How to Buy Slack Stock Online in 2021

Slack has been a household and office name for several years now. The company operates one of the most popular messaging and productivity platforms on the market today. The platform has been able to consistently compete with products offered by from the likes of Microsoft and Google.

Since Slack debuted on public markets in 2019, but their stock hasn’t fared well. The coronavirus crisis has however breathed new life into this remote work-friendly platform, and Slack’s stock could be poised to rise higher. If you believe this could be the beginning of a bullish run for the company shares, now may be the perfect time to buy Slack stock.

In this guide, we’ll cover everything you need to know to purchase Slack shares. We’ll review three of the best brokerages you can use for the job, plus explore reasons you might consider buying Slack stocks now.

-

-

How to Buy Slack Stock in 3 Quick Steps

Dont have time to go through this entire guide? Follow these three steps to buy Slack stock right now.

[three-steps id=”200345″]Where to Buy Slack Stock

In order to buy Slack stock, you’ll need a trading account with a broker that lists slack shares. Thankfully, since Slack is traded on the popular NASDAQ exchange, just about any brokerage that offers stock trading on US markets will let you buy and sell this company shares.

Still, it’s worthwhile to get the best brokerage for the job. Let’s take a closer look at our three favourite brokers for buying Slack stock.

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

Detailed provider overview

1. eToro - Best for Researching Stocks

eToro is one of our favourite platforms for buying stocks like Slack. This broker goes beyond just trading to offer a full-fledged social network. You can follow other investors on eToro, start conversations about a trade, or join discussion boards for individual stocks. Even better, you can diversify your holdings with just a few clicks by copying other traders’ entire portfolios.

Importantly, eToro gives you access to more than 800 stocks traded on major exchanges across the world. You can invest in not just Slack stock, but also any other hot stocks. Plus, while eToro lets you own stock shares outright, you can still trade stock CFDs with leverages of up to 1:5.

Just be sure to watch out for extra fees at eToro. The platform doesn’t charge trade commissions and it keeps spreads relatively low across the assets on offer. But, eToro does charge withdrawal fees and inactivity fees that can add up over time.

Our Rating

- Social Network: Start discussions with other traders

- Global Access: Buy stocks from any major exchange

- Leverage: Trade stocks on margin up to 30:1

- Fees: Charges withdrawal and inactivity fees

- Limited Charts: Do not include advanced technical studies

75% of investors lose money when trading CFDs.2. Plus500 - Trade Slack Stock through CFDs

Unlike a lot of traditional stock brokers, you don’t own stock shares outright when you trade with Plus500. Instead, this platform allows you to trade contracts for differences (CFDs), which are derivatives based on the price of individual shares.

CFDs are advantageous because you can trade with leverage, up to 20:1 in the case of Plus500, and you have the option to bet that a stock’s share price will drop rather than keep rising. While you’re not eligible for dividends when trading CFDs, this shouldn’t be a huge issue for investing in Slack stock. Slack and most of its tech peers have never paid a dividend and aren’t likely to anytime soon.

Plus500 has a few other advantages going for it, too. The platform offers access to hundreds of highly liquid stocks around the globe and keeps its spreads tighter than most other brokers we’ve seen. Plus500 also offers beginner-friendly charts and price alerts so you never miss a trading opportunity. Just beware that the technical charting capabilities are somewhat limited as you get deeper into investing.

OUR RATING

- Trade CFDs: Use leverage and short stocks

- Global Markets: Trade stocks on any major exchange

- Price Alerts: Set email and text alerts on individual stocks

- Few Technical Studies: Charts don’t cater to advanced traders

- No Dividends: Cannot earn dividends when trading CFDs

80.5% of retail investor accounts lose money when trading.3. StashApp - Best for Long-term Investing

If you are just starting out with limited trading experience and limited investment capital, check out StashApp. This US-based broker is built around helping traders consistently move money into an investment account. That means you can invest in stocks and save for retirement without a ton of effort.

To help, StashApp lets you automatically schedule transfers from your bank account to your investment account. If you make purchases with a debit card, the broker will also round your transactions up to the nearest dollar and invest your spare change for you. StashApp enables you to buy fractional shares of stocks, so you can invest that spare change just one dollar at a time.

StashApp offers access to the vast majority of US stocks, bonds, and ETFs. But, bear in mind that you won’t be able to diversify your portfolio with forex or commodity trading in the future with this brokerage. In addition, StashApp is surprisingly light on research and analysis tools and doesn’t include any technical studies.

Our Rating

- Consistent Investment: Schedule transfers to your trading account

- Invest Spare Change: Automatically rollover spare funds for investment

- Bonds and ETFs: Invest in US stocks, bonds, and ETFs

- Limited Asset Variety: Cannot trade forex or commodities

- Very Basic Charts: No technical analysis or indicators

How to Buy Slack Stock from eToro

Ready to buy Slack stock but don’t know exactly how to navigate your new trading account? We’ll walk you through the process at eToro, our favourite online brokerage. We especially like using eToro because it has a low minimum deposit, doesn’t charge trade commissions, and makes it easy to start trading in just a few minutes.

Opted for a different broker? Don’t worry. The steps we outline below are similar between most stock trading platforms.

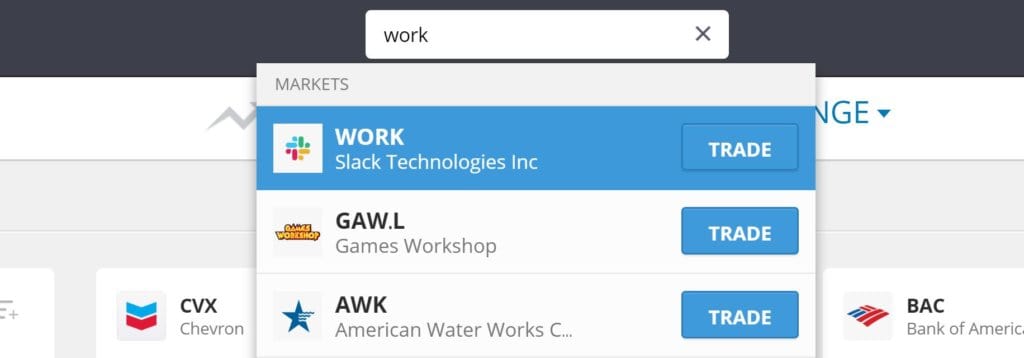

Step 1: Search for Slack (WORK) Stock

eToro has hundreds of stocks available for trading. To find Slack shares, enter ‘Slack’ or ‘WORK’ (the company’s ticker symbol) in the search box at the top of the page.

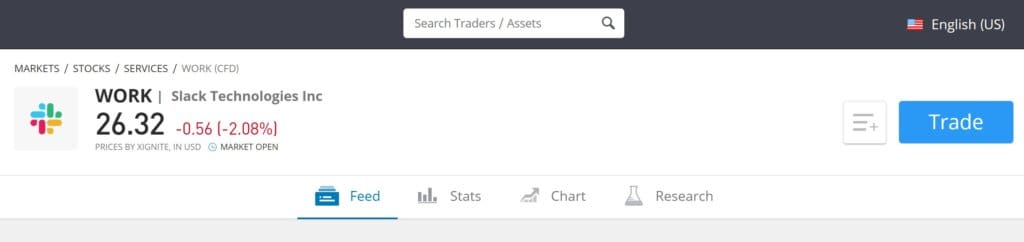

Step 2: Click on ‘Trade’

Click the ‘Trade’ button to be taken to the order form for Slack stock.

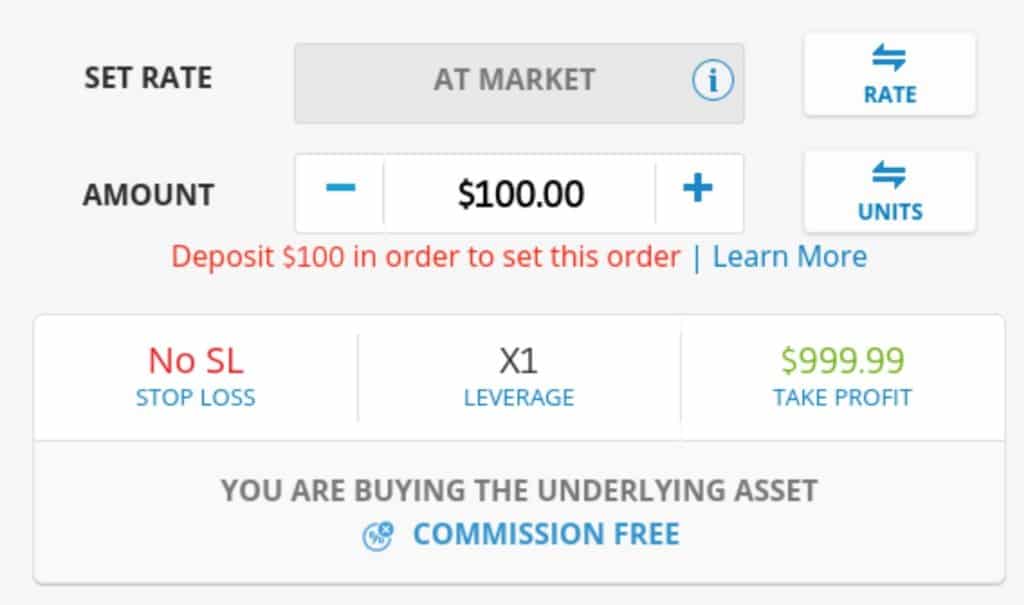

Step 3: Set Up Order and Buy Slack Stock

Set the trade parameters.

These include:

- Set Rate: The rate is the price you’ll pay for Slack stock. If you leave it as ‘At Market,’ your broker will buy the stock at the current market price. Alternatively, you can specify a specific price you’re willing to pay for Slack stock. In that case, your purchase will only be executed if the share price rises or falls.

- Amount: This specifies how many shares of Slack you want to buy. By default, it’s in dollars because eToro enables you to buy fractional shares. But, if you want to purchase whole shares, click the ‘Rate’ button and you can enter your purchase amount in shares.

- Stop Loss: Stop losses are extremely important when trading. This is a price below the current market price at which your broker will automatically sell your Slack stock. Don’t set this too close to the current market price, but don’t set it too far below, either. You can’t lose more than your stop loss, so it’s an important protection against a bad trade.

- Take Profit: The take-profit level is a price above the current market price at which your broker will automatically sell your stock. Only set this if you want to make a quick profit from Slack stock rather than hold it for years to come.

Click ‘Buy’ to complete your trade.

Why Invest in Slack?

Slack stock has seen nothing but hard times since the company went public in June of 2019. But, it has rebounded quickly from a sharp sell-off in response to the coronavirus crisis and is now sitting at a higher price level than it did for the better part of last year.

So, is now the right time to buy Slack stock? We think so, based on three key pieces of evidence:

Note: Always conduct your own investment research in addition to considering our advice. You’re responsible for your money and should be informed about what you’re investing in.Slack is on a Growth Streak

Slack has been growing steadily for several years now and the company is planning to continue at full steam. Slack expanded its revenue by 57% in the first quarter of 2021. While you might think there was a catastrophe from seeing the mass sell-off in mid-March, in reality, the company only barely missed earnings expectations. Guidance for the rest of the year looks good, too, even before accounting for potential growth as remote work takes off.

Importantly, Slack has been able to capitalize on large customers. The number of its clients spending more than $100,000 each year rose by 55% from 2019 and have made up an increasingly large share of its revenue.

Even better, this is stable revenue. Slack recently reported a 132% retention rate, meaning that it’s not just keeping existing customers, but also encouraging them to spend more.

Slack Can Take Advantage of Remote Work

While Slack works well for in-office communications, it caters equally well to remote productivity. The software offers phone and video calling, plus integrations with a variety of cloud storage platforms. And while it’s no Zoom when it comes to video meetings, Slack can more than hold its own in this regard and offers a wider range of features.

Slack further stands to benefit immensely from the coronavirus pandemic. Many businesses, large and small, are turning to remote work for the first time and exploring software options to help ease the transition. Slack is well-positioned to get that extra business and to keep it in the future, especially if remote work continues after the crisis as many analysts predict.

So, expect Slack to keep cranking up revenue as the company slurps up new remote working customers.

Slack is Still Trading at a Discount

Right now, Slack is trading at around 11 times annual sales. That may sound high to conservative investors, but in the tech world, it’s something of a bargain. Most high-growth companies trade closer to 15 times sales.

In addition, Slack still hasn’t broken back above the high price it reached in its first few days of trading, at nearly $40 per share. That’s an important milestone for the company’s stock. Once it breaks through resistance at that price level, Slack’s stock price could be poised for a significant step higher.

About Slack Stock

Slack, a reverse acronym for ‘Searchable Log of All Conversation and Knowledge,’ was first introduced as a messaging platform in 2013. The software had been developed by Tiny Speck initially as an internal communication tool, but founder Stewart Butterfield saw the program’s utility for other companies and remote workers.

After years of building out the platform’s messaging features and integrations, Slack decided to go public in June 2019. The company listed on the NASDAQ exchange at a share price of $26, and it quickly shot up to almost $40 per share—a valuation of over $21 billion at the high-water mark.

Since then, the price of Slack shares slowly declined and the stock actually spent much of 2019 below its IPO price. After a brief, sharp dip in March 2019 in response to an earnings report, Slack shares are currently trading right around the $26 IPO price level.

Should You Buy Slack Stock?

Analysts express mixed feelings on whether Slack stock is a worthwhile buy. Some firms are going all-in on Slack on the belief that it’s an undervalued tech company with huge growth potential. Others look at the fact that Slack isn’t yet profitable and its recent earnings miss as a warning sign that this company isn’t ready for a price surge just yet.

There’s no way to accurately predict the future for Slack or its stock price, so you’ll need to think carefully about this company’s financial history and how its business model fits into the global economy going forward. Given that Slack is bringing new clients onboard and is poised to take even more advantage of the shift to remote work, we think that this company is just at the beginning of a long and sustained upward momentum.

FAQs

What is Slack’s stock ticker?

Slack is listed on the NASDAQ stock exchange as ‘WORK.’

What countries is Slack available in?

Slack reports daily active users in more than 150 countries, covering six continents. Most of Slack’s user base is concentrated in North America and Europe.

Does Slack pay dividends?

Slack does not pay dividends. In fact, since the company is not yet profitable, it actually offers negative earnings per share. Don’t expect Slack to pay dividends even after it’s profitable, as few of its tech peers pay out profits to shareholders.

Can I buy fractional shares of Slack?

Some brokers, including eToro and StashApp, allow you to purchase fractional shares of Slack and other stocks. When fractional shares are available, you can invest in Slack in increments as small as one dollar at a time.

See Our Full Range of Stock Buying Resources

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up