – as they are now.

For that to happen, Chewy must accompany that higher revenue with an improvement in net margins. If that happens, chances are that the market could revise the firm’s price-to-sales multiple to levels that are more in line with its historical and future growth prospects.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account