Kabbage Review 2021 – READ THIS BEFORE Applying

Are you currently running a small business, but require a bit of extra funding? If so, you’re certainly not alone. In fact, the availability of instant cash is a major roadblock for the vast majority of new startups. Here’s where the likes of Kabbage aim to help. The online FinTech platform offers small business lines of credit of up to $250,000, subsequently giving you fast access to much needed working capital.

If this sounds like something you’re interested in exploring further, be sure to read our comprehensive Kabbage review. We’ve covered everything you need to know, such as how a Kabbage line of credit works, who is eligible, how much you’re likely to get, and more.

Apply for a Payday Loan Now! | Best Payday Lender 2020

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

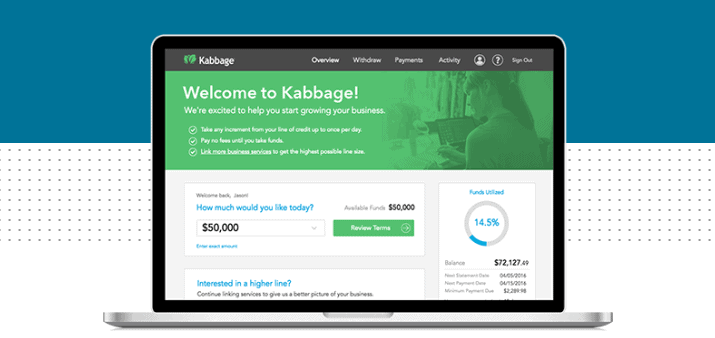

Kabbage is an online platform that can facilitate lines of credit to small businesses. This operates in a very similar way to a business account overdraft, meaning that you can access the funds as and when you need it. This is particularly useful for business startups, as it effectively gives your working capital levels a much needed boost. Although minimum eligible requirements still apply, obtaining a line of credit with Kabbage is much easier than using a traditional lender. In return for this somewhat more relaxed eligibility process, you will of course need to make some serious considerations regarding rates. In fact, you should expect to pay anywhere from 24% APR, up to a staggering 99% APR. Nevertheless, as a small business owner, you’ll know that this is often the price to pay for access to credit facilities. The main reason for this is that the lender will look at how your small business is performing, as opposed to your individual credit score. It does so by integrating your business accounts, accounting software, and payment systems. It can then assess your business’s creditworthiness and thus, offer you a line of credit that it thinks the business can afford to repay. Kabbage Pros: ✅Small business lines of credit of between $2,000 and $250,000 ✅Business owners with bad credit still considered ✅Lowest APR rate of 24% is competitive ✅More than $7 billion funded across 200,000 businesses ✅Simple online application process Kabbage Cons: ❌ Highest rate of APR at 99% is expensive ❌ Fee system can be complicated to understand at first glance Kabbage describes itself as a fintech platform dedicated helping small businesses access loan services. Unlike most online personal and installment loan providers that only provide one-time loan options, Kabbage provides an expansive business line of credit to small businesses with extended repayment periods and highly attractive interest rates. But how does it compare to such other online loan providers like an Oportun, LendUp, and Opploans? We held it against these lenders and summed up their key features in this table: Kabbage LendUp Oppoloans Oportun The best thing about the Kabbage platform is that the entire application can be completed online. Moreover, if you have all of the required information to hand, alongside the capacity to link your business tools (business checking account, PayPal, Sage, etc), the application process can be completed in less than 10 minutes. Take note, unlike other business loan providers such as Lendio, CashUSA, or LendingClub – the Kabbage application process is somewhat different. To make things a bit clearer for you, we’ve listed the main steps that you will need to take to get started. To get started you will need to visit the Kabbage website. Click on ‘Apply Now’, before opening an account. You’ll need to enter your email address and choose a strong password. You’ll also need to enter the name of your business, your trading address, and telephone number. Before moving to the next step, you will be required to read through the platform’s terms of usage policy. If you’re happy to proceed, move on to the next step. Kabbage will ask that you enter some more information about your business. This will include the specific industry that your business operates in (for example energy, construction, finance, etc), when the business was launched, and how much turnover the business generates annually. Kabbage will also need you to provide some information about yourself. On top of your full name, address, and date of birth, Kabbage will need to verify your identity. As such, you’ll need to enter your social security number and the number found on either your driver’s license or passport. You also need to decide whether or not you want a Kabbage card with your line of credit, which is effectively a Visa debit card that allows you make cash withdrawals and online purchases with ease. This stage of the application process is very innovative. Typically you would be required to submit countless documents for the lender to then review the performance of your small business. However, Kabbage can do this automatically by linking your business accounts to the platform. The more platforms you are able to link, the better chance there is that Kabbage will be able to give you an instant decision. This can include the following: ✔️ Business checking account (not personal account) ✔️ Payment processors (such as Stripe, PayPal, etc) ✔️ Accounting software (such as QuickBooks, Sage, etc) In most cases, Kabbage will be able to let you know whether or not you qualify within a few minutes. If you do qualify, then you will be informed what your available line of credit is. Moreover, you will also be told what APR rates you will need to pay on your line of credit. If you’re happy with the terms outlined in the offer, you will need to sign a digital loan agreement. As soon as you do, your line of credit should be available the next working day. Take note, if you opted for the Kabbage Visa debit card, then delivery can take 7-10 working days. As with any financing product, you need to have a firm understanding of how the fee structure works before you proceed with your application. Although Kabbage notes that the fee structure is simple, it does need to be broken down in more detail. Firstly, you have three options to choose from in terms of how long you can have the line of credit open for. This includes 6 months, 12 months, or 18 months. In terms of pricing, this will not only depend on which of the three terms you decide to opt for, but in some cases, the rates will move during the term. Irrespective of what term you do choose, the fees are based on a percentage of the amount of cash you have drawn down from your line of credit. 💰 6 months: If you opt for a 6 month term, you could pay 4% per month for the first two months, and then 1.25% for the remainder of the term. For example, if you draw down $5,000, the fees will initially amount to $200 per month, and then go down to $62.50. 💰 12 months: If you opt for a 12 month term, you could pay 3% per month for the first two months, and then 1.25% for the remainder of the term. For example, if you draw down $5,000, the fees will initially amount to $300 per month, and then go down to $125. 💰 18 months: If you opt for an 18 month term, the structure is slightly different, not least because your rate will remain constant throughout the term. For example, if you draw down $15,000 and your rate is 2%, then the monthly fee will always be fixed at 2%. Although Kabbage is a bit more flexible with who it provides financing to, you still need to ensure that you and your business are eligible. We’ve listed the main two factors that Kabbage will look at below. ✔️ Age of business Your company must have been in business for at least one year. Anything less than this and you won’t be considered. ✔️ Minimum turnover Your business must also meet the minimum turnover requirements set out by Kabbage. This needs to a minimum annual turnover of $50,000, or a monthly turnover of $4,200. If opting for the latter, this will need to have been achieved in each of last three months. Take note, just because you meet the above two requirements, this doesn’t necessarily mean that you will be approved for a line of credit. Even if you are, you will have no say in how much you are able to borrow. As we noted earlier, the amount of credit available starts from just $2,000, all the way up to a whopping $250,000. The amount you are offered will be dependent on the checks that Kabbage makes after you submit your application. As noted earlier, most approved applicants will have their line of credit activated the next working day. In terms of accessing the money, you effectively have two options. The easiest way is to order the Kabbage debit card. As the card is issued by Visa, you can use it much in the same way as any other debit card. This includes ATM withdrawals and online purchases. There is no minimum when it comes to the amount you can draw down. Alternatively, you can manually draw your funds down via your Kabbage account portal. This will allow you to transfer your stipulated funding amount directly into your checking account, or into your connected PayPal account. If you do go for the manual option, you will need to draw down a minimum of $500. If you need to speak with a member of the customer service team, Kabbage offers a number of support channels. 📱Phone: 888-986-8263 📧 Email: [email protected] ✍️ In Writing: Kabbage, 925B Peachtree Street NE, Suite 1688, Atlanta, GA, 30309 Although the customer support team does operate 7 days per week, they only work during the following business hours: ⏲️ Monday to Friday: 08:00 – 21:00 (EST) ⏲️ Saturday to Sunday: 10:00 – 18:00 (EST) In summary, we really like what Kabbage offers. When you first visit the platform, you’ll see straight away that the website is backed by some really innovative FinTech contributors. This smooth and easy-to-navigate website is further amplified by the simple 10 minute application process. On top of entering some information about you and your business, Kabbage is able to verify your financial credentials by linking your key business accounts. In doing so, there is no requirement to submit countless documents – as is often the case in the traditional business funding scene. In terms of how much your business will be able to borrow, this will ultimately be determined by the Kabbage system. Take note, this can vary from just $2,000, all the way up to $250,000. We also like that Kabbage does not focus exclusively on your credit score. On the contrary, the minimum requirements ask that your business has been trading for at least one year, and that it either turns over $50,000 annually, or $4,200 per month. Apply for a Payday Loan Now! | Best Payday Lender 2020What is Kabbage?

What are the Pros and Cons of Kabbage

Comparing Kabbage with online personal and business loan providers

How Does Kabbage Work?

Step 1: Create an account

Step 2: Enter information about your business

Step 3: Enter your personal information

Step 4: Connect your business accounts

Step 5: Review your offer

How Much Does Kabbage Cost?

Am I Eligible for a Kabbage line of credit?

Using your line of credit

Customer Service at Kabbage

Kabbage Review: The Verdict

FAQ:

How much will Kabbage let me borrow?

How much does Kabbage cost?

How do I withdraw from my line of credit?

Can I repay my Kabbage balance early?

How long does the Kabbage application process take?

US Payday Loan Reviews – A-Z Directory