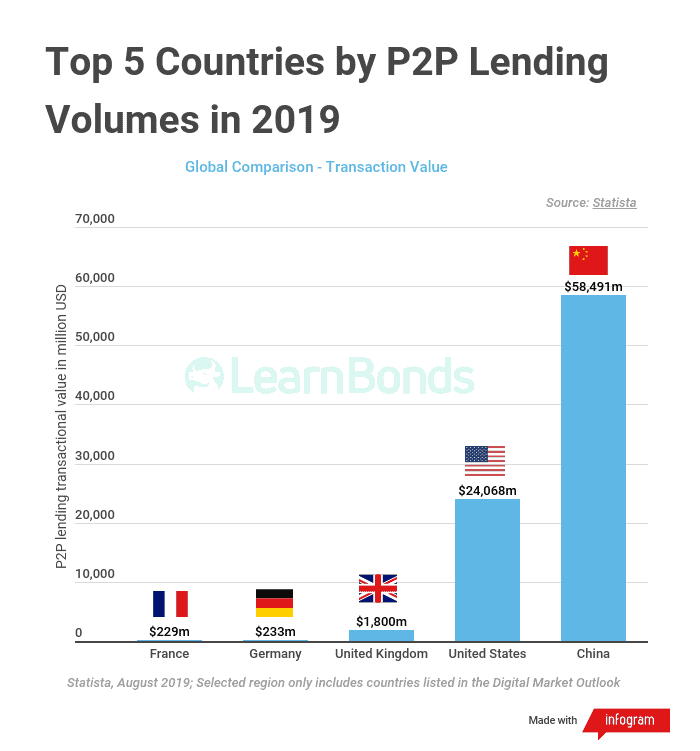

P2P lending has been expanding in many regions around the world through different platforms and solutions. According to a recent report released by Statista, the top 5 countries with the largest P2P lending volumes in 2019 are China, the United States, the United Kingdom, Germany and France.

P2P Lending Volumes Expand

As reported by Statista, the total transaction value in the marketplace lending segment amounted to $86,333 million in 2019. The main countries in the market included China with $58.491 million, followed by the United States with $24.068 million, the United Kingdom with $1,800 million, Germany with $223 million and France with $229 million.

These marketplace lending platforms offer private users the possibility to place requests for loans in an online marketplace and find private investors that would place their funds in these initiatives.

The report in-scope includes online marketplaces for personal loan apps and private investors and P2P loans with interest rates depending on internal credit scoring of the platform provider. Out-of-scope we can find online comparison websites, traditional bank loans and loans for business purposes.

Some of the most important platforms include Lending Club, Mintos, Zopa and many others. It is possible for investors to lend their funds to the users they consider convenient without risk audits or formal requirements related to credit lending. That makes the whole process much more straightforward.

As reported by Statista, the total transaction value in the marketplaces lending industry is expected to reach $100,477 million by 2023. That represents an increase of 16% in just 4 years. Compared to 2017, this would represent an increase of 38%. The transaction value is expected to grow annually at 3.9%.

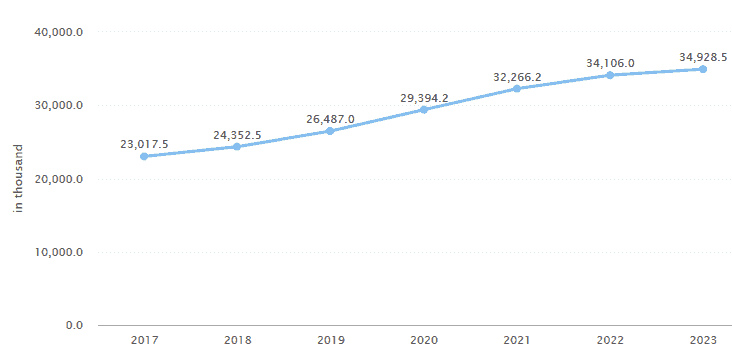

Furthermore, the number of successfully funded alternative loans is expected to amount to 34,928.5 thousand by 2023. Additionally, the number of loans in 2019 amounted 26,487 thousand, an increase of 8.8% compared to the last year. By 2023, the number of loans is expected to grow by 31% and hit 34,928.5.

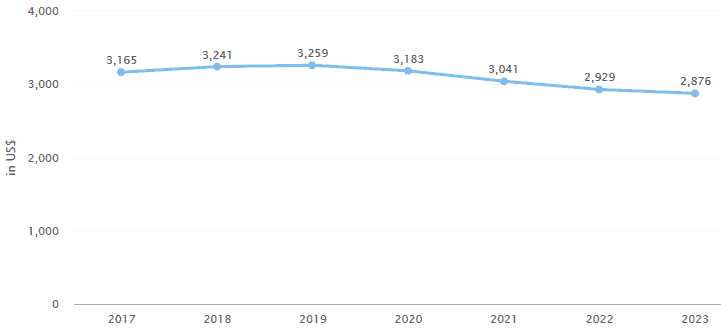

However, the average funding per loan is expected to be decreasing in the coming years from a high registered in 2019. This year, the average loan was $3,259 and it is expected to decline 11% by 2023.

The whole P2P lending market is becoming very active around the world. Every single continent is represented by a diverse group of countries that are entering the market. As mentioned before, the number of users is expected to grow faster than in other industries. Moreover, considering the market continues expanding, P2P loans would become a more important part of the general lending marketplace.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account