Palantir stock (PLTR) stock has risen sharply from its listing price. What’s the outlook for the company that looks successful yet controversial at the same time?

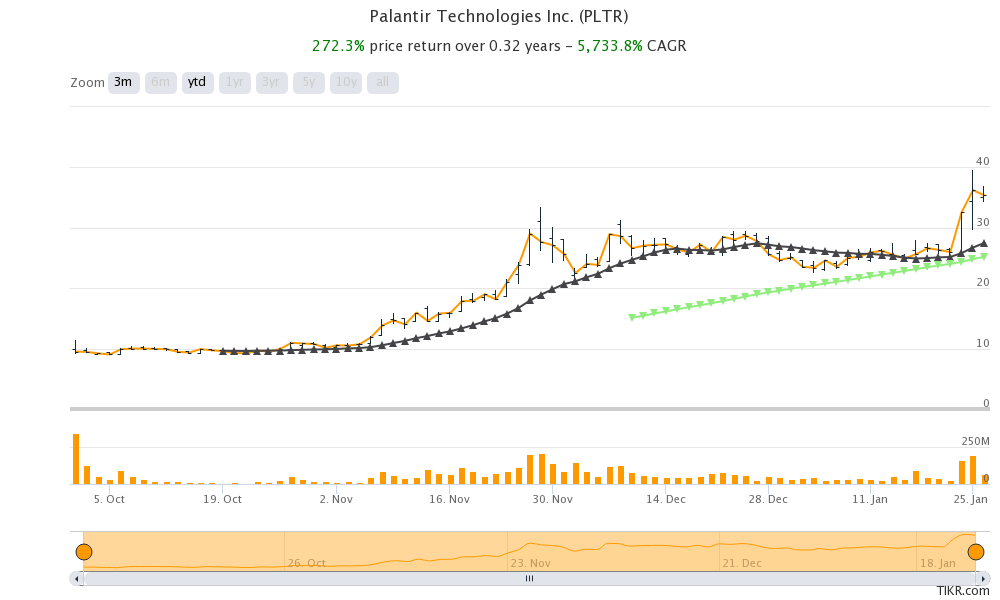

Palantir stock has gained 50% so far in 2020 and 272% from its listing day. Notably, the company had opted for a direct listing last year. Prior to Palantir, Spotify, Asana, and Slack had also listed through the direct listing process.

Palantir’s direct listing

Now, gaming platform Roblox is also set to go for a direct listing next month. In a direct listing process, the company that intends to go public shuns the traditional IPO and underwriting process and the selling shareholders sell their shares directly to investors. However, the company cannot raise money through the direct listing and it is only an exit option for selling shareholders.

Direct listing process

The popularity of direct listing has risen after the stellar listings last year. As the IPOs soared on listing day, it exemplified the point that underwriters ended up underpricing the issue. While it meant that investors who invested in these IPOs made strong listing gains, the selling shareholders lost out.

Palantir’s lockup expiration

Palantir’s lockup expiration is next month only. Notably, while the lockup expiration period is between 90-180 days for companies that list through traditional IPO, the process is different for the direct listing. In a direct listing, the “insiders” anyway sell some of their shares on the listing date.

In Palantir’s case, the lockup period would end on the third trading day after it reports its Q4 earnings in February. Some analysts are concerned that there could be a sell-off after the lockup period is lifted. There have been instances like in Nikola where stocks sold off after the lock-up period ended and insiders sold their shares.

Palantir’s earnings

Analysts expect Palantir to post revenues of $396 million in the fourth quarter, a year over year rise of 31.6%. However, it is expected to post a GAAP loss of 3 cents per share. While filing for the IPO, Palantir had noted that “We have incurred losses each year since our inception, we expect our operating expenses to increase, and we may not become profitable in the future.”

Palantir on WallStreetBets

Palantir is among the stocks that are popular on the WallStreetBets community on Reddit. However, it is GameStop (GME) stock that is getting all the attention. Chamath Palihapitiya also revealed that he is long on GameStop stock. However, Michael Burry, who was long on GME stock in the third quarter of 2020, says that the SEC should probe the sharp rally in GME stock. Even Elon Musk, who has been oscillating between the world’s richest and second richest person, tweeted about GME stock.

Is Palantir overvalued?

Palantir stock trades at an NTM (next-12 months) enterprise value to revenue multiple of 45x which is not cheap by any standards. Also, the company’s current growth rate is not as high as say Zoom Video Communications and Snowflake that too have high valuation multiples but these are backed by strong growth.

Earlier this month, Citi downgraded Palantir to sell from neutral over the valuation concerns. “After a 150+% rise in the stock since the September direct listing, we believe the stock is vulnerable heading into 2021 with the upcoming lockup expiry, and an expected deceleration in growth. Specifically, we see risk around the lapping of COVID-19 related contracts, which have the potential to become headwinds in 2H21 into 2022,” said Citi analysts.

Analyst ratings

Looking at the consensus ratings, Palantir has an average price target of $16.29 which is a discount of 54% over current prices. Of the eight analysts polled by MarketBeat, only one rates the stock as a buy while four rates it as a hold or some equivalent. The remaining three analysts have a sell rating on Palantir stock. The most recent analyst action was on 20 January when William Blair initiated coverage with a market perform rating that is equivalent to a hold.

WallStreetBets

But then, valuations and fundamentals have meant little for many retail investors as is exemplified in the sharp rally in GME and Palantir stock. While Palantir is a long-term growth story, it faces several risks including revenue concentration with governments.

Palantir stock fell 2.4% on Tuesday and was trading 3.8% down at $34.02 in US premarket trading today. The stock has a 52-week trading range of $8.90-$39.58.

How to buy Palantir stock?

You can buy Palantir stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

As an alternative, you can look at ETFs like the Renaissance IPO ETF that invests in newly listed companies to get diversified exposure to newly listed companies.

Through an IPO ETF, you can diversify your risks across many companies instead of just investing in a few IPOs. While this may mean that you might miss out on “home runs” as we saw in Snowflake IPO, you would also not end up owning the worst-performing IPOs in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account