The US dollar is retreating today in early forex trading activity while European currencies are advancing strongly on election day as investors seem to be adopting a risk-on attitude despite the volatile backdrop.

The value of the greenback – as reflected by the US dollar index (DXY) – is retreating 0.5% this morning at 93.58, with the Australian dollar leading the winners’ board with a 1% appreciation against the dollar at 0.7129 followed by the euro and the pound which are gaining 0.6% each at 1.1710 and 1.2996 respectively.

Other foreign currencies including the Swiss Franc, the Canadian Dollar, and the New Zealand Dollar are advancing at a similar pace against the North American currency as well, a move that seems to contradict the flight-to-safety move that usually precedes a volatile event such as today’s presidential election.

Despite this retreat seen by the greenback, implied volatility – a measure of how much trader expects that the dollar will fluctuate over the next twelve months – remains at elevated levels as indicated by DXY’s December options contracts, which are trading at an implied volatility of 7.61%.

Based on this figure, options traders seem to be expecting a 2.2% move in the greenback – in any direction – over the next 31 days.

The risk of a contested election remains one of the most volatile scenarios according to traders, while a surge in social unrest, protests, and violence across the country once the results are revealed is also a possibility that markets seem to be contemplating, with all of these factors potentially playing in favor of a stronger dollar.

Moreover, the reintroduction of lockdowns across Europe and a third wave of the virus in the United States – with the possibility of focalized lockdowns on individual states – are also risk factors that could push a flight-to-safety move that should favor the greenback over the coming days.

What’s next for the US dollar?

The outlook for the greenback remains bullish given the uncertain backdrop that the financial markets are currently navigating.

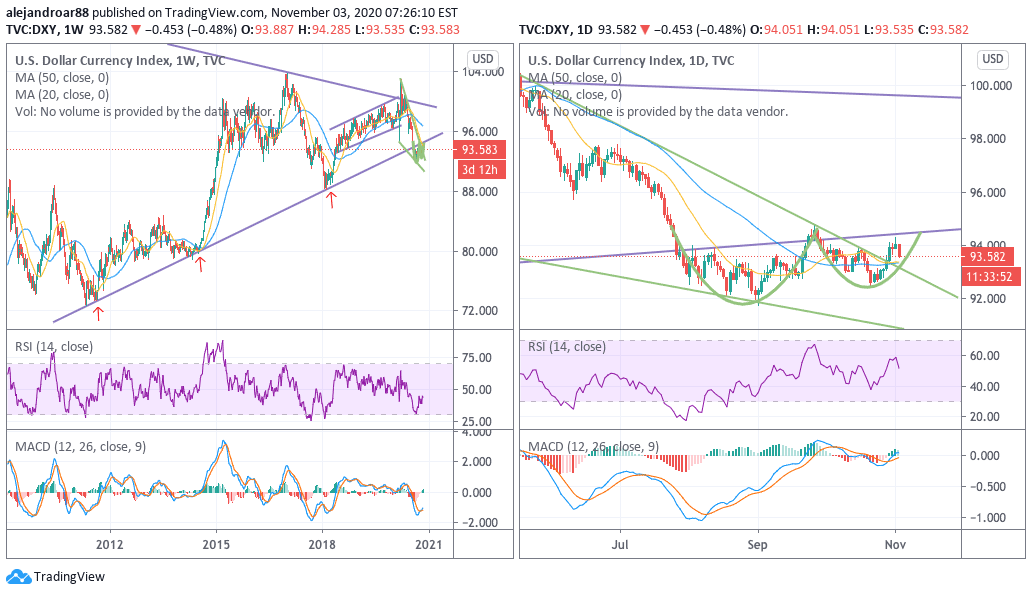

This view is reinforced by technicals, as the latest price action seen by the US dollar appears to be forming a bullish cup and handle formation that could lead to a break above the 95 level – which would put the greenback back on a long-dated upward trend shown in the chart above.

Meanwhile, the MACD has already sent a buy signal while climbing to positive territory – another sign that bullish momentum is building up for the North American currency.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account