What is Spread Betting? How to Spread Bet in 2022

The investment arena is jam-packed with complex financial products and services.

One such example of this is spread betting. In a similar nature to CFDs, spread betting allows you to speculate on the future price of an asset without actually owning it. Instead, you are merely guessing whether the asset will go up or down in price.

However, it is crucial that you have a firm grasp of how spread betting works before parting with your money.

In our Ultimate Spread Betting Guide, we go over the basics of spread betting. This will include the ins and outs of how spread betting works, what you can trade, what risks you need to consider and more.

-

-

How does Spread Betting Work?

Spread betting is a form of trading that allows you to buy and sell a range of financial instruments without actually owning the asset.

Instead, you are simply speculating on whether the price of the asset will go up or down. For example, let’s say that you wanted to invest in oil. By doing this through a spread betting platform, you would not be required to own or store the asset.

You simply need to choose how much you want to invest and whether you believe the future price will go up or down. This is why people often think that spread betting and CFD (contract-for-difference) platforms are one of the same thing, as the investment process is very similar.

However, spread betting is different from other forms of trading due to the way that your stake is calculated. Let’s take a look at a quick example so that you can see how a spread betting trade would be structured.

Note: The risks of spread betting should not be understated. You stand the chance of losing your entire investment, so do tread with caution.Example of a Spread Betting Trade

i) Choosing a Trade

Let’s say that you want to speculate on the price of IBM stocks. After performing some analysis on the company, you feel that IBM is heavily undervalued. This means that you are going to place a ‘buy’ order, which means you believe the price will increase.

ii) Stake Per Point

The current ‘sell’ price is £250, and the ‘buy’ price is £252. This means that the ‘spread’ is 2 (the difference between £250 and £252). We’ll cover the spread in more detail further down. Moving on, you now need to think about how much you want to stake per ‘point’. In this example, each dollar that IBM moves in the market will represent 1 point. You decide to stake £10 per point.

iii) Calculating Your Gains/Losses

A few hours after placing your trade, IBM stocks are now valued at £262. This is great for your trade, as you purchased a buy order. As you opened the trade at £252, this represents a profit of 10 points. Your stake was £10 per point, so you made a total of £100.

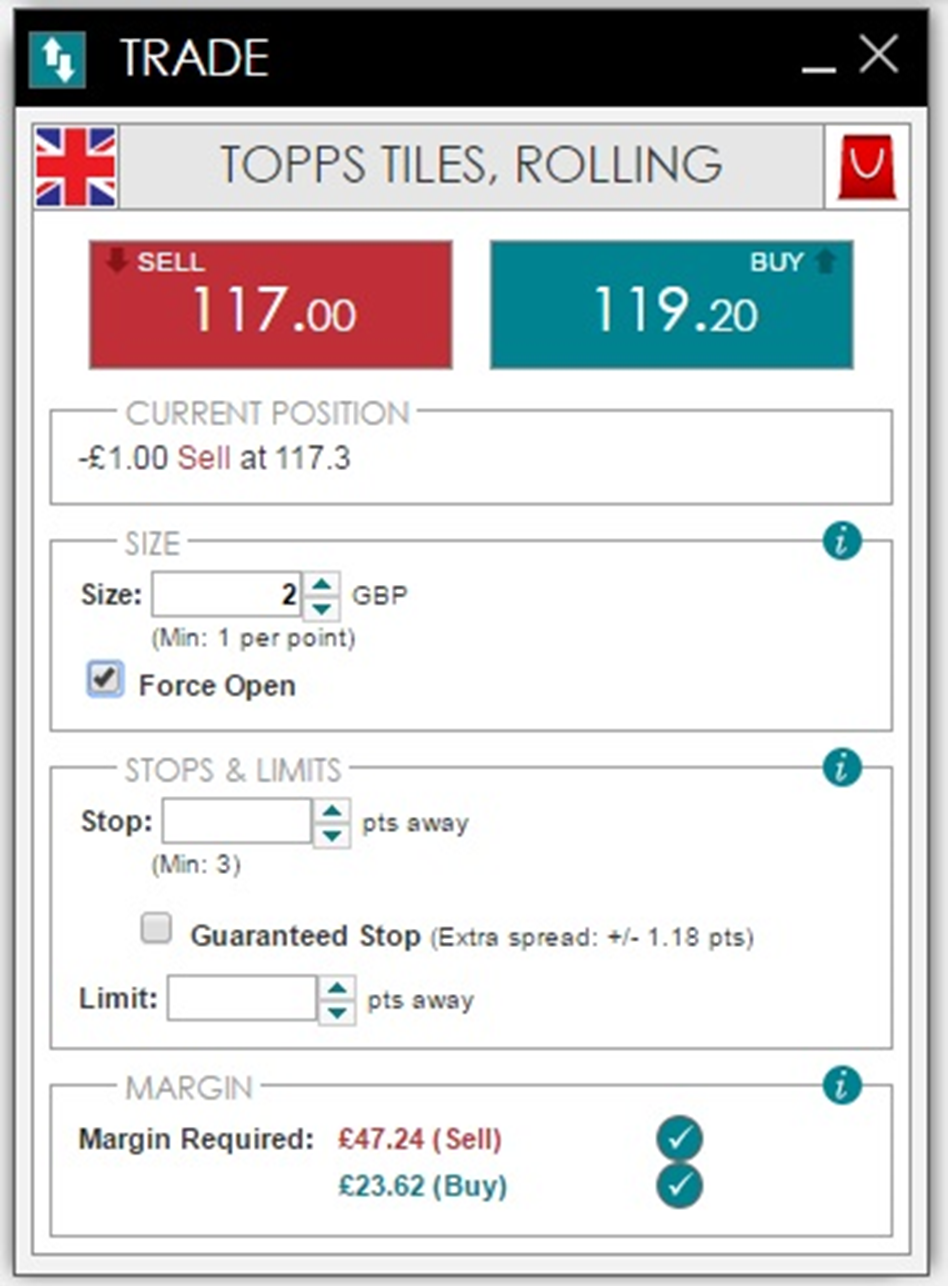

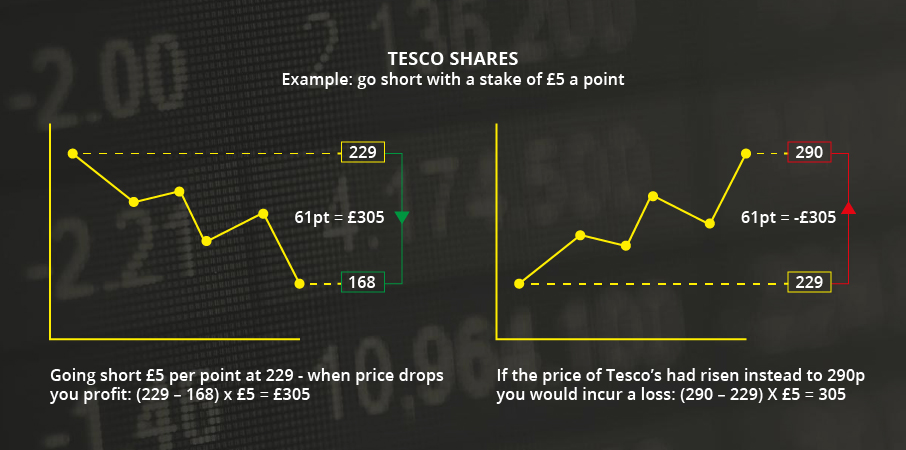

Example of Spread Betting, courtesy of CityIndex What does Going Long and Short Mean in Spread Betting?

One of the biggest advantages of using a spread betting platform is that you will have the option of going ‘long’ or ‘short’. If you were to go long on your trade, this means that you believe the price of the asset will increase. If you were instead to go short, you would be speculating that the price of the asset will go down. This is something that you cannot do when you purchase stocks in the traditional way.

- Going Long

Let’s say that you went long on gold at an original buy price of £1,000, at £1 per point. If the price of gold increased to £1,200, you would have made £200 (200 points x £1). If the price of gold went down to £800, you would have lost £200.

- Going Short

Shorting at a spread betting platform works in exactly the same way as going long but in reverse. For example, let’s say that you went short on oil at an original sell price of £500, at £2 per point. If the price went down to £450, you would have made £100 (50 points x £2). If the price of gold went up to £550, you would have lost £100.

What is the Spread Bet Size?

If you were to place a bet at a trackside bookmaker, you would always know how much you were staking, and how much you stood to win. For example, if you staked £100 at 3/1, you would either collect £400 (£100 x 3/1) or lose your original £100 stake. However, spread betting works in a completely different way, as there is technically no limit to the amount you can make or lose.

In order to get your head around this, you need to have a firm understanding of the ‘point’ system. As I have loosely covered in some of my spread betting examples so far, you need to decide how much you want to stake per point. The point will vary depending on the type of asset you are trading. For example, trading stocks and shares might see the point set at every £1 movement of the underlying asset. If the asset increased by £7 in value, this would mean 7 points. If you were staking £20 per point, then your profit or loss would be £140 (7 points x £20 per point).

What is Leverage in Spread Betting?

When you trade at a spread betting platform, you will be taking on leverage. This is a popular instrument in the financial space as it allows you to trade more than you have in your account. For example, let’s say that you are looking to make a trade worth £10,000, but you do so with 1:10 leverage. This means that you would only need to deposit £1,000 in your account (£10,000 * 10%). This would also mean that your gains are amplified by a factor of 10.

However, applying leverage to your spread betting investments also comes with its risks. While you stand the chance of amplifying your gains by a factor of 10, your losses would also be amplified by the same figure. By applying leverage to your trades, you also need to consider the fees.

This is because you are effectively borrowing the money from the broker. For example, if your trade is worth £25,000 at a leverage of 1:10, but you only deposit £2,500, then the broker is lending you the remaining £22,500. This is known as financing, and it is charged as a percentage of the amount you borrow. The financing fee is charged for every day that you keep your leveraged trade open.

What Margin in Spread Betting?

Understanding how the margin works in spread betting is crucial.

Let’s say that you want to trade £20,000 worth of oil, and the margin requirement is 10%. This means that you can place your £20,000 trade by simply depositing £2,000. This gives you much greater exposure to your chosen marketplace. If your trade is successful, your gains are multiplied by a factor of 10. For example, if the price of oil went up by 5%, you would actually have made 50% because of the way the margin works.

However, if the price of oil went against you, then you could lose all of the margins that you put up.

Sticking with the same example as above, your margin on the trade is £2,500, which is 10% of the total order. If the price of oil went down by 10%, this would mean that your trade would be ‘liquidated’. This closes the trade automatically, and the margin would then be collected by the spread betting company.

Note: The only way to avoid having your margin liquidated is to deposit more money into the spread betting platform. You would normally receive a notification from the broker letting you know that you are approaching liquidation. This gives you the option of deciding whether or not you want to keep the bet open or cut your losses.What is the Spread?

The spread is the difference between the ‘buy’ and ‘sell’ price offered by the spread betting platform.

The percentage difference between the two numbers is how spread betting firms make a profit. For example, let’s say that the ‘sell’ price on Facebook stocks is £100, and the ‘buy’ price is £102. This means that for every £100 staked, the platform would make 2%, or £2.

The size of the spread can have a direct impact on the amount you are able to make from your spread betting trade.

Sticking with the same example as above, you would need to make a profit of at least 2% just to break even. As such, you should assess the average spread charged by a spread betting firm before signing up.

What is the Spread Bet Duration?

Unless you are trading a specific time-sensitive financial asset (such as futures or options), then you can keep your trade open for as long as you like.

However, you do need to make some considerations regarding the costs of financing. As I briefly noted earlier, you will need to pay financing costs when you apply leverage to trade.

As virtually all spread betting trades are based on leverage, these costs cannot be avoided. You will be charged a financing fee for each day that you keep your trade open. The platform should let you know what this amounts to when you set up your trade.

What are the Origins of Spread Betting UK?

Spread betting first grew its roots in 1940s Chicago. It is believed that the concept was developed by a mathematics teacher and soon-to-be bookmaker.

However, spread betting as we know it today is still a relatively new phenomenon. Platforms were originally limited to institutional investors, and the number of tradable asset classes was limited.

When the first regulated spread betting platform reached the UK in the 1970s, investors could only invest in gold. Fast forward to 2021 and everyday investors can now access thousands of financial instruments at the click of a button from a mobile or desktop device.

How is Spread Betting Taxed in the UK?

Although this will depend on where you are a tax resident, spread betting is often classed as gambling. As most jurisdictions do not charge tax on gambling winnings, your spread betting profits could be tax-free. Gains made on the stock markets will always be taxed via capital gains.

Spread Betting versus Stocks, what’s the difference?

- Ownership: When you invest in an asset with a spread betting platform, you do not actually own it. Instead, you are merely speculating on whether the price will go up or down in the markets. When you invest in stocks with a traditional stockbroker, you will own the asset 100%. This means that you will be entitled to dividends and investor rights.

- Points: Spread betting platforms base your profits and losses on a points system. For example, if you were to wager £10 per point, and the point is set at 100, you will make or lose £10 every time the asset moves by 100 points. Stock markets base your gains by the value of the share, and the number of shares you hold. For example, if you hold 10 shares and the price of the stock increases by £5, you will have made £50.

- Going Short: If you were to buy shares with a traditional stockbroker, you would only be able to go long. In order to go short, you would need to obtain a more complex financial instrument, such as those offered by spread betting platforms.

- Risk: As spread betting is based on leverage, you can lose your entire account balance if your margin is liquidated. The only way that you would lose everything on a traditional stock market investment is if the value of the stock went to 0.

- Markets: Stock markets only list publicly traded companies such as those found on the NYSE or NASDAQ. Spread betting platforms allow you to speculate on thousands of financial assets, such as currencies, commodities, energies, futures, options, and cryptocurrencies.

What are the Risks of Spread Betting?

Regardless of what asset class you are investing in, there will always be the risk that you can lose money.

This is no different from the spread betting industry. Your potential losses will come on two main fronts. Firstly, if the price of the asset you have traded goes against you, you’ll lose money.

For example, if you go long on oil, but the price of oil goes down, then you will have made a loss. These losses will only be realized once your trade has been closed.

The biggest risk that you need to consider is that of liquidation. This is because you will be required to cover the margin on your spread betting trades, which is based on the amount of leverage you obtain. For example, the broker might ask you to deposit 5% of the total amount you wish to trade. If the asset then went down by 5%, and you didn’t add more funds to your account to cover the margin, your trade would be closed automatically.

Managing the Risks of Spread Betting

Although the risks of spread betting are plentiful, you can mitigate these risks by implementing a number of risk management strategies.

-

Tip 1. Always install stop-loss orders

The most important risk strategy that you can employ is that of stop-loss orders. This is where you choose a pre-defined price to automatically close the trade, in the event that the trade goes against you. For example, let’s say that you go long on Twitter shares at £120. As you do not want to lose more than 10% on your trade, you can install a stop-loss order at £108. This means that the trade will automatically close at a loss of 10% if the price of Twitter hits £108. If you don’t utilize a stop-loss order on your trades, you could lose a significant amount of money.

-

Tip 2. Consider taking profit orders

In the same way that you should install a stop-loss order to protect yourself from the risks of a sudden market downturn, you should also think about cashing out profits automatically. This is known as a ‘take profit’ order, and you can set this at any amount. For example, let’s say that you go long on natural gas at a buy price of £150. You might decide to set your take profit order at 20%, which means the trade would close automatically when the price hits £180.

-

Tip 3. Know your market

You should only trade markets that you know well. If you have good knowledge of currencies, then focus on forex. Similarly, if your experience is from within the traditional equities space, you should only trade stocks and shares. By trading markets that you don’t know well, you stand a much higher chance of losing money.

-

Tip 4. Understand market gapping

Market gapping is when the price of an asset changes outside of standard trading hours. If the move goes against you, you won’t be able to close the trade until the markets reopen. A standard stop loss will not protect you in this scenario either. However, although it will cost you slightly more in fees, you should consider installing a ‘guaranteed stop-loss’. This will ensure that you close your trade automatically, even if market gapping occurs.

-

Tip 5. Take losses when they come

Regardless of how you decide to trade, losses are something that all investors experience. You need to be emotionally prepared for this, as some spread betting traders are unable to handle the effects of losing money. If and when one of your trades is unsuccessful, don’t dwell on it. If you do, you might find that you engage in more reckless trades in order to recoup the loss. Crucially, if a trade is going against you and you haven’t set-up a stop-loss order, know when to cut your losses.

Conclusion – how to spread bet online

If you have read my guide on spread betting from start to finish, then you should now have a good understanding of how the industry works.

As you now know, traders are fond of spread betting platforms because of the ease at which they can access the financial markets. Whether it’s currencies, stocks, and shares, futures, indices, or commodities – spread betting allows you to speculate on assets in a matter of seconds. Spread betting also enables you to wager more than you have in your account via leverage.

However, you should also have a firm grasp of the risks of spread betting. As I have outlined in my guide, you should install a range of safeguards on your trades.

This should include stop-loss orders at a minimum, as well as ‘guaranteed’ stop-loss orders to cover market gapping. Just make sure you are fully prepared for the risks of spread betting before you take the plunge.

What can you trade in spread betting

Spread betting platforms typically offer thousands of financial instruments. This is likely to cover stocks and shares, commodities, currencies, futures, options, cryptocurrencies, and more.

What is the spread in spread betting?

The spread is the difference between the ‘buy’ and ‘sell’ price. This is how spread betting companies make a profit.

What payment methods do spread betting sites support?

Spread betting sites usually support a full range of everyday payment methods. This includes debit/credit cards, e-wallets, and a bank transfer.

Do spread betting sites ask for ID?

In order to remain compliant with anti-money laundering laws, all spread betting sites must verify your identity.

What is the minimum deposit amount at a spread betting site?

This will vary from site-to-site. Some spread betting platforms allow you to deposit just £50, while others will ask for more.

How much margin do I need to put up when spread betting?

The minimum margin requirement will vary depending on the asset you are trading. While forex typically averages 1%, stocks and shares are usually around 10%.

UK Trading – A-Z Directory

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up